Candidate, U.S. Senate; Founder, CryptoLawUS; Managing Partner, Deaton Law Firm; CLA, SpendTheBits, Entrepreneur; Author; Survivor.

20 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/senwarren/status/1806721878163177869In fact @ewarren epitomizes what’s wrong with Washington D.C. Think about it: a Member of Congress is complaining that the Supreme Court stripped away power from the Administrative State and returned that power back to members of Congress. 🤔

https://twitter.com/bgarlinghouse/status/1341193536780214273

Consider that during his deposition, Hinman admitted that he was the one who reached out to Joe Lubin to discuss #ETH. When asked by Ripple’s lawyers whether Clayton was the one who asked Hinman to reach out to Lubin and Consensys, Hinman testified that he couldn’t recall whether Clayton had suggested it. 🤔

Consider that during his deposition, Hinman admitted that he was the one who reached out to Joe Lubin to discuss #ETH. When asked by Ripple’s lawyers whether Clayton was the one who asked Hinman to reach out to Lubin and Consensys, Hinman testified that he couldn’t recall whether Clayton had suggested it. 🤔

https://twitter.com/cgasparino/status/1683122072963145735If I had owned #BTC in 2013 and those same SEC officials had sued the #Bitcoin Foundation and/or #BTC Miners, I would’ve sued the SEC - just like I did regarding its gross overreach related to #XRP.

https://twitter.com/marc_fagel/status/1670828108562436096If an investment contract remained one in perpetuity it would nullify the common enterprise factor moving forward.

Notice the email referenced in his testimony. This is one of the emails that @EMPOWR_us is fighting to get released but the SEC has refused to turn over. Now notice that Jay Clayton spoke with Hinman specially about the @ConsenSys meetings at least 1-2 times.

Notice the email referenced in his testimony. This is one of the emails that @EMPOWR_us is fighting to get released but the SEC has refused to turn over. Now notice that Jay Clayton spoke with Hinman specially about the @ConsenSys meetings at least 1-2 times.

https://twitter.com/leerzeit/status/1669861110948790272If it was baseless, you wouldn’t have even asked Clayton the question. Becky, it’s not just about Bill Hinman and his conflicts of interests that are involved in the @Ripple XRP case. You know very well that there is, at a minimum, a gross appearance of impropriety.

https://twitter.com/johnedeaton1/status/1669551796459651072@s_alderoty’s and @bgarlinghouse’s tweets about receiving the documents is on 10-22-22 - 15 months AFTER the deposition.

https://twitter.com/bgarlinghouse/status/1583231464195338241

https://twitter.com/johnedeaton1/status/1660088199576682498

The SEC wanted all statements by SEC staff redacted and it appears they all were. What this tells me is that the statement about XRP not satisfying Howey is NOT a direct quote from a senior SEC official - otherwise it would be reacted.

The SEC wanted all statements by SEC staff redacted and it appears they all were. What this tells me is that the statement about XRP not satisfying Howey is NOT a direct quote from a senior SEC official - otherwise it would be reacted.

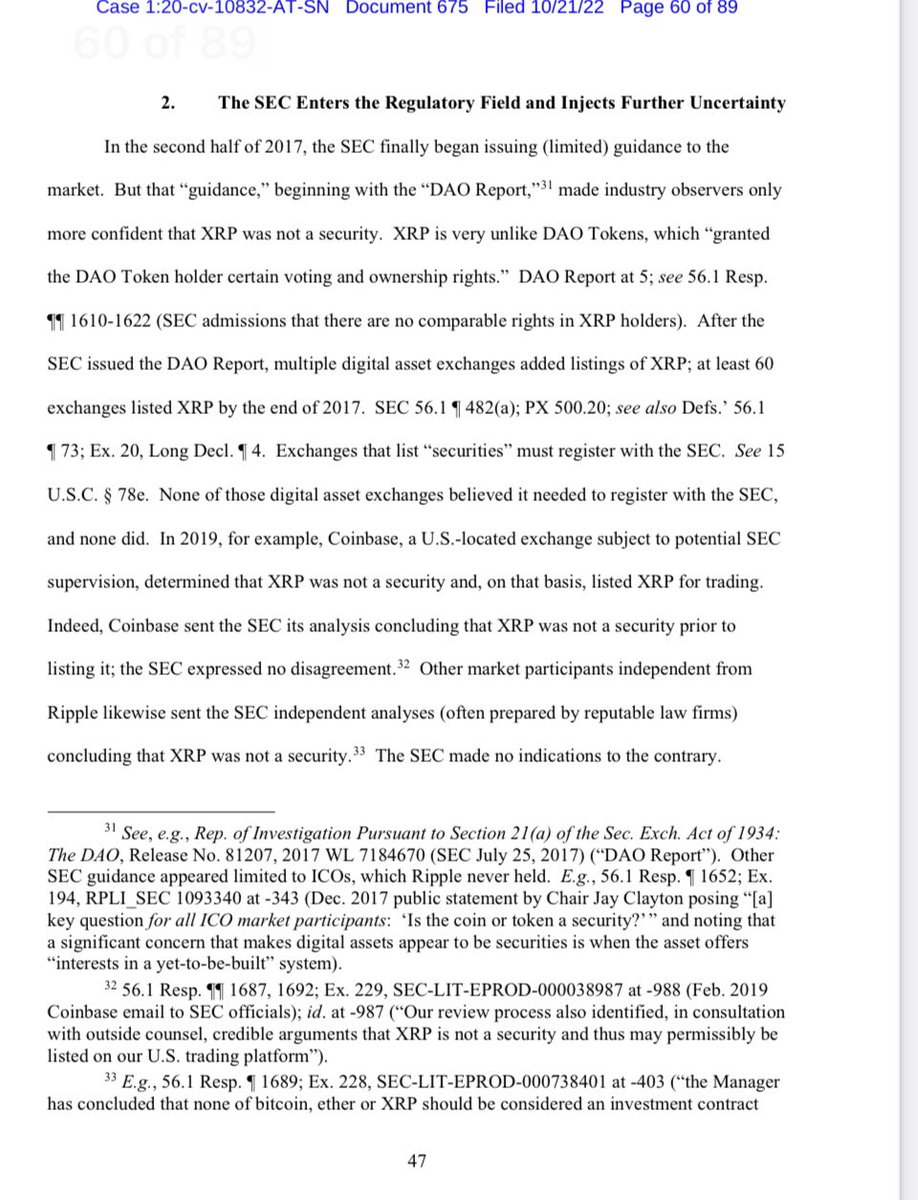

https://twitter.com/johnedeaton1/status/1660059269834723329I think I know how I missed it. Here’s the page before, now read the sentence ending with footnote 33. The sentence says “other market participants” independent from Ripple sent the SEC analyses of XRP, concluding XRP was not a security. That first citation is not the emails.

https://twitter.com/johnreedstark/status/1658463538304765952The @coinbase Writ was very smart strategy. For one, SEC lawyers (and most federal prosecutors for that matter) are great at playing offense but suck when you fight back and put them on their heels. The SEC has to respond and when they do we have it in writing forever.

https://twitter.com/scottmelker/status/1659496457504710657

Hinman must’ve took precautions to avoid any conflict, right? Wrong!

Hinman must’ve took precautions to avoid any conflict, right? Wrong!

https://twitter.com/filanlaw/status/1659574815655710720@RoslynLayton intervened for the purposes of the public getting to read these documents. Judge Torres said her motion was moot b/c the documents must be made public. The 2nd Circuit will NEVER overturn that ruling. @dragonchain, @coinbase, etc will all seek these documents.

https://twitter.com/petervas6/status/1659164734242033665Thus, it is very difficult for anyone, including me, to accurately weigh specific evidence submitted by the SEC and @Ripple. For example, every one knows that Ripple’s Blue Sky argument is that there must be an underlying contract before the Judge can even apply the Howey test.

https://twitter.com/kashta9/status/1654257260418457600world, offered by anyone, including amici, was, is, always has been, and always will be, the offer and sale, of a security. ECF 640 at 49-50 (“a purchase of XRP WAS an investment of money into a common enterprise with other XRP investors and with Defendants.”) (emphasis added);

https://twitter.com/coinbase/status/1653385513011740672Also in 2019, former Chairman Clayton publicly agreed with Hinman’s speech stating the token itself is NOT a security and that a token can, at first, start out or be issued as a security, but later transform so that subsequent sales of the token no longer meet the Howey test.

https://twitter.com/curbmanjess/status/1653165113556230144Does Bank of America, a Ripple partner feel comfortable with the decision or wait to see if Judge Torres gets overturned if the SEC appeals her ruling.

https://twitter.com/blckchaindaily/status/1653082319975071764How is Genlser going to agree that ongoing and future sales of #XRP are not securities AND pursue Coinbase and others? Sure he could try and thread 🧵 the needle 🪡 and somehow claim claim that #XRP is like no other token AFTER claiming that it was like others for over 2 years.

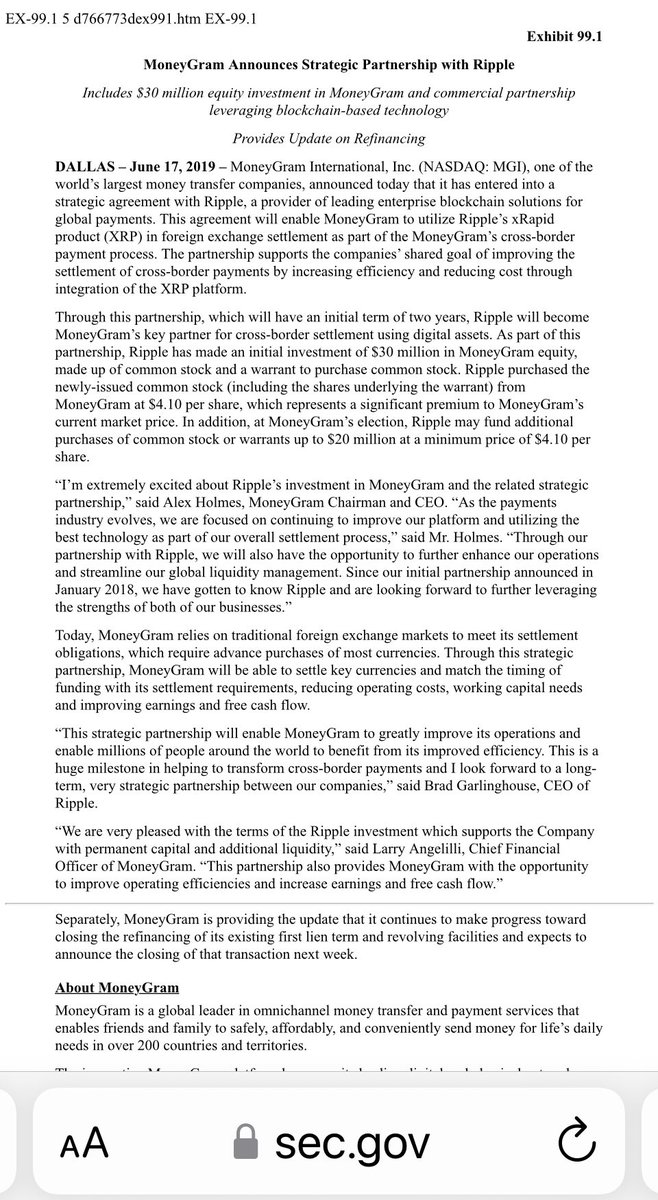

If #XRP was itself an illegal security the way the SEC now claims, why would the SEC allow this MoneyGram partnership 18 months before Clayton dropped the lawsuit on his last full day at the SEC and the very next day after meeting with @GaryGensler? 🤔

If #XRP was itself an illegal security the way the SEC now claims, why would the SEC allow this MoneyGram partnership 18 months before Clayton dropped the lawsuit on his last full day at the SEC and the very next day after meeting with @GaryGensler? 🤔