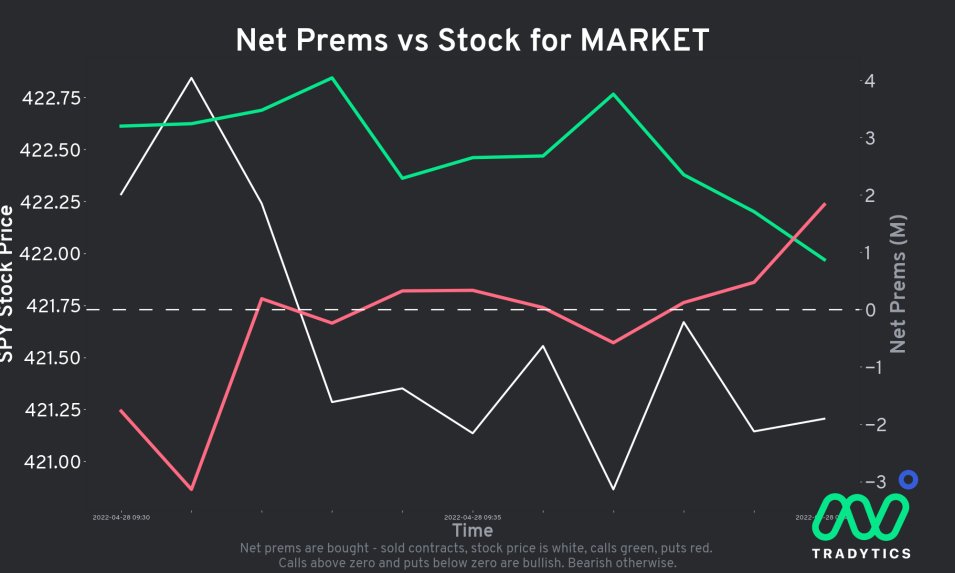

MARKET NETFLOW TO THE WEBSITE 🥳

Market net flow is now available on the Options Market Dashboard on the website. Enjoy, and put in the work to prepare for your week

Dashboard link: tradytics.com/options-market

Market net flow is now available on the Options Market Dashboard on the website. Enjoy, and put in the work to prepare for your week

Dashboard link: tradytics.com/options-market

For those who are new and don't know what Algo or Net flow is, here's a video on the topic -

Market flow is simply a generalization of Net flow for all stocks in the market.

Market flow is simply a generalization of Net flow for all stocks in the market.

Will this be available on mobile? Not for another 3 months at least. Please don't ask again in every tweet I make 🙏

Is this live? The data is updated every 1 minute, but you do need to refresh to see new data. Auto-refresh will be there very soon.

Is this live? The data is updated every 1 minute, but you do need to refresh to see new data. Auto-refresh will be there very soon.

Thank you for your patience, and have a wonderful week. Happy to answer any questions.

• • •

Missing some Tweet in this thread? You can try to

force a refresh