LIC IPO - Long Thread:

This could be the most hated thread of mine, coz who can argue with LIC fan base? But if your money is not going the right way, I’ll raise questions like I always do. With $3BN riding on #LICIPO , this could be the saving bet for many. Or so you hope…🧵

This could be the most hated thread of mine, coz who can argue with LIC fan base? But if your money is not going the right way, I’ll raise questions like I always do. With $3BN riding on #LICIPO , this could be the saving bet for many. Or so you hope…🧵

2/n

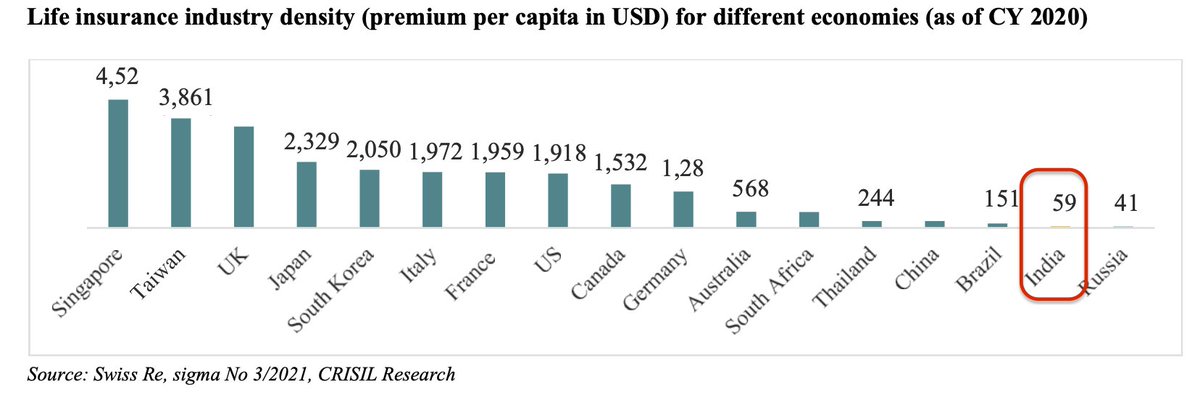

India’s Insurance density (Premiums/population) is very low & you will hear this most from insurers. India at $59 per capita premium appears to be in its "infancy" with huge upside ahead. Even with a base of 1.4 Bn people, this does look attractive for high growth. Right ?

India’s Insurance density (Premiums/population) is very low & you will hear this most from insurers. India at $59 per capita premium appears to be in its "infancy" with huge upside ahead. Even with a base of 1.4 Bn people, this does look attractive for high growth. Right ?

3/n

Until you look at the YoY trend below (not found in DRHP, obviously). India has been stuck in this range since 2009. In-fact we have a falling trend with some spurts. This hardly looks like a growth market to me. So what happened here ? We’ll examine this later.

Until you look at the YoY trend below (not found in DRHP, obviously). India has been stuck in this range since 2009. In-fact we have a falling trend with some spurts. This hardly looks like a growth market to me. So what happened here ? We’ll examine this later.

4/n

Valuation check first: #LIC seeks $3 Bn diluting 3.5% on $ 80 Bn valuation at Rs 950/share. I’ve tried to compare valuations for 7 global players with 4 Indian peers. Notice the extremely high PE multiples of Indian insurers at much lower assets/GDP ratio. Justified...?

Valuation check first: #LIC seeks $3 Bn diluting 3.5% on $ 80 Bn valuation at Rs 950/share. I’ve tried to compare valuations for 7 global players with 4 Indian peers. Notice the extremely high PE multiples of Indian insurers at much lower assets/GDP ratio. Justified...?

5/n

Enter LIC P&L. FY'21 premiums at $ 54 BN including renewals & group policies. OpEx at 0.9% of AUM ( $4.7 Bn/$533 Bn) is high. Add other expenses & you get total of ~2.5 - 3.0 % cost before provisions. In the league of $ 500 Bn+, this would be the most expensive fund globally

Enter LIC P&L. FY'21 premiums at $ 54 BN including renewals & group policies. OpEx at 0.9% of AUM ( $4.7 Bn/$533 Bn) is high. Add other expenses & you get total of ~2.5 - 3.0 % cost before provisions. In the league of $ 500 Bn+, this would be the most expensive fund globally

6/n

Look how profit of $ 0.40 BN is driven by “provisions”. $1.3 BN (Rs 9.3K cr) moves to provisions & then back. EPS for last 3 yrs at Rs 4.2, 4.3 & 4.7, look “consistent & growing” but with $1.3 Bn moving to provisions & back, earnings are anything but “consistent”. Growing?

Look how profit of $ 0.40 BN is driven by “provisions”. $1.3 BN (Rs 9.3K cr) moves to provisions & then back. EPS for last 3 yrs at Rs 4.2, 4.3 & 4.7, look “consistent & growing” but with $1.3 Bn moving to provisions & back, earnings are anything but “consistent”. Growing?

7/n

Dealing with $533 BN funds with ~3% exp resulting in profits of barely $0.4 BN?

Embedded Value(EV) is a European concept, not used in US. Look at the EV for #LIC. Rs 46 K cr to 5.4 lac cr in 2 yrs. Would you rely on a number based on company discretions in listing year?

Dealing with $533 BN funds with ~3% exp resulting in profits of barely $0.4 BN?

Embedded Value(EV) is a European concept, not used in US. Look at the EV for #LIC. Rs 46 K cr to 5.4 lac cr in 2 yrs. Would you rely on a number based on company discretions in listing year?

8/n

Why did EV rise 1000% in 2 years? #LIC gives the below explanation. If something is right, LIC should have done it earlier. Anyways, this doesn’t change the EPS. Ironical, since EV is PV of future earnings+Net worth. Profit is a matter of opinion! Fair value at 1.1x EV ?

Why did EV rise 1000% in 2 years? #LIC gives the below explanation. If something is right, LIC should have done it earlier. Anyways, this doesn’t change the EPS. Ironical, since EV is PV of future earnings+Net worth. Profit is a matter of opinion! Fair value at 1.1x EV ?

9/n

Time to zoom out & understand the global life ins market(Table below). Insurance penetration = Premiums/GDP is the real measure as it takes GDP as denominator (vs population).

India stands tall at 3.1% penetration, markets like US, Canada, Australia & Germany are much behind.

Time to zoom out & understand the global life ins market(Table below). Insurance penetration = Premiums/GDP is the real measure as it takes GDP as denominator (vs population).

India stands tall at 3.1% penetration, markets like US, Canada, Australia & Germany are much behind.

10/n

If you were looking for a metric where India could beat China, this is it. With China at just 2.3% life penetration, India wins hands down! Some credit to LIC here. But is Indian market in its infancy or is it over penetrated? If we did beat US & China, the question is how?

If you were looking for a metric where India could beat China, this is it. With China at just 2.3% life penetration, India wins hands down! Some credit to LIC here. But is Indian market in its infancy or is it over penetrated? If we did beat US & China, the question is how?

11/n

While Europe has a different insurance system with big govt linkages & pensions, Indian market should compare to capitalist developed markets. Why did India beat most developed markets in penetration?

Because they peaked in life insurance somewhere in 2000 as seen below.

While Europe has a different insurance system with big govt linkages & pensions, Indian market should compare to capitalist developed markets. Why did India beat most developed markets in penetration?

Because they peaked in life insurance somewhere in 2000 as seen below.

12/n

As markets mature, interest rates drop & life ins based saving products become less lucrative vs market returns offered by mutual funds & ETFs. Increased financial literacy & investing in stocks started hitting life ins funds & they peaked out across developed world by 2000s

As markets mature, interest rates drop & life ins based saving products become less lucrative vs market returns offered by mutual funds & ETFs. Increased financial literacy & investing in stocks started hitting life ins funds & they peaked out across developed world by 2000s

13/n

Even emerging Asia has peaked out around 2008. Except China that continues to penetrate. But never mind, with 2.4% penetration, it is way behind India at 3.1%. Hmm…..so what about India now? Back to our question….has India peaked in life insurance ?

Even emerging Asia has peaked out around 2008. Except China that continues to penetrate. But never mind, with 2.4% penetration, it is way behind India at 3.1%. Hmm…..so what about India now? Back to our question….has India peaked in life insurance ?

14/n

Post the stagnation of 2010 - 2015, premiums in last 5 years have risen moderately. As per DRHP, India seems to have entered the “accelerated phase”. Not very convincing. But there is a bigger question here – what about "before 2007" when markets had the biggest bull run?

Post the stagnation of 2010 - 2015, premiums in last 5 years have risen moderately. As per DRHP, India seems to have entered the “accelerated phase”. Not very convincing. But there is a bigger question here – what about "before 2007" when markets had the biggest bull run?

15/n

Enter the chart that life insurance companies in India hate – take your time to absorb this.

Life insurance penetration in India had best years from 2005 to 2009, where it also peaked in penetration at 4.5%. India is in steady fall in penetration now.

This is good news!

Enter the chart that life insurance companies in India hate – take your time to absorb this.

Life insurance penetration in India had best years from 2005 to 2009, where it also peaked in penetration at 4.5%. India is in steady fall in penetration now.

This is good news!

16/n

Why good? It indicates that we’ve also matured as a market, moving towards cost efficient mutual funds/Index funds. Let’s avoid the cliched debate of ULIP vs MFs and concur that insurance products are an expensive way to invest money.

Come on now….you know that!

Why good? It indicates that we’ve also matured as a market, moving towards cost efficient mutual funds/Index funds. Let’s avoid the cliched debate of ULIP vs MFs and concur that insurance products are an expensive way to invest money.

Come on now….you know that!

17/n

So how does this low penetration & market stagnation affect you? Look at the charts below for 3 major life insurers that listed since 2016 promising a “market at the cusp of growth”. #HDFCLIFE , #ICICIprulife & #SBIlife. What happened when you invested in these IPOs?

So how does this low penetration & market stagnation affect you? Look at the charts below for 3 major life insurers that listed since 2016 promising a “market at the cusp of growth”. #HDFCLIFE , #ICICIprulife & #SBIlife. What happened when you invested in these IPOs?

18/n

Well you made some progress but nothing like “accelerated growth”. SBI life moved from 700 to 1050 (50%) , HDFC life rose 369 to 565 (53%) ICICI Pru life rose 334 to 510 (52%). In 5 years, this is just about 9% CAGR. Do they look like the IPOs of HDFC & ICICI Bank ? Hardly!

Well you made some progress but nothing like “accelerated growth”. SBI life moved from 700 to 1050 (50%) , HDFC life rose 369 to 565 (53%) ICICI Pru life rose 334 to 510 (52%). In 5 years, this is just about 9% CAGR. Do they look like the IPOs of HDFC & ICICI Bank ? Hardly!

19/n

And this is half the story. When EPS falls & shares rise, you get inflated PEs. Share prices rose by a CAGR of 9% but not coz of earnings. We’re just paying higher valuations. And we can do that for a while….until we realize that the “accelerated growth” is not happening.

And this is half the story. When EPS falls & shares rise, you get inflated PEs. Share prices rose by a CAGR of 9% but not coz of earnings. We’re just paying higher valuations. And we can do that for a while….until we realize that the “accelerated growth” is not happening.

21/n

Conclusions:

India looks under insured market on per capita basis on 1.4 BN people. However the market is mature, saturated & over-penetrated even when compared to developed world. And why not? #LIC has been capturing minds & hearts of people like no other.

Conclusions:

India looks under insured market on per capita basis on 1.4 BN people. However the market is mature, saturated & over-penetrated even when compared to developed world. And why not? #LIC has been capturing minds & hearts of people like no other.

22/n

But life insurance penetration peaked globally in 2000 & has been in decline with falling interest rates, lower life insurance returns, increased financial literacy & rise of efficient mutual funds & ETFs. Likewise, India peaked in 2010 & has been falling ever since.

But life insurance penetration peaked globally in 2000 & has been in decline with falling interest rates, lower life insurance returns, increased financial literacy & rise of efficient mutual funds & ETFs. Likewise, India peaked in 2010 & has been falling ever since.

23/n

There is an upper ceiling to premium/GDP & we're past that peak. The rise of direct trading & SIP investing is further pulling the young generation away from insurance investing. The stagnant & falling EPS of insurers is a proof that the growth remains elusive since 2010.

There is an upper ceiling to premium/GDP & we're past that peak. The rise of direct trading & SIP investing is further pulling the young generation away from insurance investing. The stagnant & falling EPS of insurers is a proof that the growth remains elusive since 2010.

24/n

Recent “new age” IPOs have taught some lessons –

(a) buy at any price doesn’t work

(b) Earnings matter more than stories

(c) Question the “under-penetration” tables provided by IPO lead bankers.

60 yr old company is not in "growth phase".

Recent “new age” IPOs have taught some lessons –

(a) buy at any price doesn’t work

(b) Earnings matter more than stories

(c) Question the “under-penetration” tables provided by IPO lead bankers.

60 yr old company is not in "growth phase".

n/n

LIC policy is mostly about capital preservation, savings & feeling safe in the herd. #LICIPO will be no different. LIC policies however don’t make you rich.

Will LIC IPO be the wealth creator you want it to be? Unlikely !

LIC policy is mostly about capital preservation, savings & feeling safe in the herd. #LICIPO will be no different. LIC policies however don’t make you rich.

Will LIC IPO be the wealth creator you want it to be? Unlikely !

• • •

Missing some Tweet in this thread? You can try to

force a refresh