Now that $UST has de-pegged, collateralization looks as important as event.

A 🧵on the synergies between over-collateralized and algorithmic stables to achieve:

- better security

- more sustainability

- incentives alignment

- better margins

- scale

A 🧵on the synergies between over-collateralized and algorithmic stables to achieve:

- better security

- more sustainability

- incentives alignment

- better margins

- scale

To start off, I think we can agree on the fact that the cryptocurrency market, broadly, needs to lvl up its game on stable's design if it wants to come up with an 🧠 alternative to the current centralized FIAT regime, which is imposed by force and headed to a devaluation💀spiral.

@ this point I think everybody gets why $UST has been such a terrible example of instability, we have to admit though, that it did scale, even though it wasn't a sustainable model.

Objectively this has a lot to do with both $LUNA appreciating in value and Anchor's 20% yeld.

Objectively this has a lot to do with both $LUNA appreciating in value and Anchor's 20% yeld.

I'd suggest you to read this brilliant thread from @hasufl and @zhusu to understand why earnings and thus yeld sustainability will be a key point for scalability/adoption going forward and a value proposition of our space vs FIAT.

uncommoncore.co/interest-rates…

uncommoncore.co/interest-rates…

Another value proposition for our space is inclusion and decentralization.

Seniorage allows inclusion but a fully unbacked system that sacrifices security is undesirable.

Also all the collateral must be on-chain, moved in a transparent way and under direct governance control.

Seniorage allows inclusion but a fully unbacked system that sacrifices security is undesirable.

Also all the collateral must be on-chain, moved in a transparent way and under direct governance control.

Collateral has to become decentralized over time, shifting from $USDC to $ETH or a decentralized wrapped form of $BTC like $renBTC.

Hopefully as the crypto option's market and capitalization grows we'll achive more stability in that sense.

Hopefully as the crypto option's market and capitalization grows we'll achive more stability in that sense.

The overcollateralized stable design, on the other hand, has security @ its core.

Ofc this is a feature that shines in time of instability such as the ones that we are currently undergoing.

It has some problems, though, when it comes to margins and to align incentives for scaling

Ofc this is a feature that shines in time of instability such as the ones that we are currently undergoing.

It has some problems, though, when it comes to margins and to align incentives for scaling

Gov vs Users:

In overc. stables, Gov (long peg) mostly profits wen IR are high (aka contraction phase = low demand for leverage/risk = low rate of adoption and mcap shrink)

Users (short peg) tend to seek risk (open CDP) in the expansion phase w/low IR (Gov rekt)

In overc. stables, Gov (long peg) mostly profits wen IR are high (aka contraction phase = low demand for leverage/risk = low rate of adoption and mcap shrink)

Users (short peg) tend to seek risk (open CDP) in the expansion phase w/low IR (Gov rekt)

When the market is🐂 there is not much demand for stability and moreover the earnings are low (low IR)

When the market is🐻, even if the IRs are high, the mcap is still shrinking bcs Users are de-risking

When the market is🐻, even if the IRs are high, the mcap is still shrinking bcs Users are de-risking

Variable IR and can be hiked to force repayment, still mcap reduction doesn't produce a very scalable/profitable model.

A fixed rate (expecially LOW) is not sustainable, otherwise users can short the peg and not be forced to close the CDP...

A fixed rate (expecially LOW) is not sustainable, otherwise users can short the peg and not be forced to close the CDP...

... in this case the collateral is not deployed to save the peg (eg. $MIM)

💡😲

What if we could get best of both worlds by fusing both designs together?

Better stability/security for algos,

better scalability/incentives structure for money market's stables.

What if we could get best of both worlds by fusing both designs together?

Better stability/security for algos,

better scalability/incentives structure for money market's stables.

After all, these differnt models have already started to slowly converge.

If you look @ $DAI's D3M (=AMO) and PSM, which is an istantaneous on-chain collateral redemption mechanism (always in line to what $FRAX was already doing) for instance.

If you look @ $DAI's D3M (=AMO) and PSM, which is an istantaneous on-chain collateral redemption mechanism (always in line to what $FRAX was already doing) for instance.

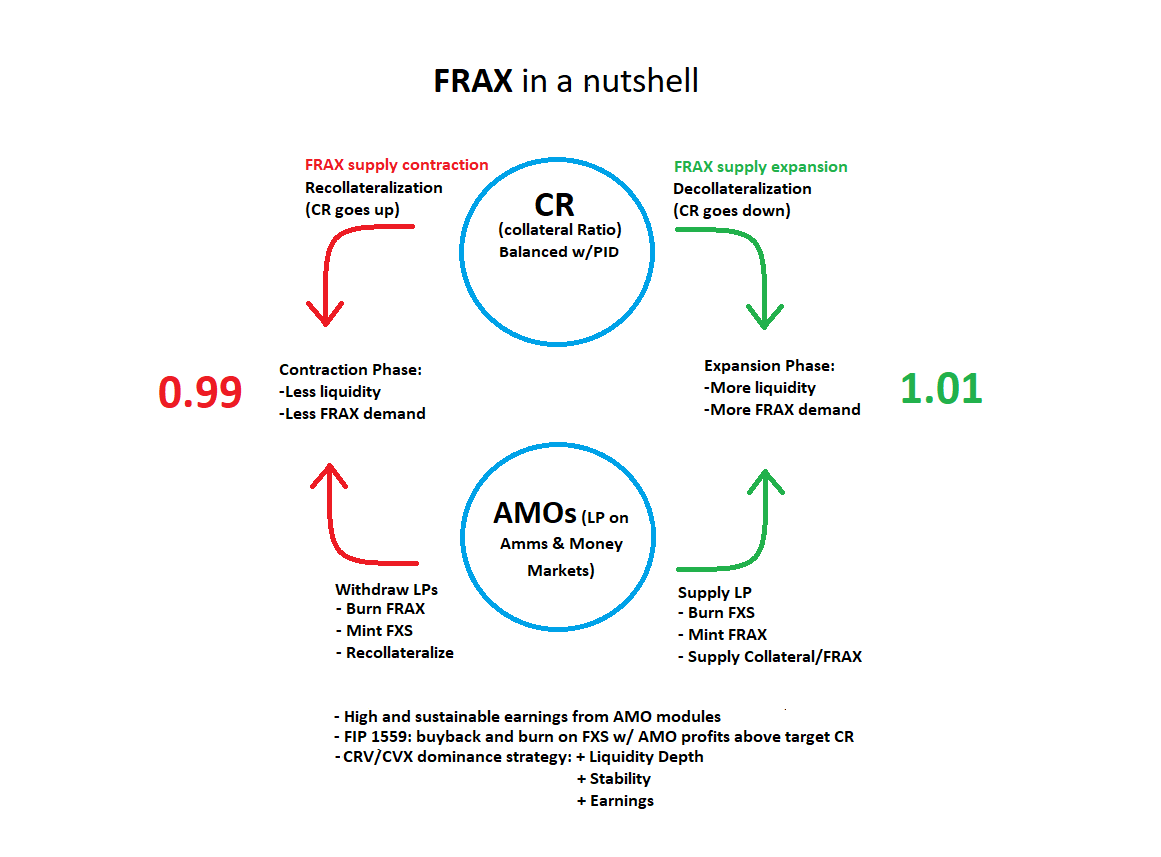

Let's talk $FRAX:

Fractional reserve partially backed w/Seniorage + #Fraxlend

$FRAX is an algostable that is backed by a free floating portion of collateral and, at the same time, allows seniorage ( $FXS) to align community interest towards scaling and adoption.

Fractional reserve partially backed w/Seniorage + #Fraxlend

$FRAX is an algostable that is backed by a free floating portion of collateral and, at the same time, allows seniorage ( $FXS) to align community interest towards scaling and adoption.

#Fraxlend: Let's imagine a $Frax Money Market(MM)(which the team have already said they want to develop)

from which $Frax is minted by overcollateralising the issue with a surplus of collateral.

Just as #Oasis is to $DAI

from which $Frax is minted by overcollateralising the issue with a surplus of collateral.

Just as #Oasis is to $DAI

Why would merging $FRAX's design with that of an overcollateralized stable be cool?

The Seniorage's CR could be balanced with that of the MM

The collateral oversupply of the MM could cover the "decollateralized" part of the seniorage, reaching equilibrium between the two:

The Seniorage's CR could be balanced with that of the MM

The collateral oversupply of the MM could cover the "decollateralized" part of the seniorage, reaching equilibrium between the two:

💡CDPs collateral requirements get stipulated @ the time of opening according to Seniorage/MM's CR needs, then they remain fixed until repayment:

-In the expansion phase the Seniorage's CR decreases and that of the MM increases (🐂 phase, demand for leverage increases, so does risk = less FRAX lent and more collateral gets required in CDPs)

-Similarly, during the contraction phase (🐻) less collateral demand in the MM to open a CDP, while the CR of the seniorage is naturally getting replenished. (Recollateralization)

Same (or inverse) feedback loop with interest rates:

-During contraction (🐻) IR hikes (💡paid in $FXS) force repayments and in addition exert buy pressure on $FXS while the seniorage mints it, counterbalancing the consequent sell pressure.

-During contraction (🐻) IR hikes (💡paid in $FXS) force repayments and in addition exert buy pressure on $FXS while the seniorage mints it, counterbalancing the consequent sell pressure.

-During the expansion phase(🐂) $FXS supply contracts and appreciates in value.

IR, even if they do drop in %, have a relative higher $ cost, thus producing more income.

IR, even if they do drop in %, have a relative higher $ cost, thus producing more income.

Borrowers could subsidize IR by LPing into cvxFXS/FXS pool and partecipating in the earnings distribution of the DAO.

Incentives would be aligned.

Incentives would be aligned.

@fraxfinance already has, $ to $, the most profitable model for revenue.

#Fraxlend's IR would further increase the earnings,

obviously one or more AMO modules would run on top of the MM too.

💸💸💸

#Fraxlend's IR would further increase the earnings,

obviously one or more AMO modules would run on top of the MM too.

💸💸💸

High and sustainable earnings + possibility to "buy equity" with $FXS would resolve the conflict of interest between gov and users (profitability vs adoption) of the overcollateralized stables

The overcollateralized model increases earnings and scalability.

The overcollateralized model increases earnings and scalability.

The algo (or partially algo, in this case) model becomes more solid @ the lvl of collateral guarantees, it also increases its earnings.

Overcollateralized 🤝 Algo-backed

Positive sum.🏆

FIAT gets brutally rekt.💀

Overcollateralized 🤝 Algo-backed

Positive sum.🏆

FIAT gets brutally rekt.💀

As important as ever* omfg 🤦

• • •

Missing some Tweet in this thread? You can try to

force a refresh