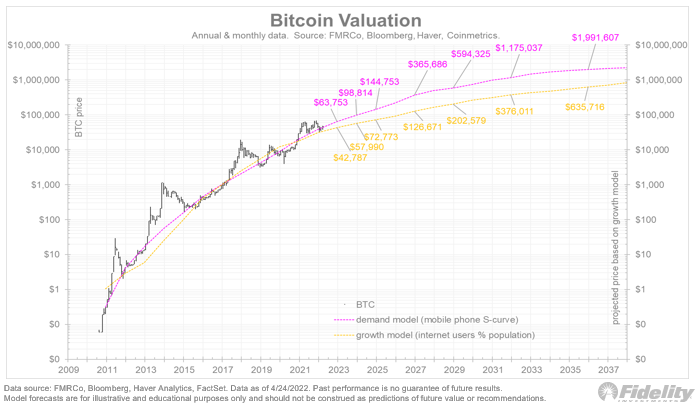

Will Bitcoin become a fixture? Here we see the number of global mobile phone users and global internet users, regressed against the number of BTC addresses. Both analogs support the idea that the Bitcoin (and Ethereum) network has a lot more growing to do. / 🧵

However, the different slopes for mobile phones vs internet users presents a challenge for valuing Bitcoin. How do you calculate a present value of future growth when it’s not clear how steep the slope is? /2

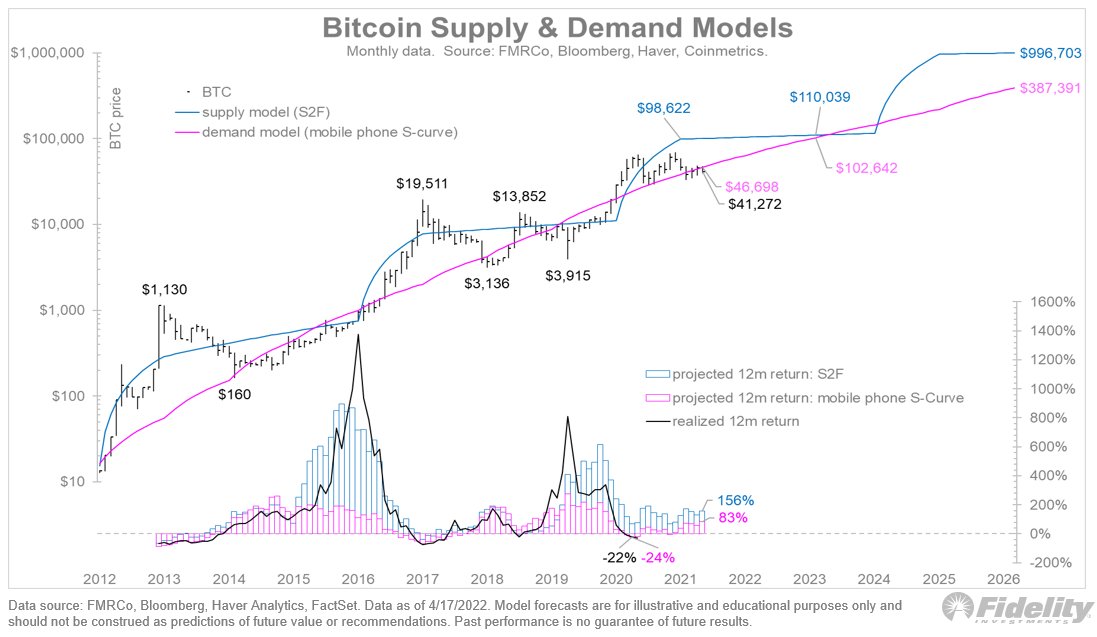

Based on a regression between price and network size, we can create an estimate for the fair value of Bitcoin down the road, using these two different curves as guides. "Higher than now” is suggested, but “how high” is also important, depending on one’s time horizon. /3

Based on the mobile phone adoption curve, my model suggests a fair value of $100k by the end of 2023, which would be a 2.5x return or a 58% CAGR. But using the internet adoption curve, Bitcoin might only be worth $58k then, which would be a 1.5x return or a 20% CAGR. /4

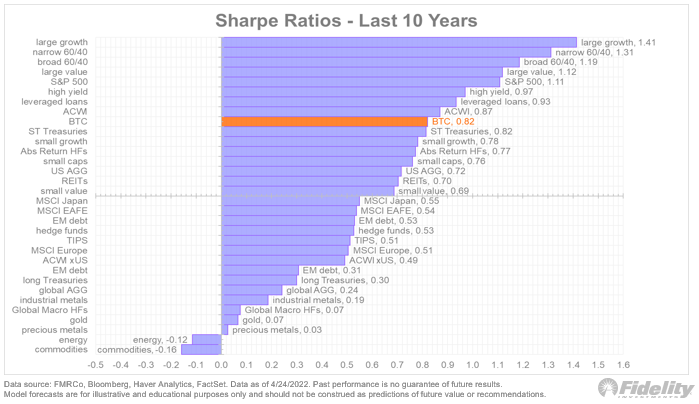

In Sharpe Ratio terms (assuming a 60 vol), the former would be 1.0 while the latter would be 0.3. A Sharpe Ratio of 1.0 seems attractive compared to the available investment choices out there (see below), but I’m not sure that 0.3 would be. /5

Conclusions: The adoption curve for Bitcoin (and Ethereum) seems far from complete, suggesting further growth in the years ahead. /6

However, history shows a high degree of variability in how “up and to the right” the curve might get. This could make it more complicated to value Bitcoin, especially given its lack of cash flows. /7

In recent months, the slope of Bitcoin’s adoption curve seems to have flattened somewhat. While this may seem like a minor nuance, it could explain why the price action has become less robust lately. /8

All this suggests that valuing Bitcoin will continue to be a dynamic process, driven less by the momentum cycles of yesteryear, and more by what informed investors deem to be an attractive risk-adjusted expected return. /9

That suggests that the entry point for an investment in BTC is more important than ever, just as it is for every other asset class. /END

• • •

Missing some Tweet in this thread? You can try to

force a refresh