How to get URL link on X (Twitter) App

Here we have a very nice transition reversal bar, and we have price rejection at same level before pop with volume.

Here we have a very nice transition reversal bar, and we have price rejection at same level before pop with volume.

@lusse03 här ser du ungefär var jag la stop loss. köp 2 gav jag mer spelrum (men det behövdes inte). köpte när jag såg att köptflödet vände i time and sales

@lusse03 här ser du ungefär var jag la stop loss. köp 2 gav jag mer spelrum (men det behövdes inte). köpte när jag såg att köptflödet vände i time and sales

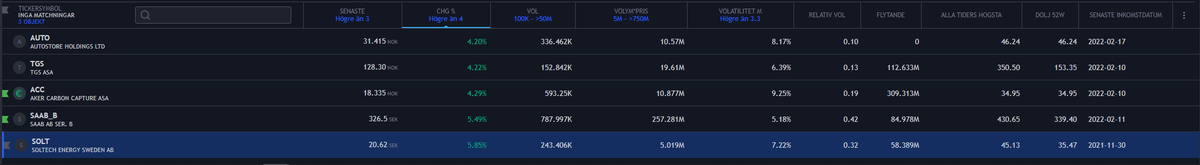

Gets you a pretty good selection in Nordic markets already

Gets you a pretty good selection in Nordic markets already