Its the weekend!

Grab a cup of coffee, today I will tell you about all the tools and services I use in my investing journey

Some are free, some are paid but all of them are guaranteed to deliver value

Lets dive right in!

Grab a cup of coffee, today I will tell you about all the tools and services I use in my investing journey

Some are free, some are paid but all of them are guaranteed to deliver value

Lets dive right in!

Service # 1

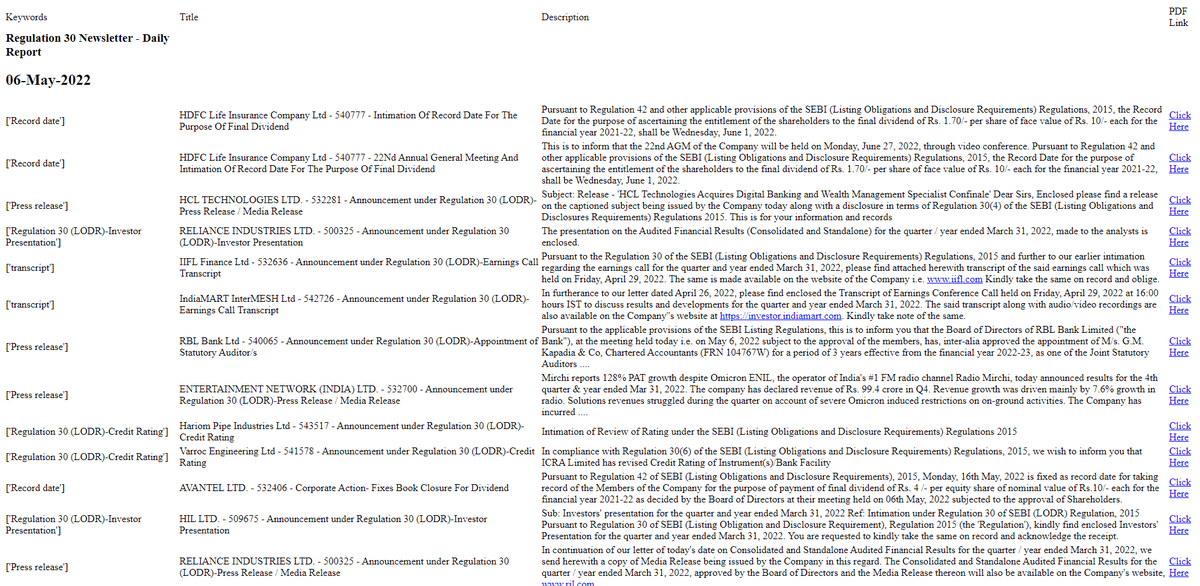

Name: @Regulation30

Type: Paid

Regulation30 is my go to source to hunt for exchange filings that are worth studying further

This is also the source where I get lot of special situation ideas that aren't that widely known

Name: @Regulation30

Type: Paid

Regulation30 is my go to source to hunt for exchange filings that are worth studying further

This is also the source where I get lot of special situation ideas that aren't that widely known

Every day thousands of filings are made over the exchange, among them only a handful are worth studying

Regulation 30 filters out the noise and sends me a daily email of every exchange filing that is worth reading

Here is a snapshot of the email they sent me yesterday

Regulation 30 filters out the noise and sends me a daily email of every exchange filing that is worth reading

Here is a snapshot of the email they sent me yesterday

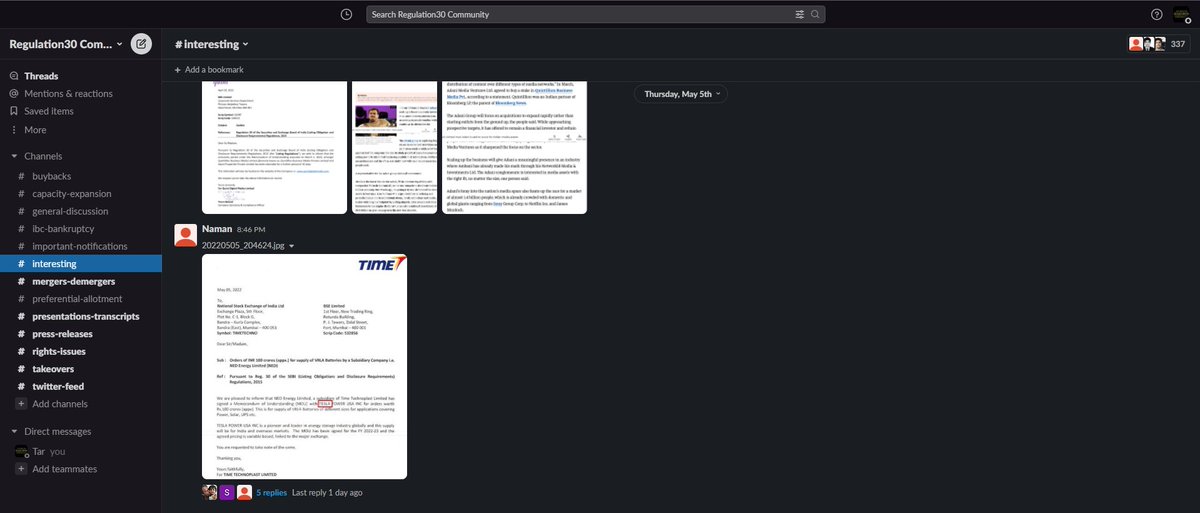

Apart from the newsletter, there is a Slack community where founders of Regulation30 routinely share great insights into less known companies

Service # 2

Name: CapTwist

Type: Free

Wouldn't it be cool if you could search across all exchange filings of all companies via keywords or phrases and join them together as a theme?

Well, CapTwist does just that!

captwist.in

Name: CapTwist

Type: Free

Wouldn't it be cool if you could search across all exchange filings of all companies via keywords or phrases and join them together as a theme?

Well, CapTwist does just that!

captwist.in

Via CapTwist you can search across various filings of all companies

For example, I wanted to search the keyword 'solar' across company filings

Here is what CapTwist search function returns

For example, I wanted to search the keyword 'solar' across company filings

Here is what CapTwist search function returns

Want to follow your favorite investor?

You can search by their name and get details of all concalls they recently participated in

You can search by their name and get details of all concalls they recently participated in

You can even check latest concalls and get summary insights on the bearish or bullish commentary

There is a lot more to CapTwist and its 100% free to try, so do play around.

There is a lot more to CapTwist and its 100% free to try, so do play around.

Service # 3

Name: WhaleWisdom

Type: Freemium

Want to quickly find what your favourite international fund is buying/selling?

WhaleWisdom helps you achieve exactly that

whalewisdom.com

Here is what Seth Klarman recently bought / sold

Name: WhaleWisdom

Type: Freemium

Want to quickly find what your favourite international fund is buying/selling?

WhaleWisdom helps you achieve exactly that

whalewisdom.com

Here is what Seth Klarman recently bought / sold

Service # 4

Name: Koyfin

Type: Freemium

Want a Bloomberg Terminal but do not want to pay for a Bloomberg Terminal? Koyfin is your answer

Lots of data and lots of charts, at your fingertips

app.koyfin.com

Name: Koyfin

Type: Freemium

Want a Bloomberg Terminal but do not want to pay for a Bloomberg Terminal? Koyfin is your answer

Lots of data and lots of charts, at your fingertips

app.koyfin.com

Service # 5

Name: Tikr

Type: Freemium

Don't want the complexity of Koyfin but still want to screen and research US or Global companies?

Tikr helps you achieve just that in an uncluttered and simple UI

app.tikr.com

Name: Tikr

Type: Freemium

Don't want the complexity of Koyfin but still want to screen and research US or Global companies?

Tikr helps you achieve just that in an uncluttered and simple UI

app.tikr.com

Service # 6

Name: Screener.in

Type: Freemium

This website is my default homepage and possibly the only website I will never stop paying for

Simple UI, powerful custom options and the only screener you ever need to screen Indian stocks

Name: Screener.in

Type: Freemium

This website is my default homepage and possibly the only website I will never stop paying for

Simple UI, powerful custom options and the only screener you ever need to screen Indian stocks

Service # 7

Name: Tijori

Type: Freemium (ish)

Want a screener but more data and powerful features? tijorifinance.com is your answer

Tijori has several premium features like advance text based filtering, growing knowledge base and live raw material prices

Name: Tijori

Type: Freemium (ish)

Want a screener but more data and powerful features? tijorifinance.com is your answer

Tijori has several premium features like advance text based filtering, growing knowledge base and live raw material prices

Service # 8

Name: CommonStock

Type: Free

Fed up with the toxicity of Twitter but still want to connect with fellow investors who invest in global stocks?

commonstock.com is your go to platform

Imagine Twitter...but better and centered around investors.

Name: CommonStock

Type: Free

Fed up with the toxicity of Twitter but still want to connect with fellow investors who invest in global stocks?

commonstock.com is your go to platform

Imagine Twitter...but better and centered around investors.

Service # 9

Name: Multipie

Type: Free

Fed up with Twitter again but want to socialize with investors who invest in Indian stocks?

multipie.co is your answer

You will find lot of investors sharing ideas and insights, minus all the clutter of Twitter

Name: Multipie

Type: Free

Fed up with Twitter again but want to socialize with investors who invest in Indian stocks?

multipie.co is your answer

You will find lot of investors sharing ideas and insights, minus all the clutter of Twitter

Service # 10

Name: SpecialSituationsTracker

Type: Free

Created by yours truly, specialsituations.investkaroindia.in is a special situation tracker with details on all active special situations

PMS funds are known to source an idea or two from here and call it there own *wink wink*

Name: SpecialSituationsTracker

Type: Free

Created by yours truly, specialsituations.investkaroindia.in is a special situation tracker with details on all active special situations

PMS funds are known to source an idea or two from here and call it there own *wink wink*

So those were a few tools I regularly use.

Do you know of any tools that are not covered here?

Let me know in the comments.

Do you know of any tools that are not covered here?

Let me know in the comments.

Meanwhile, sign up for my newsletter here

Regularly publish deep dives and long form articles on stocks and emerging investing trends

getrevue.co/profile/itstarh

Regularly publish deep dives and long form articles on stocks and emerging investing trends

getrevue.co/profile/itstarh

I hope you've found this thread helpful.

Follow me @itsTarH for more.

Like/Retweet the first tweet below if you can:

Follow me @itsTarH for more.

Like/Retweet the first tweet below if you can:

https://twitter.com/itsTarH/status/1522873216133332995

• • •

Missing some Tweet in this thread? You can try to

force a refresh