I want to take a moment to show everybody just how fucking serious this market crash is about to be.

$MBB is the Vanguard managed ETF for Mortgage Backed Securities (MBS) and is a barometer for the value of MBS across the entire US market.

Further dd in thread...

$MBB is the Vanguard managed ETF for Mortgage Backed Securities (MBS) and is a barometer for the value of MBS across the entire US market.

Further dd in thread...

This chart demonstrates $MBB versus the $SPX market index.

What you probably *don't* know is that government-originated or "Agency" MBS accounts for $7.7 Trillion in American consumer debt. This is a whopping 25% of our national debt.

And the Fed is about to dump it on us.

What you probably *don't* know is that government-originated or "Agency" MBS accounts for $7.7 Trillion in American consumer debt. This is a whopping 25% of our national debt.

And the Fed is about to dump it on us.

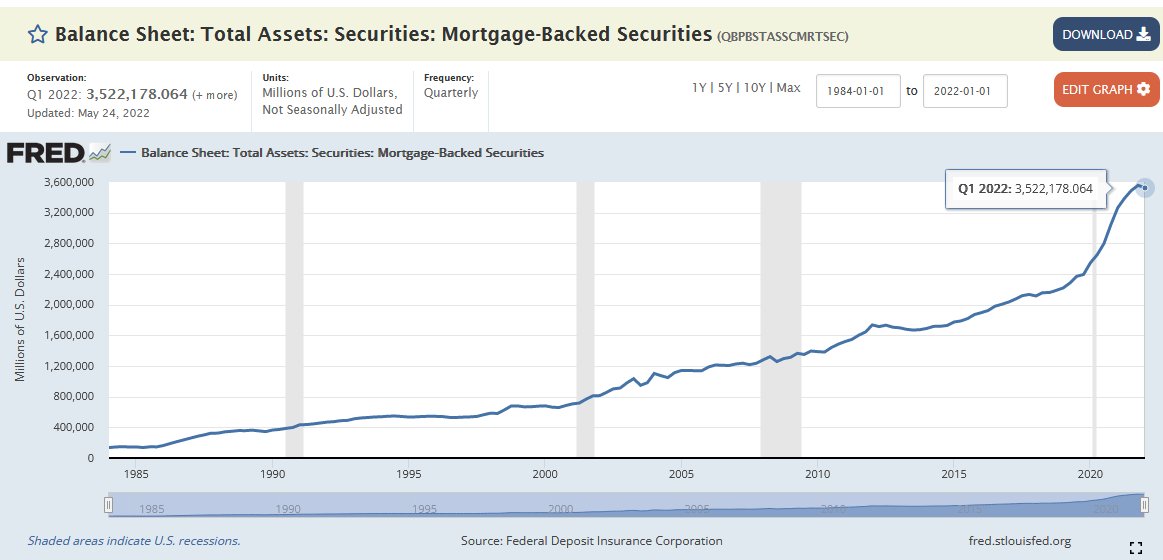

The following is a chart of the FED's total assets in MBS:

They hold 45% of all Agency MBS in circulation, or 11.4% of US National Debt.

Why does this matter?

Because we live in a "credit" economy, or more accurately, our economy is propped up by our debt and its collateral

They hold 45% of all Agency MBS in circulation, or 11.4% of US National Debt.

Why does this matter?

Because we live in a "credit" economy, or more accurately, our economy is propped up by our debt and its collateral

When you think of collateral, you think of a house, a car, goods, and things you can sell or barter if you default on debt.

In the case of the United States, our collateral is the GDP, or the total cash value generated by the sum of our yearly production of goods and services.

In the case of the United States, our collateral is the GDP, or the total cash value generated by the sum of our yearly production of goods and services.

For only the second time in US history has the US GDP fell by 4% during the covid crash. The first was 2008, but that was the first time it ever happened in a single quarter.

That hit to our economy was felt across the world, but most severely in the real estate market.

That hit to our economy was felt across the world, but most severely in the real estate market.

As a consequence of that devastating blow, the Federal Reserve pushed $2 Trillion into the economy (a 8200% rise) at the cost of its total book value on Agency MBS...

Which is the only thing of actual value the Fed Holds over the American Economy other than treasury bonds.

Which is the only thing of actual value the Fed Holds over the American Economy other than treasury bonds.

And when you put Inflation into the context of this fucking disaster, it gets a whole lot worse because the FED's money-printing habit, coupled with a bunch of price-gouging retail chains and oil barons, our economy is now being thrown into the fire of Stagflation

What I'm saying is that we are just getting fucking started when it comes to witnessing a market-wide crash.

If you think this is the bottom of the market and decided to start buying now of all times, you are playing hot-potato with a live hand grenade.

If you think this is the bottom of the market and decided to start buying now of all times, you are playing hot-potato with a live hand grenade.

The FED screwed up...plain and simple, and unsurprisingly after finding out that Powell & Co. were selling assets when they new they'd be talking about tapering comes as no surprise. They knew this was coming and only NOW are they warning us to prepare for pain.

I'm begging everyone to be exceedingly careful about playing in the market right now. Keep cash set aside, or be prepared for things to turn against the market quickly, and what I'm talking about are the "traditional safe stocks" like real estate, banking, finance, and tech

If you're trading on margin, you are especially the one in danger, because like all other margin traders, your debt is leveraged against the collateral of your broker, their lending banks, and the primary assets of intrinsic value.

**Mortage Backed Securities**

**Mortage Backed Securities**

There is *no justification* for the amount of margin debt that has accumulated into brokerages upon the surging S&P 500 and DJI indices that exploded in 2020-2021.

This dip that we're witnessing is merely the first stage in a long road to despair.

We are witnessing margin calls

This dip that we're witnessing is merely the first stage in a long road to despair.

We are witnessing margin calls

The market is about to get a heavy dose of reality

Starting with the fact that housing supply has just skyrocketed in a single month from less than 6 to 9 mo. supply.

Buyers are giving up.

Sellers are being turned down.

Home builders are canceling contracts

Foreclosures are up

Starting with the fact that housing supply has just skyrocketed in a single month from less than 6 to 9 mo. supply.

Buyers are giving up.

Sellers are being turned down.

Home builders are canceling contracts

Foreclosures are up

The #1 problem with what happened in 2007 is the fact that America was delusionally buying homes that it couldn't afford at prices that were unrealistic at a time when housing supply was PLENTIFUL, but the news media pumped out bullshit convincing everyone

Houses $ only go up💩

Houses $ only go up💩

When reality finally set in, and home-buyers realized they couldn't afford their homes, couldn't find anyone to buy, and couldn't refinance their debt, their equity burned like they marinaded it in gasoline before lighting the match.

This reality is what absolutely fucked insurers and banks heavily invested in MBS like AIG, Goldman Sachs, and Morgan Stanley because they overestimated the value of those securities so badly, not realizing that the supply and default rates were about to evaporate their value.

It isn't just the un-collateralized Credit Default Swaps from AIG, Goldman, Deutche Bank, JPM Chase, etc that savvy investors like Dr. @michaeljburry took out against these bad securities that caused the crash.

It was the fact that MBS was losing its value at unprecedented rates

It was the fact that MBS was losing its value at unprecedented rates

Well guess the fuck what, ladies and gentlemen... MBS is falling like a piano from a skyscraper, and it is OBVIOUS to anyone with a brainstem that it is running inverse to Housing Supply.

US home buyers just woke the fuck up. There IS no supply crisis. The last 12 months was BS.

US home buyers just woke the fuck up. There IS no supply crisis. The last 12 months was BS.

The scarcity of homes creates equity and over-inflated values of homes, coinciding with higher premium payments on MBS.

Combined with high-interest rates, MBS can make a killing.

But now interest rates are rising at 50bps per month until Inflation drops below 2%.

Combined with high-interest rates, MBS can make a killing.

But now interest rates are rising at 50bps per month until Inflation drops below 2%.

Once again, the home owners of America have been left holding the fucking bag because of Wall Street's greed, and it's too late for most of them unless their house has already been on the market with a pending closure, and even then... they may not get out in time.

The one saving grace is that BlackRock, BlackStone, and Vanguard are holding the fucking bags too because they tried to overbuy the houses in America, whose equity is about to collapse to new lows that will set us back perhaps as far as 10 years when the median price was $250K

What I am saying is, be ready, because we haven't seen no fucking crash yet. I wish stonks only went up, but we've been detached from reality for far too long.

Hell, we were already in a bubble -BEFORE- the covid crash, recovery, and surge took us to all-time highs.

Hell, we were already in a bubble -BEFORE- the covid crash, recovery, and surge took us to all-time highs.

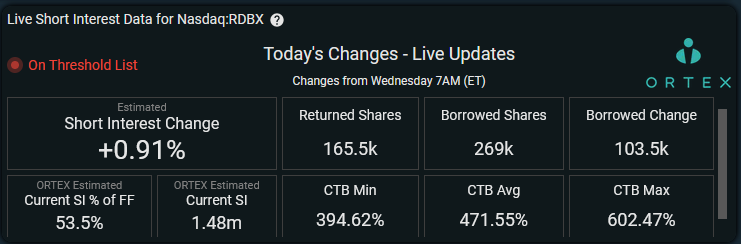

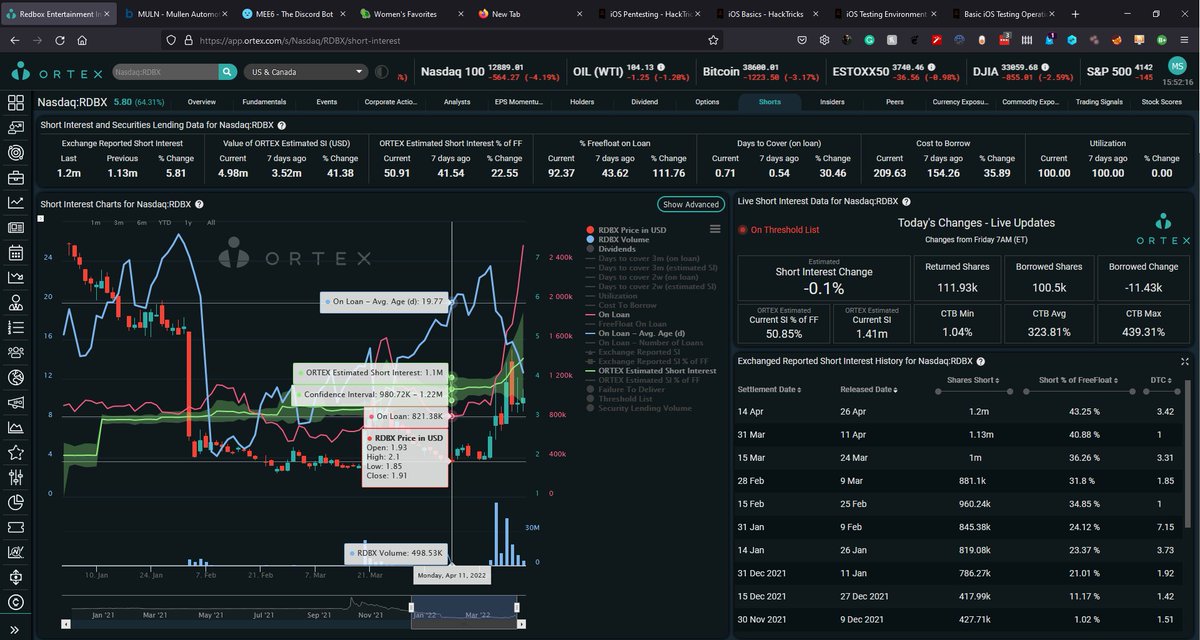

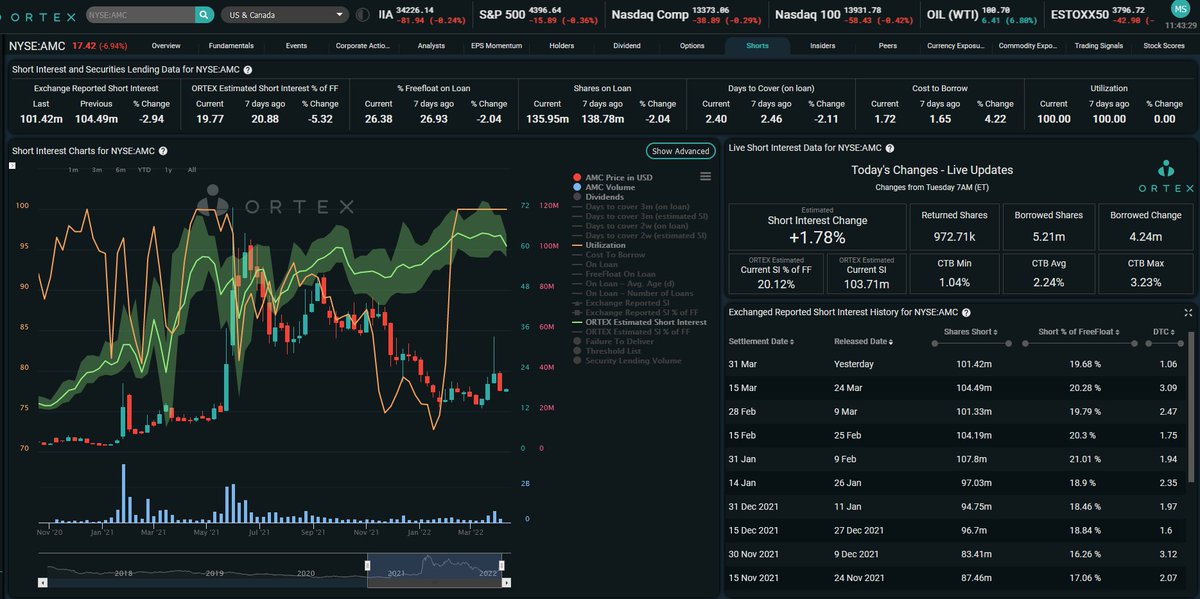

I already anticipate people are going to ask me:

"What does this mean for the meme stocks and the naked shorts?"

Frankly, I have no fucking idea, but I do know that there is going to be a major, economic cataclysm in our near futures, and it will result in MANY margin calls

"What does this mean for the meme stocks and the naked shorts?"

Frankly, I have no fucking idea, but I do know that there is going to be a major, economic cataclysm in our near futures, and it will result in MANY margin calls

MY fear is it is going to be many of the banks themselves once they realize that they have no equity with which to pay back their reverse repo agreements with the FED for all of THIS bullshit...

And the soon-to-be-gone equity of the housing market is the collateral for all this

And the soon-to-be-gone equity of the housing market is the collateral for all this

Is going to come back in the form of mass defaults by the banking sector...

None of this is financial advice... but I'm shorting all the banks that put us here...

Their bills are coming due.

And they have nothing to pay it back with...

None of this is financial advice... but I'm shorting all the banks that put us here...

Their bills are coming due.

And they have nothing to pay it back with...

• • •

Missing some Tweet in this thread? You can try to

force a refresh