How to get URL link on X (Twitter) App

There has been a very active claims market for FTX accounts, whereby distressed credit funds will purchases the rights to a users bankruptcy claim.

There has been a very active claims market for FTX accounts, whereby distressed credit funds will purchases the rights to a users bankruptcy claim.

https://x.com/Ren_gmi/status/1887139120281256219

2/7

2/7

First, Frax revolves around the FRAX stablecoin - a stablecoin pegged to the US dollar.

First, Frax revolves around the FRAX stablecoin - a stablecoin pegged to the US dollar.

https://twitter.com/Riley_gmi/status/1643227012880801793They acquired creams validator set & this means those who have staked their ether with Cream Finance will now be staking to Manifold’s liquid staking protocol.

Using @0xgeert's model [a Manifold community member] we can work out the actual profit generated by Sushiguard if it were deployed and running in 2021 & 2022.

Using @0xgeert's model [a Manifold community member] we can work out the actual profit generated by Sushiguard if it were deployed and running in 2021 & 2022.

I took a look at Alameda's on-chain holdings using @ArkhamIntel & their Alameda entity.

I took a look at Alameda's on-chain holdings using @ArkhamIntel & their Alameda entity.

Berachain is an EVM compatible layer 1 blockchain built atop Tendermint [Cosmos SDK]. The chain is secured by a novel consensus mechanism called 'Proof-of-Liquidity' [PoL].

Berachain is an EVM compatible layer 1 blockchain built atop Tendermint [Cosmos SDK]. The chain is secured by a novel consensus mechanism called 'Proof-of-Liquidity' [PoL].

@GMX_IO For an introduction to GMX's upcoming synthetic derivative product, start here:

@GMX_IO For an introduction to GMX's upcoming synthetic derivative product, start here:https://twitter.com/Riley_gmi/status/1546946551649488896?s=20&t=u1LbzlZNyMDnKQXucgyb9g

@GMX_IO @808_Investor First off, what are Synthetic assets?

@GMX_IO @808_Investor First off, what are Synthetic assets?

@Crypto_Joe10 First, what is Lido & stETH?

@Crypto_Joe10 First, what is Lido & stETH?

@Tetranode @CurveFinance @ConvexFinance First, some background

@Tetranode @CurveFinance @ConvexFinance First, some background

First, what is hedging?

First, what is hedging?

https://twitter.com/laurashin/status/15290885863767900182/9

2/

2/

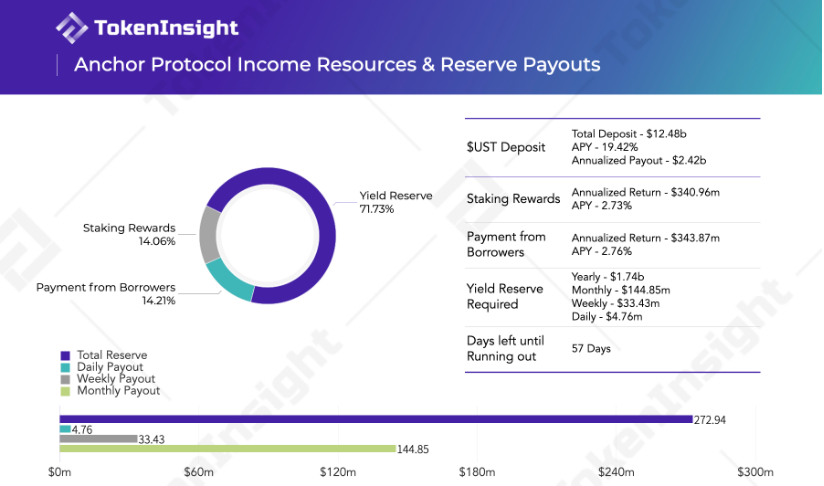

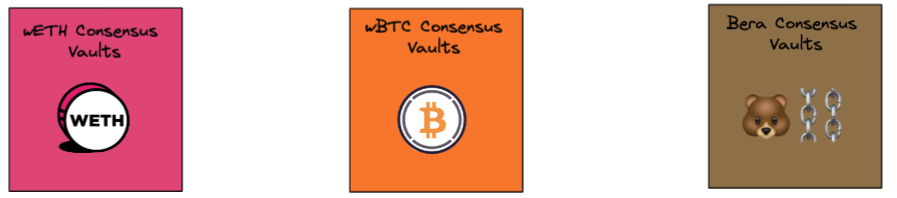

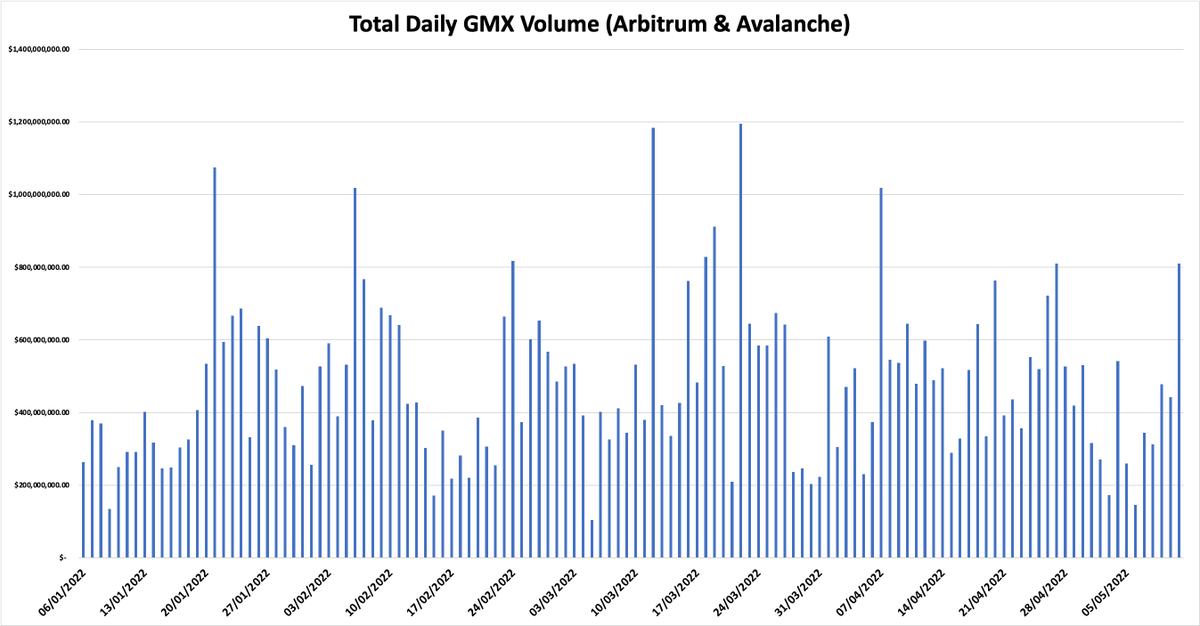

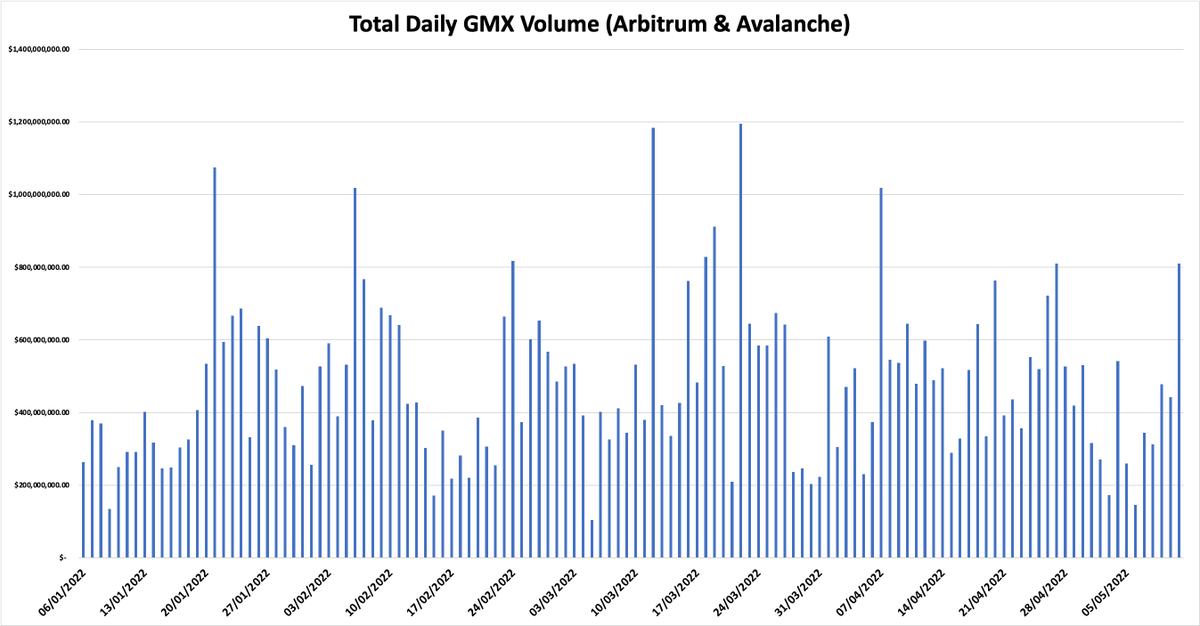

GMX processed a total of $810,400,000 in volume yesterday.

GMX processed a total of $810,400,000 in volume yesterday.

Most forecasts agree that crypto’s share of the market will grow until it reaches between 25%-33% of the total money serving the economies of the world. With this in mind, Near has just launched it’s stablecoin, $USN

Most forecasts agree that crypto’s share of the market will grow until it reaches between 25%-33% of the total money serving the economies of the world. With this in mind, Near has just launched it’s stablecoin, $USN