WHY NOT SUE HINMAN NOW?

I probably have 100 DMs asking the above question and many others are frustrated and wondering why I or others aren’t moving forward with a lawsuit against Hinman for his blatant ethical conflicts. Everyone wants justice today. I get it. So do I.

I probably have 100 DMs asking the above question and many others are frustrated and wondering why I or others aren’t moving forward with a lawsuit against Hinman for his blatant ethical conflicts. Everyone wants justice today. I get it. So do I.

https://twitter.com/CrapaudDuBitume/status/1522207655414042624

The truth is anyone could file a suit today. But, as of right now, the case would get dismissed with prejudice based on the qualified immunity Hinman enjoys as a former government official.

I have said if Hinman knew his law firm was a member of the EEA and he didn’t get approval from the Ethics Office (which he couldn’t), it would, IMO, constitute a violation of criminal conflict laws. But we must PROVE Hinman had actual knowledge that STB was a member of the EEA.

We don’t have proof, yet. Only a fraction of Hinman’s deposition was disclosed to the public.

I GUARANTEE during Hinman’s deposition he was asked whether he knew Simpson Thacher was a member of the EEA.

I GUARANTEE he said that he wasn’t aware of it when he gave the speech.

I GUARANTEE during Hinman’s deposition he was asked whether he knew Simpson Thacher was a member of the EEA.

I GUARANTEE he said that he wasn’t aware of it when he gave the speech.

How can I be so sure? Because if he admits he knew his firm was a member of the EEA, he incriminates himself. It is a blatant violation of criminal conflict laws. If he admits he knew, he has to admit he should’ve sought clearance from the Ethics Office.

oge.gov/web/oge.nsf/0/…

oge.gov/web/oge.nsf/0/…

The Ethics Office would NEVER approve him giving that speech if it knew his firm was a member of the EEA and that he was an active profit sharing partner (as they concluded).

They instructed him not to even talk to STB!

I have zero doubt Hinman denied knowing about the EEA.

They instructed him not to even talk to STB!

I have zero doubt Hinman denied knowing about the EEA.

I have no idea if the Ripple lawyers had evidence to the contrary when they cross examined Hinman. Unless the Deposition is made public or relevant information appears in Ripple’s Summary Judgment papers, we won’t see it.

This is why we MUST get an investigation.

This is why we MUST get an investigation.

Trust me, Hinman hopes we sue him prematurely. His massive team of high priced lawyers along with a team of lawyers from the SEC will rush to dismiss the case. Hinman and the SEC will show up immediately invoking qualified immunity.

“Qualified immunity is not immunity from having to pay money damages, but rather immunity from having to go through the costs of a trial at all. Accordingly, courts must resolve qualified immunity issues as early in a case as possible, preferably before discovery.”

“BEFORE”!!

“BEFORE”!!

A federal judge is not going to let us engage in a fishing expedition and serve discovery requests on Hinman hoping we find proof of actual knowledge.

Qualified immunity shields 🛡 Hinman and other government officials from being served discovery.

We need the evidence upfront.

Qualified immunity shields 🛡 Hinman and other government officials from being served discovery.

We need the evidence upfront.

Thus, if we filed a case and the only evidence we have is Bill Hinman denying he knew his firm was a member of the EEA, the Judge would say there is no evidence Hinman acted outside the scope of his duties for his own personal gain.

The fact that so many other SEC lawyers and staff helped him with the speech supports a claim that he wasn’t acting outside the scope of his duties as Director of Corporation Finance.

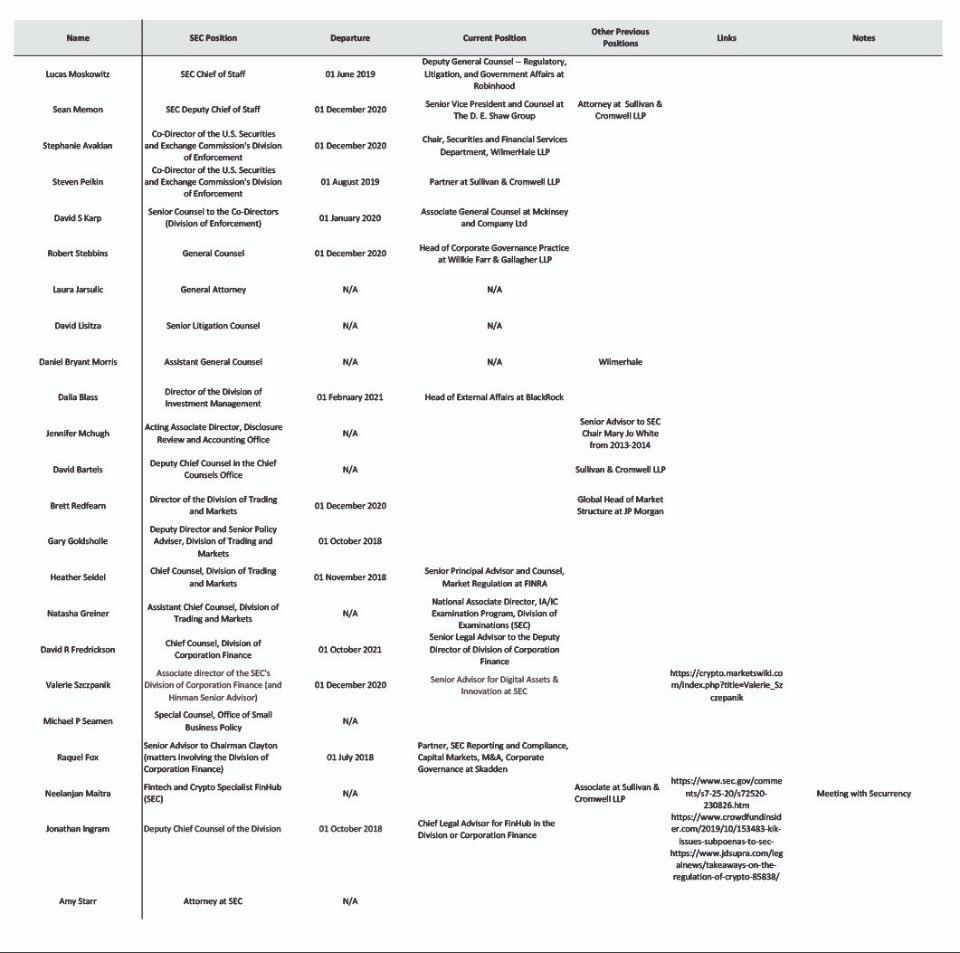

See table 👇 by @_CryptoArsenal

See table 👇 by @_CryptoArsenal

Despite the SEC claiming it was his personal opinion in the @Ripple case, does anyone seriously doubt that the SEC would show up in a case against Hinman and tell the Judge that the speech was official SEC work product and therefore protected by immunity.

Of course they would.

Of course they would.

Without more proof, all we can show, today, is a gross appearance of impropriety.

Ignoring the Ethics Officer’s warning not to meet with STB is enough to warrant an investigation but it’s not enough to pierce through the shield 🛡 of immunity to overcome a motion to dismiss.

Ignoring the Ethics Officer’s warning not to meet with STB is enough to warrant an investigation but it’s not enough to pierce through the shield 🛡 of immunity to overcome a motion to dismiss.

An appearance of impropriety (even a gross one) is not enough to get over the hurdle of qualified immunity in the early stages of a civil lawsuit. The Judge would dismiss the case with prejudice.

If a judge dismisses the case with prejudice, it could be game over for justice.

If a judge dismisses the case with prejudice, it could be game over for justice.

If the case is dismissed with prejudice, it can prevent any future case from going forward, even if strong evidence of wrongdoing surfaced later.

There are doctrines of law called res judicata and collateral estoppel that could be triggered by a dismissal with prejudice.

There are doctrines of law called res judicata and collateral estoppel that could be triggered by a dismissal with prejudice.

If a second case was filed later, with additional evidence, Hinman’s lawyers could invoke these doctrines of law and a judge could rule that the issue was already decided and that he must honor the prior judge’s ruling.

Even worse, when we ask a Congressman or Senator sitting on the Financial Services Committees to investigate, they might say “didn’t a federal judge look at this already and decide it lacked merit?”

Imagine that.

In fact, Hinman would love it. He could control the narrative.

Imagine that.

In fact, Hinman would love it. He could control the narrative.

We would then have to listen to CNBC finally cover the story, except the coverage would be how it was dismissed (even though no real discovery took place).

The reality is that there will likely be only one chance at filing a civil case against any former gov’t official.

The reality is that there will likely be only one chance at filing a civil case against any former gov’t official.

The same applies to going after the SEC itself. In addition to qualified immunity you have to overcome sovereign immunity. It is not an easy thing to overcome. Look at the Bernie Madoff case. Look at how egregious the SEC’s negligence and conduct was in not pursuing Madoff.

“a federal appeals court upheld the dismissal of lawsuits against the securities regulator brought by Madoff investors. The court said the SEC’s actions and “regrettable inaction” were protected by a law that shields federal agencies from liability.”

👇

reuters.com/article/us-mad…

👇

reuters.com/article/us-mad…

The point is that justice and accountability isn’t going to come easy or fast. It is imperative that we keep asking for and demanding an investigation.

Intentional misconduct and gross negligence IS NOT fully protected by qualified or sovereign immunity, giving life to cases.

Intentional misconduct and gross negligence IS NOT fully protected by qualified or sovereign immunity, giving life to cases.

Look what’s been uncovered by @EMPOWR_us and #XRPHolders through publicly available information or FOIA. An investigation with subpoena power brings it all home. We keep fighting. I have an appointment with a MAJOR journalist at a MAJOR publication next week.

Slowly but surely.

Slowly but surely.

• • •

Missing some Tweet in this thread? You can try to

force a refresh