#HellsTradingFloor is currently up ~100% on $RDBX #squeeze thanks to the call out from @dmcalls. Thanks for being a part of the community and keeping your 👀 open for runners.

Retail is rapidly soaking up this micro-float like a sponge, hence I feel this is just the beginning.

Retail is rapidly soaking up this micro-float like a sponge, hence I feel this is just the beginning.

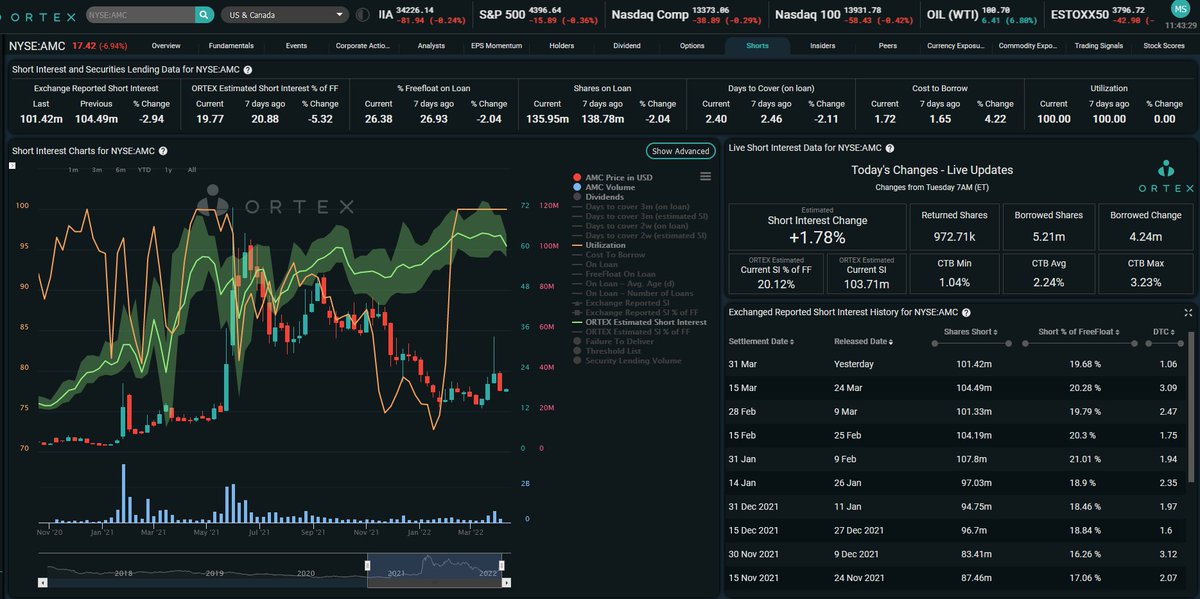

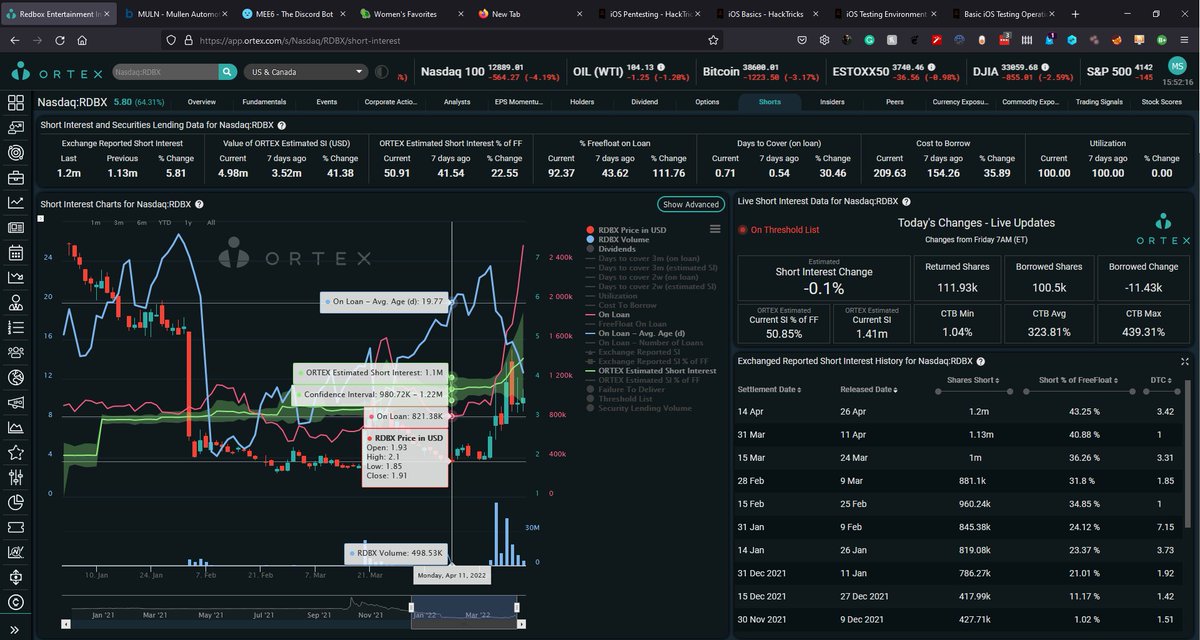

@ORTEX data shows that 50% of all shorts entered (at best) at $11.00 or lower. The other 50% of all 1.41m shares sold short entered below $3.00 and are deep in the red.

All this adds up to old-shorts losing out on their gains, and new ones rapidly losing equity on their margin.

All this adds up to old-shorts losing out on their gains, and new ones rapidly losing equity on their margin.

Additionally, as of yesterday, $RDBX was officially put on the Threshold Security List, which indicates that FTDs on the stock are rapidly outpacing market makers' ability to deliver them.

The best part is that $RDBX short lending volume was so thin the past month that shorts took an absolute beating because of limited liquidity, and it forced market makers to take at least 1 short exempt for every 100 shares traded today.

This has happened once before...in $GME

This has happened once before...in $GME

$RDBX has only 50% of its float shorted, where as $GME had 150% of its float shorted at the time, but in December 2020, there were similar moves in the chart while shorts increasingly struggled to find lendable shares to utilize because market makers borrowed them all.

We are seeing a similar phenomenon because $RDBX shares have been borrowed up to the point that 92% of the Free Float is on loan on 100% utilization for more than 2 months!

If retail believes that short squeezes and a MOASS is possible, then $RDBX is one such stock.

If retail believes that short squeezes and a MOASS is possible, then $RDBX is one such stock.

I already anticipate the tidal wave of hate I'm about to get from $GME holders for suggesting that other stocks can be naked shorted like this, but I'm pointing out $RDBX anyway because this situation has happened before, whether ya'll choose to recognize it or not.

This is a pure buy-and-hold stock with no options available for market makers to fuck with, and now retail knows better after what we went through with $GME and $AMC.

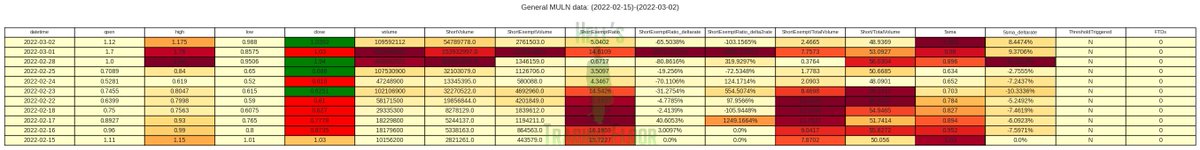

Further, I have the short exempt data to back up my thesis that market makers have lost control.

Further, I have the short exempt data to back up my thesis that market makers have lost control.

As always, please understand that this is a high-risk investment, and how the stock reacts to this information will strongly depend on whether retail decides to buy-and-hold regardless of price action, up or down.

For me, I'm choosing this one to hold for a squeeze.

For me, I'm choosing this one to hold for a squeeze.

The movement is already taking place, so please be careful if you choose to chase this. Any purchase at this price level is 100% a FOMO buy, so please understand that at any point, the bottom could be pulled out from beneath it.

Don't risk what you can't afford to lose.

Don't risk what you can't afford to lose.

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh