When bad geology meets great management, it is bad geology that wins.

#PARN is likely just that - an overvalued oil exploration company with a lot of OOIP within a challenging reservoir destined to disappoint the market's high expectations.

1/n

#PARN is likely just that - an overvalued oil exploration company with a lot of OOIP within a challenging reservoir destined to disappoint the market's high expectations.

1/n

https://twitter.com/BurggrabenH/status/1529477069167640576

We encountered that for Hurricane Energy ($HUR) in 2017 after extensive due diligence work.

Back then, HUR was somewhat of a "darling stock" in the UK. Kind of the hope of an aging UK North Sea E&P industry. Why? For one, the 2017 CPR claimed a 1.1bnbbl 3P resource!

2/n

Back then, HUR was somewhat of a "darling stock" in the UK. Kind of the hope of an aging UK North Sea E&P industry. Why? For one, the 2017 CPR claimed a 1.1bnbbl 3P resource!

2/n

Its CEO Robert Trice was a geologist & claimed to be one of only a handful "expert" globally on "Fractured Basements".

But the reservoir next to the Shetland Island was always a tough location while initial data was everything but straight forward.

3/n

But the reservoir next to the Shetland Island was always a tough location while initial data was everything but straight forward.

3/n

Yet, Trice managed to silence critics & raised hundreds of millions on the basis of hope.

Kerogen Capital, a PE firm based in London with $2bn AuM specialised in energy, funded the first 2 wells in April 2016 with an initial $63m (£44m) in straight equity for a 29.9% share.

4/n

Kerogen Capital, a PE firm based in London with $2bn AuM specialised in energy, funded the first 2 wells in April 2016 with an initial $63m (£44m) in straight equity for a 29.9% share.

4/n

In July 2017 (on the back of the CPR) this financing continued with a 2022 Convertible Bond of $230m, 7.5% coupon & $0.52/share conversion price - a 25% premium to its GBp29/share closing (i.e. GBp 36 conversion price; share price today GBp 9p).

5/n

5/n

Cash ($360m) and resource-promise rich, Trice went into overdrive and explained the path to production in H1 2019 by way of a so called "Early Production System" (EPS) in a presentation on May 2018.

6/n

6/n

The presentation contained to usual reference to "regional activity" (as does $PANR) and "analogue fields", both of which turned out to be not so analogue or better, completely irrelevant noise.

7/n

7/n

The production forecast of the EPS was - as for all giant conventional offshore fields - a steady 17kbpd production for years to come. And thus, it would fund the full production development in the not so distance future to unlock the billion barrel resource riches.

8/n

8/n

On 3/9/2018, Spirit Energy (an industry player) was convinced (others declined such as Premier Oil) in the form of a farm-in with a initital 3-well carry of up to $180m cost against a 50% Working Interest (WI) in all licenses covering the Greater Warwick Area (GWA).

9/n

9/n

A few months before, the stock peaked at GBp 67 in May 2017 but the promising farm-in gave a brief new life the stock which climbed back to GBp 60 in Sept 2017.

10/n

10/n

U would think a specialised PE & industrial player with access to the data room would have done their homework?

Well, we decided to do our own work & contacted Ross Runciman at @RSEnergyGroup to help us assessing the well data - expensive, but worth every $.

11/n

Well, we decided to do our own work & contacted Ross Runciman at @RSEnergyGroup to help us assessing the well data - expensive, but worth every $.

11/n

In Oct 2017, we received the first draft. It was devastating, with the key sentences highlighted below: "In our opinion, HUR can’t reconcile [the CPR] model, or any that it has investigated, with instances of oil below and water above closure"

12/n

12/n

Ross went on to explain me in a 3 hour phone call and 55 slides why this was going to end badly as the evolution of the "Trice reservoir models" was full of red flags such as 4 different Oil-Water Contact lines (OWC).

13/n

13/n

Ross predicted that "he expects producer water breakthrough when it occurs will be catastrophic and non-reversible. Anecdotally, industry has a poor track record of predicting when water will hit in fractured reservoirs. It usually occurs much sooner than expected."

14/n

14/n

By 4/2020, evidence from the EPS proved Ross right. Water came in earlier and big, rendering the reservoir model, production & FCF forecast useless.

In 5/2021, the stock went as low as GBp0.5, recovered since to GBp9.6 but remains well short of the 36p CB conversion price.

15/n

In 5/2021, the stock went as low as GBp0.5, recovered since to GBp9.6 but remains well short of the 36p CB conversion price.

15/n

10.3kbpd 2021 production (vs original guideance of 17k) at least allowed HUR to repurchase $132m worth of its CB in 2021. With a more stable outlook despite a much shorter reservoir life, the CB recovered to par - $100 Brent bailed them out.

16/n

16/n

The new CPR assumes 70mb 2P (vs 523 2C 2017). We'll have to see how the new team (Trice was fired) wants to deliver the necessary drilling on the "fractured reserves" with a 2022 guidance of a mere 8kbpd production at cash cost of $35/bbl = i.e. $190m OpCF at $100 Brent.

17/n

17/n

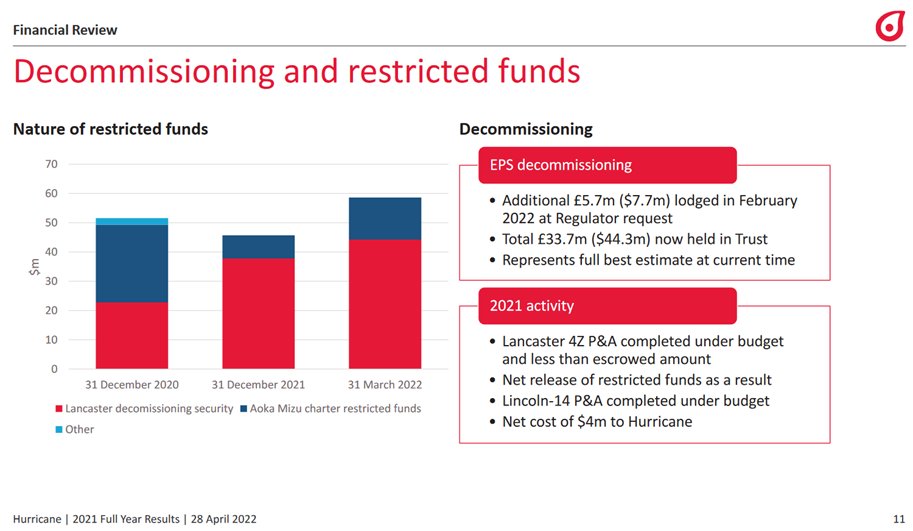

That OpCF will have to fund $93m CB repayment due in 7/2022 while much of the $76m cash as at Dec 2021 remains reserved for decom liability.

18/n

18/n

Remember - when bad geology meets great management, it is the bad geology that wins.

This is why the new team explained 3 scenarios as part of its restructuring efforts: (a) wind-down; (b) no further activity & (c) P8 2022 case.

Not pretty.

19/n

This is why the new team explained 3 scenarios as part of its restructuring efforts: (a) wind-down; (b) no further activity & (c) P8 2022 case.

Not pretty.

19/n

$PANR reminds me of $HUR.

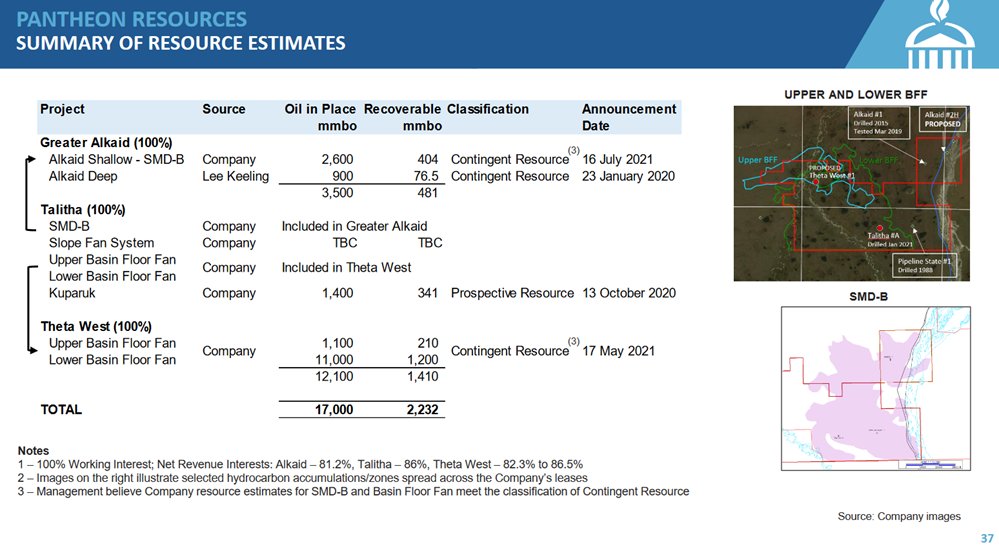

While there is a lot of OOIP, the commerical recovery of it remains uncertain. Halliburton agrees: It returned its 25% WI for free after the disappointing Alkaid D (77mb 2P; 108bpd flow at 0.25mD) in 2019.

Note what $PANR didn't mention below?

20/n

While there is a lot of OOIP, the commerical recovery of it remains uncertain. Halliburton agrees: It returned its 25% WI for free after the disappointing Alkaid D (77mb 2P; 108bpd flow at 0.25mD) in 2019.

Note what $PANR didn't mention below?

20/n

Of course, like Trice $PANR mgmt keeps hyping.

It now approached the reservoir with an unconventional fracing approach & assumes 1500bpd flow rates for its Alkaid-2 drilling program at est cost of $23m. But for how long? 12 months? At what decline rates or opex?

21/n

It now approached the reservoir with an unconventional fracing approach & assumes 1500bpd flow rates for its Alkaid-2 drilling program at est cost of $23m. But for how long? 12 months? At what decline rates or opex?

21/n

As with Trice, mgmt doesn't hold back on "resource est" without any 3rd party backing except for Alkaid Deep - its lowest est :-).

CPRs aren't the holy grail of resource investing, but they are a starting point to tune out the resource mirage noise.

22/22 End; Good luck

CPRs aren't the holy grail of resource investing, but they are a starting point to tune out the resource mirage noise.

22/22 End; Good luck

• • •

Missing some Tweet in this thread? You can try to

force a refresh