Tackling climate change requires closing many oil and gas fields. Who owns these stranded assets? In @NatureClimate we trace $1.4 trillion in losses at the field to their ultimate owners and show that mainly private persons in rich countries stand to lose. nature.com/articles/s4155…

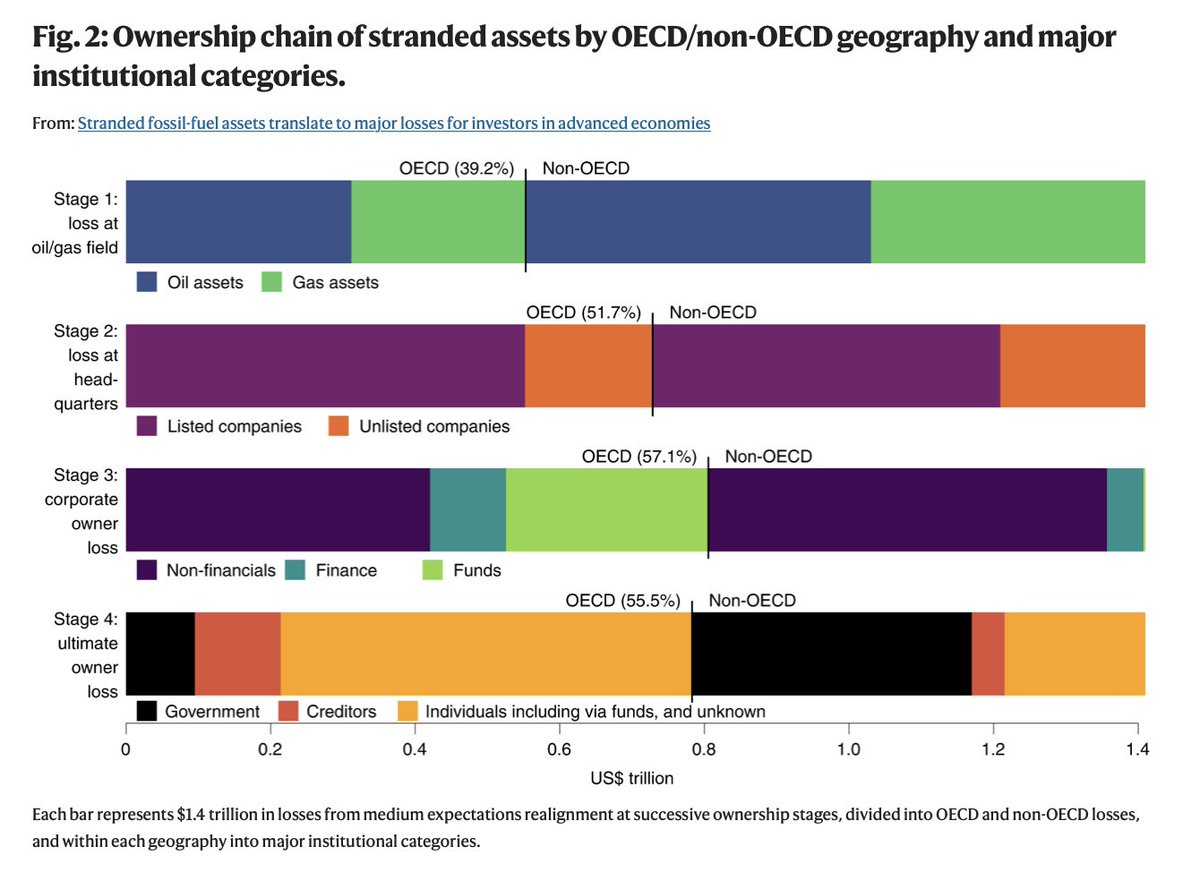

Previous studies focus on physical stranded assets which are mostly located in non-OECD regions (stage 1). But this does not capture the financial beneficiaries of oil & gas extraction: 56% of ultimate owners are in the OECD, compared with 39% of physical stranded assets. 2/11

We model how future global demand and prices for oil & gas decline with more stringent climate policy and analyze which of the 43,000 globally operating oil and gas fields become uncompetitive over the next 15 years, hence strand. 3/11

We trace the ownership of these stranded assets through the global network of companies (1.8 million firms) and find substantial propagation of losses through the financial sector, including through asset managers and pension funds. 4/11

Rich country investors (e.g. asset managers) therefore have crucial vested interests in how the transition in oil & gas production is managed, as ongoing supporters of the fossil-fuel economy and potentially exposed owners of stranded assets. 5/11

Financial investors might work to postpone the transition to keep dividends flowing & then lobby for compensation. But there could also be an opportunity: Policy-makers could work with activist investors to lower capital expenditure of oil & gas companies. 6/11

This would be an alternative to (of course symbolically powerful) divestment. Divestment could lead to assets being bought up by less accountable parties, such as private equity funds, in what could be called an 'ownership leakage'. 7/11 nytimes.com/2021/10/13/cli…

Finally, the global linkages we unveil show that international cooperation on managing and financing the production and stable phase-out of fossil fuels is urgently needed to lessen destabilizing expectation realignments and their social repercussions. 8/11

The article is available open access permanently, and there's also a shorter (but non-open access) research briefing that summarizes some of the findings. 9/11 nature.com/articles/s4155…

This perspicuous @guardian article by @dpcarrington covers our piece with a focus on US and UK with quotes from @MikeCoffin at @CarbonBubble 10/11

theguardian.com/environment/20…

theguardian.com/environment/20…

Thanks for a great collaboration, Phil Holden, @JFMercure, @PabloSalasB, @HectorPollitt, Kate Jobson, @PVercoulen, Unnada Chewpreecha, @Neil_R_Edwards, and Jorge Vinuales. 11/11

• • •

Missing some Tweet in this thread? You can try to

force a refresh