One reason why the Q1 GDP numbers don't necessarily mean a recession is because "senior economic reporters" like @steveliesman say that things are fine rather than hype the bad number which in itself (the hype) would kill consumer mood; then their spending and then the economy.

This is the beauty of having a Dem in the White House because if this bad number were with a GOPer, every person who follows the news would be driven into a panic how the economy contracted despite low interest rates; massive federal spending and a ballooned Fed balance sheet.

Steve's hot take about the GDP for the current quarter (April-May-June) ignores how energy costs and rising interest rates in April are stepping on the economy in ways not seen in Q1. But by media putting on a nice face about the weak economy they can keep things going.

I spoke to multiple people in the US shipping industry in the past few days. While this is anecdotal and I also don't have a baseline what their info means, they all sang the same songs: Requests are dropping like crazy; especially housing-related like tiles.📉

The economy contracted in the first 3 months of 2022; mortgage applications in recent weeks are down; gas and diesel prices are hitting new records these days; inflation is at a 40 year high; many big name stocks are down 60% - 70% from their 52 week highs.

Great times, folks.

Great times, folks.

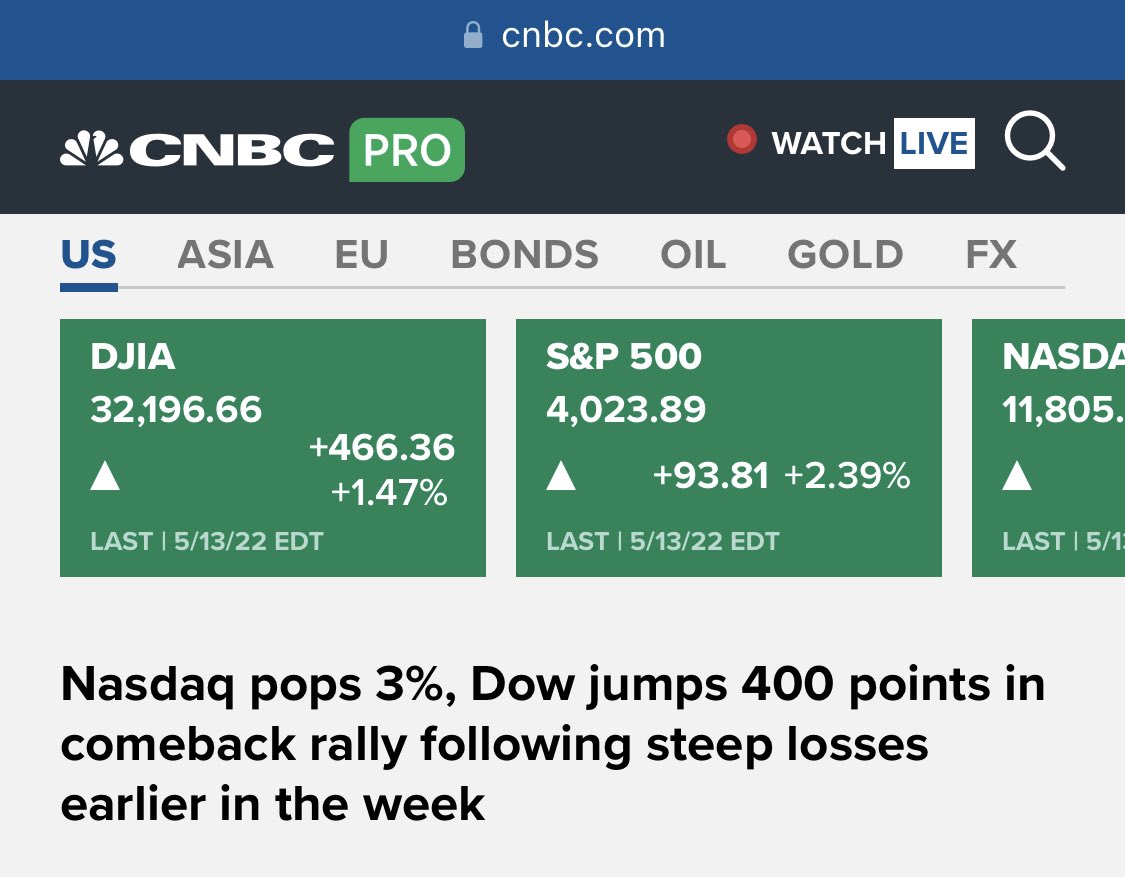

This past week, the Dow had its longest streak of losing weeks in more than TWENTY years, and the S&P500 the longest losing run in ELEVEN years.

Not even CNBC, where I saw this info, is leading with this news!

See the right grab of their headline Sunday early AM.

Not even CNBC, where I saw this info, is leading with this news!

See the right grab of their headline Sunday early AM.

This bad run on Wall Street is when inflation is still high; applications for mortgages are cooling due to popping rates; diesel broke new highs 14 days in a row; regular gas 5 days in a row. Yet there is ZERO panic-spreading media as would be if this happened under Bush/Trump.

Friday I scrolled @CBSNews to see how the above DISASTROUS news are reported to the masses.

The 28th (!) news on the home page was the first economic news and delivered quite chilled: No word that the record is daily; diesel broke more records and that families are suffering.

The 28th (!) news on the home page was the first economic news and delivered quite chilled: No word that the record is daily; diesel broke more records and that families are suffering.

I am not talking about the would-be Bush/Trump blame that we would be getting if these things happened under them.

I am pointing out how lack of (headline) coverage of BAD economic data@cuts the chance of a hard economic landing because consumers are not being spooked.

I am pointing out how lack of (headline) coverage of BAD economic data@cuts the chance of a hard economic landing because consumers are not being spooked.

Again: The S&P 500 was down MORE weeks than during the lockdowns -- more than any time the last 11 years, and the Dow had the most losing weeks since 9/11, MORE than the 2008 crisis (!!!), yet not even business websites lead with this MESS!

See CNBC's headline:

cc @steveliesman

See CNBC's headline:

cc @steveliesman

Today, the 23d news on the @CBSNews home page is the first to talk about economic issues: it's the same post from 2 days ago about gas reaching a record high despite reaching 2 more records since then.

People feel the pinch but there is no added panic from news coverage.

People feel the pinch but there is no added panic from news coverage.

Before COVID Lockdowns choked off the economy, I used to ask why is there little (leading) news about the great economic numbers. I was told that positive news does not sell well.

Odd because loads of negative developments in the economy recently aren't leading the news either.

Odd because loads of negative developments in the economy recently aren't leading the news either.

Endless headlines of the negative developments - especially if presented in panic mode - would likely lead the Stock Market lower into a Bear, and deepen the economic slow down too, so be happy Biden is POTUS because whatever economic issues we face would be worse with a GOPer.

So... Here we are Wed 5/18/22.

After the business press and the media ignored-in-headlines the DISASTROUS market/gas data of last week, the market was up Mon-Tuesday but is spiraling downhill today again because retailers reported BAD numbers.

Oh, new record today gas & diesel:

After the business press and the media ignored-in-headlines the DISASTROUS market/gas data of last week, the market was up Mon-Tuesday but is spiraling downhill today again because retailers reported BAD numbers.

Oh, new record today gas & diesel:

🚨 🚨 🚨

The Dow was down the 8th week in a row; the longest stretch since 1923 -- 99 years!

The S&P500 (which reflects 500+ large stocks) was down 7 weeks in a row; the longest such a run since March 2001; 21 years!

We got here despite no frenzied-panic spreading by media.

The Dow was down the 8th week in a row; the longest stretch since 1923 -- 99 years!

The S&P500 (which reflects 500+ large stocks) was down 7 weeks in a row; the longest such a run since March 2001; 21 years!

We got here despite no frenzied-panic spreading by media.

"Stock Market Indices are on Their Longest Losing Streak in 21 and 99 Years."

"Dow Down the Most Weeks Since 1923; S&P 500 Down the Longest Since March 2001."

With Bush/Trump, such headlines would be above-the-fold, top-of-the-hour and trending on SM.

How will it be now?

"Dow Down the Most Weeks Since 1923; S&P 500 Down the Longest Since March 2001."

With Bush/Trump, such headlines would be above-the-fold, top-of-the-hour and trending on SM.

How will it be now?

Here we are a day after the NASDAQ and S&P500 both closed another week down making it their longest weekly losses since early 2001 (21 years), and the Dow's longest weekly loss since 1923! 99 years!

Yet, it's not a news on leading news sites; sure not a lead, panicked news.

Yet, it's not a news on leading news sites; sure not a lead, panicked news.

- Regular Gas & diesel are at repeated records.

- Mortgage apps down 15% year over year (YoY).

- Existing Home sales in April down 5.9% YoY

- Retail down.

- Unemployment benefits apps up.

- Inflation at 40 year high.

- Stock Market losing streak is worst in 21 and 99 years.

- Mortgage apps down 15% year over year (YoY).

- Existing Home sales in April down 5.9% YoY

- Retail down.

- Unemployment benefits apps up.

- Inflation at 40 year high.

- Stock Market losing streak is worst in 21 and 99 years.

During the...

Great Depression

WWII

1970's Energy Crisis

1980-1982 Hyper Inflation

Tech Bust

9/11

2008 Financial Crisis

March 2020 Lockdowns

The Dow was not down for the amount of weeks it was down now: 8 in a row.

NASDAQ; S&P500 for 7 weeks; most since BEFORE 9/11!

Great Depression

WWII

1970's Energy Crisis

1980-1982 Hyper Inflation

Tech Bust

9/11

2008 Financial Crisis

March 2020 Lockdowns

The Dow was not down for the amount of weeks it was down now: 8 in a row.

NASDAQ; S&P500 for 7 weeks; most since BEFORE 9/11!

"Stock futures rise after Dow falls for 8th-straight week in longest selloff since 1923."

Not sure why this was not the headline.

1923.

99 years.

The 1923 point should have been headlined and atop of the CNBC website all weekend considering how insane this is: 99 YEARS!

Not sure why this was not the headline.

1923.

99 years.

The 1923 point should have been headlined and atop of the CNBC website all weekend considering how insane this is: 99 YEARS!

Hey everyone, Friday 5/27/22.

The markets had a solid week; up +6% and up the first time after 7-8 losing weeks.

And... this good news is the 4th atop the @CBSNews website; the same website who was MIA the last few Fridays when the markets kept building its long-losing streaks.

The markets had a solid week; up +6% and up the first time after 7-8 losing weeks.

And... this good news is the 4th atop the @CBSNews website; the same website who was MIA the last few Fridays when the markets kept building its long-losing streaks.

In 2008, when the economy was in recession, only 13.2 million vehicles were sold in the US.

In April-May of this year, sales were at an annual rate of 13.6 million units.

This data would be enough to create panic if it were hammered everywhere, but it isn't even a basic news.

In April-May of this year, sales were at an annual rate of 13.6 million units.

This data would be enough to create panic if it were hammered everywhere, but it isn't even a basic news.

Almost three hours ago, the Stock Market closed in a Bear; the first time since COVID and the second time since late 2007. On Twitter trends for the US it is the 28th slot because you don't have every commentator and reporter tweeting about it, or hammering Biden for it.

🚨 🚨 🚨 🚨

Two updates ago, the Atlanta Fed's #GDPNow estimate said the economy in the Second Quarter was flat. Then they updated it to a -1% negative annualized growth rate. Now they have it at -2.1% rate.

Their input has more than 2 months of Q2 GDP data.

Two updates ago, the Atlanta Fed's #GDPNow estimate said the economy in the Second Quarter was flat. Then they updated it to a -1% negative annualized growth rate. Now they have it at -2.1% rate.

Their input has more than 2 months of Q2 GDP data.

Wow. WOW. W-O-W!

Now that an official determination of a recession seems almost certain, the integrity of those making the call gets attacked by CNN.

No person/institution is too sacred if it gets in the way of media's effort to protect a Dem Admin.

cc @NicoleGoodkind

Now that an official determination of a recession seems almost certain, the integrity of those making the call gets attacked by CNN.

No person/institution is too sacred if it gets in the way of media's effort to protect a Dem Admin.

cc @NicoleGoodkind

If the the initial Q2 GDP estimate late July is very bad, the board knows that it will remain bad even after the revisions in late August/Sept, which means they can call a recession end of July. CNN above is trying to bully the board to wait for the revisions. Midterms coming up.

Look at the weekly applications for First Time (Initial) Unemployment Claims. It's rising steadily if not steeply the last three months.

Jobs are usually a lagging indicator in the economy yet there is clearly a stark, steady softening.

cc @steveliesman

Jobs are usually a lagging indicator in the economy yet there is clearly a stark, steady softening.

cc @steveliesman

The US added 368K jobs in Juns so the question is: How can this be a recession?

A) When the 2008 recession started the economy still gained jobs as jobs lag behind in a downturn/recovery.

B) Total employment is now same as Feb 2020. US economy is 28 months without new jobs.

A) When the 2008 recession started the economy still gained jobs as jobs lag behind in a downturn/recovery.

B) Total employment is now same as Feb 2020. US economy is 28 months without new jobs.

Economists are warning that talk of recession in-itself can cause a recession.

Exactly my point of how we got into recessions (some of it meltdowns) under GOP presidents and how we are avoiding a panicked-driven meltdown now despite actual BAD numbers.

cc @VildanaHajric

Exactly my point of how we got into recessions (some of it meltdowns) under GOP presidents and how we are avoiding a panicked-driven meltdown now despite actual BAD numbers.

cc @VildanaHajric

I want to add a point: The economy contracted in the first quarter and there were so many weak numbers in the second quarter that the @AtlantaFed's analysis of the GDP shows a contraction. If it holds, then the first half was a recession. (See next tweet please.)

So... Instead of Bloomberg headlining how the economy is potentially in recession, they headline how Democrat @Markzandi says talk of a recession can cause one. Under a GOP POTUS, Bloomberg would likely have on Zandi saying now how bad things are which would make things worse.

• • •

Missing some Tweet in this thread? You can try to

force a refresh