Investor; you are here for energy & metal commodities mostly; be aware of imposters (I won’t ask for your business)

41 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/burggrabenh/status/1979545937224638861…we know that…

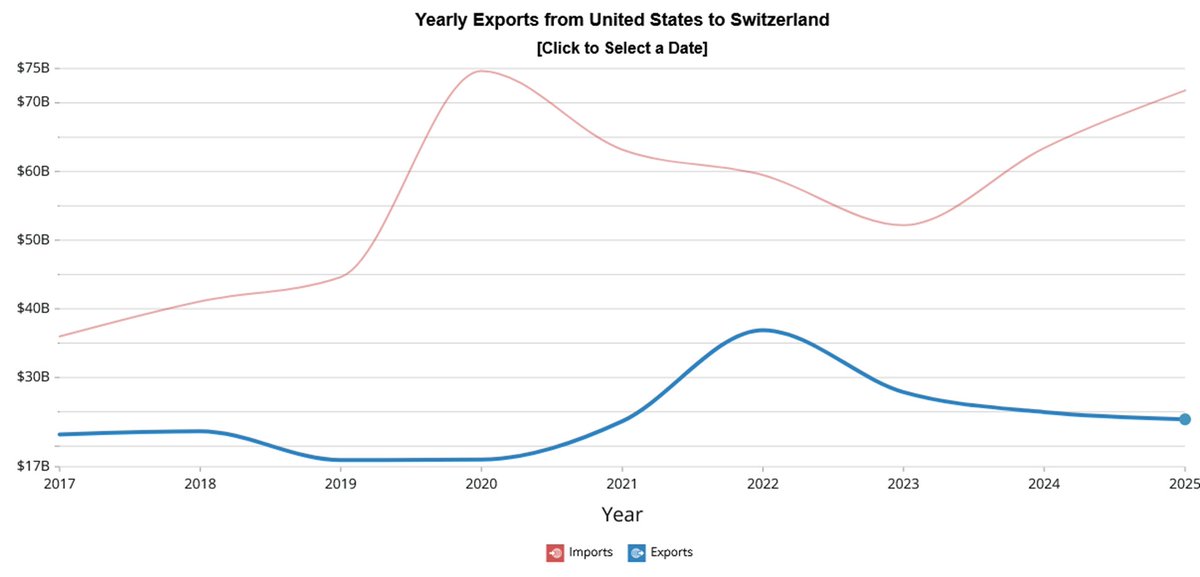

https://twitter.com/BurggrabenH/status/1951402258098430426Upfront and from a Swiss patriotic view:

https://twitter.com/rapidresponse47/status/19329397739848789522) Does Iran already have the bomb?

The problem with their logic?

The problem with their logic?

In May 2024 however, U.S. price action was more in synch with London. But it didn't reflect weak Chinese housing & construction fundamentals which has been 15-30% of GLOBAL copper use for the past two decades. Today, U.S. prices trade as if borders close tomorrow.

In May 2024 however, U.S. price action was more in synch with London. But it didn't reflect weak Chinese housing & construction fundamentals which has been 15-30% of GLOBAL copper use for the past two decades. Today, U.S. prices trade as if borders close tomorrow.

Can China replace malinvestment with more consumption?

Can China replace malinvestment with more consumption?

Starting in 1990s, China’s economic engine has been fueled by capital investments.

Starting in 1990s, China’s economic engine has been fueled by capital investments.

Yes, mainstream media picked up pace on important issues facing China today.

Yes, mainstream media picked up pace on important issues facing China today.

Note however that Chinese retail buying has slowed down recently, as best illustrated by the Shanghai gold premium over international prices.

Note however that Chinese retail buying has slowed down recently, as best illustrated by the Shanghai gold premium over international prices.

https://twitter.com/BurggrabenH/status/1731701359257190453Step by step:

Three factors matter why there is less consumption vs 2019/20 season:

Three factors matter why there is less consumption vs 2019/20 season:

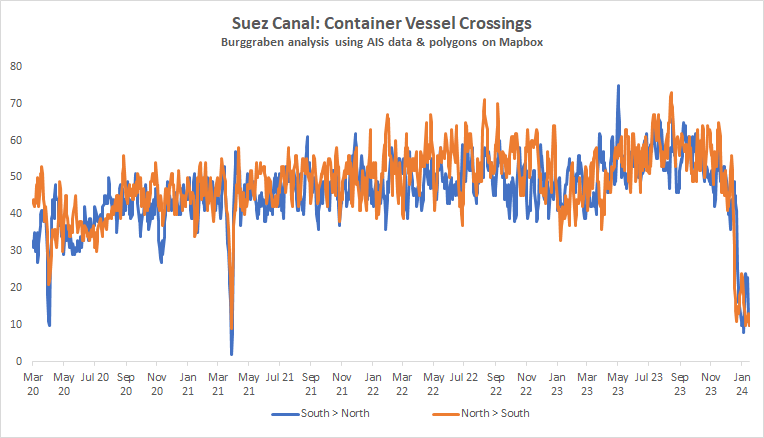

https://x.com/BurggrabenH/status/1746159260742844911?s=20Container Vessels owners have been the most consequent in diverting cargo.

https://twitter.com/KetanJ0/status/1660262870863446016First, let's look at my original tweet in which I made a specific statement:

https://twitter.com/BurggrabenH/status/1659986924113899520?s=20

https://twitter.com/BurggrabenH/status/1655545244983623682?s=20What drives policy?