Habemus embargo ("in principle")

1/4 The good news is political:

+ EU was able to engineer unanimity

+ DE substantially contributed (N Druzhba)

+ insurance and oil products included

+ an instrument to build on

1/4 The good news is political:

+ EU was able to engineer unanimity

+ DE substantially contributed (N Druzhba)

+ insurance and oil products included

+ an instrument to build on

2/4 The weaknesses I

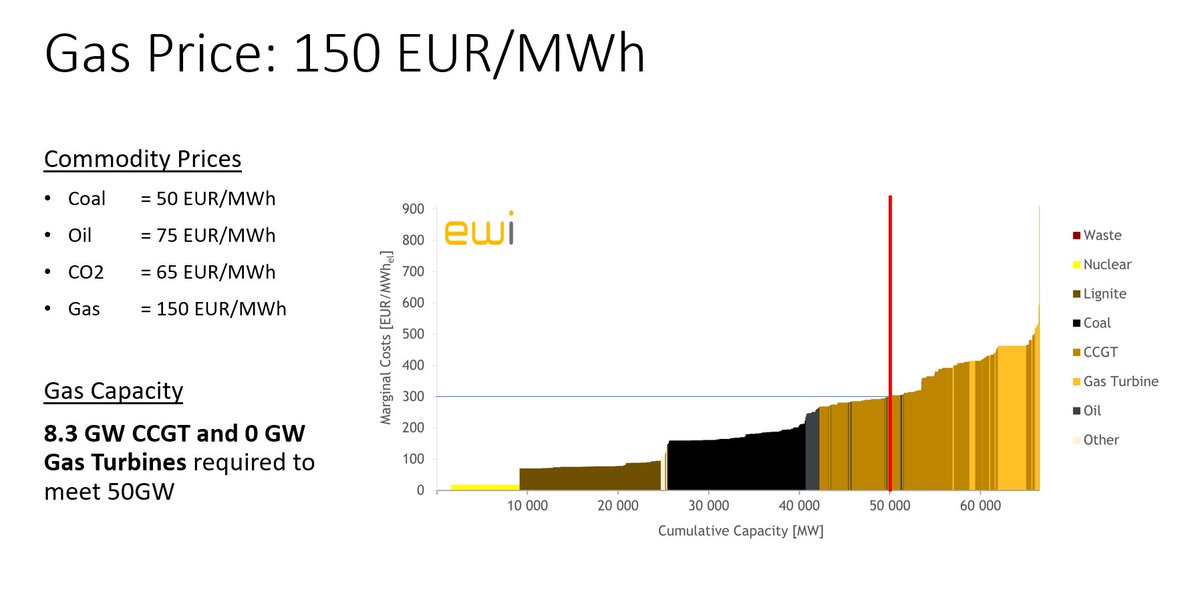

- lack of price instrument (e.g., tariff) might initially overcompensate lost volumes by higher prices

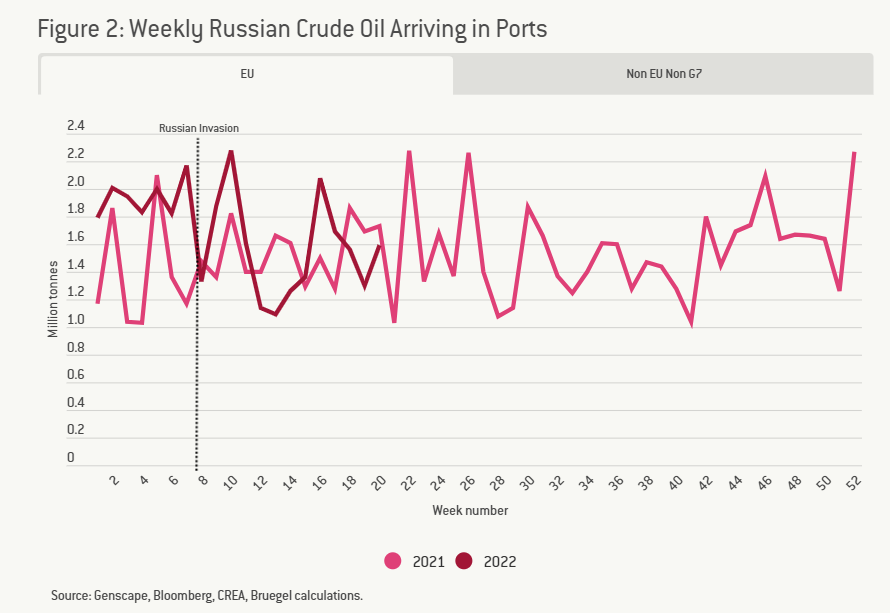

- relatively long phase-in will allow RU to seek alternative buyers

bruegel.org/2022/05/a-phas…

- lack of price instrument (e.g., tariff) might initially overcompensate lost volumes by higher prices

- relatively long phase-in will allow RU to seek alternative buyers

bruegel.org/2022/05/a-phas…

3/4 The weaknesses II

- effectiveness mitigated by list of exemptions incl. S Druzhba and shipping services

- specific exemptions show MS pressure points (vacuum oil in HR and long transition in BG)

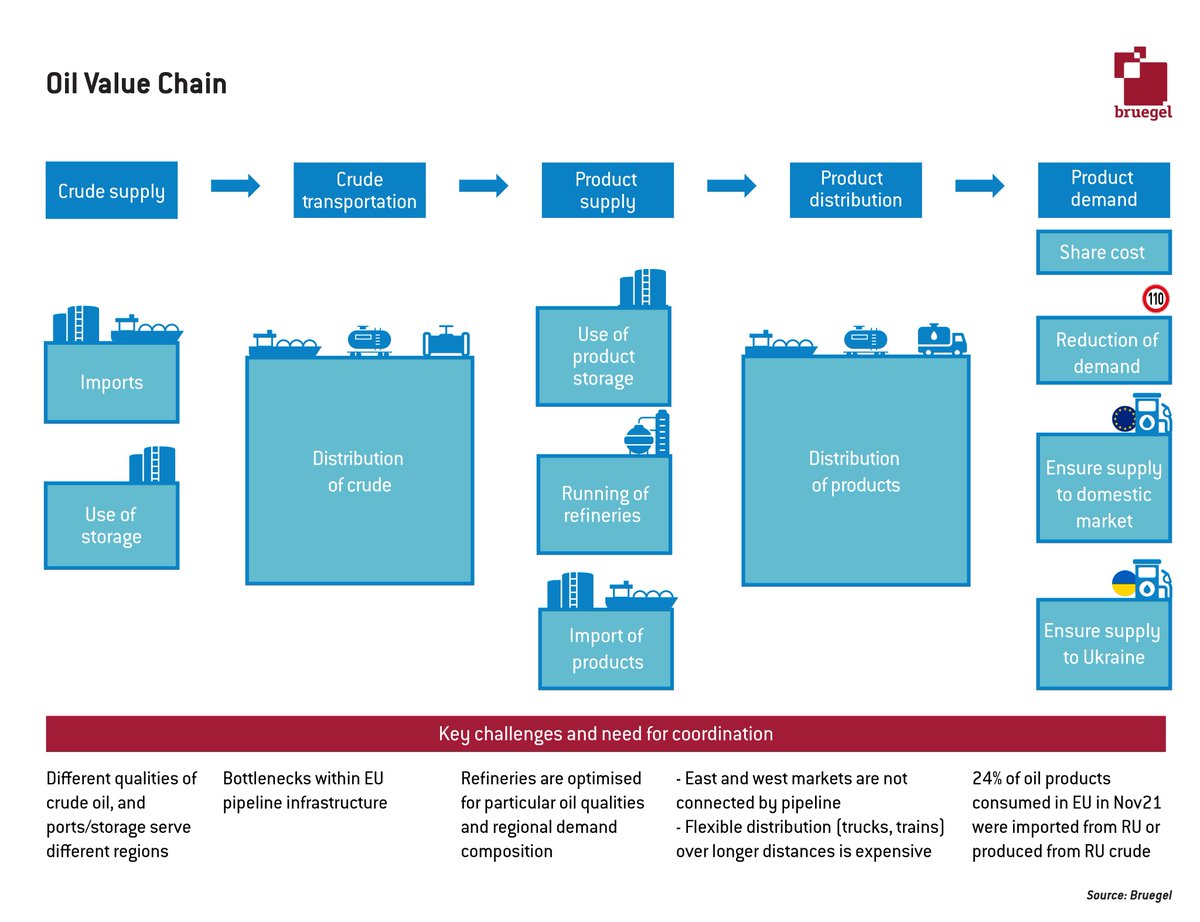

- limited preparation for RU reaction

- effectiveness mitigated by list of exemptions incl. S Druzhba and shipping services

- specific exemptions show MS pressure points (vacuum oil in HR and long transition in BG)

- limited preparation for RU reaction

4/4 Room for improvement

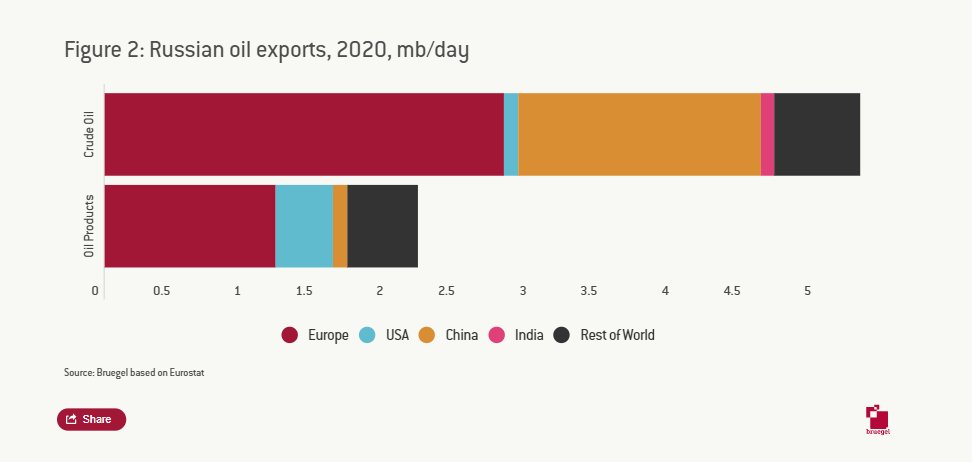

+ closely monitor RU exports (see our oil tracker↓)

+ tighten screws accordingly (convince other buyers to join sanctions, make exporting RU oil/products more difficult)

+ seek alternative supplies (convince OPEC?)

+ reduce demand (-> no fuel subsidies)

+ closely monitor RU exports (see our oil tracker↓)

+ tighten screws accordingly (convince other buyers to join sanctions, make exporting RU oil/products more difficult)

+ seek alternative supplies (convince OPEC?)

+ reduce demand (-> no fuel subsidies)

Some reading:

Reducing RU export revenues: bruegel.org/2022/04/how-a-…

Improving the management of the domestic shortfall:

bruegel.org/2022/05/the-eu…

Oil ship tracker

bruegel.org/publications/d…

Reducing RU export revenues: bruegel.org/2022/04/how-a-…

Improving the management of the domestic shortfall:

bruegel.org/2022/05/the-eu…

Oil ship tracker

bruegel.org/publications/d…

• • •

Missing some Tweet in this thread? You can try to

force a refresh