Let us talk about one of the latest, largest entrant into my portfolio.

Shivalik bimetal Controls Limited. A 7% position.

🧵🧵⤵️

Focus on the process. Names will come & names will go, but process lives on forever.

Shivalik bimetal Controls Limited. A 7% position.

🧵🧵⤵️

Focus on the process. Names will come & names will go, but process lives on forever.

Outline

This time, i want to structure the thread as a series of Q&A to help us understand the business, opportunity, risks & so forth.

13 Questions, 13 Answers.

This time, i want to structure the thread as a series of Q&A to help us understand the business, opportunity, risks & so forth.

13 Questions, 13 Answers.

Q1: What is the business of Shivalik Bimetals?

A: Shivalik is in the electronic components industry & converts metals into electronic components. This is the value add of Shivalik.

A: Shivalik is in the electronic components industry & converts metals into electronic components. This is the value add of Shivalik.

Shivalik takes 2 plates of metals, & welds them together using various technologies like electron beam welding.

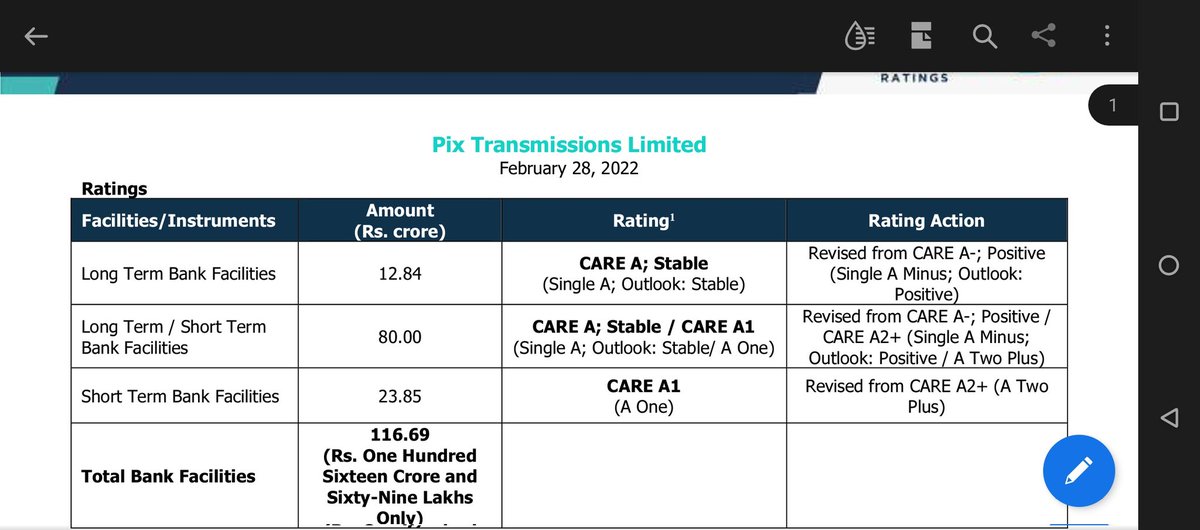

Q2: Wait, what is electron beam welding?

A:

Best to understand this with videos. Here is one i absolutely loved.

Q2: Wait, what is electron beam welding?

A:

Best to understand this with videos. Here is one i absolutely loved.

In essence, you hold 2 metal plates together & bombard it with a concentrated beam of electrons. The kinetic energy of electrons gets converted to heat in the metals, melting the metals & forming bimetals.

Q3: Is it as simple as that? Can I do it at home?

A:

(i) Best not to try at home. Highly technical process. The chamber where welding occurs has to be emptied off of air & water molecules (better the vaccum, better the outcome).

A:

(i) Best not to try at home. Highly technical process. The chamber where welding occurs has to be emptied off of air & water molecules (better the vaccum, better the outcome).

This is needed because otherwise the electrons collide with the air/water & lose their energy.

(ii) The cathode filament in the electron gun is heated to 2500C for continuous emission of electrons. For comparison, surface temperature of our host star (commonly known as Sun) is 5,505C (so the equipment operates at half the temperate of our host star surface.

This shows us how dangerous this equipment is & how much care one must pay in operating it.

(iii) This process requires extreme skill. The direction & exact angle of electron beam is controlled by a human using a lens. One can now imagine why this is called “precision” welding.

The skill with which the human operator has to gyrate & move the lens & thus the direction of electron beam is not any less than the sort of skill a surgeon requires to do surgery. The biggest entry barrier thus is the person doing the electron beam welding.

This is a technical know-how moat. Now, the reader has to appreciate why its important to go into the innards of the specifics of a company. That is how we understand its durable competitive advantages.

The experience SBCL have received by welding many lakh kilometers cannot be acquired with money alone (of course people’s allegiances can be bought or sold).

(iv) Electron beam welding is also used in nuclear, ship building, medical devices. Looks like there exist a lot of adjacencies whenever (X years down the line) they might want to expand their core competency (which is not shunts, it is welding of bimetals or trimetals).

Here are some disadvantages of electron beam welding:

Please be honest with me, does it read like a list of disadvantages or barriers to entry for a business (Remember Porter's 5 forces)?

Please be honest with me, does it read like a list of disadvantages or barriers to entry for a business (Remember Porter's 5 forces)?

Q4: Okay, but what is the use of these bimetals?

A: These bimetals are the heart of what is known as a shunt resistor.

A: These bimetals are the heart of what is known as a shunt resistor.

Shunt resistors are used for measuring current. All sophisticated electronic devices need to measure current passing through them in order to control the flow of that current. These Shunt resistors are used throughout EVs but specially important in Battery Management Systems.

EV BMS companies are some of largest current & future customers for client. In part, a play on Shivalik is a play on EV BMS

These Bimetal strips are also used in many other applications. Notable among them Smart meters which use shunt resistors. Smart meters enable better metering, feedback to the utilities (which can allow smarter load shedding decisions), & better demand planning.

Government spend on smart meters is expected to go up exponentially in next few years (just check the concall of Genus power).

Genus revenue: 700cr.

Genus Order book: 1900 cr

Orders out there that Genus will Bid for: 25000cr

Genus revenue: 700cr.

Genus Order book: 1900 cr

Orders out there that Genus will Bid for: 25000cr

Note that Genus would forward integrate to become an EPC so of course not all of this translates into opportunity for Shivalik. But you can get an estimate of TAM/opportunity size by looking at how many smart meters have been installed & how many are to be installed.

GoI has installed few million smart meters, will install 250 million smart meters by 2025. Where will the shunts come from?

Q5: Wow, so does that mean that the opportunity size for Shivalik is large?

A: It sure is. ANything where current measurement is needed, anything where heat measurement is needed, Shunts come into play.

A: It sure is. ANything where current measurement is needed, anything where heat measurement is needed, Shunts come into play.

Heaters, water heaters are also fairplay. Thermostats. EV BMS. A Play in shivalik is also a play on electronic goods ecosystem in India.

business-standard.com/article/econom…

business-standard.com/article/econom…

Q6: This sounds great, what about the Competitive intensity?

A: Actually competitive intensity is intertwined with the barriers to entry. We have to understand both together. First, shunts are generally a low value product. They are manufactured, exported in "tonnes".

A: Actually competitive intensity is intertwined with the barriers to entry. We have to understand both together. First, shunts are generally a low value product. They are manufactured, exported in "tonnes".

That means that Many companies make shunts. Shunts go into all electronics, like we discussed.

In fact until not so long ago, shivalik used to make shunts which went into mobile phones. Then, they stopped? Why? because all shunts are not created equal. Why? Because all electronics is not created equal.

If you buy a 10 lakh rupee EV or a 50k$ TEsla, you NEED to ensure that each & every component in it lasts at least 1 decade if not 15 years.

This means that shunts which go into EV, or into smart meters (which are also a capex by government & quality would be utmost priority coz it would need to last decades), that is where real quality of shunt comes out.

That is where the real quality of the electron beam welding machine, the real skill of the welder, their decades of experience welding thousands of kilometers of metels comes into picture. Qualification by these auto OEMs takes 5-7 years. THis itself is a large entry barrier.

Quality of shunts is another entry barrier. As per estimates I read on VP & talking to shivalik investors (yet to verify these myself), there are hardly 4-5 companies world wide who can manufacture OEM quality of shunt.

Hardly few dozen Electron beam welding machines worldwide & shivalik has a good chunk of them (20% or so).

One of shivalik's clients is a multi billion dollar revenue electronic component maker called Vishay.

One of shivalik's clients is a multi billion dollar revenue electronic component maker called Vishay.

Why would they travel from their HQ to Solan in Himachal pradesh (where Shivalik factories are) ? Just Think.

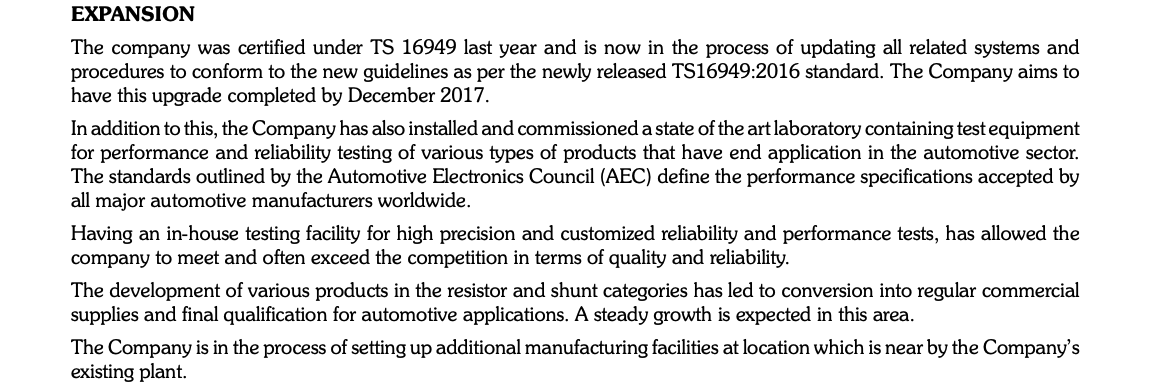

Shivalik has TS 16949 certification from FY17, generally taken for electronic components to be used in Automotive.

Imagine how they they have been working on current BMS systems.

Imagine how they they have been working on current BMS systems.

Q7: Opportunity size is large, competitive intensity is okay, what about execution?

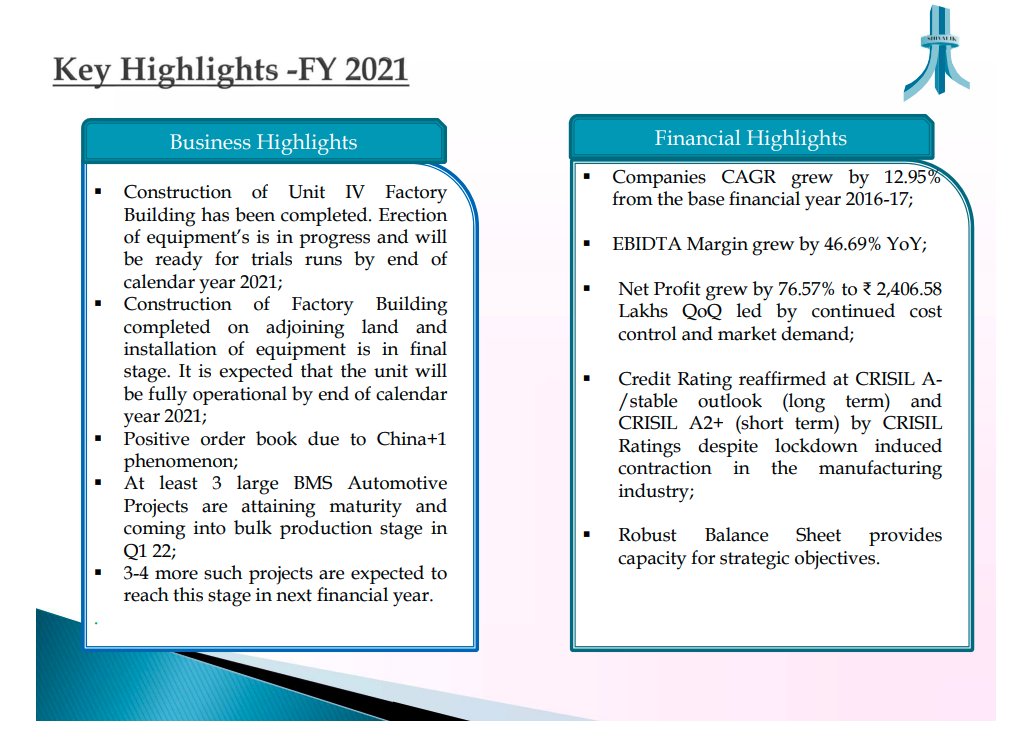

A: Look at shivalik's YoY sales growth. Revenues are growing at 8-9% QoQ. Some of this is due to electronic component shortage led realization growth, but a good part is due to volume growth.

A: Look at shivalik's YoY sales growth. Revenues are growing at 8-9% QoQ. Some of this is due to electronic component shortage led realization growth, but a good part is due to volume growth.

Forward integrating from bimetals to Shunts has enabled them to expand gross margins as well. THis trend can continue going forward.

Q8: Who exactly are shivalik's customers?

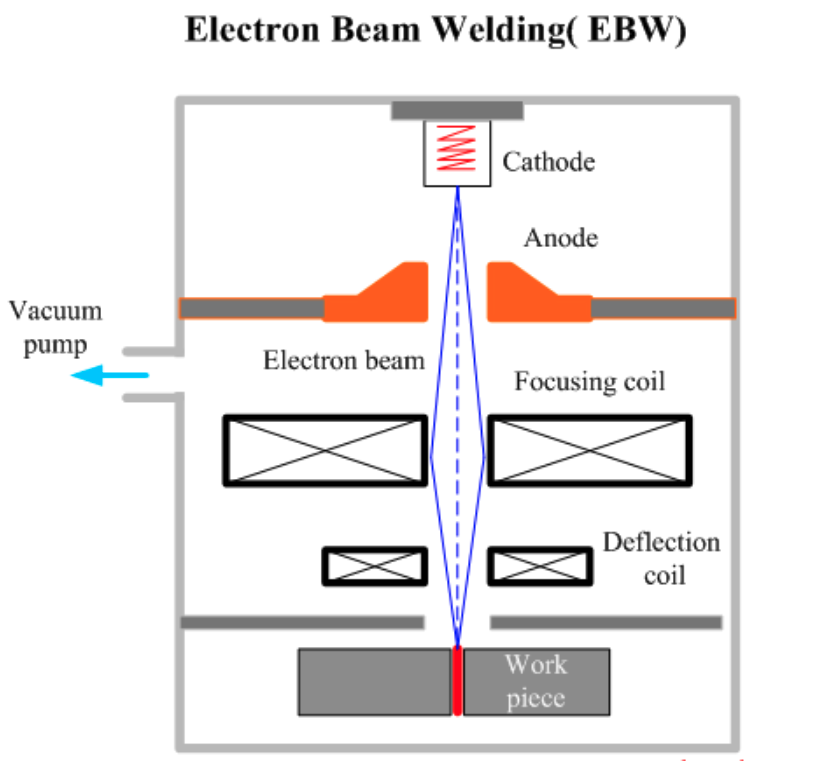

A: If we analyze export data, we find that 30-40% of shivalik's revenue come from Vishay which is a US listed electronic component giant. Vishay takes bimetal strips from Shivalik then makes shunts out of them.

A: If we analyze export data, we find that 30-40% of shivalik's revenue come from Vishay which is a US listed electronic component giant. Vishay takes bimetal strips from Shivalik then makes shunts out of them.

Apart from this Shivalik supplies will supply to EV BMS (Battery management system) manufacturers as well.

Q9: This vishay thing seems like a client concentration risk. Any thoughts on that?

A:

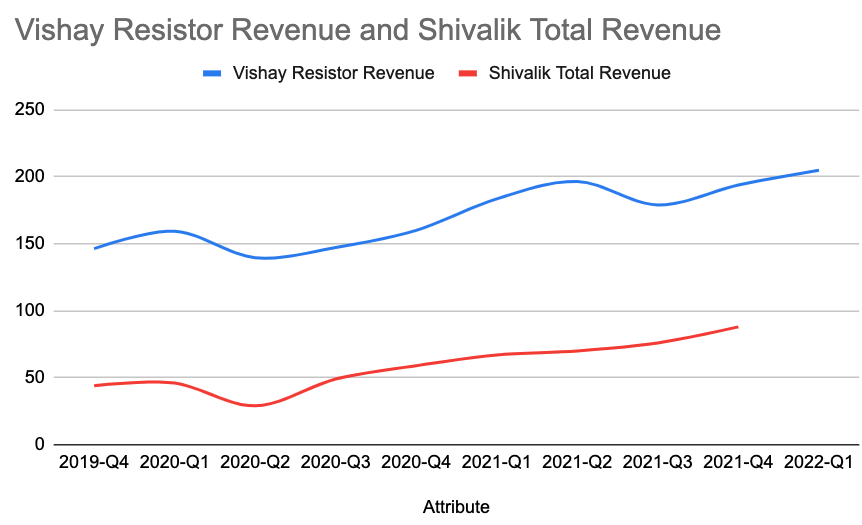

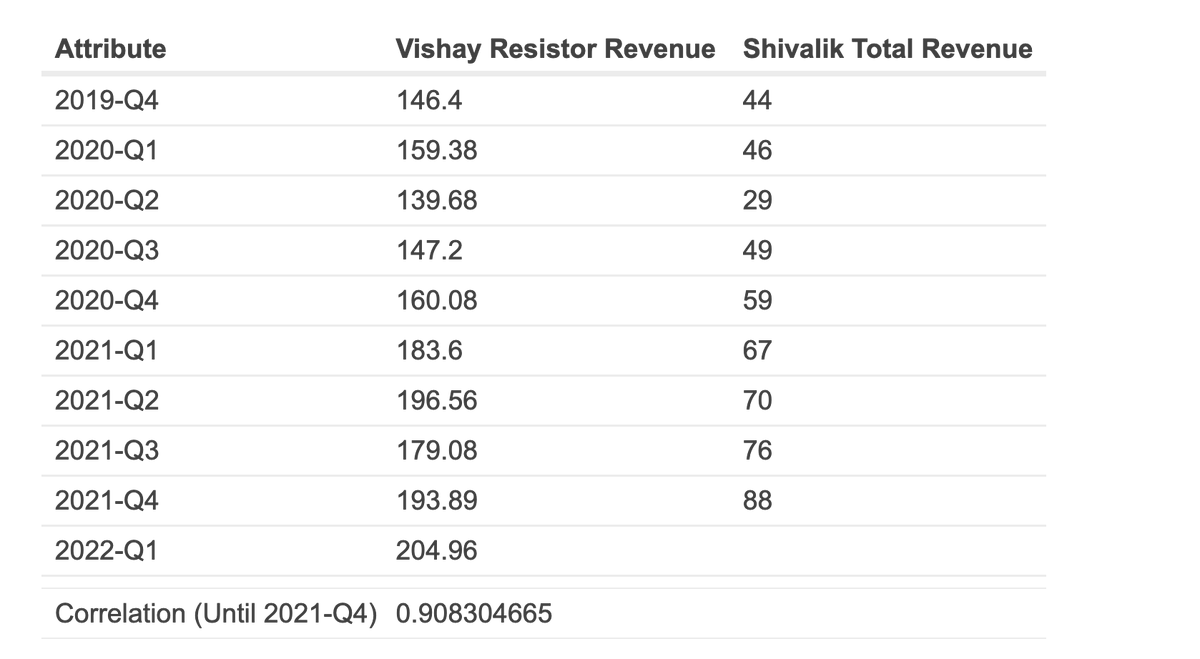

Since Vishay is listed, we can check Vishay's results each quarter to understand how their resistor segment revenue are evolving (focus on the process).

A:

Since Vishay is listed, we can check Vishay's results each quarter to understand how their resistor segment revenue are evolving (focus on the process).

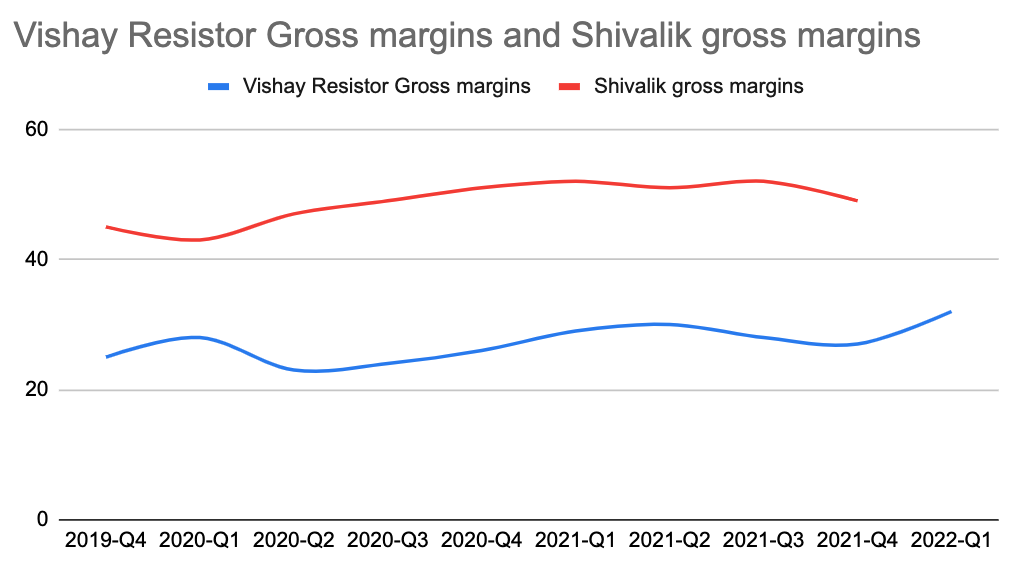

^ We can see strong correlation between Vishay's resistor & shivalik's revenues.

This means that at least as of now, vishay's resistor revenues are a decent probabilistic leading indicator of Shivalik's performance.

This means that at least as of now, vishay's resistor revenues are a decent probabilistic leading indicator of Shivalik's performance.

The QoQ growth in Vishay revenues should translate to QoQ growth for Shivalik. In fact, even the slope of the lines are similar.

Another very interesting thing to observe is that while vishay resistor revenues dipped in 2021-Q3, Shivalik did not. This could show one of two things:

(i) Vishay’s supplies from other resistor suppliers reduced, but not from shivalik

(i) Vishay’s supplies from other resistor suppliers reduced, but not from shivalik

(ii) Shivalik’s revenue is getting less dependent on Vishay.

We shall find out in FY22 annual report which one it is, but definitely either conclusion is good well for Shivallik (either it has supplier strength or is diversifying revenues; i prefer the latter though).

We shall find out in FY22 annual report which one it is, but definitely either conclusion is good well for Shivallik (either it has supplier strength or is diversifying revenues; i prefer the latter though).

We can analyze Vishay's Resistor segment gross margins against Shivalik's gross margins as well. if we consider latest data (2Q-2020 onwards) there is good correlation of 0.81.

Thinking from 1st principles, generally the change in margins should actually be correlated not inverse correlated. The reason is that generally pricing changes are absorbed by entire supply chain (OEM, Tier 1, Tier 2, Tier 3, Tier 4) together as a unit.

My measured prediction is that VIshay’s resistor pricing power would be shared with Shivalik & we might be GM expansion in q4fy22 & beyond (though these things are hard to predict as the correlation is never perfect).

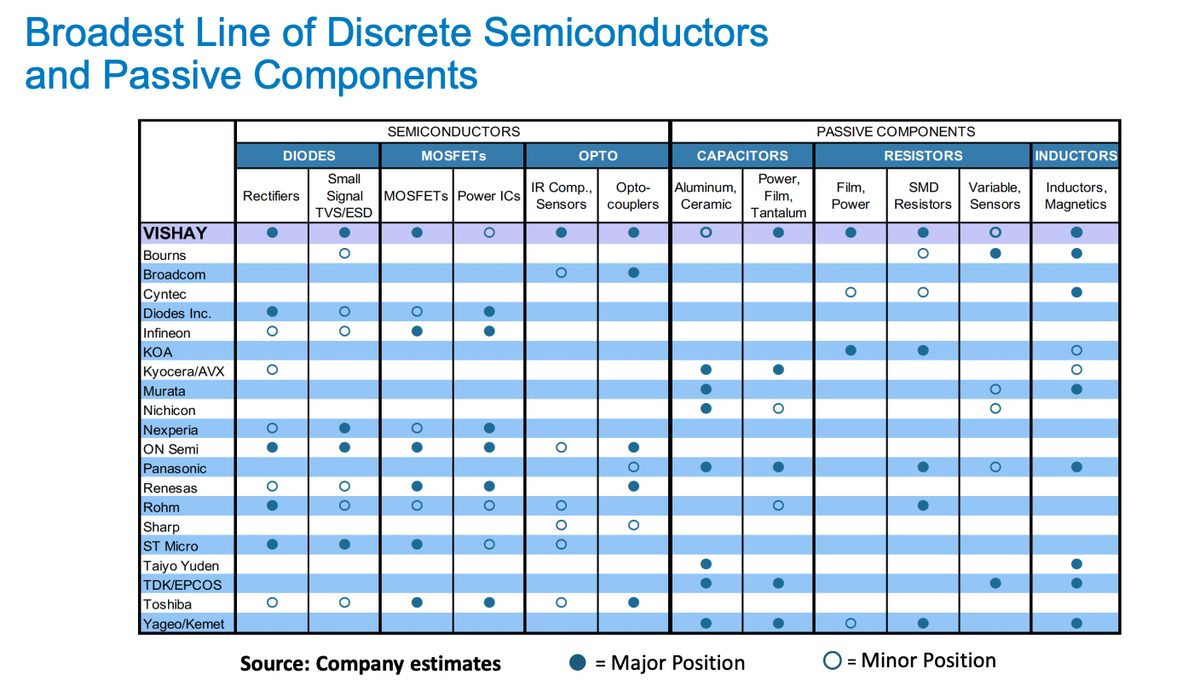

There is another very important thing to understand, the right to win here for shivalik is closely tied to Vishay (at least for the time being). Hence, what we should be doing is a vishay vs competitor competitive analysis.

Just a glimpse from the investor presentation shows us that Vishay is the only one with a wide range of resistors (power, SMD resistors, Variable, Sensors)

Even in general Vishay’s line of semiconductors & passive components is highest.

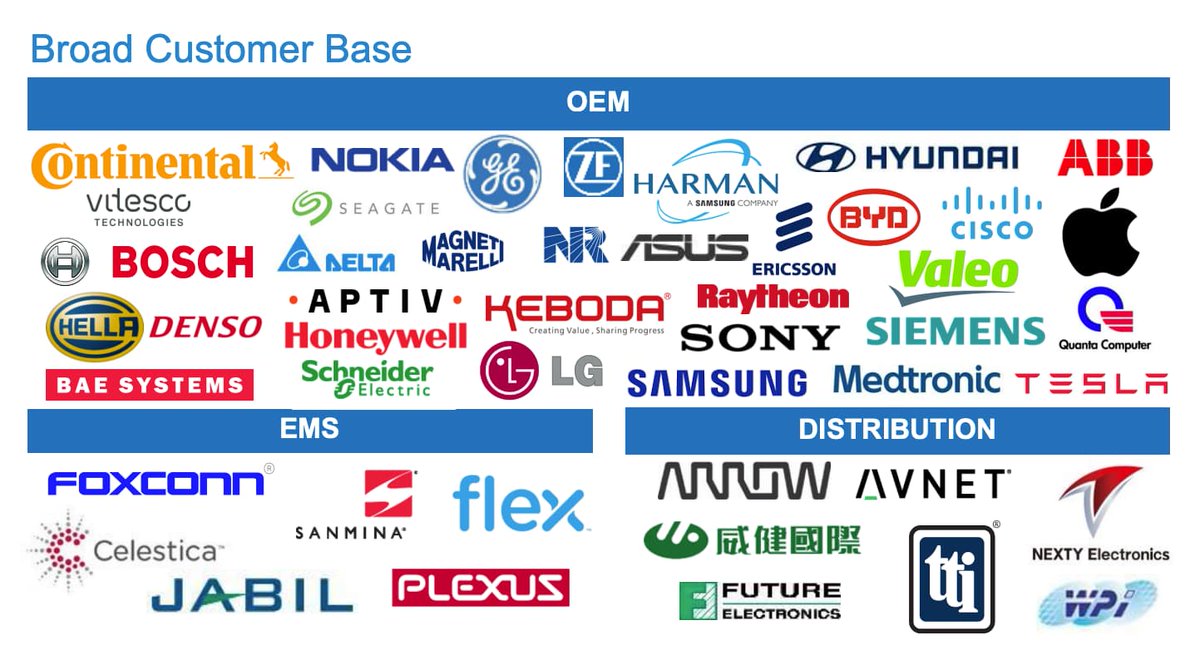

The reason this matters to us as Shivalik interested investors is that to an Apple, Nokia, Sony, ABB, BOSCH, Samsung, GM, ZF, Tesla, it is much easier to deal with 1 supplier rather than dealing with multiple suppliers.

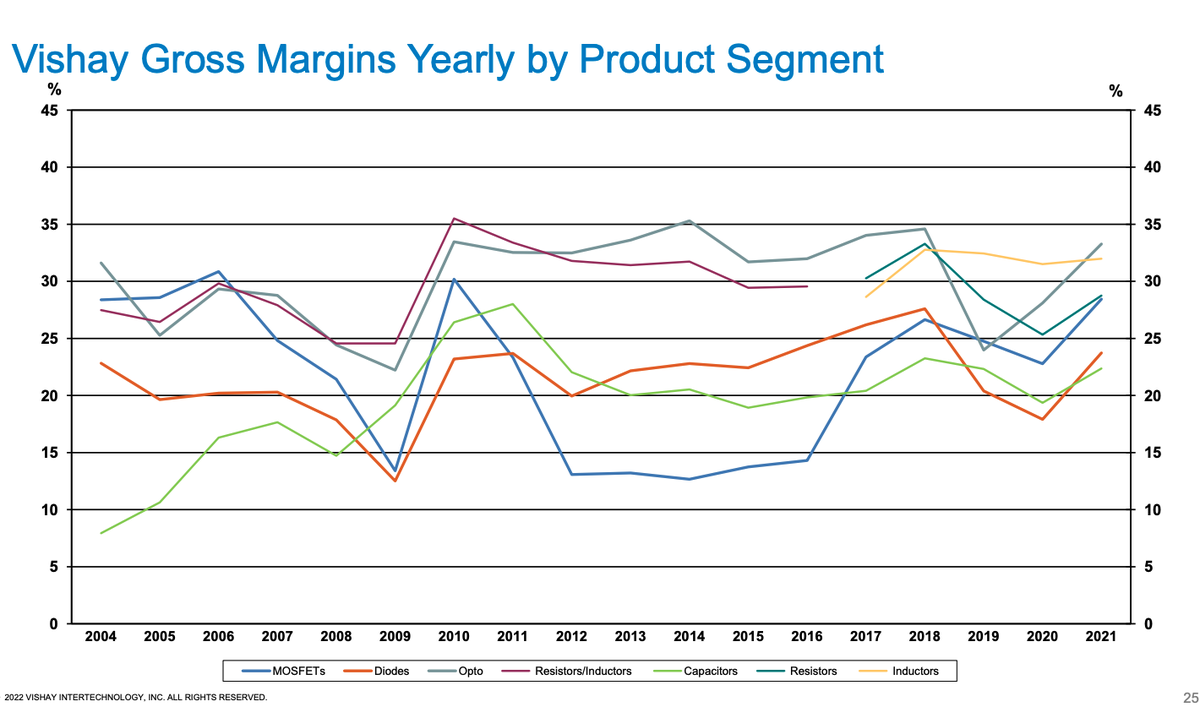

Generally electronic industry margins are influenced by supply cycles. Zooming out a little & looking at Vishay resistor (resistor + inductor pre 2017) gross margins over the years, we see that Vishay’s peak margins here have been around 35%in 2010.

Not there yet, but getting there (30% in this Q). Gives us a rough sense of when we **might** see peak margins for shivalik. Of course, over time shivalik keeps adding other clients (refer to Q3 investor presentation reference to BMS clients)

Q10: Good growth, industry structure, competitive advantages, opportunity size, tailwinds, what about the risks?

A: IMO biggest risk here is that it is a microcap & most investors borrow conviction.

A: IMO biggest risk here is that it is a microcap & most investors borrow conviction.

When investors with borrowed conviction escape with escape velocity at 1st sign of trouble stock price corrects a large amount.

66% Drop in 2019. Why? Because management commentary was bearish in 2019 AGM. Most investors do not have a > 1 year time horizon.

Repeat after me: Borrowed conviction is dangerous. If i buy Shivalik it would be based on my own research & my own conviction.

Repeat after me: Borrowed conviction is dangerous. If i buy Shivalik it would be based on my own research & my own conviction.

I will not go & ask sahil whether to buy or sell or add Shivalik if its price falls

Another risk: If new capacities come up (barriers to entry is 1 thing, quality ho ya na ho, shunt is commodity at end of day), then realizations can suffer, margins can mean revert

Another risk: Any change in government policies on EV adoption, smart meter penetration, electronics PLI can directly impact opportunity size as well as growth rates for shivalik.

Another risk: Until vishay becomes a smaller part of revenue there is client concentration risk for sure.

Q11: Isnt shivalik expensive at 31 times earnings?

A: Definitely.

A: Definitely.

What the investor is paying for is for margins to continue at same level (BMS & other forward integrations), for growth to continue at current levels & for the quality of tailwinds, competitive advantages, industry structure.

Any miss on them will test an investors depth of knowledge, understanding & conviction. If we look at Q3 earnings annualized, SBCL is at 25 times earnings. Which is fair given risk of illiquidity, microcap, industry structure yada yada.

Key question is whether growth & margins can sustain? I think they will based on my research. Do your own research, build your own conviction. Take your own decisions.

Q12: What is the growth bridge?

Q12: What is the growth bridge?

Capacity is expected to go up 2x-3x with these expansions. Automotive is at 30% so growth here will impact at overall level. Same for smart meter at 18% of sales. 3 BMS contracts have been in pipeline for 3-4 years.

Being commercialized in Q1FY23 should add materially to revenues. From what I can tell talking to investors, there are at least 12 more in the pipeline (remember, it takes time & effort to get approved in OEM supply chain)

Q13: What are co's plans for future?

A: This is a R&D focussed organisation. Usage of Bimetals is diverse. Usage of shunts is diverse. Promoter himself is R&D head. IF electronics manufacturing ecosystem is built in india, it expands shivalik's opportunity size even more.

A: This is a R&D focussed organisation. Usage of Bimetals is diverse. Usage of shunts is diverse. Promoter himself is R&D head. IF electronics manufacturing ecosystem is built in india, it expands shivalik's opportunity size even more.

Q14: How Do i track Shivalik?

A: (focus on process) Management does AGM once a year. One can travel to AGM if one has large investor. One can look at Vishay's results as a leading indicator. Concall for commentary.

A: (focus on process) Management does AGM once a year. One can travel to AGM if one has large investor. One can look at Vishay's results as a leading indicator. Concall for commentary.

Shivalik is the sole exporter for its products in India right now. One can use GOI website

tradestat.commerce.gov.in/meidb/comq.asp…

to track exports out of India for ANY HS code. HS codes for Shivalik:

85332919, 74099000

(Note that this only gives correlate for export revenue, NOT domestic).

tradestat.commerce.gov.in/meidb/comq.asp…

to track exports out of India for ANY HS code. HS codes for Shivalik:

85332919, 74099000

(Note that this only gives correlate for export revenue, NOT domestic).

<End of thread>

If you found the thread useful, please consider following me at @sahil_vi for such similar threads.

Please also consider retweeting the thread. It helps motivate me to continue to share research. 😅

If you found the thread useful, please consider following me at @sahil_vi for such similar threads.

Please also consider retweeting the thread. It helps motivate me to continue to share research. 😅

A meta thread of my older threads:

Do read the VP thread for Shivalik which contains most of the insights:

forum.valuepickr.com/t/shivalik-bim…

https://twitter.com/sahil_vi/status/1406848206181335046?s=20&t=m3MlxNRwpo_QU02Gs2Wbfw

Do read the VP thread for Shivalik which contains most of the insights:

forum.valuepickr.com/t/shivalik-bim…

Huge thanks to Ayush sir & Ram sir for offline discussions on Shivalik. Dev sir as well for all our discussions.

Please do remember that no co i talk about is a buy or sell reco. Do your own due diligence. Do not borrow conviction from me or anyone else. I am not a sebi registered advisor. I share knowledge only with hope of inspiring others to do the same.

• • •

Missing some Tweet in this thread? You can try to

force a refresh