After UEFA’s ruling that no Russian clubs will participate in its competitions until further notice, it is now certain that the winners of the Scottish Premiership will qualify automatically for the group stage of the Champions League without having to go through a play-off.

As Celtic realistically only need three points to secure the title (given their vastly superior goal difference), it looks likely that they will take Scotland’s Champions League place, so I thought it would be interesting to estimate how much this might be worth #CelticFC

#CelticFC have received £133m from Europe in TV distributions from UEFA in the last 10 years, but the difference between earnings from the Champions League (£92m in 4 years) and the Europa League (£41m in 6 years) is stark.

The last time #Celtic FC reached the Champions League group stage was in 2017/18, when they received €32.5m, even though they lost 5 of the 6 games. Around half was their share of the British TV pool (€16.1m), as Scottish clubs received 10% if they qualified for the group.

This is important, as the TV pool was reduced in 2018/19 to help fund the new UEFA coefficient payment, which is based on performances in UEFA tournaments over the past 10 years, including bonus points for winning tournaments. This change has hurt Scottish clubs.

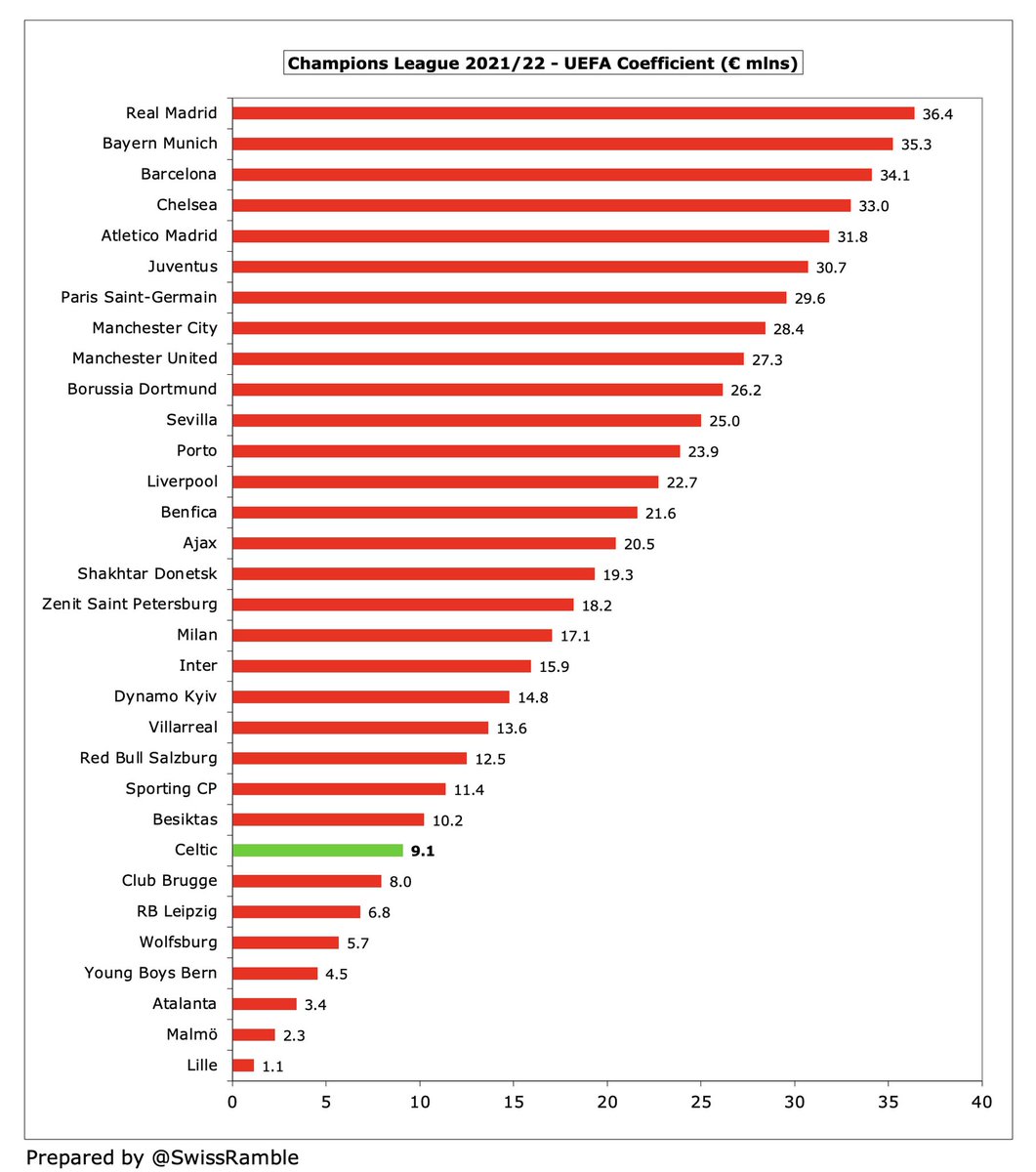

The Champions League UEFA coefficient pot is divided into shares worth €1.137m, so the highest ranked club gets €36.4m, while the lowest gets €1.1m. Based on the 2021/22 coefficients, #CelticFC are ranked 38th in Europe, so would have received €9.1m.

On the other hand, like all other clubs in the Champions League group stage, #CelticFC will receive a participation fee of €15.64m, which is up 3% from the previous cycle’s €15.25m – even if they do not win a single game.

Any positive results in the group would increase #CelticFC CL earnings: €2.8m for a win and €930k for a draw. Additional prize money is received for each further stage reached: last 16 €9.6m, quarter-final €10.6m, semi-final €12.5m, final €15.5m and winners €20m.

#CelticFC are part of British TV pool. For English clubs, half based on position in previous season’s domestic League, half on progress in current season’s Champions League. Assuming Scottish clubs continue to get 10% of the total (as was the case before), that would mean €6.8m.

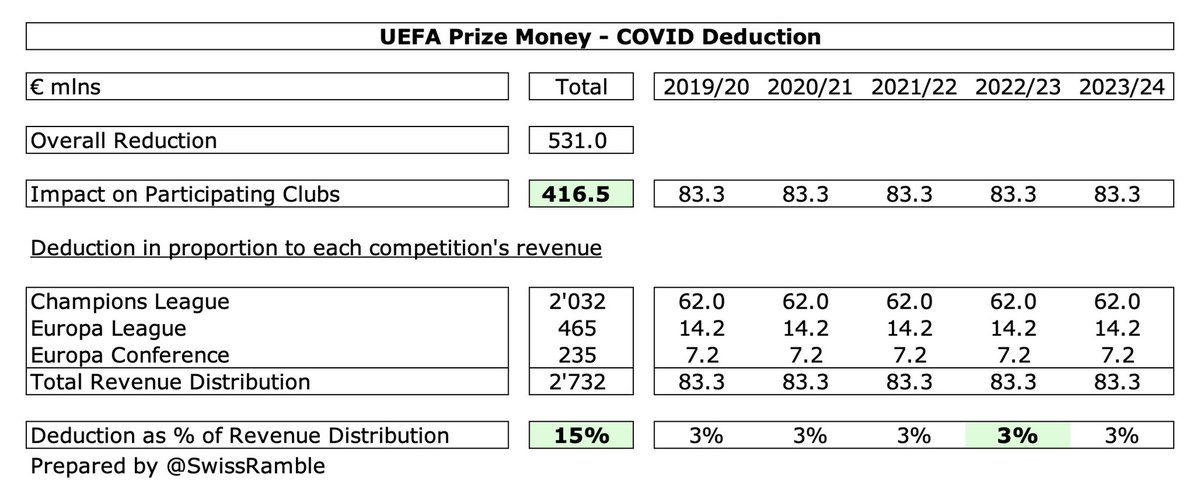

As a result of COVID-19, revenue in 2019/20 was reduced by €531m with €416.5m impact on participating clubs. This will be deducted in equal shares over five seasons (from 2019/20 to 2023/24) in proportion to each competition. This works out to around 3% of each club’s revenue.

If we assume #CelticFC win one game and draw another one in the group, they would earn €3.9m prize money. On that basis, total TV money would be €34.3m (£30m): participation €15.6m, prize money €3.9m, UEFA coefficient €9.1m and TV pool €6.8m less €1.2m COVID rebate.

Clearly, the actual amount would depend on how far #CelticFC progress in the competition, but it is clear that Champions League money will make a sizeable difference to their revenue. The only time the club generated more than £100m was in 2018, i.e. the last time they qualified.

On top of the estimated £30m TV money, #CelticFC would also earn more in terms of gate receipts plus it is likely that their sponsorship agreements include performance bonuses for Champions League qualification, so the net revenue benefit would be higher.

Against that, player contracts are likely to have similar bonus clauses for reaching the Champions League, so the #CelticFC wage bill will also increase.

If #RangersFC do manage to overtake Celtic and take the Champions League place, their earnings would be smaller, due to their lower UEFA coefficient. They are currently ranked 98th, 60 places below their rivals’ 38th place, giving a €3.4m payment (compared to Celtic’s €9.1m).

Using the same assumptions as before, #RangersFC would earn £25m from the Champions League, compared to Celtic £30m, though their coefficient will obviously improve after their impressive run this season to the Europa League semi-final (and maybe more).

It should be emphasised that these are only estimates, including assumptions around TV pool, UEFA coefficient and progress in the Champions League, but the analysis should give a decent indication of the money to be earned by Scotland’s leading clubs.

For all who asked what would happen if both #CelticFC and #RangersFC qualify for Champions League.

Last time this happened was in 2007/08 when the TV pool (equal to 10% of British pool) was split between the 2 clubs: 55% for Premiership winners, 45% for runners-up.

Last time this happened was in 2007/08 when the TV pool (equal to 10% of British pool) was split between the 2 clubs: 55% for Premiership winners, 45% for runners-up.

• • •

Missing some Tweet in this thread? You can try to

force a refresh