#Breadth is an efficient way of knowing when to be aggressive, and when to stay out of the markets.

A thread with some different tools you can use

Most of the breadth indicators will tell the same story.

1/x

A thread with some different tools you can use

Most of the breadth indicators will tell the same story.

1/x

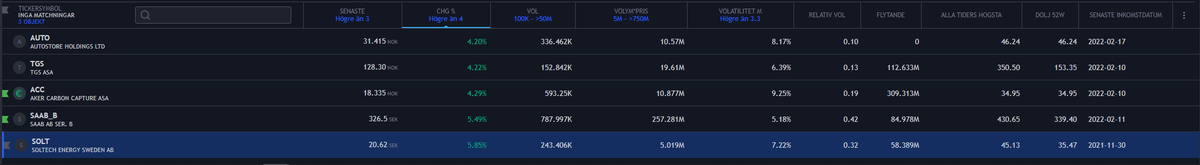

1. Stockbee breadth market monitor: docs.google.com/spreadsheets/d…

Study this a few minutes every day, and you'll build a great feedback loop.

Take note of when changes in breadth occur and what happens w stocks/indexes.

Watch what happens w. ≈1000 up.

2/x

Study this a few minutes every day, and you'll build a great feedback loop.

Take note of when changes in breadth occur and what happens w stocks/indexes.

Watch what happens w. ≈1000 up.

2/x

3. Net new highs/lows for the index you want to trade. When you have a change in breadth and/or more lows than highs it is often time to start going to cash.

Take note that NYSE this year have been working better than Nasdaq while breadth was better on NYSE.

3/x

Take note that NYSE this year have been working better than Nasdaq while breadth was better on NYSE.

3/x

5. McClellan Oscillator, in TC2000 called "T2106".

This can be added to Tradingview as well. You can use this as an oversold/overbought indicator which you can then confirm with price action in stocks of interest.

5/x

This can be added to Tradingview as well. You can use this as an oversold/overbought indicator which you can then confirm with price action in stocks of interest.

5/x

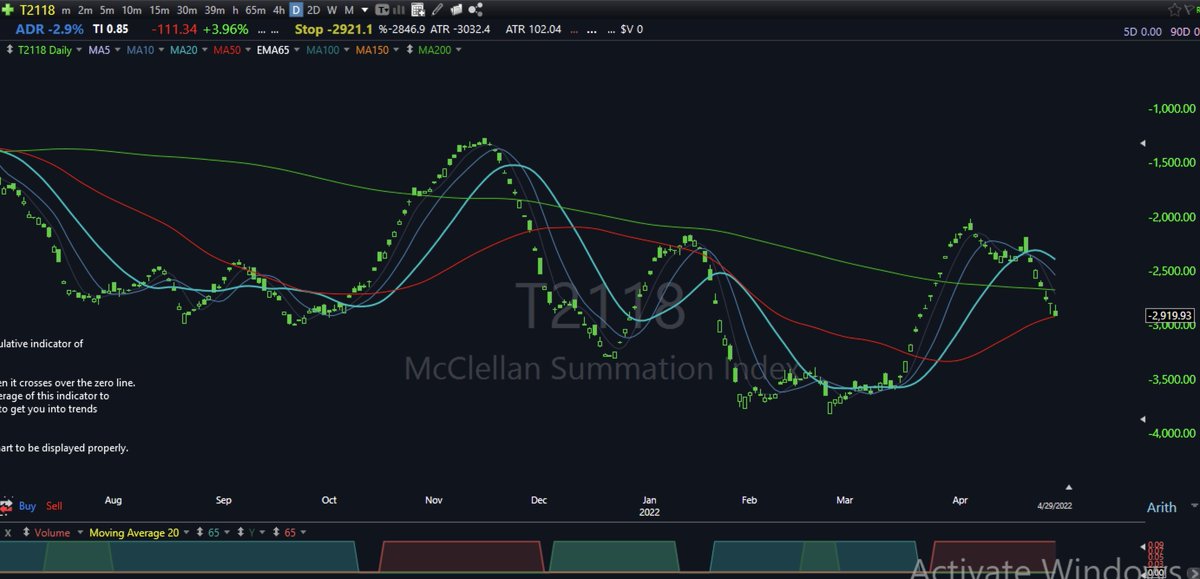

6. McClellan Summation Index T2118.

Can be interpreted as bullish or bearish when it crosses over the zero line. And a crossovers on a 10- or 20-day moving average of this indicator is great for a trend following system - will get you in most trends without much whipsaw. 6/x

Can be interpreted as bullish or bearish when it crosses over the zero line. And a crossovers on a 10- or 20-day moving average of this indicator is great for a trend following system - will get you in most trends without much whipsaw. 6/x

The arrows show the last times two times we had >1000 stocks up over 4% in a day. You'll find the same will be true each time we have a turn in the market.

Use this together w market knowledge. Moves in 3-5 days at a time in one direction + possible pivot points.

Use this together w market knowledge. Moves in 3-5 days at a time in one direction + possible pivot points.

7. 20 day MA of an index can be an effective way to know when to be in or out of the market. When price closes under 20 day MA of an index it can be a signal to go to cash/manage risk. Breakouts normally don't work as well when price is below 20 day MA.

• • •

Missing some Tweet in this thread? You can try to

force a refresh