1/ The recent survey of global fund managers by Merrill Lynch is quite interesting from a contrarian's perspective.

Over 300 money managers with circa trillion in assets under management very polled on the various portfolio, finance & economy questions.

#sentiment update 👇

Over 300 money managers with circa trillion in assets under management very polled on the various portfolio, finance & economy questions.

#sentiment update 👇

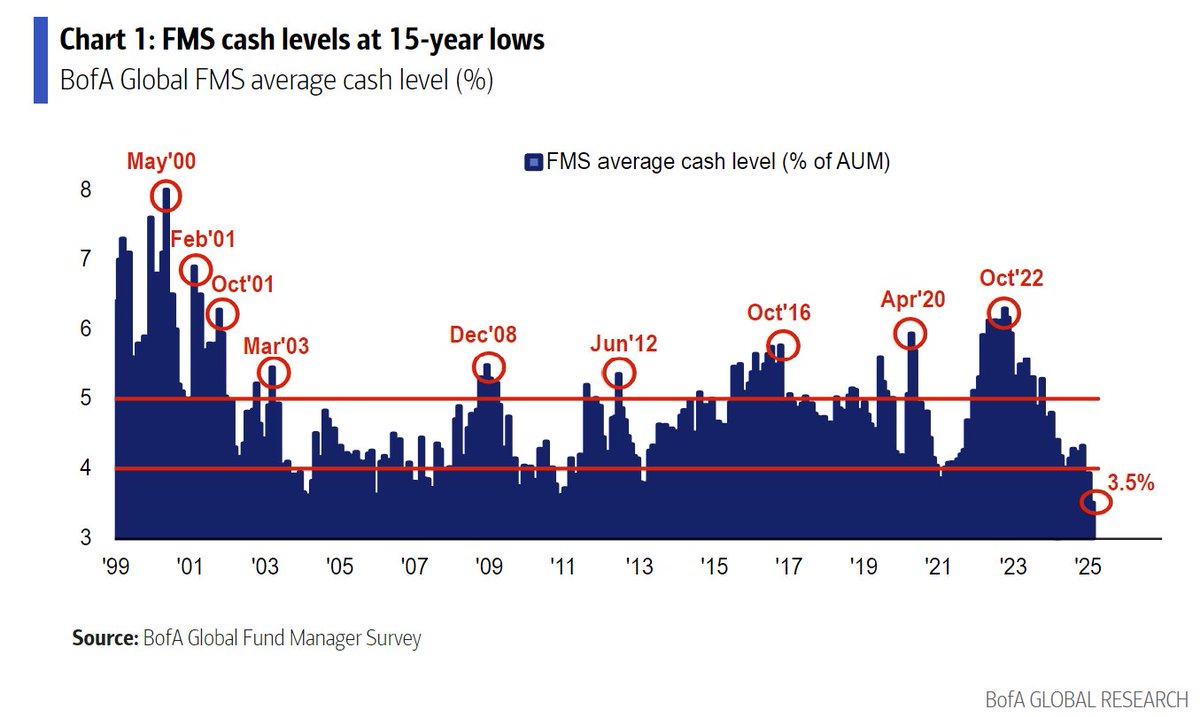

2/ Cash balance happens to be the highest since September 11 crash in 2001 (@ 6.1%). 😲

To say they are quite worried would be an understatement.

Yes, it is a small sample size (the law of small numbers leads to errors) but when others are fearful, we should be greedy.

To say they are quite worried would be an understatement.

Yes, it is a small sample size (the law of small numbers leads to errors) but when others are fearful, we should be greedy.

3/ Do you remember that classic line from Back To The Future:

"Marty McFly, are you chicken?" 😂

It looks like global managers have chickened out from taking risks, as their exposure to risk sinks to the lowest since the Global Financial Crisis.

The sentiment is in the gutter.

"Marty McFly, are you chicken?" 😂

It looks like global managers have chickened out from taking risks, as their exposure to risk sinks to the lowest since the Global Financial Crisis.

The sentiment is in the gutter.

4/ Additionally, they are all panicking about the future hawkishness of central banks and the possibility of a global recession.

The questions on our minds:

• if it's so obvious to the managers is it obviously wrong?

• has it already been discounted with the recent carnage?

The questions on our minds:

• if it's so obvious to the managers is it obviously wrong?

• has it already been discounted with the recent carnage?

5/ Fear levels have spiked swiftly and with intensity.

Once again, small sample size, but the only other time managers were this fearful was during the depths of the GFC in 2008 or briefly in Q1 of 2020 (Covid-19).

Too much fear is always a fantastic opportunity to deploy cash.

Once again, small sample size, but the only other time managers were this fearful was during the depths of the GFC in 2008 or briefly in Q1 of 2020 (Covid-19).

Too much fear is always a fantastic opportunity to deploy cash.

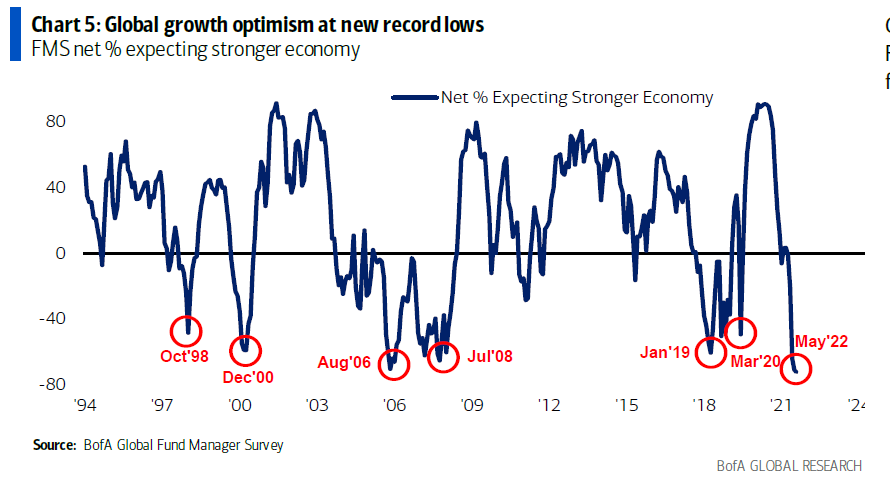

6/ Why am I asking those questions in tweet #4?

Well, it seems every single fund manager thinks the economic prospects can only get worse from here.

Growth expectations are the lowest on record! 😲

"When everyone thinks the same, nobody is thinking." — Walter Lippmann

Well, it seems every single fund manager thinks the economic prospects can only get worse from here.

Growth expectations are the lowest on record! 😲

"When everyone thinks the same, nobody is thinking." — Walter Lippmann

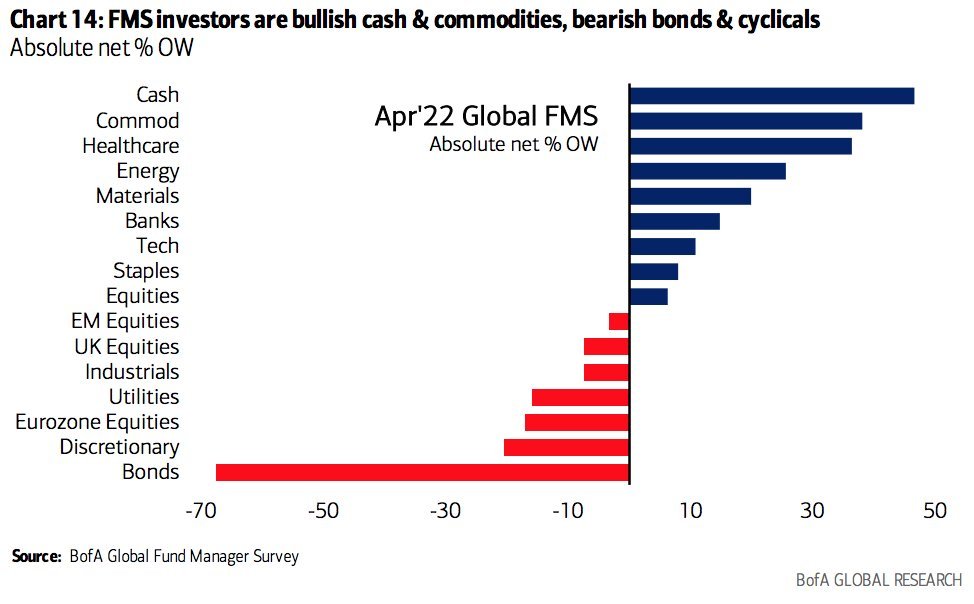

7/ Oil & Gas is by and large the groupthink, overweight, overcrowded trade of the moment. I would probably stay away from this sector as it could suffer meaningful drawdowns.

Other than energy & commodities in general, cash is the other most favored investment by fund managers.

Other than energy & commodities in general, cash is the other most favored investment by fund managers.

8/ Additional fund manager exposures:

• managers are underweight the global tech sector for the first time in 16 years

• short Treasuries, short China stocks, and underweighting EM tech are some of the most overcrowded bearish & very hated securities

• managers are underweight the global tech sector for the first time in 16 years

• short Treasuries, short China stocks, and underweighting EM tech are some of the most overcrowded bearish & very hated securities

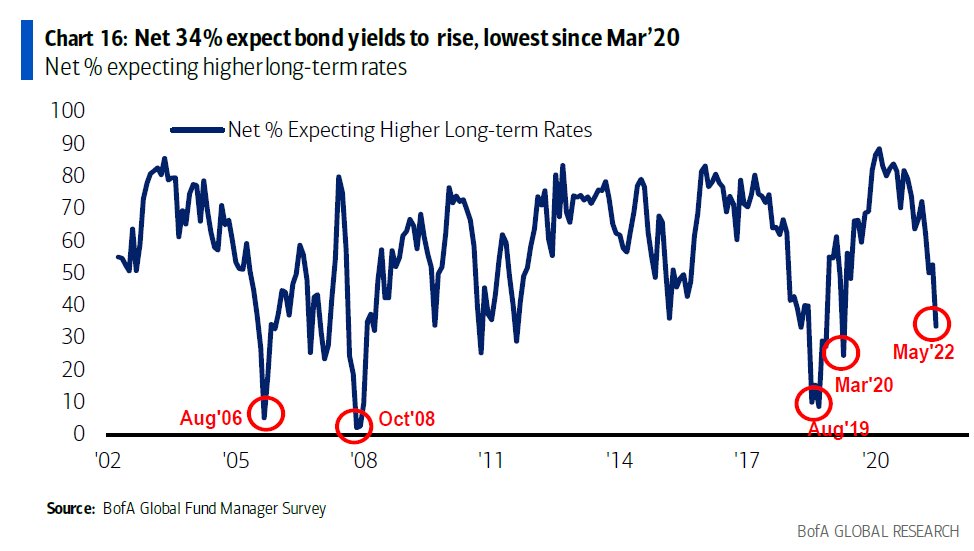

9/ Q: what has undone the stock market rally?

A: a spike in inflation pressuring central banks to tighten monetary policy, contracting risky asset multiple as bond yields rose rapidly.

The expectation for bond yields to rise further is now held by only 30% of fund managers.

A: a spike in inflation pressuring central banks to tighten monetary policy, contracting risky asset multiple as bond yields rose rapidly.

The expectation for bond yields to rise further is now held by only 30% of fund managers.

10/ Managers were also asked at what point do they think the Federal Reserve will come to the rescue (the so-called Fed's put)?

Observing the world's most popular index, it was a range between 3,500 and 3,750 points on the S&P 500.

The recent low was 3,859.

Observing the world's most popular index, it was a range between 3,500 and 3,750 points on the S&P 500.

The recent low was 3,859.

11/ You never want to be completely blinded by confirmation bias. A good way to fight it is via searching for disconfirming evidence.

So, to pour some cold water on this thread, the same investment bank showed extremely long exposure by private clients in the same month.🤔

So, to pour some cold water on this thread, the same investment bank showed extremely long exposure by private clients in the same month.🤔

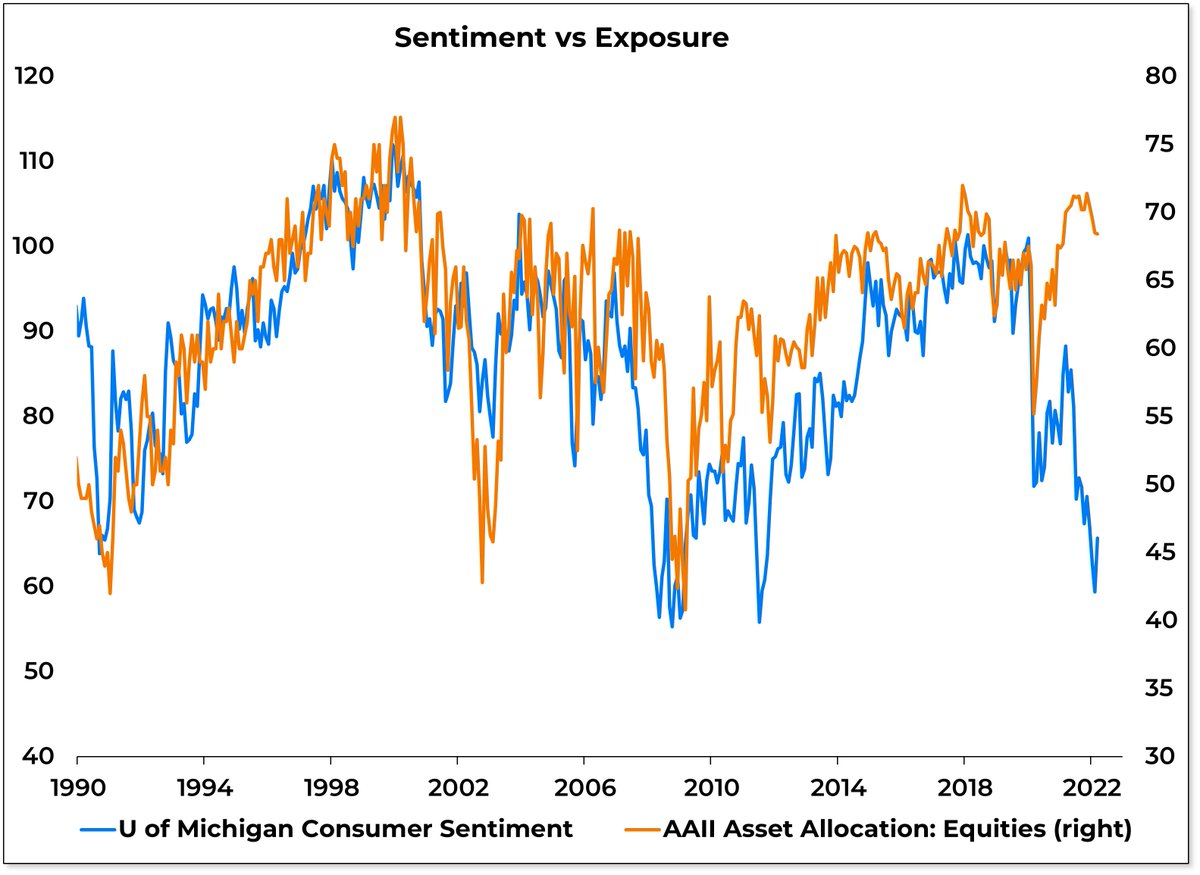

12/ I've posted the AAII sentiment survey vs AAII allocation survey last week, but @WillieDelwiche does a great job of combining public opinion vs their exposure.

Investors say they are pessimistic but are they?

Don't listen to what they say, watch what they do.

Investors say they are pessimistic but are they?

Don't listen to what they say, watch what they do.

13/ One thing is for certain, I would definitely stay away from the Oil & commodities long trade.

Considering that 2011 was a secular peak for natural resources, it is mind-blowing to see just how overexposed fund managers are today to this sector.

Considering that 2011 was a secular peak for natural resources, it is mind-blowing to see just how overexposed fund managers are today to this sector.

14/ Commodity spikes go hand in hand with geopolitical risk, and unsurprisingly, the risk has reached levels equivalent to the last two Iraq wars.

Once again, small sample size, but the previous two instances signaled a stock market bottom (under much lower valuations, though).

Once again, small sample size, but the previous two instances signaled a stock market bottom (under much lower valuations, though).

15/ Fund managers think monetary risk (policy error by central banks) is as high as its ever been.

This is obviously why every man and his dog are underweight Treasuries.

From the contrary perspective, such fear could signal a rebound in bonds (fall in yields).

This is obviously why every man and his dog are underweight Treasuries.

From the contrary perspective, such fear could signal a rebound in bonds (fall in yields).

16/ Conclusion?

In many regards, managers' sentiment towards global equities is as low as the 2008/09 period.

In many regards, managers' sentiment towards global equities is as low as the 2008/09 period.

17/ Net exposure (longs - shorts) is now below 25%, which isn't ultra bearish but getting quite pessimistic.

18/ Having said that global money managers have not cut their exposure to global equities the way they did in 2008.

Then again, the market has not crashed -60% like in 2008, rather only -20% from the recent highs.

Then again, the market has not crashed -60% like in 2008, rather only -20% from the recent highs.

19/ The last chart focuses on the "buzz word" of the day: stagflation.

I recently visited my dentist for a regular checkup & he kept talking to me about stagflation the whole time.

It doesn't surprise me that fund managers are also obsessing about it. Humans herd as do animals.

I recently visited my dentist for a regular checkup & he kept talking to me about stagflation the whole time.

It doesn't surprise me that fund managers are also obsessing about it. Humans herd as do animals.

20/ One thing I have repeated in this thread is the law of small numbers (Faulty Generalization Fallacy).

Pay attention to cognitive biases, mental shortcuts, fallacies, folly, anecdotal evidence, casual linking & arguments by analogy — all of which lead to poor decision making.

Pay attention to cognitive biases, mental shortcuts, fallacies, folly, anecdotal evidence, casual linking & arguments by analogy — all of which lead to poor decision making.

• • •

Missing some Tweet in this thread? You can try to

force a refresh