1/

You have probably heard the investing mantra "Don't fight the FED", but what does it actually mean & how does it relate to the crypto markets?

A thread

You have probably heard the investing mantra "Don't fight the FED", but what does it actually mean & how does it relate to the crypto markets?

A thread

2/

The FED & FOMC make decisions regarding interest rates and assets purchases/sales (QE/QT) in order to achieve their goals. Namely, economic growth, price stability & employment.

Don't fight the FED means you should align your investments with the monetary policy of the FED

The FED & FOMC make decisions regarding interest rates and assets purchases/sales (QE/QT) in order to achieve their goals. Namely, economic growth, price stability & employment.

Don't fight the FED means you should align your investments with the monetary policy of the FED

3/

So how do interest rates effect the economy?

Generally:

Raising rates makes it more expensive for businesses to borrow money

Lowering rates makes it less expensive for businesses to borrow money

So how do interest rates effect the economy?

Generally:

Raising rates makes it more expensive for businesses to borrow money

Lowering rates makes it less expensive for businesses to borrow money

4/

With inflation breaking reaching 40-yr high of 8.5% in March, the FED is forced to raise interest rates.

Let's look at what is likely to happen:

With inflation breaking reaching 40-yr high of 8.5% in March, the FED is forced to raise interest rates.

Let's look at what is likely to happen:

5/

1. Rate hikes

2. More expensive for consumers/ businesses to borrow

3. Cost of debt increases therefore

4. Lower consumer spending & Biz profits

5. Lower profits mean Biz spend less & reduce investment

6. Lower employment

This all acts to slow the growth of the economy

1. Rate hikes

2. More expensive for consumers/ businesses to borrow

3. Cost of debt increases therefore

4. Lower consumer spending & Biz profits

5. Lower profits mean Biz spend less & reduce investment

6. Lower employment

This all acts to slow the growth of the economy

6/

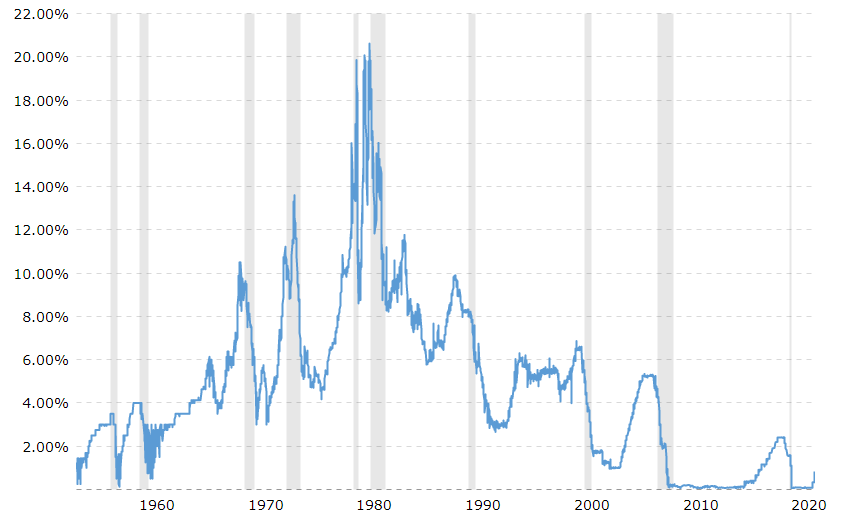

The FED has hiked rates many times in since it's inception in 1913 .

Here is a historical look at the Federal funds rate over the last 62 yrs. Highlighted in blue are recessions.

The FED has hiked rates many times in since it's inception in 1913 .

Here is a historical look at the Federal funds rate over the last 62 yrs. Highlighted in blue are recessions.

7/

Quick recap:

March - 25bps

May - 50 bps

June & July expected - 50 bps

Then, 25bps until end of 2023

The market is therefore expecting the federal funds rate to be 2.5% by end of 2023.

However the FED isn't just raising rates...

Quick recap:

March - 25bps

May - 50 bps

June & July expected - 50 bps

Then, 25bps until end of 2023

The market is therefore expecting the federal funds rate to be 2.5% by end of 2023.

However the FED isn't just raising rates...

8/

They are also starting quantitative tightening (QT).

QT is essentially the opposite of QE & it will begin next week (Jun e1st) at a rate of $47.5 bn/M, looking to scale up to $95 bn in 3 months.

They performed QT at a rate of $10bn/M in 2018 & equities fell hard

They are also starting quantitative tightening (QT).

QT is essentially the opposite of QE & it will begin next week (Jun e1st) at a rate of $47.5 bn/M, looking to scale up to $95 bn in 3 months.

They performed QT at a rate of $10bn/M in 2018 & equities fell hard

9/

We are doing QT at a pace that has never been seen before, all whilst raising rates.

In 2018, we started with $10 bn/m and slowly got up to $50bn/m at year end.

Consequently the market nuked a few months after QT

Now QT is set to start at the maximum level of 2018...

We are doing QT at a pace that has never been seen before, all whilst raising rates.

In 2018, we started with $10 bn/m and slowly got up to $50bn/m at year end.

Consequently the market nuked a few months after QT

Now QT is set to start at the maximum level of 2018...

10/

So how will this effect Crypto assets & the market in general?

Firstly, we should understand that currently the crypto markets are highly correlated to tradfi & are acting like 'risk-on' assets.

As such, the 40-day rolling correlation between the Nasdaq &

Btc is at 0.89

So how will this effect Crypto assets & the market in general?

Firstly, we should understand that currently the crypto markets are highly correlated to tradfi & are acting like 'risk-on' assets.

As such, the 40-day rolling correlation between the Nasdaq &

Btc is at 0.89

11/

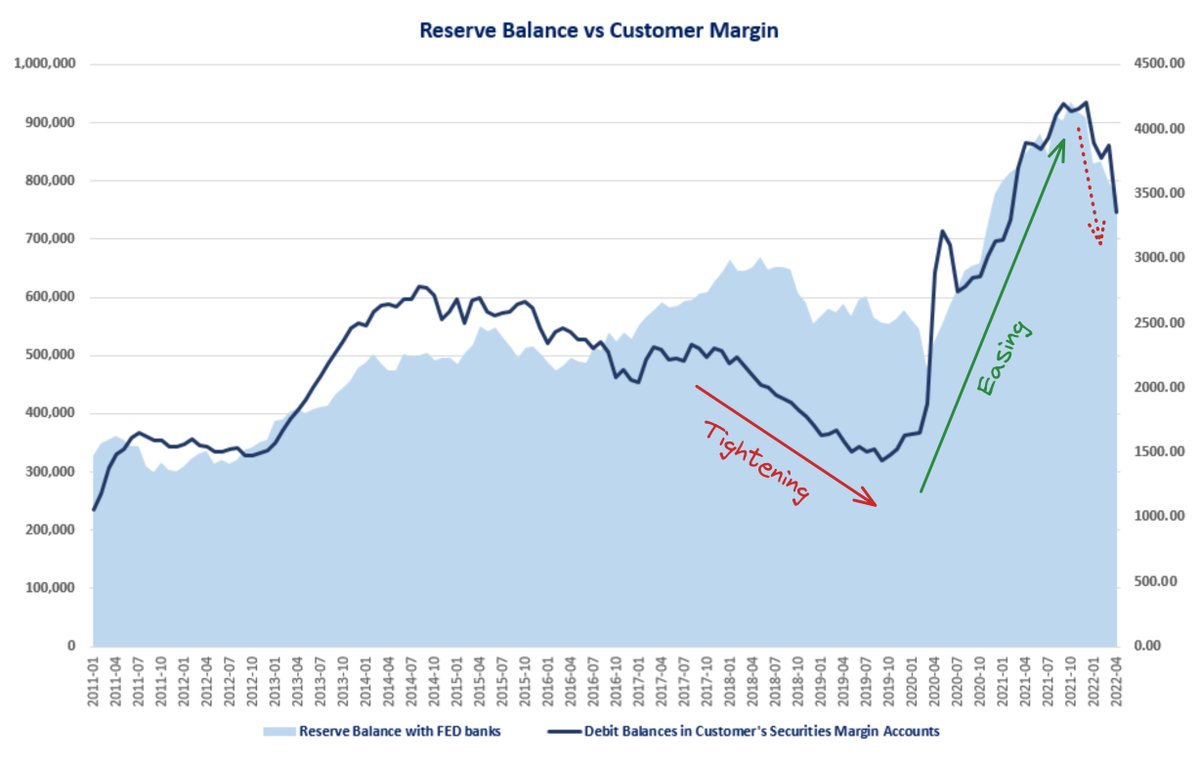

By comparing the reserve balances held by FED banks & the amount of margin in customer securities accounts, we can get an idea of how banks lend & provide liquidity to the system in different macro conditions.

We can see there is a high correlation between the two.

By comparing the reserve balances held by FED banks & the amount of margin in customer securities accounts, we can get an idea of how banks lend & provide liquidity to the system in different macro conditions.

We can see there is a high correlation between the two.

12/

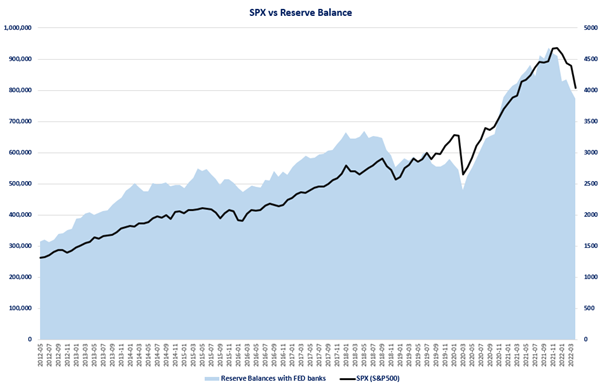

Comparing this to the tradfi markets, we can get a sense of how the reserve balance / customer margin shows up in markets.

The debit balances of customer securities margin accounts seems to be a leading indicator for the NASDAQ, showing high positive correlation.

Comparing this to the tradfi markets, we can get a sense of how the reserve balance / customer margin shows up in markets.

The debit balances of customer securities margin accounts seems to be a leading indicator for the NASDAQ, showing high positive correlation.

13/

When the FED balance sheet expands, there is more margin borrowing & stocks tend to do well.

Once the FED starts draining their balance sheet, banks will tighten up their lending & margin levels will fall.

When the FED balance sheet expands, there is more margin borrowing & stocks tend to do well.

Once the FED starts draining their balance sheet, banks will tighten up their lending & margin levels will fall.

14/

As the FED shrinks it's balance sheet, reserve balances held with FED banks will be decreased & this will shrink the amount of leverage in the system. Likely negatively impacting stocks & crypto assets.

S&P500 vs Reserve balance for reference

As the FED shrinks it's balance sheet, reserve balances held with FED banks will be decreased & this will shrink the amount of leverage in the system. Likely negatively impacting stocks & crypto assets.

S&P500 vs Reserve balance for reference

15/

With #Btc being invented in 2008, crypto has never really existed in a recession & so it's anyone's guess how it reacts.

However, with the high corr. to equities and risk-on assets, we can assume crypto will perform badly if the wider market performs badly.

With #Btc being invented in 2008, crypto has never really existed in a recession & so it's anyone's guess how it reacts.

However, with the high corr. to equities and risk-on assets, we can assume crypto will perform badly if the wider market performs badly.

end/

Please let me know your thoughts / if anything is wrong!

If you liked it, please consider liking & retweeting here:

Please let me know your thoughts / if anything is wrong!

If you liked it, please consider liking & retweeting here:

https://twitter.com/Riley_gmi/status/1528780990411198464?s=20&t=Pa2CZBht0PH0iIk-cVGx3Q

• • •

Missing some Tweet in this thread? You can try to

force a refresh