How to get URL link on X (Twitter) App

https://twitter.com/WatcherGuru/status/1651343288639553536?s=20To understand the matter and the implications of the bill one should first understand the basics of US #Liquidity:

https://twitter.com/block_muncher/status/1624672746977525765⏱️🔴Bonds have maturities of more than ten years and are often used to finance large, long-term projects or to refinance existing debt.

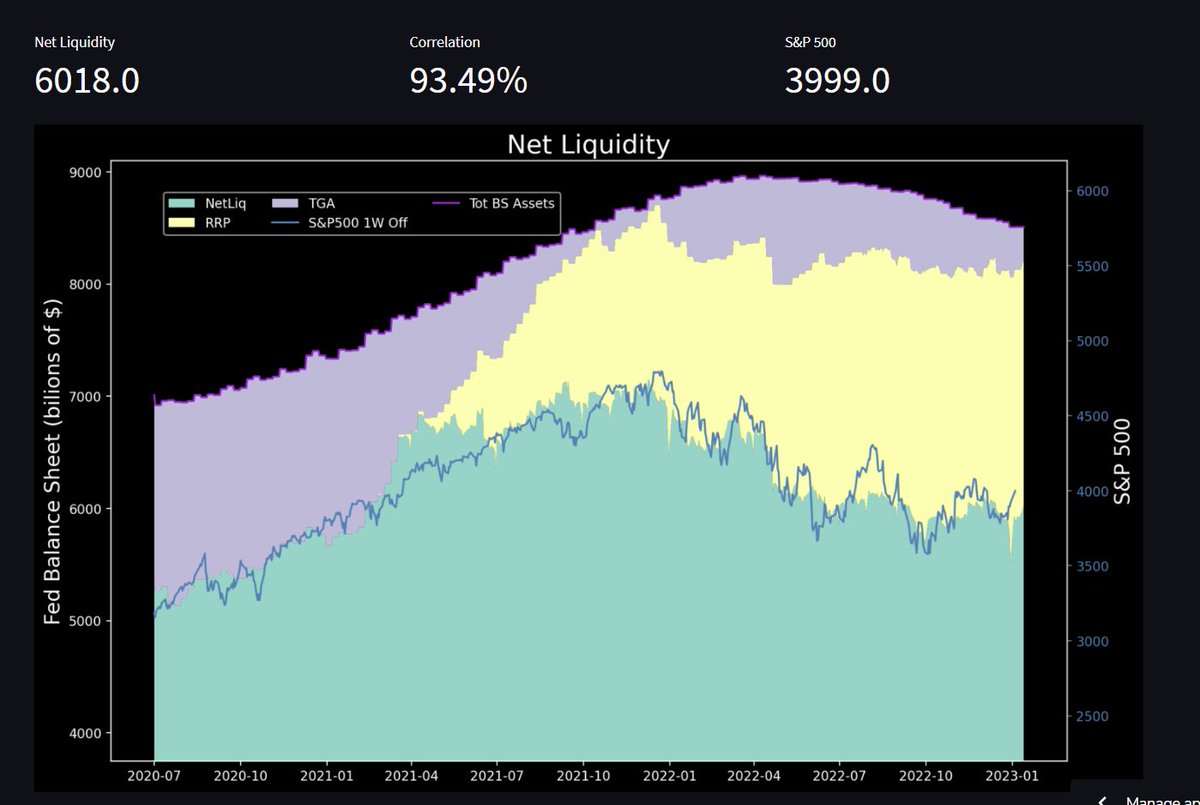

These dynamics still playing out:

These dynamics still playing out:https://twitter.com/Liscivia_/status/1612395353969508353?s=20&t=ZEXJVtheaTmhMv1D-_upJw

The Fed's tightening policy has been effectively offset by the TGE and RRP.

The Fed's tightening policy has been effectively offset by the TGE and RRP.https://twitter.com/Liscivia_/status/1612164442342526978?s=20&t=dbXs0SMlmVw9v4WXoEjZlg

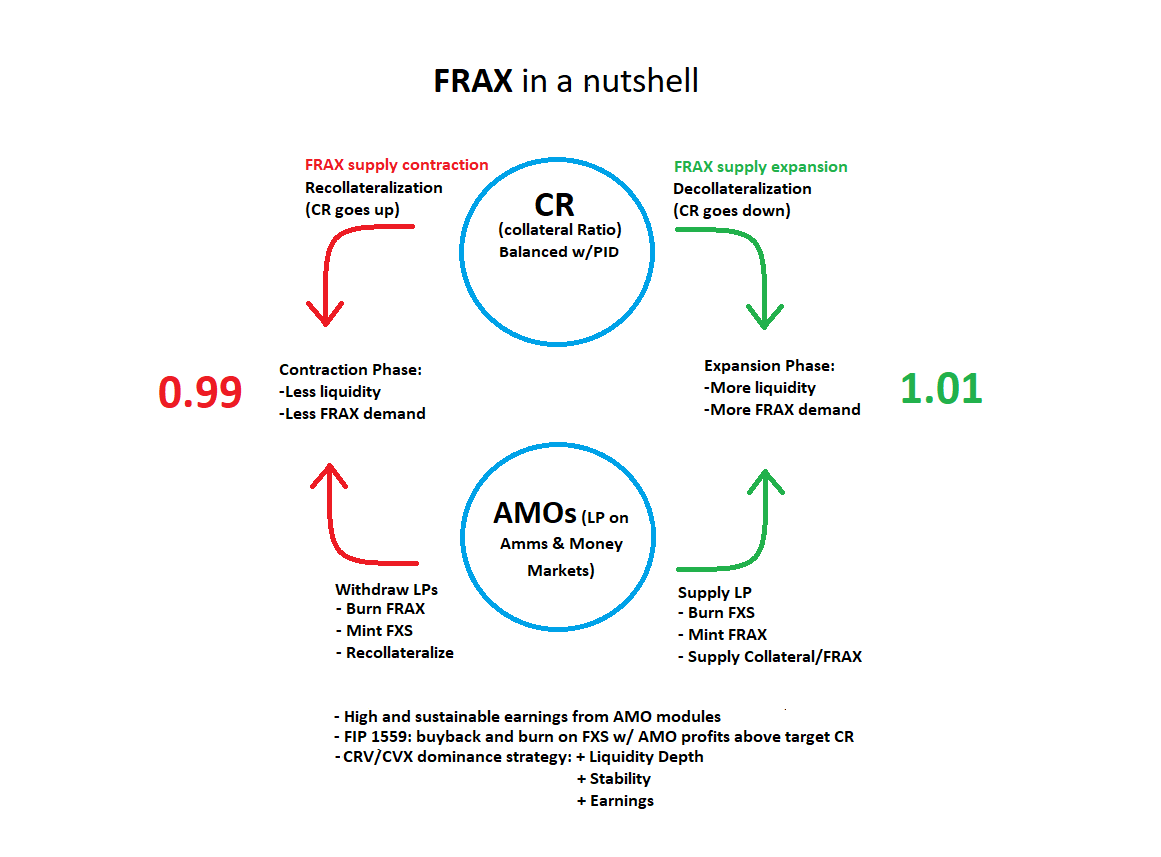

https://twitter.com/samkazemian/status/1400308033104670725