We bridge the gap between wall street traders and retail traders by providing you industry-grade data

13 subscribers

How to get URL link on X (Twitter) App

tradytics.com/community-plays

tradytics.com/community-plays

Let's assume we have a big darkpool level at 385, what happens when we reach towards that level from below 385, we could find some resistance.

Let's assume we have a big darkpool level at 385, what happens when we reach towards that level from below 385, we could find some resistance.

- As price dropped, there were occasional selling / profit taking from puts, but the total amount of puts bought has remained extremely high ever since October, look at the right side of the chart, green bars are put buying.

- As price dropped, there were occasional selling / profit taking from puts, but the total amount of puts bought has remained extremely high ever since October, look at the right side of the chart, green bars are put buying.

If you look at the $380 level earlier last week, it was smaller. As the week went on, it grew. When I am watching price action, I'm looking for Dark pools to help indicate a Support or Resistance level. A case could be made that $380 is now a good sized support.

If you look at the $380 level earlier last week, it was smaller. As the week went on, it grew. When I am watching price action, I'm looking for Dark pools to help indicate a Support or Resistance level. A case could be made that $380 is now a good sized support.

Since we're looking at a very short time frame, the most important data point here is the delta correlations which have gotten a bit positive for the first time in the last few weeks.

Since we're looking at a very short time frame, the most important data point here is the delta correlations which have gotten a bit positive for the first time in the last few weeks.

To me, puts flat shows short term flow traders are not sure about any direction right now, which is why they are taking profits, but they are not buying puts or calls anymore, they're going in cash.

To me, puts flat shows short term flow traders are not sure about any direction right now, which is why they are taking profits, but they are not buying puts or calls anymore, they're going in cash.

I am not talking about the daily flow, more like a slightly longer term perspective as to what flow is really saying.

I am not talking about the daily flow, more like a slightly longer term perspective as to what flow is really saying.

Before the big move started, dealers were already short deltas which means they were buying the underlying shares to hedge positions.

Before the big move started, dealers were already short deltas which means they were buying the underlying shares to hedge positions.

Anytime in the past we've been in the 10-20 million dollar range, that's when most of the big corrections have occurred.

Anytime in the past we've been in the 10-20 million dollar range, that's when most of the big corrections have occurred.

When we are in convergence, that means things are working well, and simply going with the flow is doing good. So we should simply do that as well.

When we are in convergence, that means things are working well, and simply going with the flow is doing good. So we should simply do that as well.

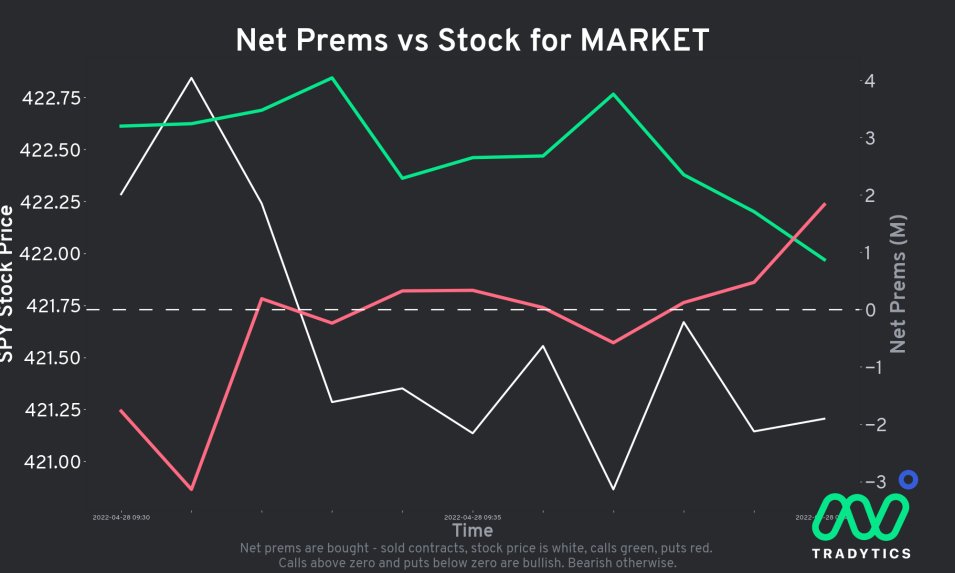

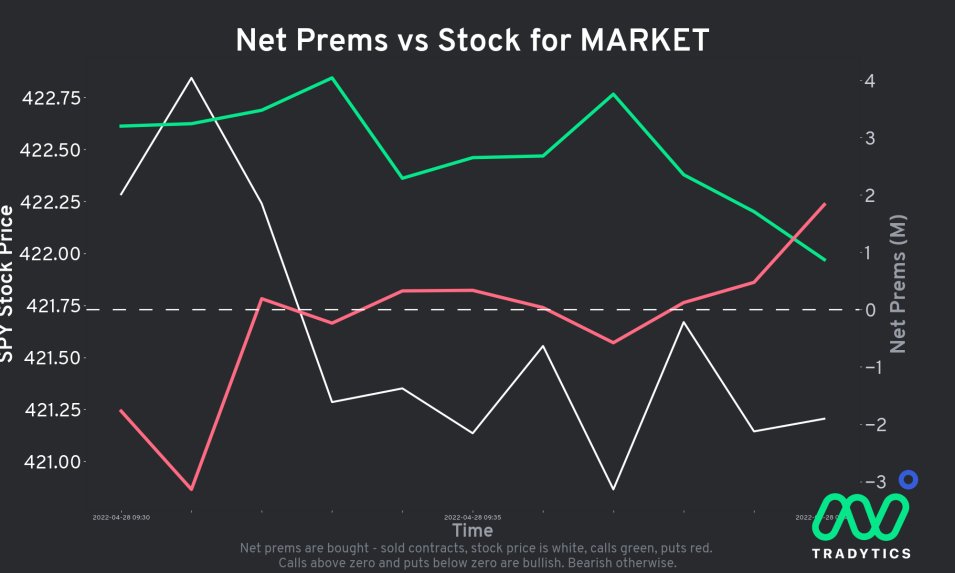

What does this chart shows?

What does this chart shows?

If the unfiltered flow turns positive as well, that’s a good sign. But until only short term flow is bullish, do not go in too heavy.

If the unfiltered flow turns positive as well, that’s a good sign. But until only short term flow is bullish, do not go in too heavy.

For those who are new and don't know what Algo or Net flow is, here's a video on the topic -

For those who are new and don't know what Algo or Net flow is, here's a video on the topic -

Not the time to get any calls right now. Puts leading.

Not the time to get any calls right now. Puts leading.

How do we calculate this?

How do we calculate this?