senior fellow - energy & climate policy - @bruegel_org

Scientific Lead - GreenDealUkraїna - @HZBde

How to get URL link on X (Twitter) App

https://twitter.com/KlaStrat/status/1611333279533371393This would continue a long-standing German tradition of cross-subsidizing selected sectors based on higher electricity cost for all other electricity consumer.

PRELUDE - SUMMER 2021

PRELUDE - SUMMER 2021

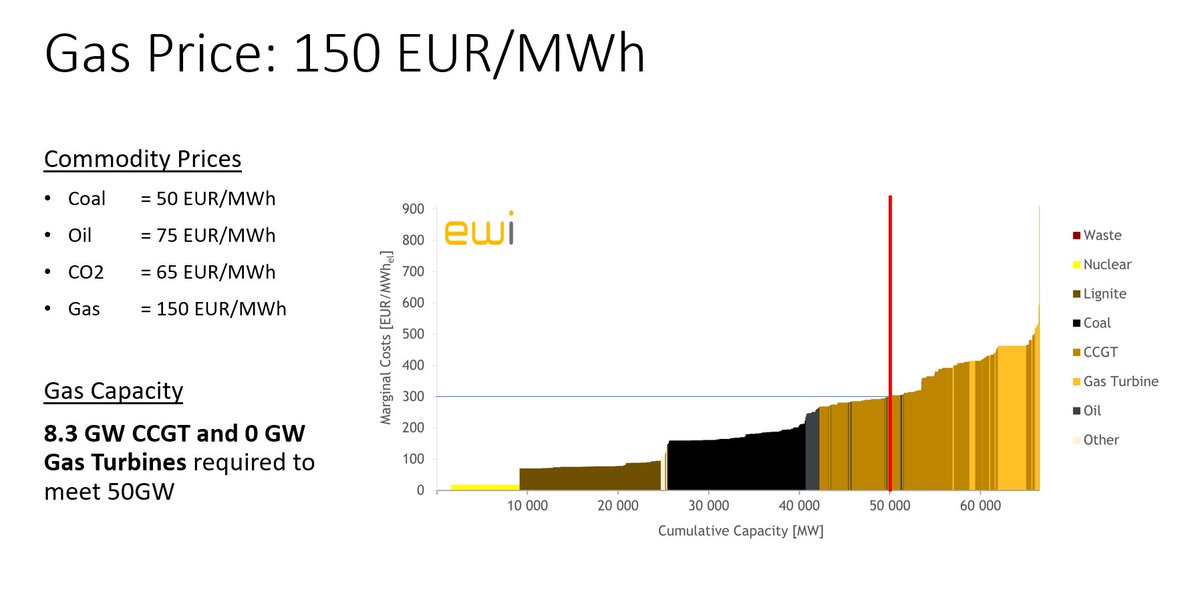

We use @ewi_koeln's cool merit order tool, adjust the fuel cost assumptions to be roughly in line with current numbers and assume a situation with a residual demand of 50 GW.

We use @ewi_koeln's cool merit order tool, adjust the fuel cost assumptions to be roughly in line with current numbers and assume a situation with a residual demand of 50 GW.

https://twitter.com/JMGlachant/status/1582920633029038080First, should we particularly support energy-and-trade-intensive sectors? This would keep their substantial energy demand high – resulting in much higher energy prices for all other industries.

https://twitter.com/jakluge/status/1558221062122381312Beim Gas hat bisher nur Russland substantiell gehandelt. Die Taktik scheint gezielte Verknappung, aber gerade nicht vollkommener Stopp zu sein (würde ich auch bei Lebensmitteln so sehen).

only diversification will not be enough

only diversification will not be enough

Gazprom already reneged on most EU countries' gas supply contracts partially or fully.

Gazprom already reneged on most EU countries' gas supply contracts partially or fully.

1. Focus : 2022/23

1. Focus : 2022/23

2/4 The weaknesses I

2/4 The weaknesses I

Drop in electricity consumption (that is observable in real-time) correlates rather strongly with drop in industrial production (that is observable ~2 month later).

Drop in electricity consumption (that is observable in real-time) correlates rather strongly with drop in industrial production (that is observable ~2 month later).