Bear Market Mental Models

The bear market is hard. Many people lost the wealth created during the bull market.

These mental models can help you navigate a bear market and prepare for bull recovery.

/THREAD

The bear market is hard. Many people lost the wealth created during the bull market.

These mental models can help you navigate a bear market and prepare for bull recovery.

/THREAD

You don't have to be always right.

Even the price of some of your investments can go to 0, like $LUNA or $FTM. This doesn't matter. What is matter is an average return from your portfolio.

Don't bet on one horse.

/1

Even the price of some of your investments can go to 0, like $LUNA or $FTM. This doesn't matter. What is matter is an average return from your portfolio.

Don't bet on one horse.

/1

You are not diversified.

Diversification mostly matters when is a fear in the market. Holding dozens of altcoins is not diversification. You should have also different digital assets, not just crypto tokens.

/2

Diversification mostly matters when is a fear in the market. Holding dozens of altcoins is not diversification. You should have also different digital assets, not just crypto tokens.

https://twitter.com/CryptosEngineer/status/1519653862625402880

/2

There is an offline world.

We are not living in the metaverse. Apple was worth more than the whole crypto market during a bull market.

Add bonds, gold, stocks or real estate to your portfolio.

/3

We are not living in the metaverse. Apple was worth more than the whole crypto market during a bull market.

Add bonds, gold, stocks or real estate to your portfolio.

/3

Your altcoins never reach ATH again.

Token prices are mostly driven via speculation. There is no fundamental value behind most of your projects.

Understand what caused demand for your tokens and why someone might buy it later.

/4

Token prices are mostly driven via speculation. There is no fundamental value behind most of your projects.

Understand what caused demand for your tokens and why someone might buy it later.

https://twitter.com/CryptosEngineer/status/1518601178195628032

/4

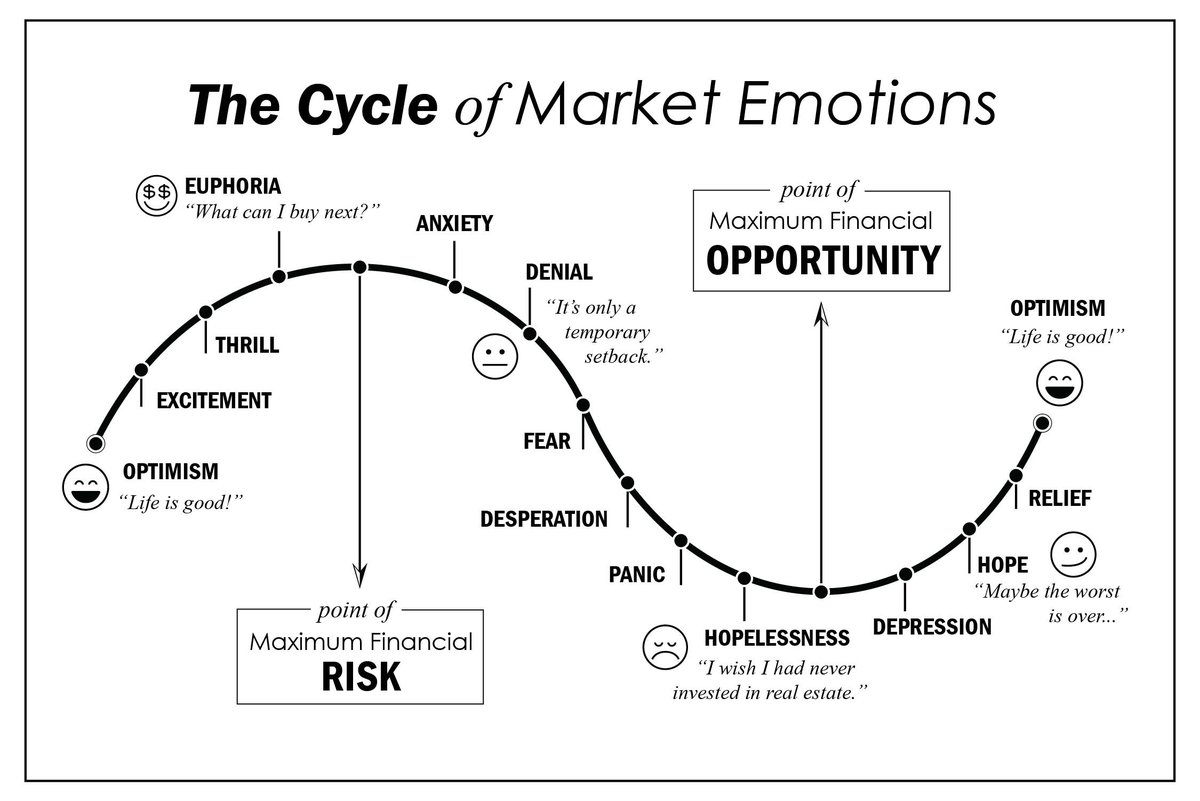

The market moves in cycles.

We know it, but we are not prepared for it.

Learn from your mistakes. Calculate your portfolio value every week and ask yourself:

How much I can lose? Am I ready for a bear market now?

/5

We know it, but we are not prepared for it.

Learn from your mistakes. Calculate your portfolio value every week and ask yourself:

How much I can lose? Am I ready for a bear market now?

/5

This is time to learn.

You can start by following these people:

@Route2FI

@phtevenstrong

@JackNiewold

@milesdeutscher

@PastryEth

@KoroushAK

@shivsakhuja

@Crypto8Fi

@DeFi_Made_Here

@ckaiwu

@danreecer_

@0xmisaka

@puntium

@nateliason

@Gojo_Crypto

@OnChainWizard

/6

You can start by following these people:

@Route2FI

@phtevenstrong

@JackNiewold

@milesdeutscher

@PastryEth

@KoroushAK

@shivsakhuja

@Crypto8Fi

@DeFi_Made_Here

@ckaiwu

@danreecer_

@0xmisaka

@puntium

@nateliason

@Gojo_Crypto

@OnChainWizard

/6

You don't understand what you are buying.

There is a project behind each token. Will you directly invest in this project if they don't have a token?

Do you know how this will perform during the bear market?

/7

There is a project behind each token. Will you directly invest in this project if they don't have a token?

Do you know how this will perform during the bear market?

https://twitter.com/CryptosEngineer/status/1521558062686883845

/7

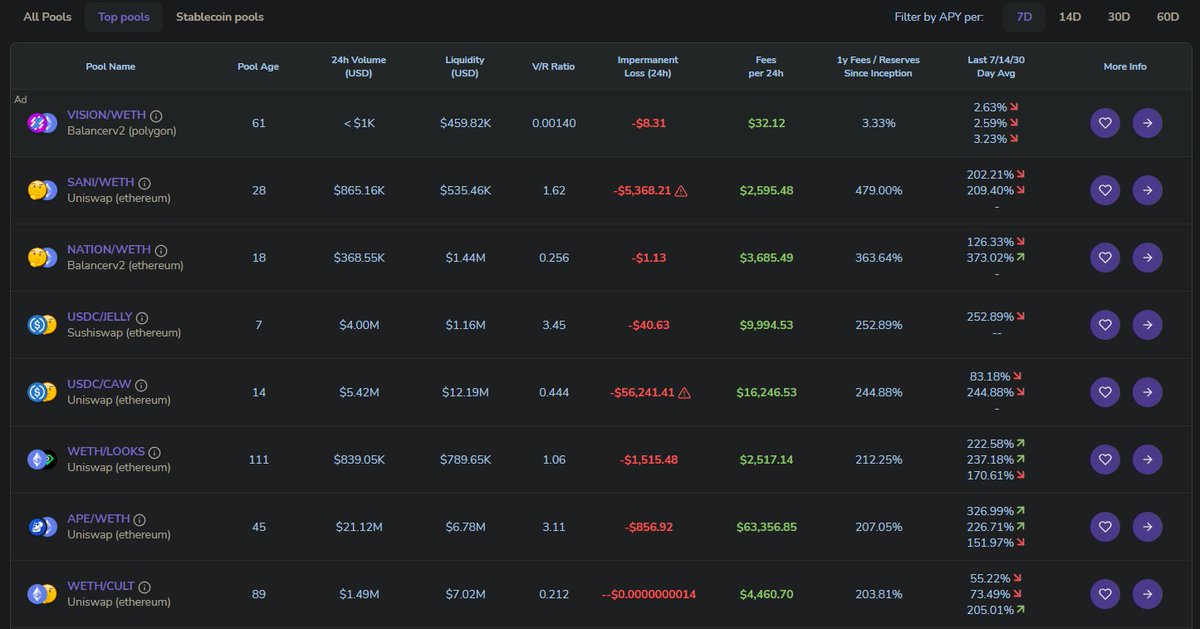

Most projects work only during the bull market.

#DeFi projects work only when we have:

• an inflow of new cash to crypto

• many tokens swaps

Understand how farm/lending/staking APY is calculated

/8

#DeFi projects work only when we have:

• an inflow of new cash to crypto

• many tokens swaps

Understand how farm/lending/staking APY is calculated

https://twitter.com/CryptosEngineer/status/1481319609005445126?s=20

/8

Stablecoins are not equal.

You should have diversified #stablecoins portfolio into different:

1) Tokens 🪙

2) Protocols 🏦

3) Chains 🔗

4) Strategies ♟️

$UST and @terra_money are good examples why.

/9

You should have diversified #stablecoins portfolio into different:

1) Tokens 🪙

2) Protocols 🏦

3) Chains 🔗

4) Strategies ♟️

$UST and @terra_money are good examples why.

/9

All mistakes can be categorized to:

1. Analytical/Intellectual♟️ (too little information, incorrect information, wrong analytical process)

2. Psychological/Emotional✨ (greed and fear, ego and envy, willingness to suspend disbelief and skepticism, extrapolating past)

/10

1. Analytical/Intellectual♟️ (too little information, incorrect information, wrong analytical process)

2. Psychological/Emotional✨ (greed and fear, ego and envy, willingness to suspend disbelief and skepticism, extrapolating past)

/10

Project Value = Story + Numbers

Every number that we use in a valuation (TVL, Tx, user growth) has to be built around a story about the project.

Every story we tell about a project (its amazing team, its superior platform or great community) has to show up in a number.

/11

Every number that we use in a valuation (TVL, Tx, user growth) has to be built around a story about the project.

Every story we tell about a project (its amazing team, its superior platform or great community) has to show up in a number.

/11

Fundamental vs Technical analysis.

The fundamental analysis couldn't explain the variability of value in short term.

Technical analysis can work because prices reflect all available information and because many market participants make decisions based on emotions.

/12

The fundamental analysis couldn't explain the variability of value in short term.

Technical analysis can work because prices reflect all available information and because many market participants make decisions based on emotions.

/12

You don't have an investment strategy.

Buying low (high) and selling high (higher) is not a strategy. Take your time to think about why are you in crypto and what and how do you want to achieve it.

/13

Buying low (high) and selling high (higher) is not a strategy. Take your time to think about why are you in crypto and what and how do you want to achieve it.

https://twitter.com/CryptosEngineer/status/1520776920148983813

/13

You are not managing your portfolio.

Portfolio management can be simplified using these tools. If you have too many positions you won't be able to manage them, especially during the bear market.

/14

Portfolio management can be simplified using these tools. If you have too many positions you won't be able to manage them, especially during the bear market.

https://twitter.com/CryptosEngineer/status/1523323205192015873

/14

You are not managing your risk.

Most investors think that they have a higher risk appetite and capacity. The bear says check now.

This is a good time to learn why risk management is important.

/15

Most investors think that they have a higher risk appetite and capacity. The bear says check now.

This is a good time to learn why risk management is important.

https://twitter.com/CryptosEngineer/status/1522641852301684738

/15

Trading is different than investment.

Choose your role when the market is boring. Most people tend to shift from investing to trading during fear and greed cycles.

/16

Choose your role when the market is boring. Most people tend to shift from investing to trading during fear and greed cycles.

https://twitter.com/CryptosEngineer/status/1521142480837627912

/16

Do something.

Holding your tokens is equal to buying them at the current price.

Do this assessment for each of the tokens. You don't have to sell them. You can swap them for different tokens with a higher potential for recovery.

/17

Holding your tokens is equal to buying them at the current price.

Do this assessment for each of the tokens. You don't have to sell them. You can swap them for different tokens with a higher potential for recovery.

/17

If you enjoyed this and want to learn more about investing, cryptocurrency & finance:

✔️ Follow me @CryptosEngineer for more threads like this.

✔️ Check out some of my other threads:

/18

✔️ Follow me @CryptosEngineer for more threads like this.

✔️ Check out some of my other threads:

https://twitter.com/CryptosEngineer/status/1486395562618503172

/18

TL;DR

Mental models to navigate in the current market:

• You don't have to be always right

• You are not diversified

• Your altcoins never reach ATH again

• Your altcoins never reach ATH again

• You are not managing your portfolio

• Do something

... and more

/19

Mental models to navigate in the current market:

• You don't have to be always right

• You are not diversified

• Your altcoins never reach ATH again

• Your altcoins never reach ATH again

• You are not managing your portfolio

• Do something

... and more

/19

• • •

Missing some Tweet in this thread? You can try to

force a refresh