The Flash Crash of 2010

How a solo British Trader Wiped $1T off the US Stock Market while trading from his parents house in London, UK

Time for a Ticker History 🧵on Navinder Sarao

How a solo British Trader Wiped $1T off the US Stock Market while trading from his parents house in London, UK

Time for a Ticker History 🧵on Navinder Sarao

Its 2002 and 22-year-old graduate Navinder Sarao is flipping through the newspaper at his parents home just outside of London

Nav sees an ad that reads, “Wanted. Futures Traders. Must work well under pressure.”

Nav, having a great mind for multiplication, decides to apply

Nav sees an ad that reads, “Wanted. Futures Traders. Must work well under pressure.”

Nav, having a great mind for multiplication, decides to apply

The training program was called FutexLive; a group focused on teaching people how to scalp/day trade

Nav quickly became very skilled at his new hobby and would sit in one spot for hours, unbothered

He even moved his desk and purchased large headphones to tune his co-workers out

Nav quickly became very skilled at his new hobby and would sit in one spot for hours, unbothered

He even moved his desk and purchased large headphones to tune his co-workers out

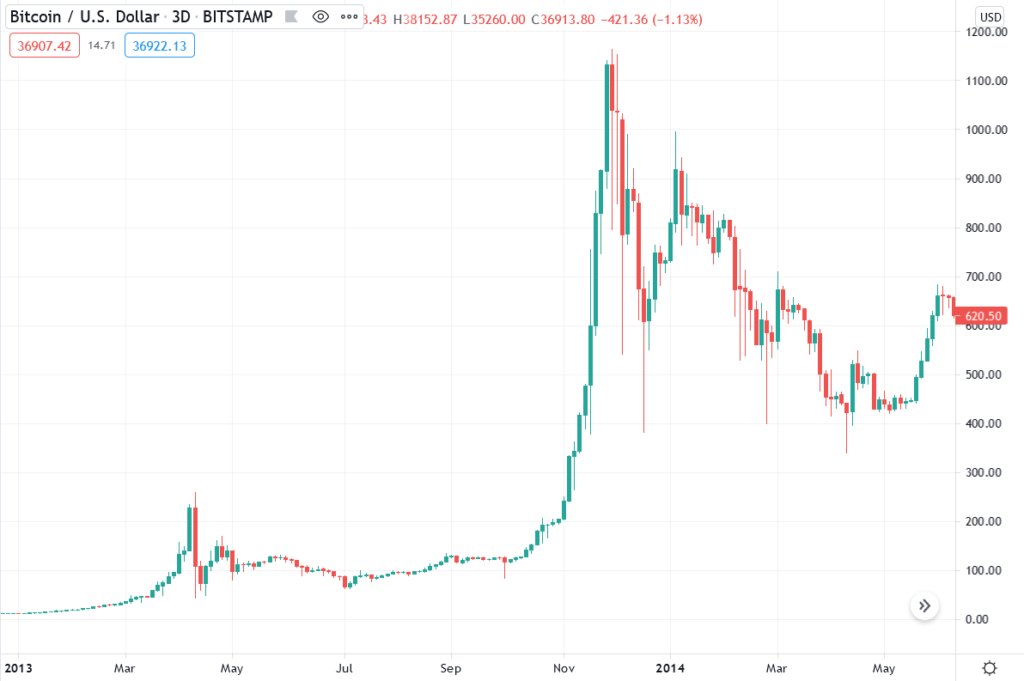

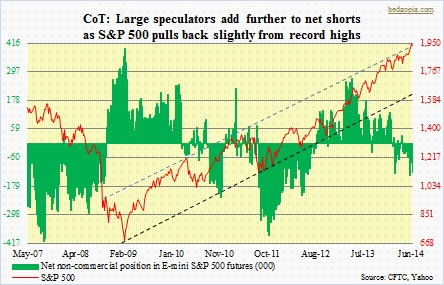

Nav traded a financial instrument called E-mini, which tracks the S&P 500 and allows traders to hedge bets and speculate on trades

He would purchase futures or options contracts and essentially bet that the market would go up or down

He would purchase futures or options contracts and essentially bet that the market would go up or down

During his time at FutexLive, Nav went from $0 to over $2M in profits; becoming a god like figure in the office

But in 2008, during the brunt of the financial crisis, he decided to leave FutexLive

This is where he would make one of the first big bets in his trading career

But in 2008, during the brunt of the financial crisis, he decided to leave FutexLive

This is where he would make one of the first big bets in his trading career

Nav believed at the time that the government would have to step in and bail out banks and distressed assets

So, he took the $2M and dumped it into the market; betting that the government would intervene and raise asset prices

Nav was right. Big time.

So, he took the $2M and dumped it into the market; betting that the government would intervene and raise asset prices

Nav was right. Big time.

He placed the bet on a Friday...

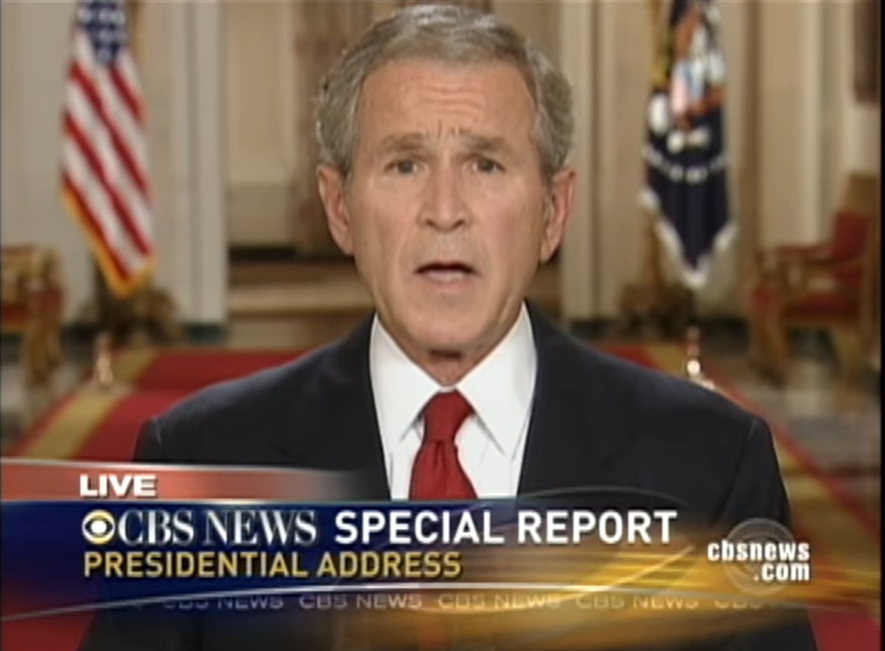

The following Monday the US government came out with a proposal to inject $700B into distressed assets

Nav's bet went from $2M to $15M in less than a week

The following Monday the US government came out with a proposal to inject $700B into distressed assets

Nav's bet went from $2M to $15M in less than a week

But instead of spending the money on fancy cars, dinners, and clothes, Nav kept to himself and didn't tell his friends or family about his wealth

He had a new goal in mind

He wanted to beat the algorithmic traders that were stealing and executing his trades at a faster pace

He had a new goal in mind

He wanted to beat the algorithmic traders that were stealing and executing his trades at a faster pace

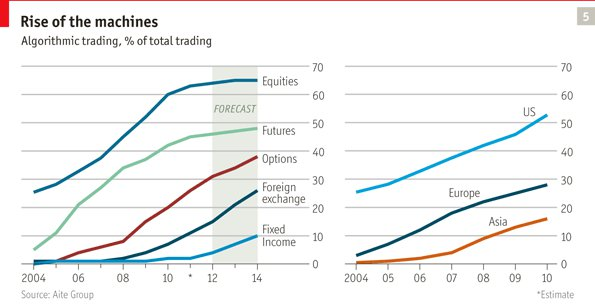

Some background

During the early 2000s high frequency trading was becoming more mainstream and widely spread on Wall Street

Today, over 60% of stock trades are based on algorithms on a computer

In 2009 Nav wanted so badly to beat them; so he went out to build his own software

During the early 2000s high frequency trading was becoming more mainstream and widely spread on Wall Street

Today, over 60% of stock trades are based on algorithms on a computer

In 2009 Nav wanted so badly to beat them; so he went out to build his own software

After testing and tweaking, Nav's HFT software started to rack up the wins in early 2010

A week before the flash crash he made $1.2M in two days using the software

Keep in mind that he is trading from his parents house, which is worth $300,000

A week before the flash crash he made $1.2M in two days using the software

Keep in mind that he is trading from his parents house, which is worth $300,000

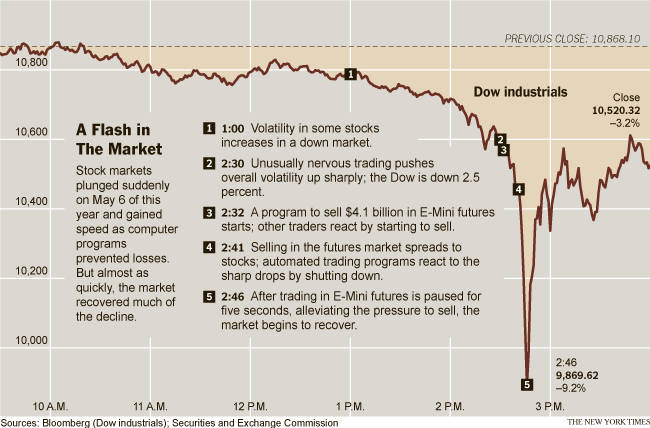

The day of the crash

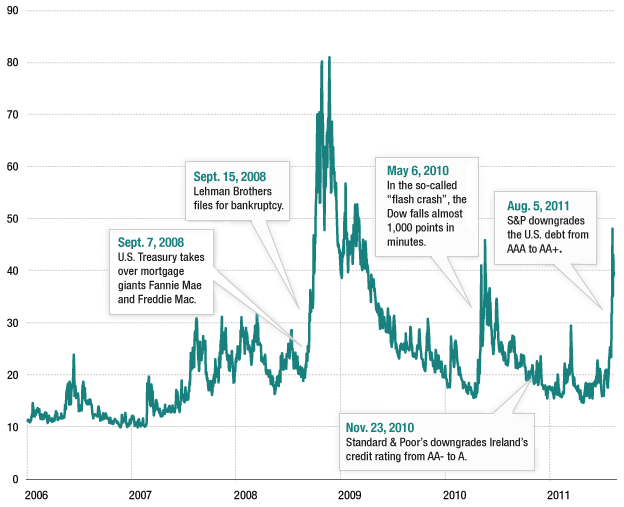

Market open: Stocks slide on news that some European banks would default on loans

The VIX, or the fear index, jumps +30% in intraday trading, causing more panic heading into the afternoon

Nav begins pumping fake sell orders to confuse the algorithms

Market open: Stocks slide on news that some European banks would default on loans

The VIX, or the fear index, jumps +30% in intraday trading, causing more panic heading into the afternoon

Nav begins pumping fake sell orders to confuse the algorithms

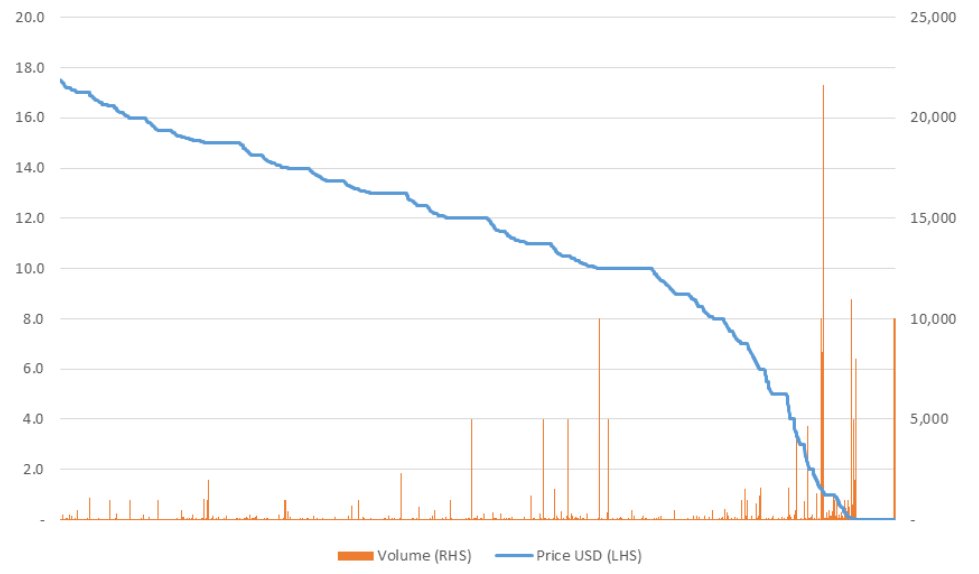

1:40 PM EST (6:40 PM GMT): Nav looks at his profit/loss, which is sitting at $950,000, and decides to turn off his computer

A minute later, the market falls at a drastic rate, and begins to wipe away billions of dollars in assets

A minute later, the market falls at a drastic rate, and begins to wipe away billions of dollars in assets

During the next 30 minutes the Dow Jones would drop more than 900 points (9%) as panic ensued

Nav's fake sell orders had caused others to actually sell, triggering a chain reaction in high frequency trading algorithms never seen before

Nav's fake sell orders had caused others to actually sell, triggering a chain reaction in high frequency trading algorithms never seen before

By the time of close, the Dow Jones had recovered by more than 600 points, but was still down over 300 points on the day

The overall consensus was frustration and confusion on Wall Street

The overall consensus was frustration and confusion on Wall Street

After the crash, US regulators started investigating into what happened

But Nav's name didn't even come up

He did get a letter from an exchange asking him to respond to questions about his order activity, in which he replied, “kiss my ass”

But Nav's name didn't even come up

He did get a letter from an exchange asking him to respond to questions about his order activity, in which he replied, “kiss my ass”

It would ultimately be another day trader similar to Nav that turned him in

He became aware of what Nav was doing when he was back testing his own software on the day of the crash when noticed Nav's fake orders coming in

He became aware of what Nav was doing when he was back testing his own software on the day of the crash when noticed Nav's fake orders coming in

Basically, this is what Nav was doing:

He would place large orders; up to $200M

Modify the orders hundreds of times to confuse the other high frequency traders

Then cancel the orders at the last moment

He would place large orders; up to $200M

Modify the orders hundreds of times to confuse the other high frequency traders

Then cancel the orders at the last moment

This is now known as “spoof and layering”

It would move the market in Nav’s direction, making him money and also sending shockwaves through HFT

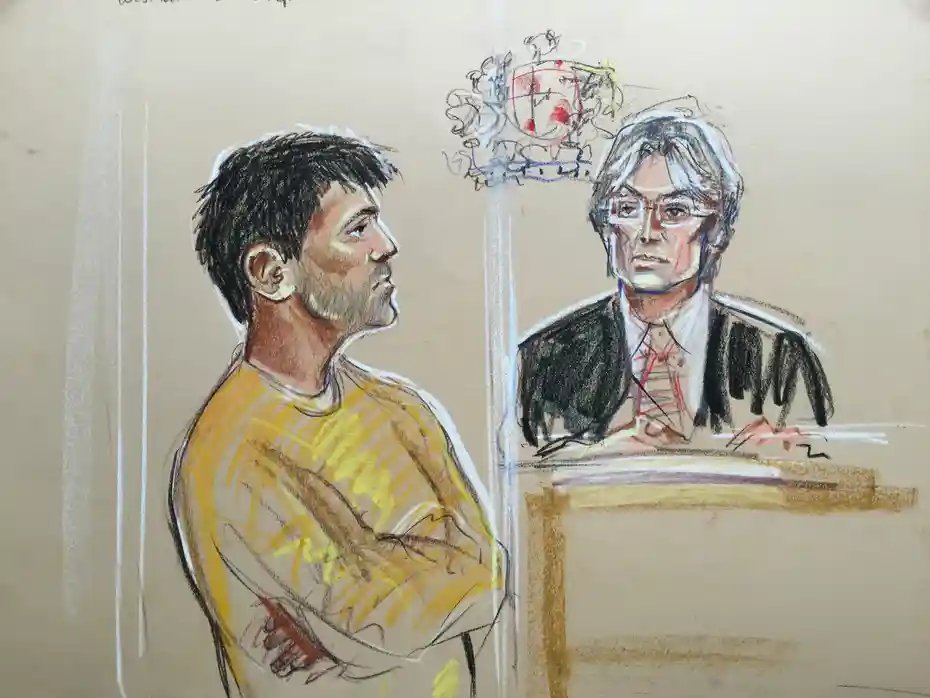

In February 2015, the CFTC’s found that Nav was indeed manipulating the market and arrested him at his parents home in London, England

It would move the market in Nav’s direction, making him money and also sending shockwaves through HFT

In February 2015, the CFTC’s found that Nav was indeed manipulating the market and arrested him at his parents home in London, England

After his arrest, Nav faced 22 counts of spoofing and wire fraud, a total of 380 years in prison

Nav failed to post the $7.5M bail

It was discovered that the money he made through trading he put in overseas accounts with shady people managing it

In other words, he was broke.

Nav failed to post the $7.5M bail

It was discovered that the money he made through trading he put in overseas accounts with shady people managing it

In other words, he was broke.

Nav was extradited to the US where his lawyer stuck a deal with prosecutors

Nav plead guilty to one count of spoofing and one count of wire fraud

But how did he get such a sweet deal after facing such long a sentence?

Nav plead guilty to one count of spoofing and one count of wire fraud

But how did he get such a sweet deal after facing such long a sentence?

In the time that Nav was arrested to when he is given the deal, prosecutors saw a different type of criminal

He wasn’t greedy and actually had lost money

He didn’t operate a large HFT scheme

And he was remorseful and helped the DOJ prosecute a number of other cases

He wasn’t greedy and actually had lost money

He didn’t operate a large HFT scheme

And he was remorseful and helped the DOJ prosecute a number of other cases

Eventually, the DOJ wrote a note to the judge asking for Nav to be released on time served, citing the reasons above

In early 2020 the judge sentenced Nav to house arrest, ironically the same location where he placed all his incriminating trades

In early 2020 the judge sentenced Nav to house arrest, ironically the same location where he placed all his incriminating trades

If you liked this thread, follow @TickerHistory for more business and stock related content

Also, follow the rest of the fam: @BullishStudio @BullishRippers

Also, follow the rest of the fam: @BullishStudio @BullishRippers

• • •

Missing some Tweet in this thread? You can try to

force a refresh