#Didyouknow

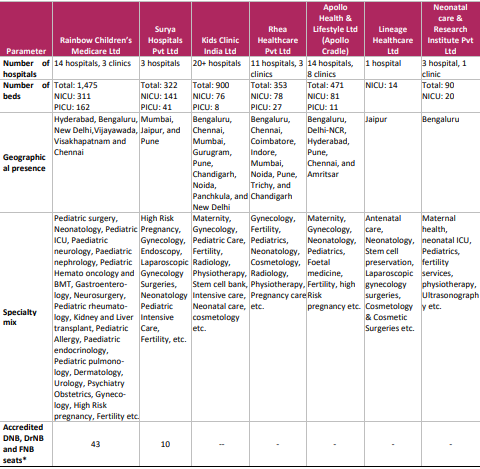

Rainbow Children’s Medicare Ltd (RCML) is a leading multi-specialty pediatric, obstetrics & gynecology hospital and had the highest number of hospital beds amongst players in the maternity and pediatric healthcare delivery sector, as of Mar 31, 2021 in India?

Rainbow Children’s Medicare Ltd (RCML) is a leading multi-specialty pediatric, obstetrics & gynecology hospital and had the highest number of hospital beds amongst players in the maternity and pediatric healthcare delivery sector, as of Mar 31, 2021 in India?

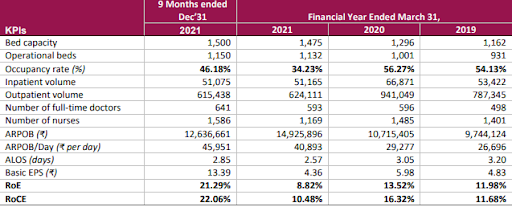

1)The co. has 14 hospitals and 3 clinics operating in 6 cities, with a total bed capacity of 1,500 beds, as of Sept 30, 2021.

2)Their core specialties are pediatrics, which includes newborn and pediatric intensive care, pediatric multi-specialty services, pediatric quaternary care (including multi organ transplants); and obstetrics and gynecology, which includes normal and complex obstetric care.

3)RCML follows a hub-and-spoke model in Hyderabad, with their Banjara Hills hospital (comprising 250 beds) being the hub and 4 spokes at 4 locations in Hyderabad, namely Secunderabad, LB Nagar, Kondapur and Hydernagar.

4)They follow a doctor engagement model whereby most of their core specialists work exclusively at their hospitals on a full-time retainer basis. This model ensures that most of their core specialists are available 24/7 on a roster basis at their hospitals.

6)Biggest Differentiator from adult hospital: A children’s hospital requires focus on psychological and emotional care, which is different from adult hospitals, and RCML keeps this understanding at the forefront while treating children.

7)RCML has built a comprehensive pediatric critical care program and have consistently allocated approximately onethird of their operational beds at all their hospitals to critical care.

8) Future Outlook:

RCML has great opportunity to expand their quaternary care operations. At their hub at Banjara Hills in Hyderabad, they commenced providing pediatric quaternary care services in 2019.

RCML has great opportunity to expand their quaternary care operations. At their hub at Banjara Hills in Hyderabad, they commenced providing pediatric quaternary care services in 2019.

9)They plan to build similar capabilities in their hospitals in Bengaluru, Karnataka, Chennai, Tamil Nadu and New Delhi- NCR. Rainbow Children’s Heart Institute is a 110-bed standalone pediatric cardiac center that treats children’s cardiac problems.

10)They also plan to develop similar cardiac capabilities in Bengaluru, Chennai and New Delhi by hiring reputed, experienced and skilled cardiac specialists in these cities.

11)They also plan to invest in specialized medical infrastructure such as cath labs, pediatric cardiac OT and echocardiogram machines, which will enhance their capabilities in treating cardiac patients.

12)They intend to increase the scope of the neonatal and advanced pediatric education (“NAPE”) program across all their network hospitals, with a view to gaining further referrals.

14)They constantly strive to increase the capacity utilization at all their hospitals by increasing their day care admissions. They also plan to further reduce the length of hospital stays as their surgical work is trending towards minimally invasive surgeries.

Follow @FinterestC for more!

• • •

Missing some Tweet in this thread? You can try to

force a refresh