Thread

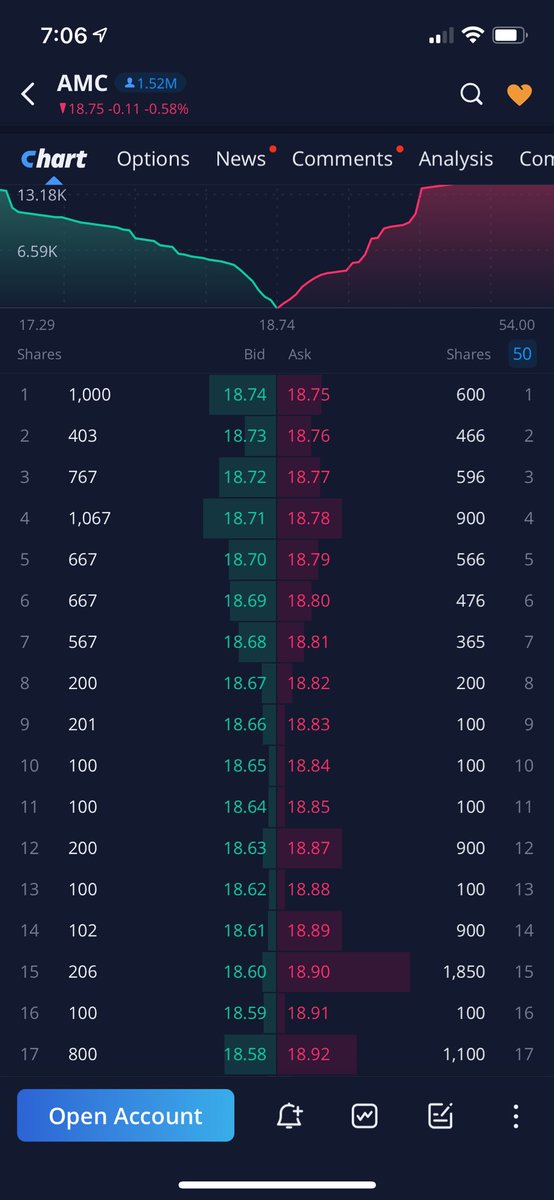

1/ I saw they borrowed several million more today & CTB average is above 14%. Think of it like someone having credit card debt & borrowing from a new card to pay the old one. Day-after-day they keep borrowing shares to short us & attack the price. Price is a way to lie...

1/ I saw they borrowed several million more today & CTB average is above 14%. Think of it like someone having credit card debt & borrowing from a new card to pay the old one. Day-after-day they keep borrowing shares to short us & attack the price. Price is a way to lie...

2/ Get the price down, scare apes, make you leave. But we know better. Massively high on borrowed, shorted, cost to borrow, & days to cover. OBV has never gone down. Market liquidity has been drying up. Business vastly improved. EVERY metric is in our favor.

3/ So see through their ponzi scheme of borrowing to cover borrowing which covered borrowing. And see through short attacks as actually representative of the real price action. We are winning. Just takes paytience and hodl. $amc #atAMC #apesnotleaving #amc

4/ And like I always tell you, hedgie. You can borrow to cover borrowing which covered borrowing, but sooner or later, the bill ALWAYS comes due and the repo man shows up. Sunk cost, pal. I'll wait. $amc #amc #atAMC #apesnotleaving

• • •

Missing some Tweet in this thread? You can try to

force a refresh