How to get URL link on X (Twitter) App

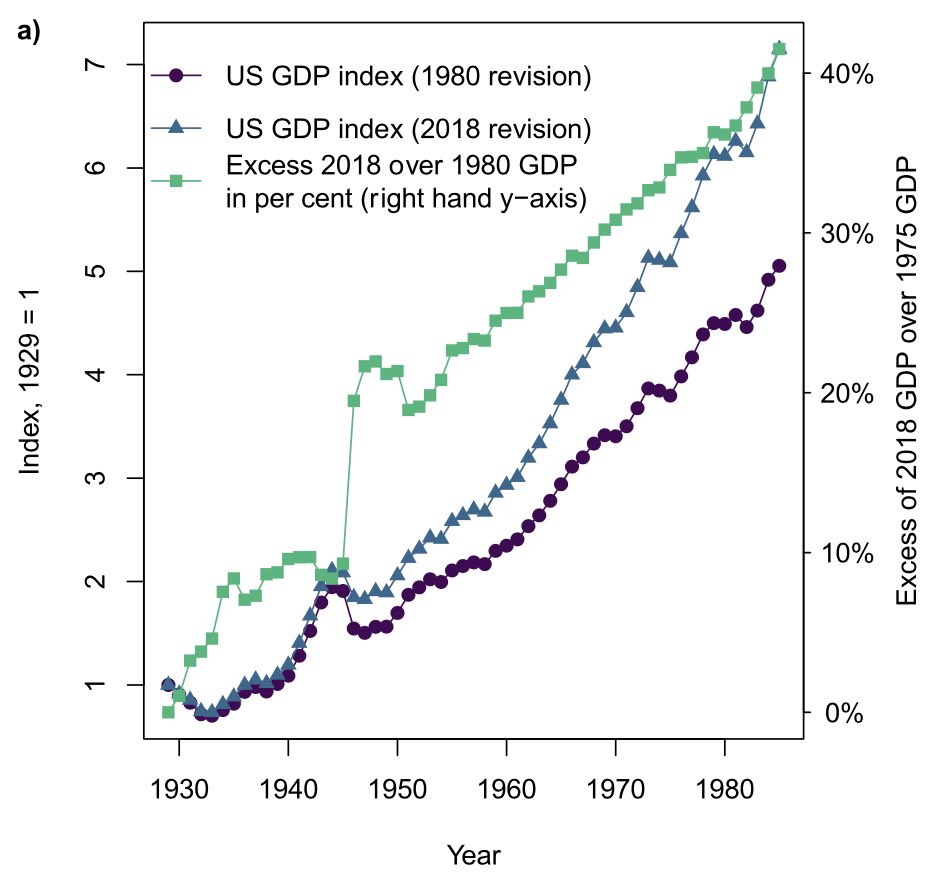

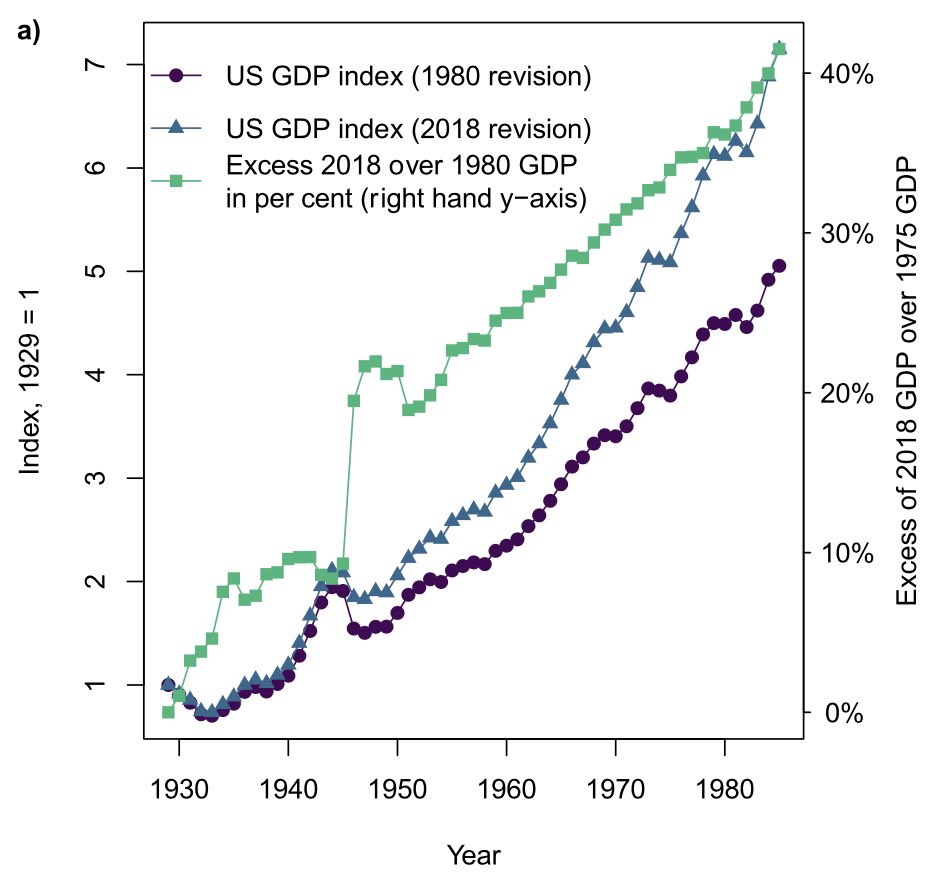

GDP is an accounting convention. Its measurement depends on social agreement, not on natural constants; it is revised for a variety of reasons. This can lead to rather different rates of change: look at US energy intensity in Schurr‘s seminal study with his vs today‘s GDP data 2/

GDP is an accounting convention. Its measurement depends on social agreement, not on natural constants; it is revised for a variety of reasons. This can lead to rather different rates of change: look at US energy intensity in Schurr‘s seminal study with his vs today‘s GDP data 2/

Current doubling-down in wealthy countries on fossil fuels - whether for energy security or profit - risks producing a new gen of long-lived fossil-fuel assets.

Current doubling-down in wealthy countries on fossil fuels - whether for energy security or profit - risks producing a new gen of long-lived fossil-fuel assets.

This finding leverages the framework of ‘fair-share regional contributions’ published by @shonali_p, @setupel, @SKreibiehl & co-authors, where the authors calculate fair investment shares according to ‘need’, ‘responsibility’, & ‘capability’. 2/9 science.org/doi/10.1126/sc…

This finding leverages the framework of ‘fair-share regional contributions’ published by @shonali_p, @setupel, @SKreibiehl & co-authors, where the authors calculate fair investment shares according to ‘need’, ‘responsibility’, & ‘capability’. 2/9 science.org/doi/10.1126/sc…

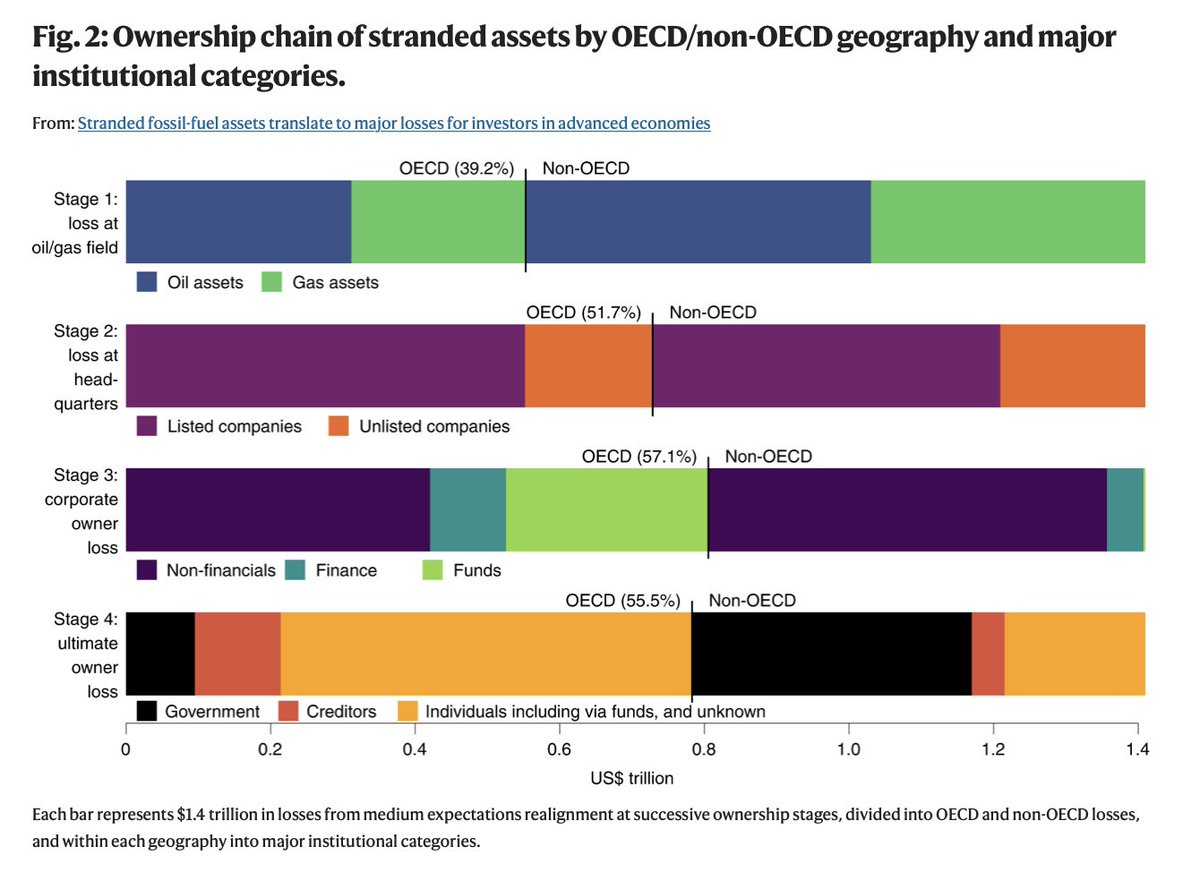

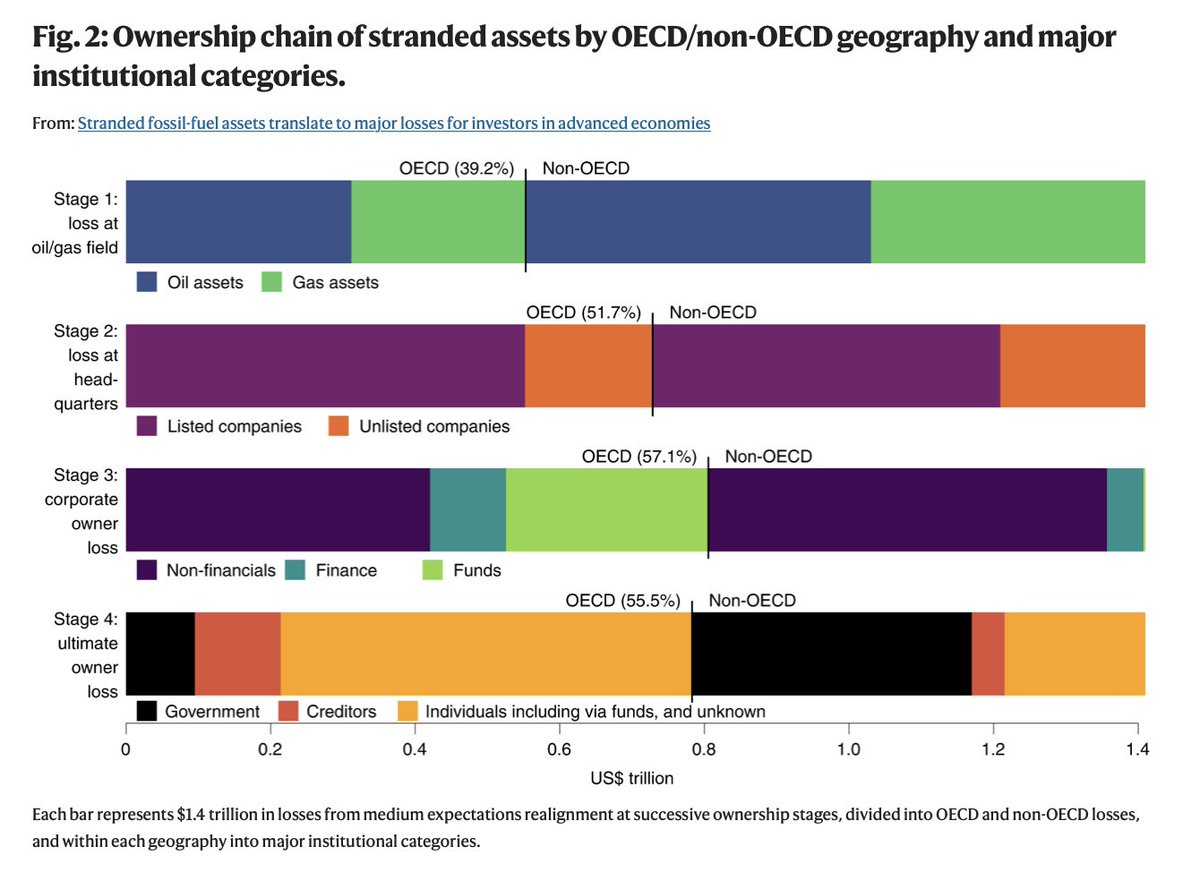

Previous studies focus on physical stranded assets which are mostly located in non-OECD regions (stage 1). But this does not capture the financial beneficiaries of oil & gas extraction: 56% of ultimate owners are in the OECD, compared with 39% of physical stranded assets. 2/11

Previous studies focus on physical stranded assets which are mostly located in non-OECD regions (stage 1). But this does not capture the financial beneficiaries of oil & gas extraction: 56% of ultimate owners are in the OECD, compared with 39% of physical stranded assets. 2/11