Cepheus Research and analytics @CepheusCapital has released their latest Ethiopia's Macroeconomic Developments and Outlook for the First Quarter 2022.

Here is a thread 🧵 highlighting the key takeaways from the report.

@CepheusCapital @Filagotes #Ethiopia

Here is a thread 🧵 highlighting the key takeaways from the report.

@CepheusCapital @Filagotes #Ethiopia

Ethiopia’s economy faced six distinct shocks including major price spikes in global markets as well as domestic shocks linked to conflict & drought.

Global shocks in fuel, food, fertilizers, and freight cost Ethiopia an additional $4bn this year, raising total imports to $18bn.

Global shocks in fuel, food, fertilizers, and freight cost Ethiopia an additional $4bn this year, raising total imports to $18bn.

Balance of Payments - significant increase in world prices for fuel, food, fertilizers, & freight is being covered by reduction in private capital imports, higher revenue from exports/services/remittances, forex supplies from franco valuta importers, & a drawdown of NBE reserves.

Fiscal policy - GoE's large spending increase is funded by increased domestic borrowing and cuts to federal capital expenditure. As a result of these policies both budget and current account, deficits are unlikely to exceed 4% of GDP this year.

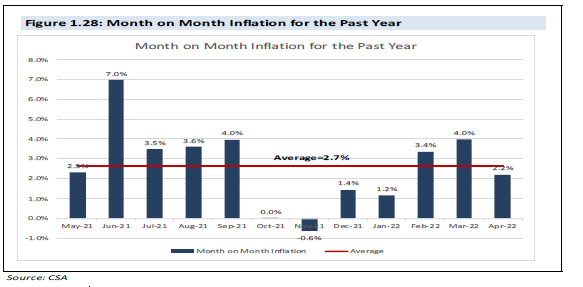

Inflation : month-on-month inflation has averaged 2.7 percent over the past year, it peaked at a recent high of 4% in March 2022 and has since moderated somewhat to 2.2% in April 2022.

This implies 29 percent inflation on an annualized basis.

This implies 29 percent inflation on an annualized basis.

Depreciation - The depreciation of the Birr’s against a basket of major currencies has been slow from an annual ‘run rate of 33% last year seemingly to limit inflation.

Public debt - Domestic debt has become the primary source of government funding this year while foreign debt is actually down by $1bn in nominal USD terms indicating a drop in new foreign loans and ongoing external debt repayments.

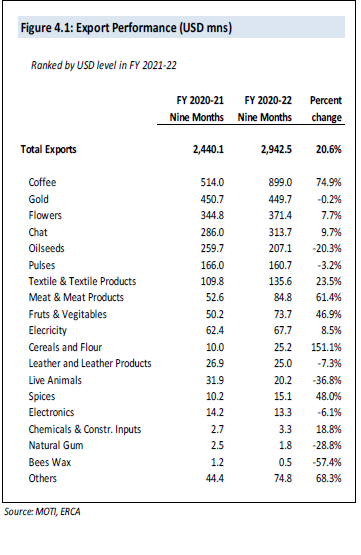

Exports - Exports have shown 21 percent year-on-year growth is now likely for the year based on nine-month trends.

The increase is almost exclusively due to exports of coffee which are on track to reach a historic record of $1bn for the year.

The increase is almost exclusively due to exports of coffee which are on track to reach a historic record of $1bn for the year.

Interesting bits:

Despite Ethiopia’s removal from AGOA trade privileges to the US, textile exports from industrial parks have actually risen in Q1 of 2022 (to $46mn), compared to the year-ago level ($34mn) & the average seen in the 2 quarters preceding removal from AGOA ($45mn).

Despite Ethiopia’s removal from AGOA trade privileges to the US, textile exports from industrial parks have actually risen in Q1 of 2022 (to $46mn), compared to the year-ago level ($34mn) & the average seen in the 2 quarters preceding removal from AGOA ($45mn).

Interesting bits:

Key monetary and fiscal indicators are up substantially in nominal terms, though given year-on-year inflation of near 36 percent as of April 2022, most such indicators are actually shrinking in real terms.

Key monetary and fiscal indicators are up substantially in nominal terms, though given year-on-year inflation of near 36 percent as of April 2022, most such indicators are actually shrinking in real terms.

Interesting bits:

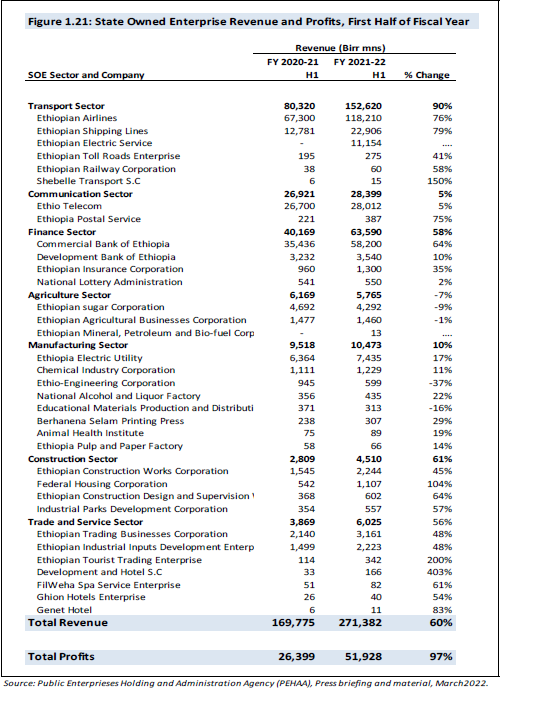

Ethiopia’s largest SoE, growth in revenue and in profits is particularly strong for those involved in the transport sector (Ethiopian Airlines, Ethiopian Shipping), the financial sector (CBE, DBE), trading, and manufacturing even after adjusting for inflation.

Ethiopia’s largest SoE, growth in revenue and in profits is particularly strong for those involved in the transport sector (Ethiopian Airlines, Ethiopian Shipping), the financial sector (CBE, DBE), trading, and manufacturing even after adjusting for inflation.

Looking ahead: Projection

There are two key turning points that would bring a major improvement in Ethiopia’s macro conditions.

(1) Successfully riding out the global shocks and (2) moving towards a deeper post-conflict re-engagement with external partners (donors, lenders).

There are two key turning points that would bring a major improvement in Ethiopia’s macro conditions.

(1) Successfully riding out the global shocks and (2) moving towards a deeper post-conflict re-engagement with external partners (donors, lenders).

Looking ahead: Projection

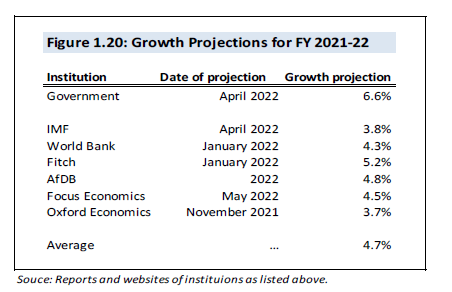

Ethiopia is likely to still see strong growth returning only next fiscal year and think minimal GDP growth of 1% is likely this fiscal year given the presumed crop/activity shortfalls in Northern regions & tight fx/credit conditions of recent quarters.

Ethiopia is likely to still see strong growth returning only next fiscal year and think minimal GDP growth of 1% is likely this fiscal year given the presumed crop/activity shortfalls in Northern regions & tight fx/credit conditions of recent quarters.

Looking ahead: Projection

- Inflation is likely to remain elevated for the rest of 2022 and for most of 2023

- A fiscal deficit just below 4% of GDP as previously expected

- A higher current account deficit is expected given global price shocks

- Inflation is likely to remain elevated for the rest of 2022 and for most of 2023

- A fiscal deficit just below 4% of GDP as previously expected

- A higher current account deficit is expected given global price shocks

Looking ahead: Projection

- Continued balance of payment pressures & severe forex challenges till late 2022 with modest improvements likely thereafter

- A crawling exchange rate that follows slow pace of recent months will take Birr rate from 52 per USD by June to 55 by end-2022.

- Continued balance of payment pressures & severe forex challenges till late 2022 with modest improvements likely thereafter

- A crawling exchange rate that follows slow pace of recent months will take Birr rate from 52 per USD by June to 55 by end-2022.

For more information, read the full report which is accessible for free here cepheuscapital.com/quarterly-macr…

Thank you @CepheusCapital for this comprehensive review of Ethiopia's Macroeconomic performance for the 1st Quarter of 2022.

Thank you @CepheusCapital for this comprehensive review of Ethiopia's Macroeconomic performance for the 1st Quarter of 2022.

@threadreaderapp Unroll, please.

• • •

Missing some Tweet in this thread? You can try to

force a refresh