Interesting tidbits on the Musk margin loan... The terms of the margin loan are 20% initial LTV with a 35% margin call level. This means that for a $12.5B loan, Musk must pledge $62.5B worth of $TSLA based on share price at closing, and gets called if TSLA drops ~43%.

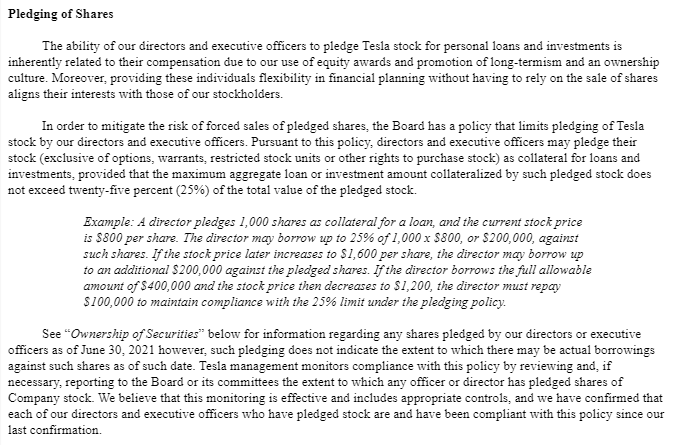

BUT - Tesla's own rules on director/officer share pledges is actually stricter and imposes its own max level at 25% LTV. (Below is from the 2021 proxy statement).

Under this requirement only a 20% decrease in $TSLA price would trigger a call. Much smaller cushion

Under this requirement only a 20% decrease in $TSLA price would trigger a call. Much smaller cushion

Finally, if you think he can satisfy his equity check ($21B ECL) by borrowing rather than selling... are... you sure? It took half of Wall Street to come up with $12.5bn... with 5x collateral cushion. $21bn more means $105B of collateral (and of course finding a lender)

The whole saga is undoubtedly entertaining and bizarre but there are still so many questions that really can't be answered until we see the actual merger agreement - conditionality, drop dead dates, break fees etc.

Personally, I find the dynamics fascinating. Like it seems like one of the largest and most complex buyouts in history was cobbled together in two weeks including a HUGE term loan, enormous margin loan on the most volatile and high performing stock, etc...

I like to imagine the calls to the lesser banks in the club like:

MS: hey are you in?

Mizuho: on what?

MS: Biggest deal of the decade

Mizuho: umm yea could you provide some more details?

MS: Biggest deal of the decade. Elon Musk. we are lead

Mizuho: Say no more fam

MS: hey are you in?

Mizuho: on what?

MS: Biggest deal of the decade

Mizuho: umm yea could you provide some more details?

MS: Biggest deal of the decade. Elon Musk. we are lead

Mizuho: Say no more fam

• • •

Missing some Tweet in this thread? You can try to

force a refresh