$QNT really is ‘THE’ NETWORK of NETWORKS disrupting all industries🤯

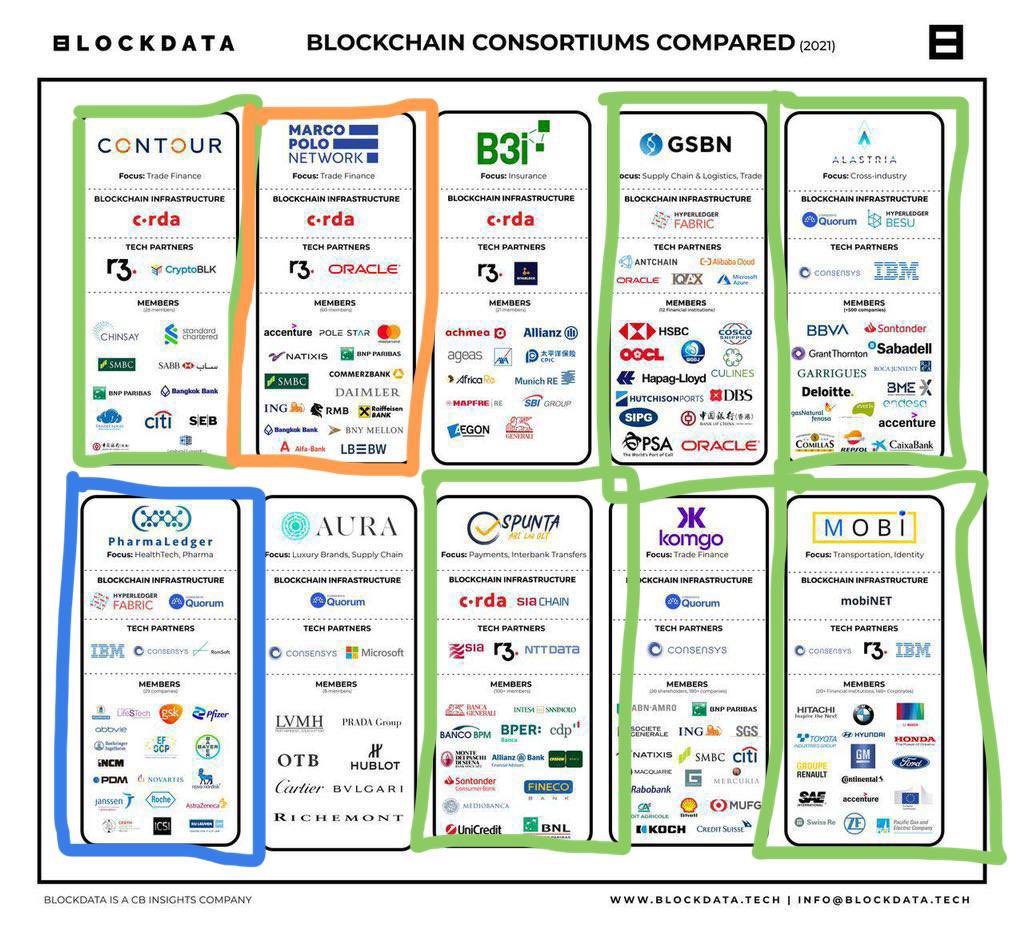

@blockdata_tech recently made this famous overview of blockchain consortiums in different sectors.

A mini 🧵on $QNT (7/10) involvement 👇🏻

🟩 Confirmed / highly likely

🟧 Solid leads

🟦 Possible

1/11

@blockdata_tech recently made this famous overview of blockchain consortiums in different sectors.

A mini 🧵on $QNT (7/10) involvement 👇🏻

🟩 Confirmed / highly likely

🟧 Solid leads

🟦 Possible

1/11

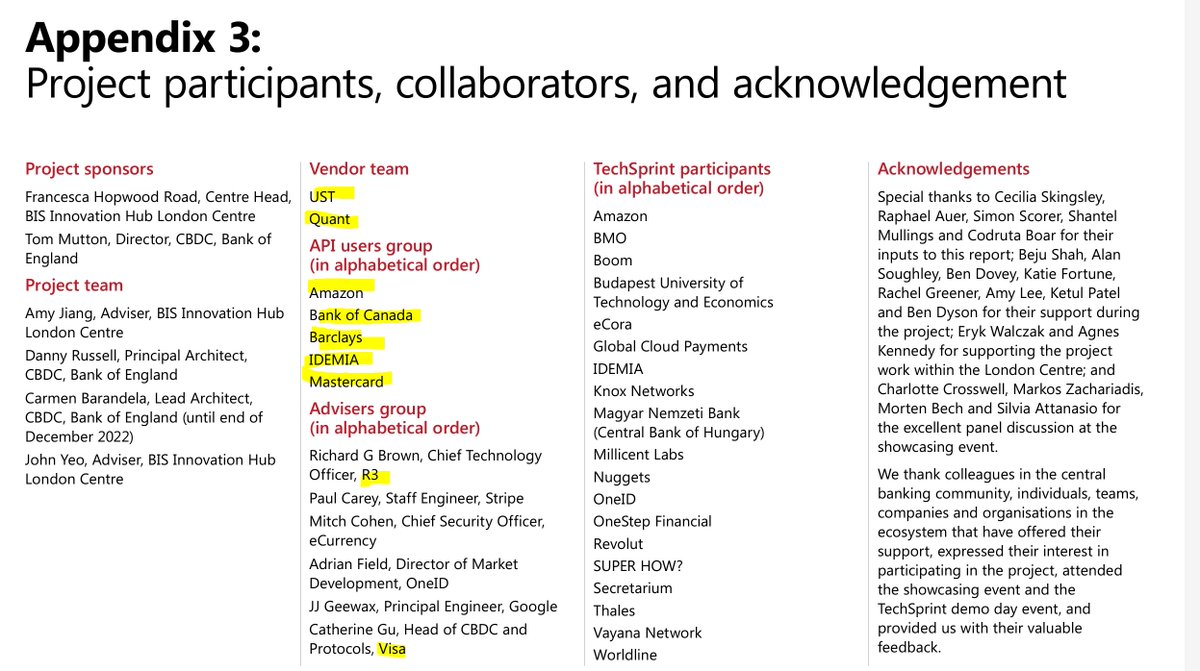

I’ll start with the 🟩 ones.

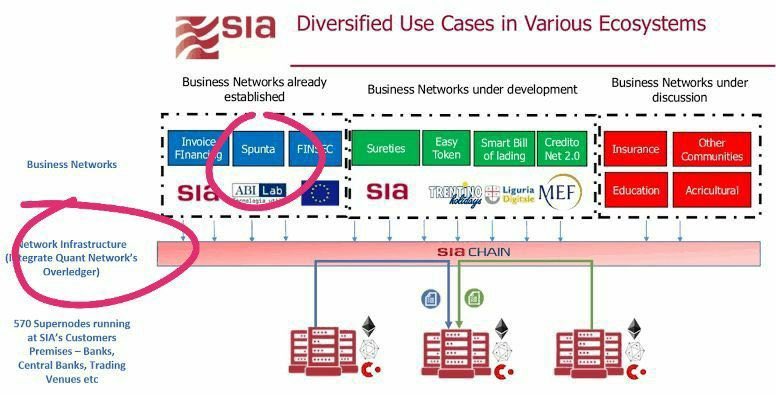

1. SPUNTA; official and build on SIAchain (Corda, Hyperledger, Eth)

Fun fact #1: 100/580 banks live✅

Fun fact #2: just 1 dapp to produce 8.4B transactions💪🏻

Fun fact #3: 11 more SIA dapps to come🔥

2/11

1. SPUNTA; official and build on SIAchain (Corda, Hyperledger, Eth)

Fun fact #1: 100/580 banks live✅

Fun fact #2: just 1 dapp to produce 8.4B transactions💪🏻

Fun fact #3: 11 more SIA dapps to come🔥

2/11

2. MOBI 🚘🚙

Consortium of:

- 20 financial insitutions💰

- 140 corporates✅

Fun fact: A pilot involving 280 million vehicles with the EU Commission 🇪🇺is being launched soon.

See thread attached👇🏻

3/11

Consortium of:

- 20 financial insitutions💰

- 140 corporates✅

Fun fact: A pilot involving 280 million vehicles with the EU Commission 🇪🇺is being launched soon.

See thread attached👇🏻

3/11

https://twitter.com/sannl11/status/1483532973626609665

3. Alastria 🇪🇸

>500 Spanish entities including multinationals BBVA, Santander, Cepsa, Repsol.

Alastria is also directly involved with LACchain/IDB (which $QNT is building the Latan American💲accross 12 countries with (😉huge).

Listen yourself in attached video🗣

4/11

>500 Spanish entities including multinationals BBVA, Santander, Cepsa, Repsol.

Alastria is also directly involved with LACchain/IDB (which $QNT is building the Latan American💲accross 12 countries with (😉huge).

Listen yourself in attached video🗣

4/11

https://twitter.com/SanNL11/status/1499437686599262209

4. Contour

Huge, if not the biggest Trade Finance network in the 🌎🔥

See thread👇🏻

5/11

Huge, if not the biggest Trade Finance network in the 🌎🔥

See thread👇🏻

5/11

https://twitter.com/sannl11/status/1525113799296032773

5. GSBN

Handles 1 in 3 shipping containers worldwide🚢 🤯

See thread👇🏻

6/11

Handles 1 in 3 shipping containers worldwide🚢 🤯

See thread👇🏻

6/11

https://twitter.com/sannl11/status/1525113799296032773

6. Marco Polo

🟧Next. Less clear but solid leads.

Another Trade Finance beast✅

Somewhat older lead (>2Y). Old team slides connecting Marco Polo makes this a plausible possibility.

7/11

🟧Next. Less clear but solid leads.

Another Trade Finance beast✅

Somewhat older lead (>2Y). Old team slides connecting Marco Polo makes this a plausible possibility.

7/11

7. Pharmaledger

🟦Missing smoking gun but definitely possible. Tech 100% matches.

✅29 (global) pharmaceutical companies working on traceability, counterfeiting, IoT, clinical trials, eConsent and more.

Another monster ecosystem to launch EOY 2022🔥

8/11

🟦Missing smoking gun but definitely possible. Tech 100% matches.

✅29 (global) pharmaceutical companies working on traceability, counterfeiting, IoT, clinical trials, eConsent and more.

Another monster ecosystem to launch EOY 2022🔥

8/11

https://twitter.com/sannl11/status/1528016845130842112

This thread 🧵 shows some of the involvement outside finance/CBDCs, an image tied around $QNT ‘only’ involvement. But its much much bigger than that‼️

$QNT total addressable market cap (TAM) is literally the whole world and all its data and systems🔥

9/11

$QNT total addressable market cap (TAM) is literally the whole world and all its data and systems🔥

9/11

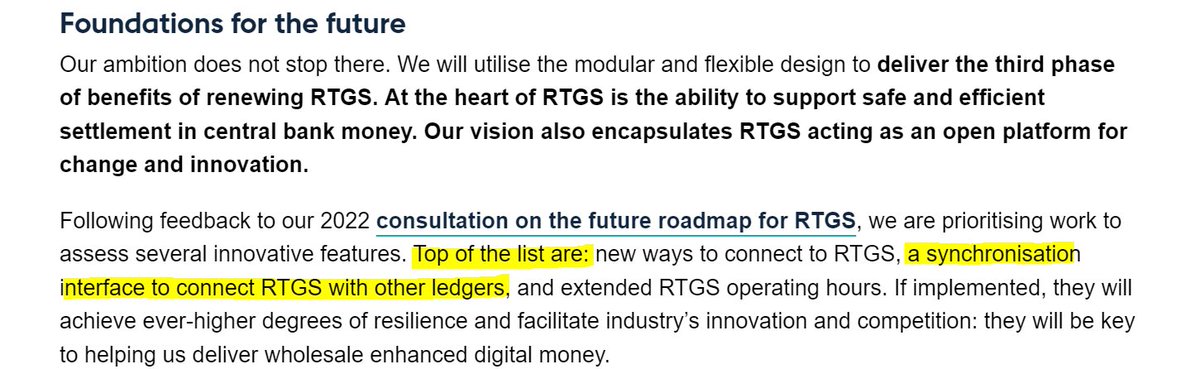

“There's 150+ central banks, 44,000+ banks and credit unions around the world. Each building products and services on their chosen (mostly private) DLTs and the DLTs of partners.

Finance🏦is just ONE sector.”

Now think EVERY sector where $QNT will be involved in🔥👇🏻

10/11

Finance🏦is just ONE sector.”

Now think EVERY sector where $QNT will be involved in🔥👇🏻

10/11

Quant is hardly warming up. Buckle up coming decade, its gonna be epic📈

#Networkofnetworks #Interoperability #futureofinancetoday #uncapped #ODAP #QuantNetwork

Bonus 🧠 (2x)👇🏻

#Networkofnetworks #Interoperability #futureofinancetoday #uncapped #ODAP #QuantNetwork

Bonus 🧠 (2x)👇🏻

Bonus 1 ⭐️ : You never see other crypto interop solutions involved at this scale. The trillion dollar initiatives are currently happening on the likes of #corda and #hyperledger (private DLT).

Private<>private is toughest form of interoperability🔒(MIT), solved by $QNT gateways!

Private<>private is toughest form of interoperability🔒(MIT), solved by $QNT gateways!

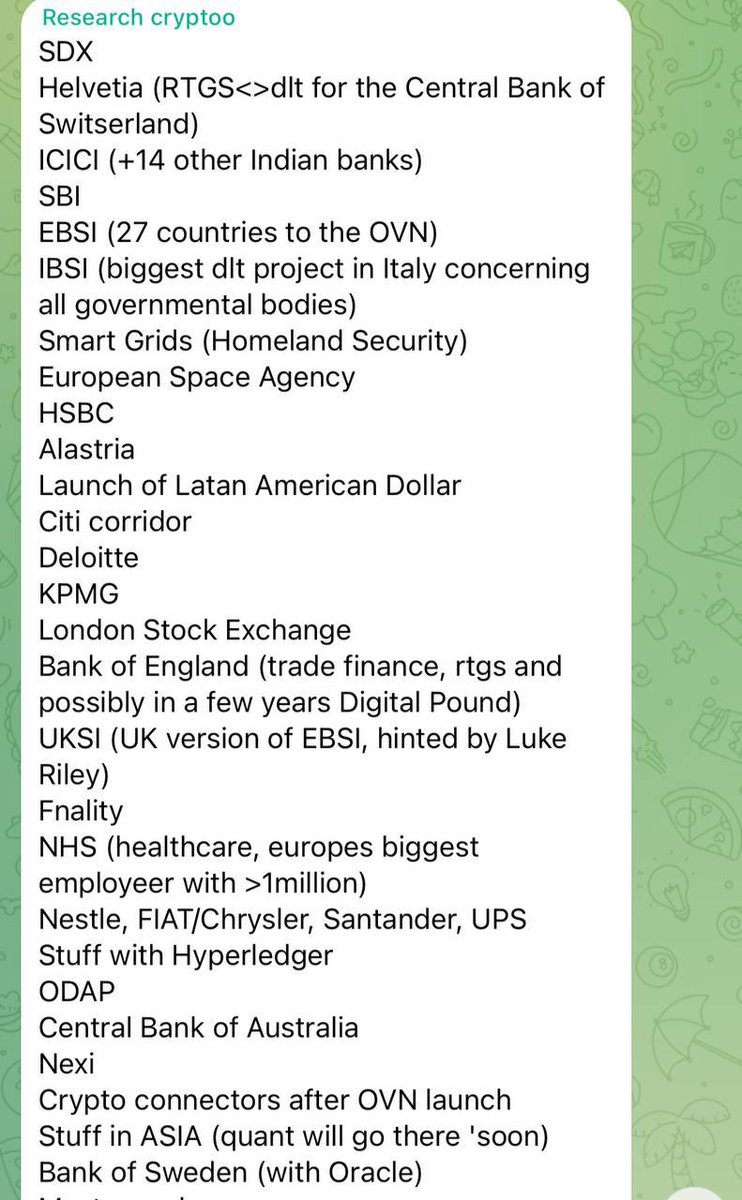

Bonus 2⭐️:

These ecosystems are probably not even 5% of where Overledger is being implemented. There is much larger stuff going on.

Just go through this list and see all the absurd clients and leads to $QNT

Typ in search: “sannl11 SDX” for example and you will find the leads🕵️♀️

These ecosystems are probably not even 5% of where Overledger is being implemented. There is much larger stuff going on.

Just go through this list and see all the absurd clients and leads to $QNT

Typ in search: “sannl11 SDX” for example and you will find the leads🕵️♀️

If you enjoyed this 🧵, don’t forget to follow me for more insights on Quant

@SanNL11

(there is just so much)

You can also like and retweet this thread for awereness, much appreciated💪🏻↓↓

$BTC $XRP $DOT $DAG $LUNA $XLM, $XDC, $QNT, $ALGO, $HBAR, $GALA, $AVAX, $ATOM

@SanNL11

(there is just so much)

You can also like and retweet this thread for awereness, much appreciated💪🏻↓↓

$BTC $XRP $DOT $DAG $LUNA $XLM, $XDC, $QNT, $ALGO, $HBAR, $GALA, $AVAX, $ATOM

https://twitter.com/sannl11/status/1529498733691514880

• • •

Missing some Tweet in this thread? You can try to

force a refresh