I'm doing a DD recap on $RDBX to update everyone on the play and give everybody _full_ transparency into the 8-K filing and understand what is going on. Buckle up, this is gonna be a long one...

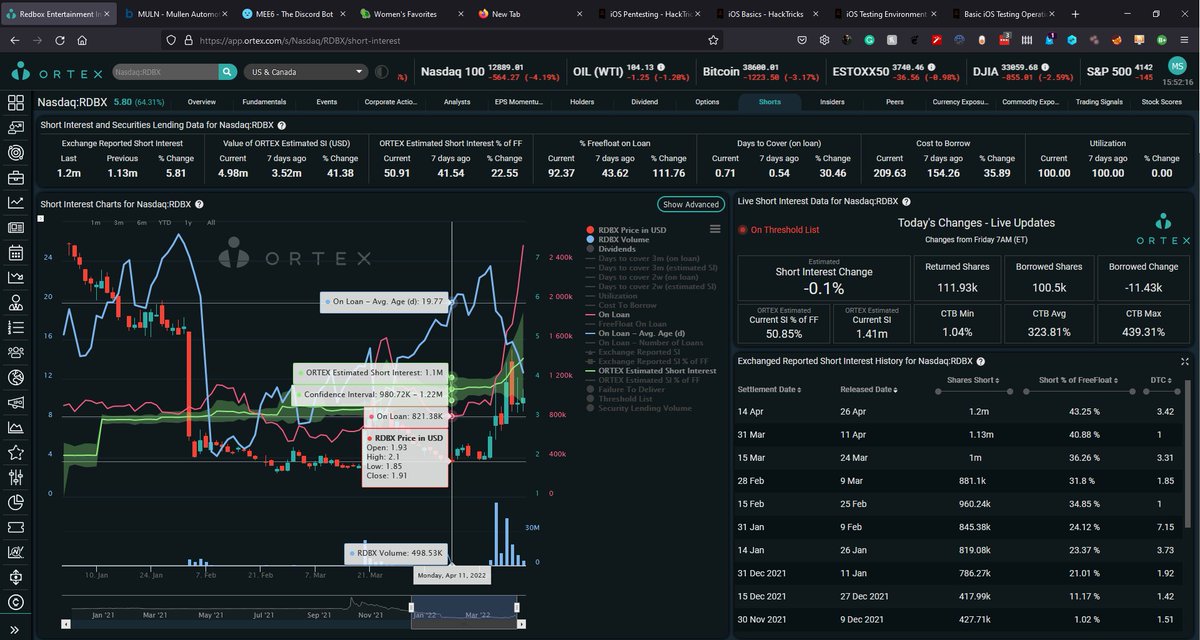

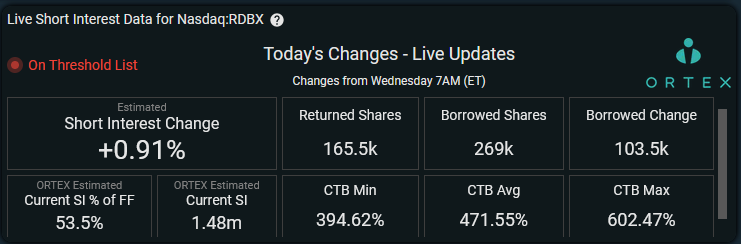

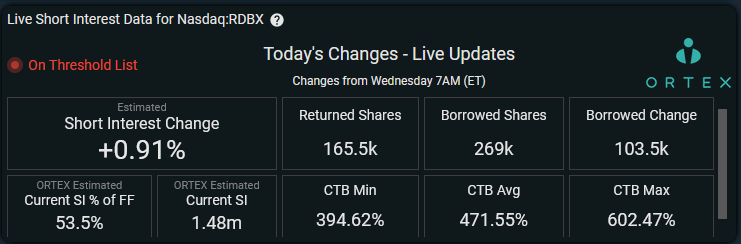

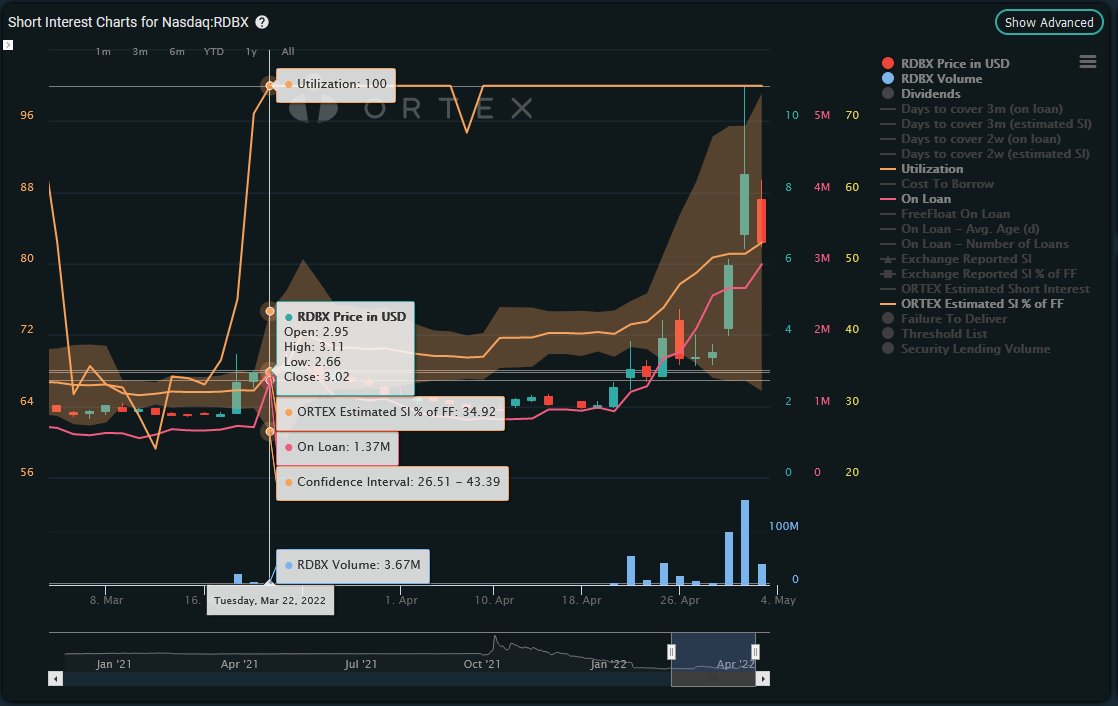

$RDBX (Redbox Entertainment) is currently the largest overleveraged stock on the market according to Ortex data. I've been carefully watching for **any** signs of shorts covering in the last 5 trading days. There have been absolutely none.

In fact, they shorted some more...

In fact, they shorted some more...

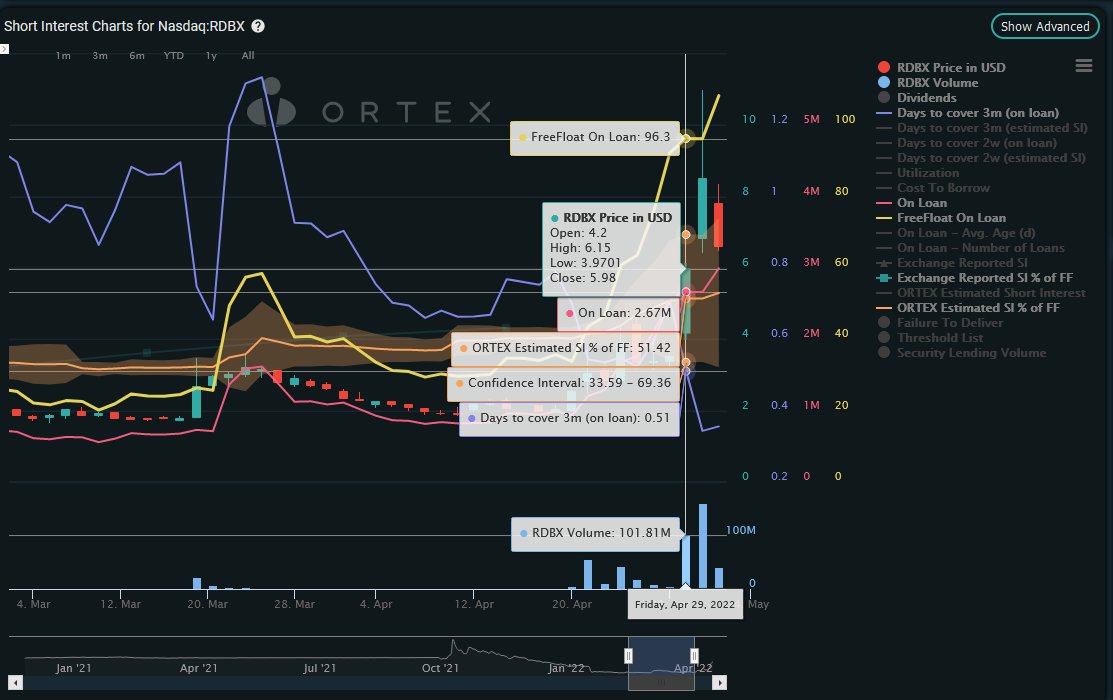

$RDBX has been shorted by 53% of its FF which has only increased in the last two trading days. Accounting for 2-day settlement, if shorts covering had caused the run-up, then the T+2 delayed data would show a dramatic drop in the number of shares on loan as of this morning.

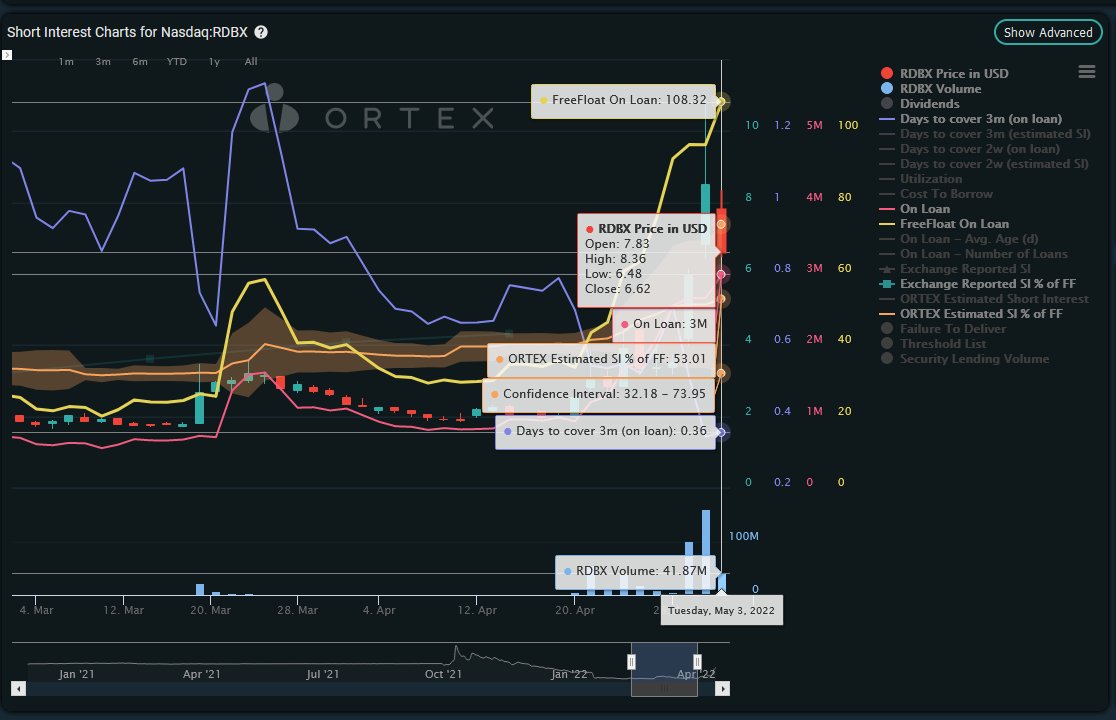

Instead, shares on loan have gone from 93% of FF to 108%... completely bonkers.

Shorts absolutely didn't cover, and market makers (MM) started borrowing to keep up with the buy orders. There are NO options for $RDBX, and as a result, MMs are forced to provide a liquid market.

Shorts absolutely didn't cover, and market makers (MM) started borrowing to keep up with the buy orders. There are NO options for $RDBX, and as a result, MMs are forced to provide a liquid market.

Let us further note that the Cost-to-borrow average is more than 471% of the cost-basis.

Imagine if you took out a 471% interest credit card and had to pay 4x your principal balance per year, and you had to make a payment _every single day_ against that balance.

Imagine if you took out a 471% interest credit card and had to pay 4x your principal balance per year, and you had to make a payment _every single day_ against that balance.

If shorts took out a $1,000 position, they'd have to pay ~$13/day just to hold the position.

After just 90 days, shorts would have already had to pay $1,175, just for the privilege to hold/short this stock.

Amp that number up 3M shares on loan, and shorts are paying ~$290k/day.

After just 90 days, shorts would have already had to pay $1,175, just for the privilege to hold/short this stock.

Amp that number up 3M shares on loan, and shorts are paying ~$290k/day.

Let's look at another factor. $RDBX lendable shares have been 100% utilized since Mar 22, and on threshold ever since Apr 28.

After today that's 5 days.

If shorts don't deliver their outstanding FTDs by T+13 (May 16), the SEC can force them to close their positions.

After today that's 5 days.

If shorts don't deliver their outstanding FTDs by T+13 (May 16), the SEC can force them to close their positions.

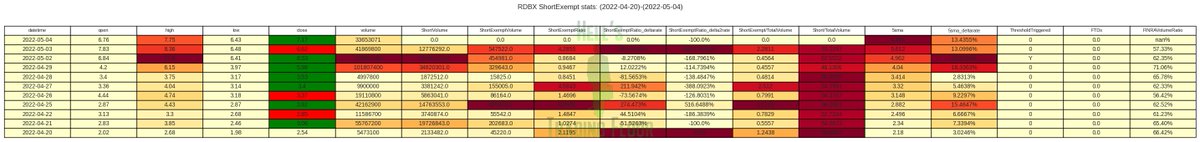

But for market makers, the issue is far more serious because MMs are only permitted to FTD for 6 days before the SEC starts putting pressure on them.

Per REGSHO, MMs will be forced to cover their short exempts with either a borrow or a purchased share by T+6 from their purchase

Per REGSHO, MMs will be forced to cover their short exempts with either a borrow or a purchased share by T+6 from their purchase

So for us, this is great, because market makers are continuously backing themselves into a corner, thinking they'll be able to rug-pull retail and cover those short-exempts for 20-30% cheaper than when they created them.

if $RDBX goes up, however, the opposite occurs.

if $RDBX goes up, however, the opposite occurs.

If price goes up past $11 & MMs say,

"Oh shit, we have 1.33M shares of $RDBX that will FTD before Fri, and they'll be due by Tues morning May 10... and we borrowed 108% of the free float because we never located our short exempt borrows... what the fuck are we gonna do?!~"

"Oh shit, we have 1.33M shares of $RDBX that will FTD before Fri, and they'll be due by Tues morning May 10... and we borrowed 108% of the free float because we never located our short exempt borrows... what the fuck are we gonna do?!~"

Mean while retail keeps buying shares, and the MMs on Wall Street and in downtown Chicago see this shit in the distance...

I rarely talk like this because I try very hard to stay impartial and unbiased in my assessment, and I *AM* biased here. After all, I own a whole... 300 shares 🤣

It's not the numbers of one individual that matter, it's the numbers that a wave of individuals can consume.

It's not the numbers of one individual that matter, it's the numbers that a wave of individuals can consume.

I'm not in the business of pump and dumps, and I work very hard to make sure to keep my DD and my decisions transparent, honest, and ethical, but what I see here is seriously one of the best squeeze setups I've seen since $SPRT went from $8.10 to $57 in a span of a month...

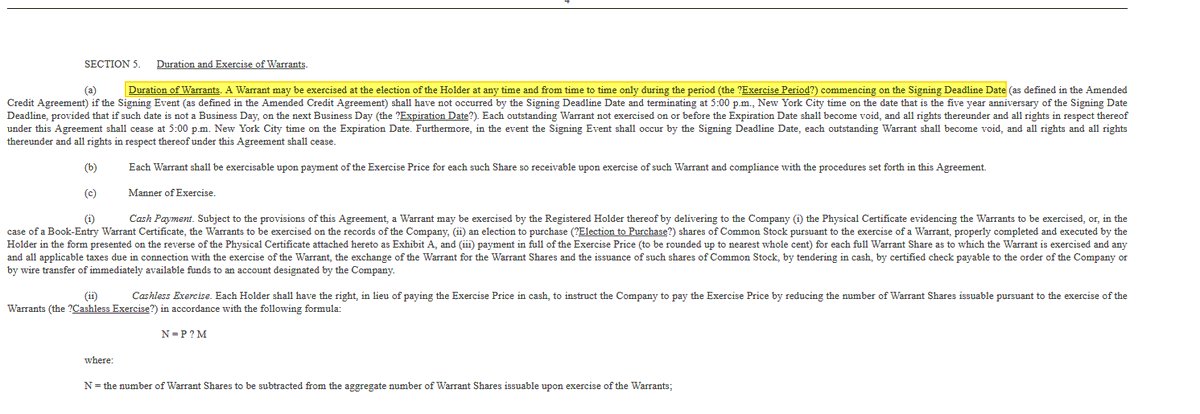

Before we get too ahead of ourselves, I must let everyone know about the potential for dilution which can happen very soon, but luckily it's not as bad as it seems. Still, I want to make sure everyone knows EXACTLY what the risks are and what can happen.

Currently there are warrants for $RDBX which are eligible for a cashless exercise starting on May 10th. This is per $RDBX's latest 8-k filing. The warrants can dilute $RDBX by up to 20% of its outstanding shares, maximum. That's 1.26M shares, approximately.

Proof in the pics.

Proof in the pics.

So... short sellers are betting on a 20% dilution to bail their asses out of the fire... after suffering a cool $7M in net losses on Apr 29 and May 2 back to back...

That being said, the importance of this information isn't so much that "dilution is bad" as much as misinformation about dilution is bad.

In order to fight the misinformation, I'm getting ahead of it and making everyone aware that, beginning May 10th, 20% dilution is possible.

In order to fight the misinformation, I'm getting ahead of it and making everyone aware that, beginning May 10th, 20% dilution is possible.

$RDBX technicals are set up for consolidation and continuation once we break out of the $8 level. $RDBX held $6.40 twice now, despite shorts piling on.

The effect is that shorts have left their asses swinging in the breeze with a nice, brightly colored bullseye on them. 🎯

The effect is that shorts have left their asses swinging in the breeze with a nice, brightly colored bullseye on them. 🎯

The OBV shows consolidation after massive bullish divergence, and the MACD cross down appears shallow. After some time passes with shorts biting their nails and hemorrhaging borrow fees, I anticipate another cross above and a breakout from $8-$9. Final resistance is at $10.50

Shorts have earned their scorch marks on this one. Don't feel bad for them. Whoever found a way to borrow 108% of the free float in order to try to short this company to death is no friend to free and fair markets.

They deserve to burn.

They deserve to burn.

As always, none of this is financial advice, and I am not a financial advisor nor a fortune teller, but I am long on $RDBX with no intention to sell.

I wish everyone the best of luck as we chase this next squeeze.

Godspeed.

I wish everyone the best of luck as we chase this next squeeze.

Godspeed.

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh