Let’s go back to basics.

#DeFi is ripe for opportunity but the lingo can be confusing at first.

One of the basic concepts you MUST get to grips with is "Liquidity Pools"

Check out this short thread explaining them in a way that even Grandma would understand.

#DeFi is ripe for opportunity but the lingo can be confusing at first.

One of the basic concepts you MUST get to grips with is "Liquidity Pools"

Check out this short thread explaining them in a way that even Grandma would understand.

The local DeFi Swimming Centre's grand opening is just around the corner.

Currently, they just have one big, empty pool. They need to fill it up.

However, being a DeFi swimming centre, they decide to do things a little differently...

Currently, they just have one big, empty pool. They need to fill it up.

However, being a DeFi swimming centre, they decide to do things a little differently...

Instead of filling the pool themselves, the Centre decides on an alternative solution.

They put out flyers, asking the public if they can help fill the pool. Just add equal amounts of water and chlorine.

Anyone who does so will get a portion of the swimming ticket sales.

They put out flyers, asking the public if they can help fill the pool. Just add equal amounts of water and chlorine.

Anyone who does so will get a portion of the swimming ticket sales.

The members of the public who provide greater amounts of water and chlorine to the pool will be rewarded with a greater fraction of the ticket sales.

With a little incentive, the public is more than happy to help, and the pool gets filled in no time.

With a little incentive, the public is more than happy to help, and the pool gets filled in no time.

All is well, the swimming pool opens, and everyone who helped fill the pool gets a nice little reward every time someone goes for a swim.

What the hell Naly?! What has this got to do with DeFi?

Let me explain.

The analogy may not be perfect, but the basics hold true.

Let me explain.

The analogy may not be perfect, but the basics hold true.

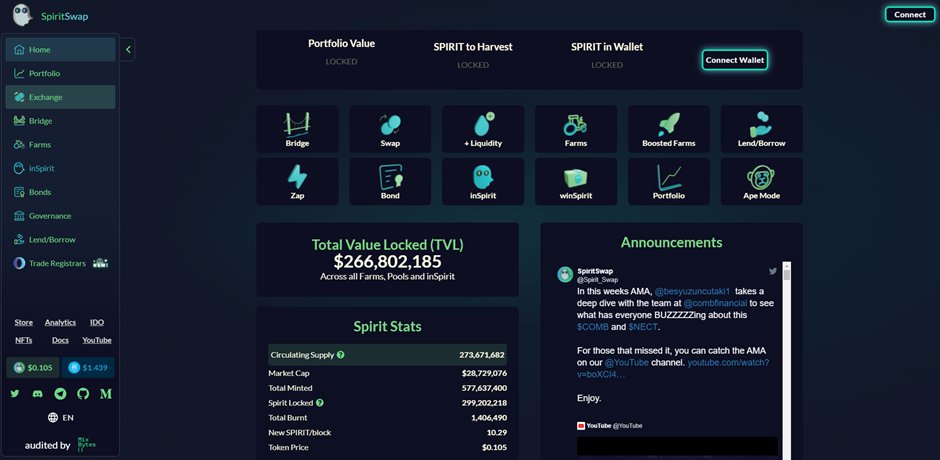

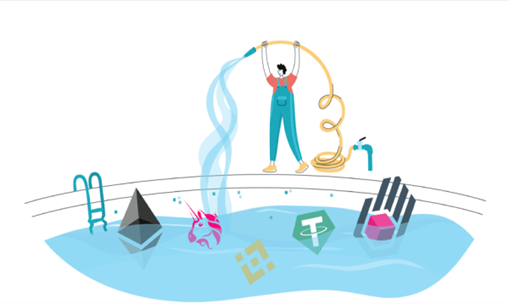

• Centre needs the pool filled - DEX needs liquidity

•Water and chlorine are needed for the pool - Assets on the DEX

• Swimmers buying tickets and entering the pool - Trades taking place

•Public earning a share of ticket fees - Share of trading fees

•Water and chlorine are needed for the pool - Assets on the DEX

• Swimmers buying tickets and entering the pool - Trades taking place

•Public earning a share of ticket fees - Share of trading fees

However, trading fees aren’t the only way to earn as an LP provider.

After a great grand opening, the Defi Swimming Centre's business is booming.

They decide to open up more pools!

After a great grand opening, the Defi Swimming Centre's business is booming.

They decide to open up more pools!

This time, they decide to spice things up a bit.

Not only will you earn a share of the ticket fees, but the centre also offers you the renowned DeFi chocolate cake every time you visit.

The centre now provides an extra incentive for you to provide your assets.

Not only will you earn a share of the ticket fees, but the centre also offers you the renowned DeFi chocolate cake every time you visit.

The centre now provides an extra incentive for you to provide your assets.

This is what lots of Decentralised exchanges do.

They provide an extra incentive for providing an LP besides the trading fees.

Allowing users to earn an additional yield.

This is known as Yield Farming.

They provide an extra incentive for providing an LP besides the trading fees.

Allowing users to earn an additional yield.

This is known as Yield Farming.

Well, that’s it, Liquidity pools explained simply.

You now understand one of the most important terms in DeFi.

See if you can explain it to your Grandma.

You now understand one of the most important terms in DeFi.

See if you can explain it to your Grandma.

If you enjoyed the analogy make sure to give the first tweet a retweet.

Truly believe that DeFi can make finance almost poetic, there is a beauty to it.

Everyone should learn the basics and find out for themselves

Truly believe that DeFi can make finance almost poetic, there is a beauty to it.

Everyone should learn the basics and find out for themselves

https://twitter.com/DeFi_naly/status/1526552574043856898?s=20&t=f30XbfCO8bOowqZlxo26Iw

• • •

Missing some Tweet in this thread? You can try to

force a refresh