#BANKNIFTY

Outlook for the week May 30 - Jun 3, 2022

THREAD: Deconstructing BANKNIFTY on 5 different TF's

Outlook for the week May 30 - Jun 3, 2022

THREAD: Deconstructing BANKNIFTY on 5 different TF's

#BANKNIFTY

1. Monthly TF:

• Despite a LH-LL structure, witnessed a smart recovery from the lower levels in BNF

• So far a doji candle, albeit two more days are remaining for this month

• 32-33k is the BO support zone which has been held on so far

1. Monthly TF:

• Despite a LH-LL structure, witnessed a smart recovery from the lower levels in BNF

• So far a doji candle, albeit two more days are remaining for this month

• 32-33k is the BO support zone which has been held on so far

#BANKNIFTY

2. Weekly TF:

• BNF is moving within a falling channel

• However, current week candle exhibits bullishness

• The FIBO 0.5 level works to 35900 (pic 2)

• Unless a BO or a BD is witnessed the volatility will continue

2. Weekly TF:

• BNF is moving within a falling channel

• However, current week candle exhibits bullishness

• The FIBO 0.5 level works to 35900 (pic 2)

• Unless a BO or a BD is witnessed the volatility will continue

#BANKNIFTY

3. Daily TF:

• May 4, 2022 we witnessed a BD below 35600 after a pause, BNF is trading exactly at those levels

• The selling was resumed from May 4, 2022 onwards and the high of the same is 36300

• Successful BO of the W pattern in daily done on Thursday

3. Daily TF:

• May 4, 2022 we witnessed a BD below 35600 after a pause, BNF is trading exactly at those levels

• The selling was resumed from May 4, 2022 onwards and the high of the same is 36300

• Successful BO of the W pattern in daily done on Thursday

#BANKNIFTY

5. Hourly TF:

•Erstwhile resistance of 34800 might act as a support for now

•Expecting a sideways to bullish bias for the current week

5. Hourly TF:

•Erstwhile resistance of 34800 might act as a support for now

•Expecting a sideways to bullish bias for the current week

#BANKNIFTY

• Strategy for the current week: As there are multiple supports on the way down as well few resistance on the way up

• Strangle might work good for the current week

• Strategy for the current week: As there are multiple supports on the way down as well few resistance on the way up

• Strangle might work good for the current week

#BANKNIFTY

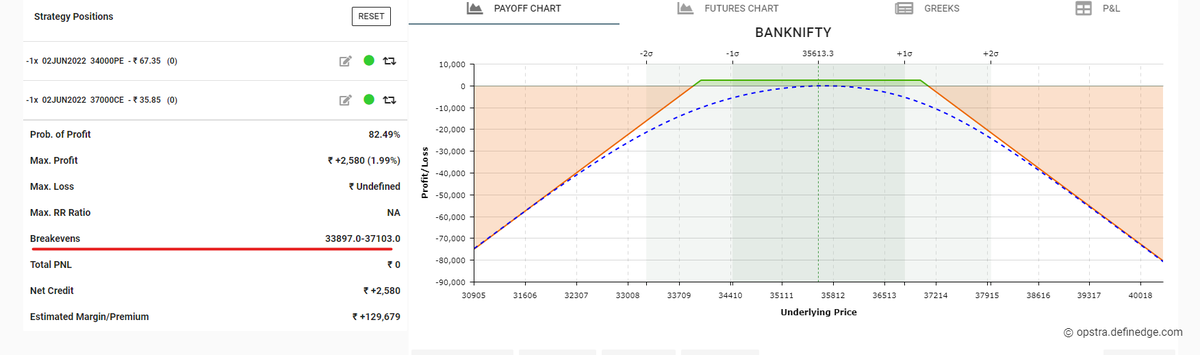

👉 Strategy for risky traders

• Adjustment only when BNF breaches 34800 (till tuesday) on the downside or 36500 on the upside

👉 Strategy for risky traders

• Adjustment only when BNF breaches 34800 (till tuesday) on the downside or 36500 on the upside

#BANKNIFTY

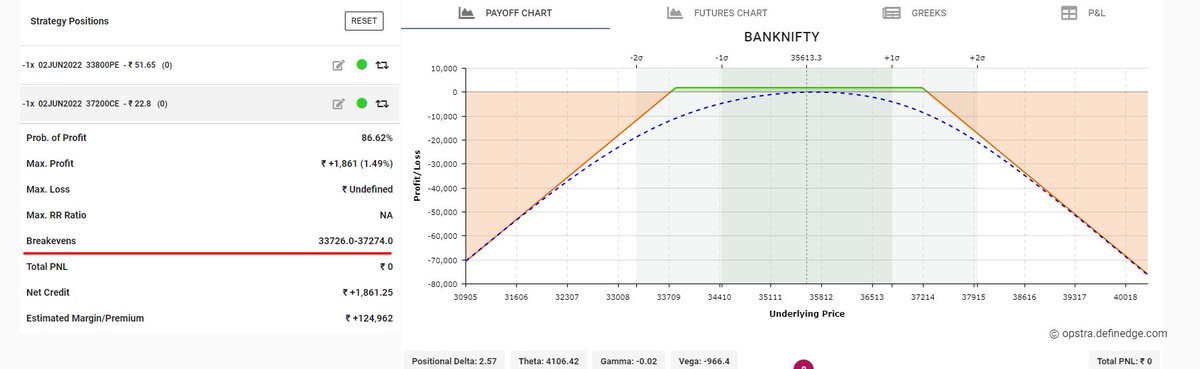

👉 Strategy for moderate risk seekers

• Adjustment only when BNF breaches 34500 on the downside or 36800 on the upside

👉 Strategy for moderate risk seekers

• Adjustment only when BNF breaches 34500 on the downside or 36800 on the upside

#BANKNIFTY

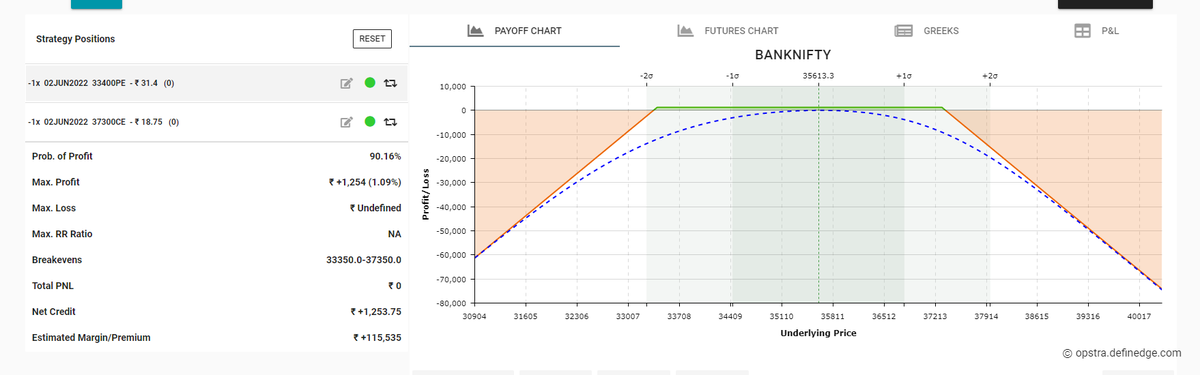

👉 Strategy for safe players

• Adjustment only when BNF breaches 33650 on the downside or 36800 on the upside

👉 Strategy for safe players

• Adjustment only when BNF breaches 33650 on the downside or 36800 on the upside

Conclusion:

• A sideways to bullish market is expected

• 34800 might act as a good support for the current week

• 36.3 k might act as a resistance for the current week

• A sideways to bullish market is expected

• 34800 might act as a good support for the current week

• 36.3 k might act as a resistance for the current week

If you enjoyed this, then do check out my other threads.

I regularly share weekly outlook on indices (NIFTY & BANKNIFTY) and many more threads on trading & finance.

I regularly share weekly outlook on indices (NIFTY & BANKNIFTY) and many more threads on trading & finance.

• • •

Missing some Tweet in this thread? You can try to

force a refresh