Crypto isn't a fair playing field.

The truth is that 99% of "retail" investors are at the behest of the top whales and VCs. So, how can you break the mould?

🧵: Here are 5 things that crypto whales and insiders don't want you to know (but you should). 👇

The truth is that 99% of "retail" investors are at the behest of the top whales and VCs. So, how can you break the mould?

🧵: Here are 5 things that crypto whales and insiders don't want you to know (but you should). 👇

1. Harsh reality: Most DeFi protocols don't need a token.

I'm a proponent that the world is moving to a tokenised future. Many companies could benefit greatly from the token model as it:

• Enables division of governance

• Increases liquidity and facilitates a secondary market

I'm a proponent that the world is moving to a tokenised future. Many companies could benefit greatly from the token model as it:

• Enables division of governance

• Increases liquidity and facilitates a secondary market

But in crypto, tokens are often created with the intent of lining the team's pockets, as opposed to offering a strategic benefit.

There are many great projects out there, but unfortunately this space is also full of cash grabs (who may have a great product, but a useless token).

There are many great projects out there, but unfortunately this space is also full of cash grabs (who may have a great product, but a useless token).

So to avoid this, if you're investing in a project - make sure the token:

• Has a strong value accrual mechanism (price growth reflects user growth)

• Fills a market need

• Has a competitive advantage over comparable protocols

• Has a purpose beyond making holders money

• Has a strong value accrual mechanism (price growth reflects user growth)

• Fills a market need

• Has a competitive advantage over comparable protocols

• Has a purpose beyond making holders money

2. The majority of VCs make their money through investing early in token seed & private sale rounds.

You might think a project is "cheap", but the reality is that the VCs got in at much lower levels.

You might think a project is "cheap", but the reality is that the VCs got in at much lower levels.

For example, initial private round investors got into $SOL at $0.04 (that's a 2250x vs current levels). They also bought:

$FTM for $0.043

$AVAX for $0.50

$BNB $0.15

You can check the price of investment rounds on icohigh.net (this is very important to consider).

$FTM for $0.043

$AVAX for $0.50

$BNB $0.15

You can check the price of investment rounds on icohigh.net (this is very important to consider).

Private and seed rounds are a crucial part of the development process. Without them, new projects wouldn't be able to generate the funding and support necessary to build.

The rounds aren't the problem. The problem is that retail forgets where the majority of VCs bought in.

The rounds aren't the problem. The problem is that retail forgets where the majority of VCs bought in.

This can create large sell events.

Even though a token's market price may drop 50%, the reality is that most initial investors are still up 500x+.

This leads to profit taking, or as some people would label it: "dumping on retail."

Even though a token's market price may drop 50%, the reality is that most initial investors are still up 500x+.

This leads to profit taking, or as some people would label it: "dumping on retail."

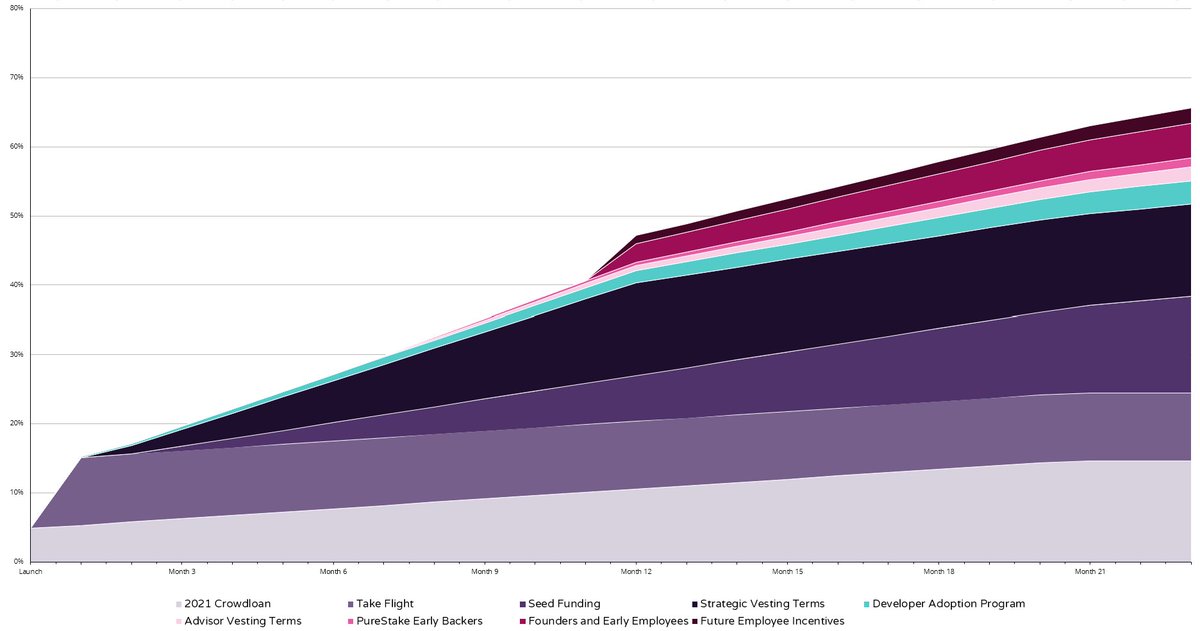

For example, $GLMR is fundamentally a great project. But its token price hasn't fared too well. Why? Due to its vesting schedule.

We can see the major unlocks outlined in the token release schedule:

We can see the major unlocks outlined in the token release schedule:

Watch out for unlock dates before investing. Each project should outline the vesting schedule under "tokenomics" in their white paper. Consider:

• When tokens are unlocking

• How steep the "cliff" is

• Where tokens are being allocated

• When tokens are unlocking

• How steep the "cliff" is

• Where tokens are being allocated

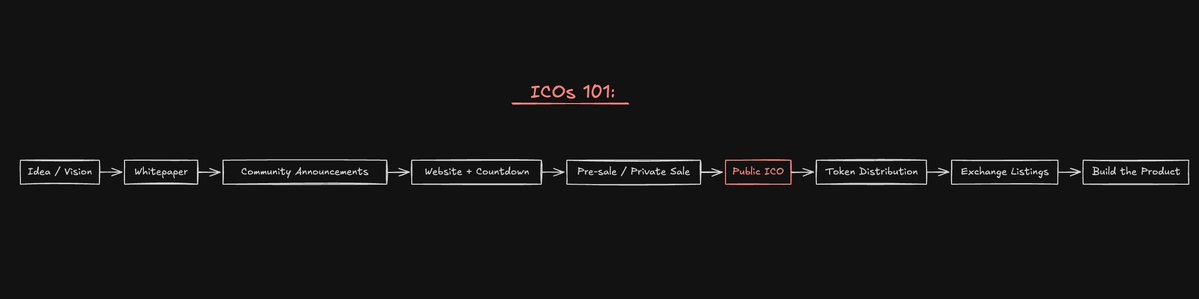

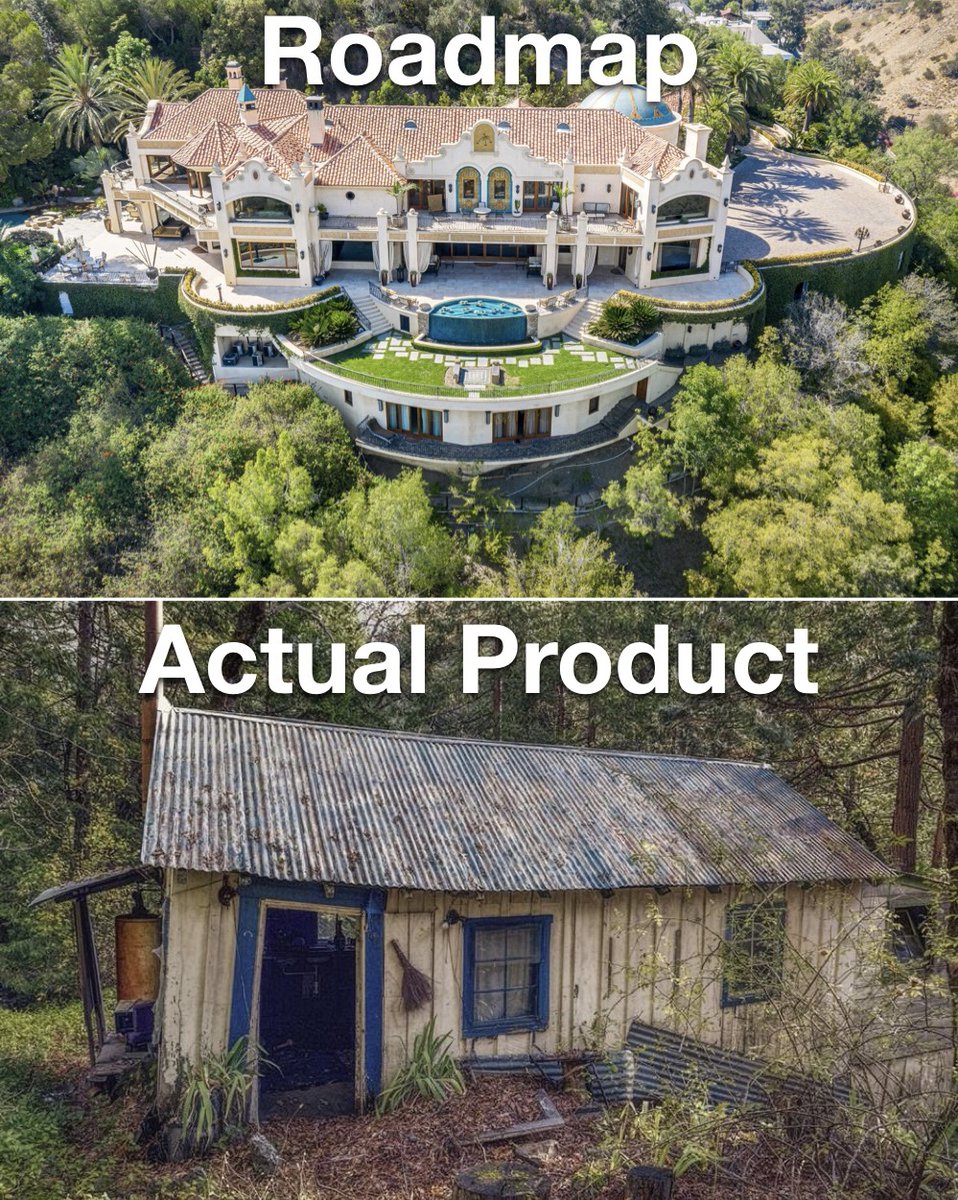

3. Many projects don't have a product.

Projects often use their seed and private rounds to bootstrap funding for development.

They'll put out a fancy white paper and ambitious roadmap, before they've built a single thing.

Projects often use their seed and private rounds to bootstrap funding for development.

They'll put out a fancy white paper and ambitious roadmap, before they've built a single thing.

This is the way crypto works (which is fine).

But it becomes a problem when the market slaps an exorbitant valuation on a project before it even has a product.

This significantly increases the risk profile of said investment.

But it becomes a problem when the market slaps an exorbitant valuation on a project before it even has a product.

This significantly increases the risk profile of said investment.

For example, there are many gaming projects commanding valuations of $100m+, despite having little or no product to show for it.

Ultimately, it's a new industry and the market is pricing in future growth. But on the other hand, it manufactures more room for downside.

Ultimately, it's a new industry and the market is pricing in future growth. But on the other hand, it manufactures more room for downside.

Overpromising and underdelivering is basically the synopsis of every NFT project barring a few exceptions.

So before investing, ask yourself:

• Does the team have a proven track record?

• Who are the big backers?

• Is their valuation reasonable vs other projects?

So before investing, ask yourself:

• Does the team have a proven track record?

• Who are the big backers?

• Is their valuation reasonable vs other projects?

4. APRs are meant to incentivise liquidity.

In the real world, when companies first launch they'll offer promotions to incentivise people to spend money/grow accustomed to their product.

"Buy one get one free"

"50% off for the 1st 100 users"

"First time sign up bonus of $__"

In the real world, when companies first launch they'll offer promotions to incentivise people to spend money/grow accustomed to their product.

"Buy one get one free"

"50% off for the 1st 100 users"

"First time sign up bonus of $__"

In crypto it's no different. Except instead of incentivising via discounts, DeFi projects use token emissions to incentivise early liquidity.

This model has worked very successfully for the likes of $LUNA (via @anchor_protocol), @CurveFinance etc.

This model has worked very successfully for the likes of $LUNA (via @anchor_protocol), @CurveFinance etc.

But for the majority of DeFi projects, emissions end up being their downfall.

Often times, the tokenomics are poorly designed and lead to over dilution.

A few examples:

Often times, the tokenomics are poorly designed and lead to over dilution.

A few examples:

Thus, the burning question in DeFi is "what happens when emissions run out?"

Well, protocols will need to pivot from incentivising liquidity towards incentivising fees.

Holders should primarily generate a return via fees, not emissions.

Well, protocols will need to pivot from incentivising liquidity towards incentivising fees.

Holders should primarily generate a return via fees, not emissions.

Look for projects with:

• High fees generated vs emissions

• Tangible users and trade volume (leading to fees)

• Strong token value accrual mechanisms

• Real utility

That way, you won't end up holding the bag on a farming token which endlessly prints.

• High fees generated vs emissions

• Tangible users and trade volume (leading to fees)

• Strong token value accrual mechanisms

• Real utility

That way, you won't end up holding the bag on a farming token which endlessly prints.

Investing in farming tokens is fine, but only if you're actively benefitting from the emissions (which offset the decline in token price).

Many naive investors will purchase DEX tokens etc. but not use them for their intended purpose (to generate a return via yield).

Many naive investors will purchase DEX tokens etc. but not use them for their intended purpose (to generate a return via yield).

Since APRs are used to incentivise liquidity, the #1 lesson is: Never chase yield.

Don't buy a token solely because it's paying a high APR.

Invest in a token primarily because you have conviction, then look to farm it. This mindset switch could save you a lot of pain.

Don't buy a token solely because it's paying a high APR.

Invest in a token primarily because you have conviction, then look to farm it. This mindset switch could save you a lot of pain.

5. Whales do the opposite of the market.

As Warren Buffet famously stated: Be "fearful when others are greedy, and greedy when others are fearful."

Historically (in traditional markets and crypto), those who buy during extreme times of fear come out ahead over time.

As Warren Buffet famously stated: Be "fearful when others are greedy, and greedy when others are fearful."

Historically (in traditional markets and crypto), those who buy during extreme times of fear come out ahead over time.

Whales accumulate when the market is low, and take profits when the market is high.

Whales were:

• Taking profits in May 2021

• Accumulating in September

• Taking profits in November

• Accumulating now.

We can see this clearly evidenced via the whale holdings chart:

Whales were:

• Taking profits in May 2021

• Accumulating in September

• Taking profits in November

• Accumulating now.

We can see this clearly evidenced via the whale holdings chart:

What's the pattern here? Whale holdings are inversely correlated with price.

They do the exact opposite of retail participants. To simplify:

• Take profits into massive pumps (greed)

• Buy into massive dumps (fear)

Rinse/repeat.

They do the exact opposite of retail participants. To simplify:

• Take profits into massive pumps (greed)

• Buy into massive dumps (fear)

Rinse/repeat.

Hopefully these 5 tips help you navigate this market.

Crypto is a tricky game, but if conducted successfully it can create life changing wealth.

If you want to be as rich as a whale, it's time to act like one. 🐋

Crypto is a tricky game, but if conducted successfully it can create life changing wealth.

If you want to be as rich as a whale, it's time to act like one. 🐋

If you enjoyed this thread, please give the first tweet a like and retweet. 💙

https://twitter.com/milesdeutscher/status/1521606009495728129?s=20&t=5CwlR66rSqxQMF9_Mopulg

• • •

Missing some Tweet in this thread? You can try to

force a refresh