So you want to be a real estate investor?

IMO real estate is the single best risk-adjusted investment on 🌎—the ultimate compounding vehicle.

And it ain’t rocket science...

Here’s a simple 5-part framework for RE success. Think of it as "LP 101"...

🧵👇

IMO real estate is the single best risk-adjusted investment on 🌎—the ultimate compounding vehicle.

And it ain’t rocket science...

Here’s a simple 5-part framework for RE success. Think of it as "LP 101"...

🧵👇

The assumption here is that you’re interested in investing in real estate as a passive LP. If you’re not familiar with the basic GP/LP structure, there’s lots of info about that on #REtwit and elsewhere.

We’re going to look at 5 criteria for evaluating a RE deal as an LP:

We’re going to look at 5 criteria for evaluating a RE deal as an LP:

1. GP ➡️ Look at track record & longevity

2. Asset Class ➡️ Align with macro trends

3. Geography ➡️ Seek strong economies w/population growth

4. Model ➡️ Bias to in-place cash flow

5. Asset/Deal ➡️ Look for desirable properties & fair deal terms

2. Asset Class ➡️ Align with macro trends

3. Geography ➡️ Seek strong economies w/population growth

4. Model ➡️ Bias to in-place cash flow

5. Asset/Deal ➡️ Look for desirable properties & fair deal terms

Here are some rules of thumb for each:

1. GP:

This is by far the most important criteria. If you pick the right GP the rest tends to take care of itself.

First & foremost I look at track record & longevity. Experience matters and…

1. GP:

This is by far the most important criteria. If you pick the right GP the rest tends to take care of itself.

First & foremost I look at track record & longevity. Experience matters and…

👉I’m not in the business of funding the education of a new GP. Let them learn hard lessons on someone else's dime.

Ideally I want to see 10+ deals over many years and several successful exits in a variety of market conditions.

Other things to consider:

Ideally I want to see 10+ deals over many years and several successful exits in a variety of market conditions.

Other things to consider:

- Bias to GPs that are focused on one asset class and/or strategy

- A full team in place (not overly dependent on founder)

- A compelling POV on macro trends & downside scenarios

- A strong deal-sourcing pipeline

In short, work with the best!

- A full team in place (not overly dependent on founder)

- A compelling POV on macro trends & downside scenarios

- A strong deal-sourcing pipeline

In short, work with the best!

2. Asset Class:

LPs have a luxury that GPs don't: We can diversify across asset classes and quickly pivot when a new trend emerges.

Here's what you want in an asset class: TAILWIND!

That looks like:

LPs have a luxury that GPs don't: We can diversify across asset classes and quickly pivot when a new trend emerges.

Here's what you want in an asset class: TAILWIND!

That looks like:

- Favorable economic & societal trends (e.g. e-commerce drives industrial, housing shortage drives multi-family)

- Demand exceeds supply

- Fragmented market with sub-institutional opportunities (riches in niches & exploitation of market inefficiency)

- Demand exceeds supply

- Fragmented market with sub-institutional opportunities (riches in niches & exploitation of market inefficiency)

3. Geography:

There’s an old saying in real estate:

“Only 3 things matter—location, location, and location.”

Don’t limit yourself to your local region—think nationally and pick the best geographies.

There’s an old saying in real estate:

“Only 3 things matter—location, location, and location.”

Don’t limit yourself to your local region—think nationally and pick the best geographies.

https://twitter.com/seandsweeney/status/1523433157684432896?s=20&t=HC5N3yPAjWJpSkid0m9aoQ

Look for:

- Major markets (and select secondary markets) with a strong, growing economy

- Population & job growth

- Pro-business politics

Based on the above I personally like the sunbelt region. Most of my RE investments are in major markets in TX.

- Major markets (and select secondary markets) with a strong, growing economy

- Population & job growth

- Pro-business politics

Based on the above I personally like the sunbelt region. Most of my RE investments are in major markets in TX.

https://twitter.com/fortworthchris/status/1523650965332660224?s=20&t=HC5N3yPAjWJpSkid0m9aoQ

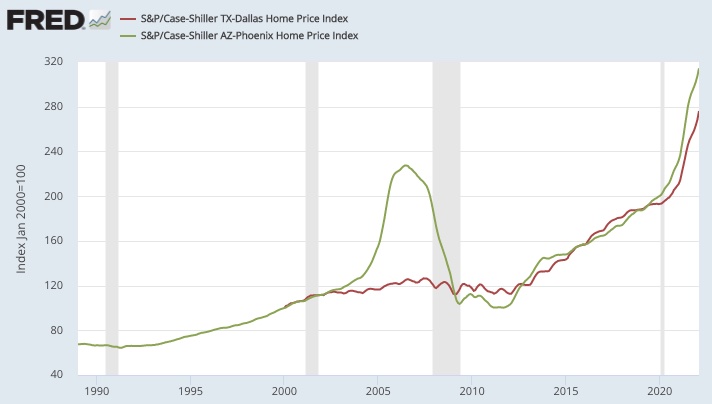

👉Market selection is *especially* important in a down-trending or volatile market. For example, here's a chart comparing home prices in Phoenix (green) vs. Dallas (red) during the Great Financial Crisis.

Apparently someone forgot to tell Dallas that there was a crisis...

Apparently someone forgot to tell Dallas that there was a crisis...

4. Model:

I avoid ground-up development—it introduces a lot of risk without significantly higher returns. I like to invest in properties with in-place cash flow.

I like value-add (renovation) deals, especially when the GP has unique in-house capabilities (like @Scottbeverett).

I avoid ground-up development—it introduces a lot of risk without significantly higher returns. I like to invest in properties with in-place cash flow.

I like value-add (renovation) deals, especially when the GP has unique in-house capabilities (like @Scottbeverett).

5. Asset / Deal

Ironically, the specific property/deal is the *last* thing I look at because if you choose wisely on the first 4 criteria then almost by definition the deal will check out.

Here are a few things I look for in a deal:

Ironically, the specific property/deal is the *last* thing I look at because if you choose wisely on the first 4 criteria then almost by definition the deal will check out.

Here are a few things I look for in a deal:

- Premium location within the market

- Purchase price below replacement cost

- Conservative assumptions in pro forma

- Value-add / NOI-improvement opportunity

- Proper leverage (~65%) & fair promote structure

- Attractive projected IRR (12-20%+ depending on deal type)

- Purchase price below replacement cost

- Conservative assumptions in pro forma

- Value-add / NOI-improvement opportunity

- Proper leverage (~65%) & fair promote structure

- Attractive projected IRR (12-20%+ depending on deal type)

A note on fees:

As an LP I focus on MY total return (IRR). Some investors get hung up on GP fees—that can be penny wise & pound foolish. If a GP delivers a great return then (within reason) I don't care about fees. I care more about working with the best GPs on the best deals.

As an LP I focus on MY total return (IRR). Some investors get hung up on GP fees—that can be penny wise & pound foolish. If a GP delivers a great return then (within reason) I don't care about fees. I care more about working with the best GPs on the best deals.

Obviously I’m only scratching the surface here but this framework will serve you well as a starting point for evaluating investment opportunities as an LP.

If you have questions ask away in the comments and I’m happy to answer them.

🤙

If you have questions ask away in the comments and I’m happy to answer them.

🤙

PS: To invest as an LP you have to be *accredited* (basically, a millionaire). Accreditation laws block millions from some of the best wealth-building opportunities. You can speculate on crypto but can’t invest in RE 😡

I’m trying to fix this. Join me👇

SwellMoney.com

I’m trying to fix this. Join me👇

SwellMoney.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh