A statement form SBA Cap reguarding $SU and #Elliott.

Well this is going to be fun. $SU

The legendary activist shop Elliott has kicked off what we, like they, hope to be the beginning of the end for this malaise that has set in at Suncor for many years now. $SU

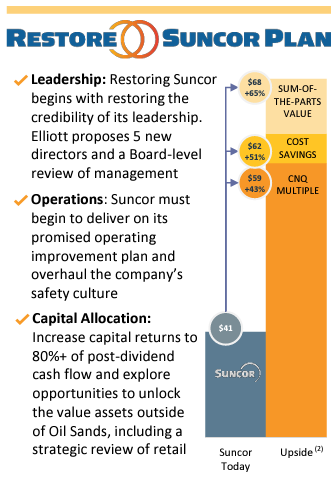

We agree with Elliott about their diagnosis and the recommended course of treatment – as we have pointed out here ad nauseam Suncor is profoundly undermanaged, $SU

while we have been impressed with Mark Littles’ willingness to personally own their issues around HSE and employee fatalities we are unconvinced that he is the correct person to lead what needs to be a substantial cultural turn around; $SU

to whit we support Elliott in their move to add 5 directors to the Board of Suncor, and we look forward to seeing the esteemed roster they have assembled. $SU

It is heartening to see the inclusions of Suncors’ emission reduction plans into Elliott’s presentation $SU

this shows the understanding that any course of action that does not maintain or increase efforts to decarbonize will run into a dramatically less friendly political environment than it otherwise may. $SU #Suncor

Between Suncors’ reaction and the assumptions imbedded in any activist campaign it is being taken as received wisdom that Suncor will be particularly difficult activist case, $SU

at the risk of being overly contrarian we have a high degree of confidence in the Elliott campaign to succeed. $SU #Suncor

We have been critical of Suncor since before Elliott started sniffing around, and their letter reads like I wrote it (not bitter at all about that, not even a shout out or a follow). $SU #Elliott #Suncor

In all this time being a bear on Suncor we have never heard anyone make an affirmative case for current management; $SU #Elliott

many a case that it is due for a rerate, or that the market will wake up to the cash generation or any number of other things about why the stock will move higher but never a case that current management is good at what they do. $SU #Suncor #Elliott

this seems to be a pretty universal take, even in stodgy Calgary where the C-Suites tend to circle the wagons. $SU #Suncor

As such while it goes against the conventional wisdom we are much more bullish on Elliotts’ chances than others as existing management does not have a leg to stand on when trying to make an affirmative case for their own existence. $SU #Suncor

Any how, we wish the Elliott team all the success in this good fight, in addition – Jesse, in the future, remember to grab the twitter handle for your campaign @RestoreSuncor is in good hands, mine – let me know.

$SU #RestoreSuncor #Elliott

$SU #RestoreSuncor #Elliott

• • •

Missing some Tweet in this thread? You can try to

force a refresh