#WeeklyIndexCheck CW19/2022

Market Quadrant:

⦿ Trend: Confirmed Downtrend

⦿ Momentum: Negative & worsening

⦿ Breadth: Worsening & oversold

⦿ Bias: Bearish on all timeframes

Market Quadrant:

⦿ Trend: Confirmed Downtrend

⦿ Momentum: Negative & worsening

⦿ Breadth: Worsening & oversold

⦿ Bias: Bearish on all timeframes

Trend

⦿ Almost all indices are in confirmed downtrend

⦿ Only PSE, Power & Energy in uptrend under pressure

⦿ No index in confirmed uptrend

⦿ Almost all indices are in confirmed downtrend

⦿ Only PSE, Power & Energy in uptrend under pressure

⦿ No index in confirmed uptrend

Momentum

⦿ Almost all indices (including Nifty, Banknifty, CNX500, Midcap, Smallcap) have negative & worsening momentum.

⦿ Only Energy & Power still have positive (but worsening) momentum

⦿ Almost all indices (including Nifty, Banknifty, CNX500, Midcap, Smallcap) have negative & worsening momentum.

⦿ Only Energy & Power still have positive (but worsening) momentum

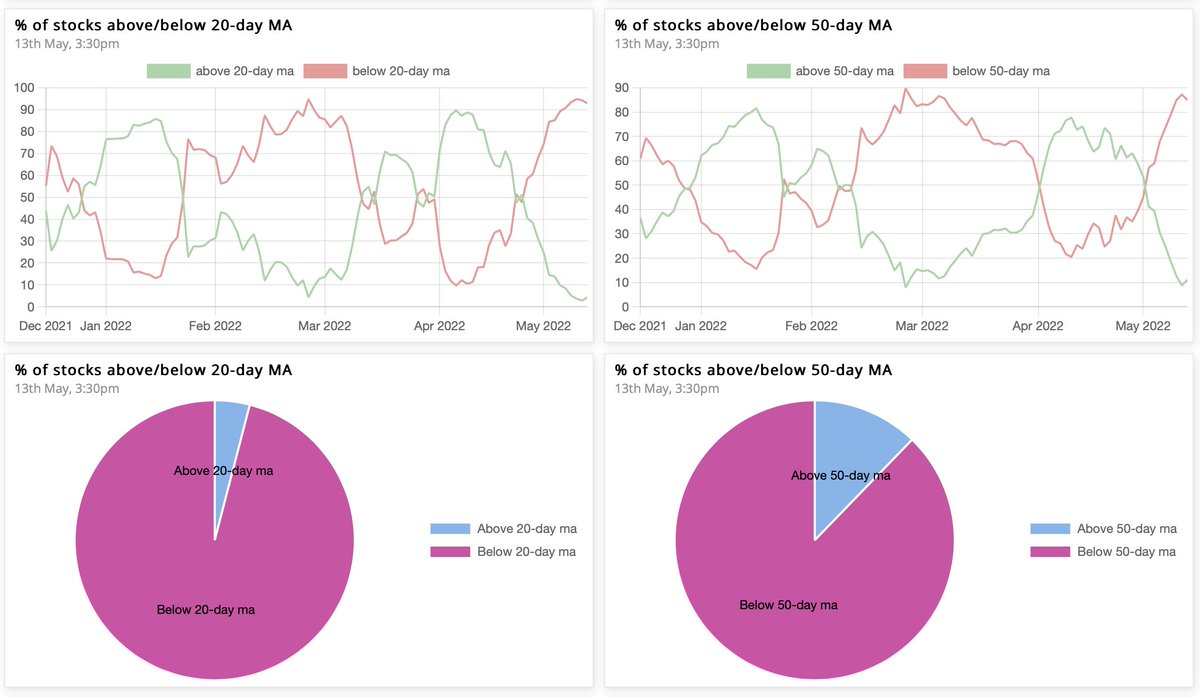

Market breadth worsening on all timeframes. Higher timeframes have bearish bias, while lower & intermediate ones well oversold.

⦿ 9% → 4% above 20MA (highly oversold)

⦿ 30% → 11% above 50MA (oversold)

⦿ 31% → 20% above 150MA (bearish)

⦿ 35% → 25% above 200MA (bearish)

⦿ 9% → 4% above 20MA (highly oversold)

⦿ 30% → 11% above 50MA (oversold)

⦿ 31% → 20% above 150MA (bearish)

⦿ 35% → 25% above 200MA (bearish)

% of stocks above/below 20& 50MA

The Ratio between stocks above & below 50MA is 0.14, while that for 20MA is 0.04.

The 10-day cumulative ratio for stocks above 50MA is 0.3 now. A value >2 is good for swing trades on the long side.

The Ratio between stocks above & below 50MA is 0.14, while that for 20MA is 0.04.

The 10-day cumulative ratio for stocks above 50MA is 0.3 now. A value >2 is good for swing trades on the long side.

Bias

On a modified Stockbee market monitor, the short-term indicator of 13% up in 34 days was already negative since past week.

Now, the intermediate 25% plus in a month & long-term metric of stocks 25% plus quarter are also negative.

On a modified Stockbee market monitor, the short-term indicator of 13% up in 34 days was already negative since past week.

Now, the intermediate 25% plus in a month & long-term metric of stocks 25% plus quarter are also negative.

4% up/down in 1 day

The 10-day cumulative ratio (10-DCR) between stocks up & down 4% in a day is now below 0.5, & an indication of a bearish breadth thrust.

When market is in bearish phase, a fresh bull move starts when 10-DCR first time crosses above 2.

The 10-day cumulative ratio (10-DCR) between stocks up & down 4% in a day is now below 0.5, & an indication of a bearish breadth thrust.

When market is in bearish phase, a fresh bull move starts when 10-DCR first time crosses above 2.

Primary Breadth Ratio

Overall, the market is now bearish, as the number of stocks up 25% plus in a quarter is now lesser than that down 25% plus in a quarter. The ratio between the two is the primary breadth ratio, which is now 0.29.

Overall, the market is now bearish, as the number of stocks up 25% plus in a quarter is now lesser than that down 25% plus in a quarter. The ratio between the two is the primary breadth ratio, which is now 0.29.

That’s all for this week. If you'd like to read this as a newsletter, find it here:

world.hey.com/nitinranjan/we…

world.hey.com/nitinranjan/we…

• • •

Missing some Tweet in this thread? You can try to

force a refresh