You shouldn't be forced to invest your money in order to grow or even preserve your wealth.

Saving your money should be effective.

But our current monetary system punishes saving.

This creates massive downstream problems.

And #Bitcoin fixes this. (THREAD 🧵)

Saving your money should be effective.

But our current monetary system punishes saving.

This creates massive downstream problems.

And #Bitcoin fixes this. (THREAD 🧵)

If you’ve spent any time in the #personalfinance or #FIRE spaces you’re almost certainly familiar with the popular and widely proclaimed tenet that one cannot save one’s way to wealth; that, rather, one must invest to achieve wealth.

Scroll through the Instagram and Twitter accounts of popular finfluencers and you will encounter a plethora of graphics/charts underlining the paltry yield one makes on a savings account vs the divinely guaranteed 7% return one can expect to make in the stock market every year.

These posts invite the viewer/scroller to draw the obvious, unimpeachable conclusion that the only way to get wealthy is to invest. Savings=bad. Investments=good. This formulation has never really been questioned b/c, in our current economic environment, it is unassailably true.

We celebrate how "easy" investing has become. It’s so easy, everyone can do it!

This, of course, has helped create the booming industry of personal finance, with its panoply of coaches, advisors, and gurus.

This, of course, has helped create the booming industry of personal finance, with its panoply of coaches, advisors, and gurus.

Empowered by the discovery of how easy investing truly is, these acolytes now charge for 1-on-1 sessions to share a historical chart of the S&P and point you in the direction of a Vanguard account. Some charge hourly rates equivalent to those of partners at white shoe law firms.

In the personal finance space, “investing” is often contrasted with “gambling,” with the former meaning simply to hold an investment for a long time and the latter referring to day-trading and shorter term stock picking.

In practice, however, these concepts, as understood and implemented in the personal finance space, are less distinguishable. No one is really doing security analysis, reading SEC filings, etc.

Instead, one is just sanctimoniously anointed as an investor if one simply buys and holds index funds no matter what price they’re trading at, and one is even more sanctimoniously maligned as a gambler if one does anything else.

I want to turn this orthodoxy on its head and question the underlying tenet about saving versus investing.

What does it say about money when simply saving it is a losing enterprise?

What does it say about money when simply saving it is a losing enterprise?

What does it say about money when every single earner who wants to grow or merely sustain his/her wealth must step out onto the risk curve and invest?

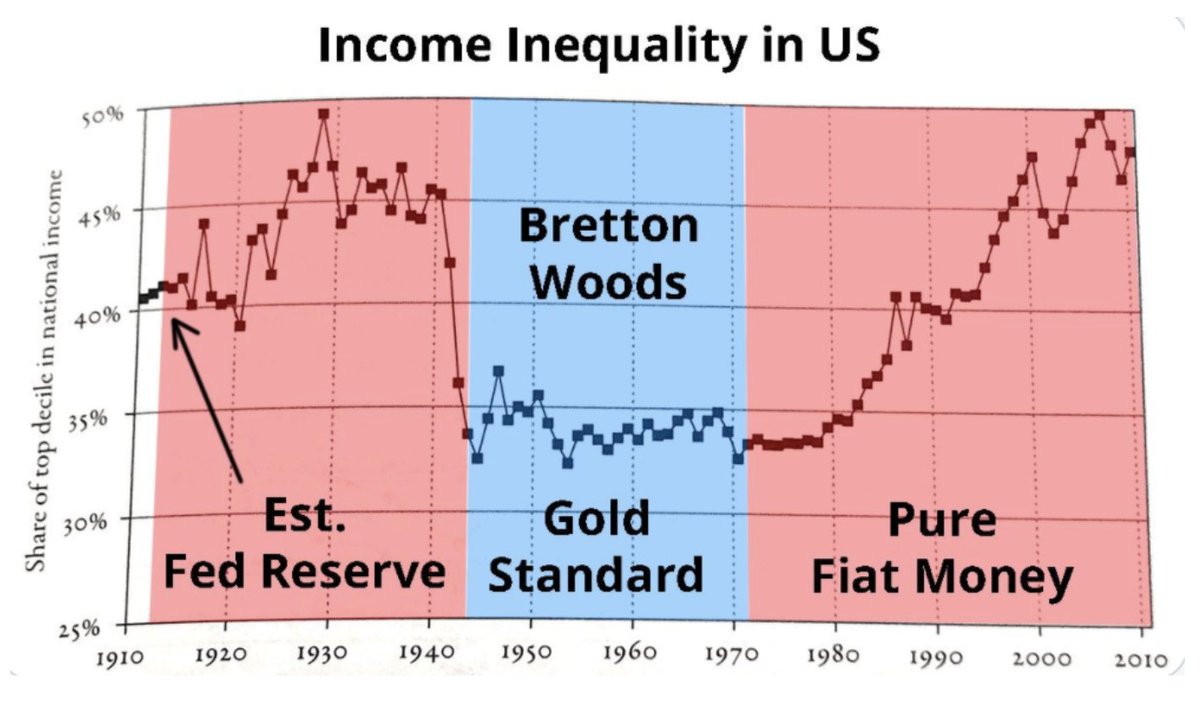

I would argue that this simply illustrates the fundamental flaw of fiat currency, which is that it debases the currency so thoroughly that everyone is forced to become an investor and be thankful for the privilege.

Because fiat money bleeds purchasing power (as a result of inflationary monetary policies), merely saving money won’t grow or even preserve wealth.

But saving SHOULD create wealth, or at the very least preserve it. And everyone should not have to invest.

But saving SHOULD create wealth, or at the very least preserve it. And everyone should not have to invest.

Not only should investing not be easy; it should be difficult. Not difficult in terms of access, but difficult in terms of successful execution. And it should not carry the illusion of being low-risk or risk-free, no matter its iteration or implementation.

Statements like “it’s never been easier to invest,” are ridiculous. Sure, access to investing is easier, but nothing about actual security analysis has become easier.

We’ve just made risk-taking easier and more palatable and celebrated it as an achievement for the little guy. The modern necessity that everyone be an investor to preserve or grow his/her wealth, coupled with the crop of tools and exchanges developed to service (and profit from)

this necessity, paints it with a veneer of egalitarianism that tends to blind us to the downstream effects of such “achievements,” and prevents us from coalescing around a real achievement, which would be making saving effective.

There are numerous negative downstream effects of everyone being an investor and indiscriminately piling money into index funds. Here are five salient ones:

(1) This type of investing is almost entirely price-insensitive. This makes markets less efficient. When a growing percentage of the market is doing this type of passive investing into index funds, companies that are already large get rewarded with the most incremental dollars.

This investment money is not going to those companies b/c these passive investors perceive them to be mispriced or b/c of some data- or sentiment-based thesis. This outsized proportion of each incremental dollar is going to those companies simply and solely because of their size.

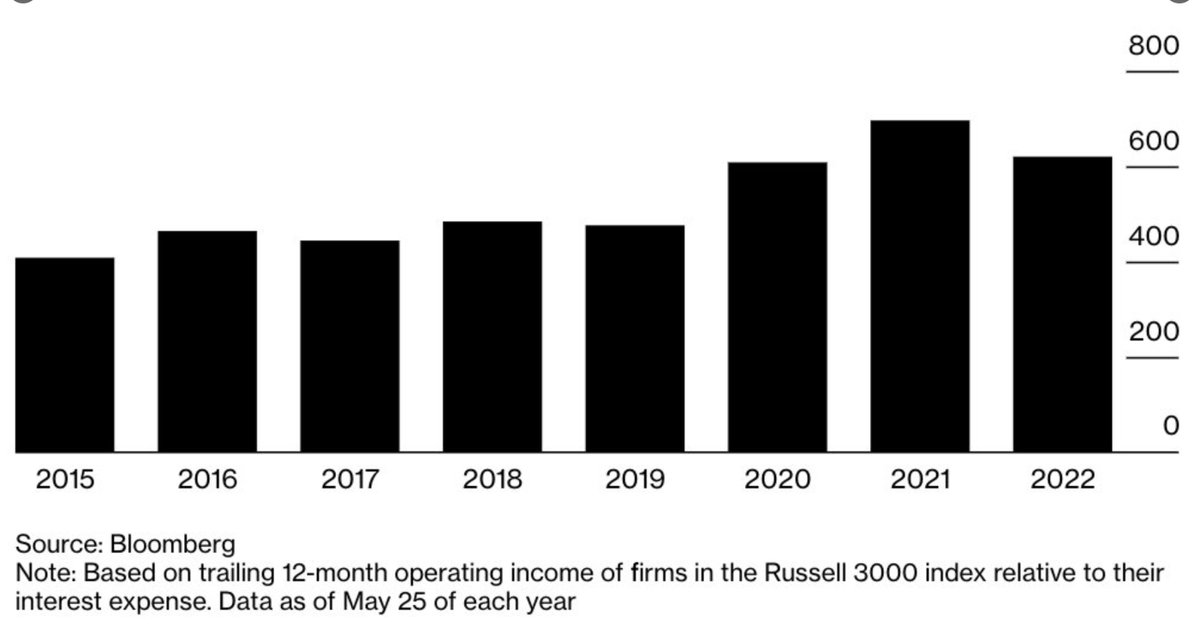

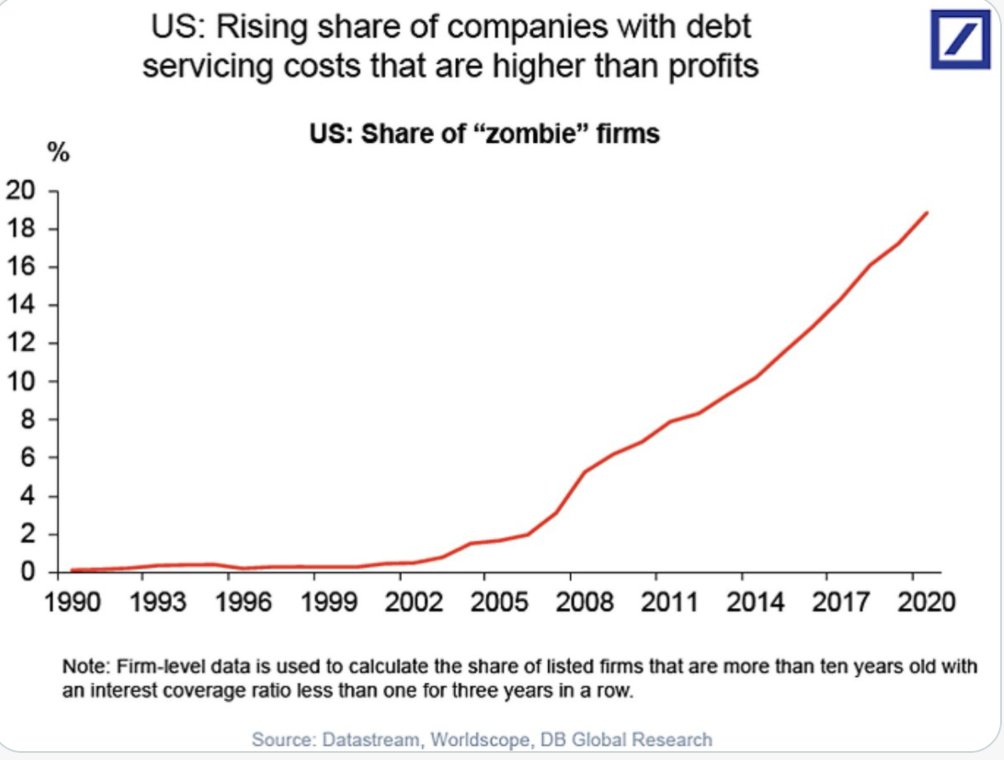

(2) this environment encourages and perpetuates widespread malinvestment. When everyone is throwing money at indexes, firms within an index that are unprofitable and over-leveraged are propped up by the inflows.

This is why we’ve seen an increasing amount of zombie companies. Roughly 25% of the companies in the Russell 3000, for example, are zombie companies.

(3) The three largest low-cost asset managers, each of which has grown in size and influence to service the ever-growing demand for investment products in a world where everyone is forced to be an investor, now hold $22 trillion of assets under management.

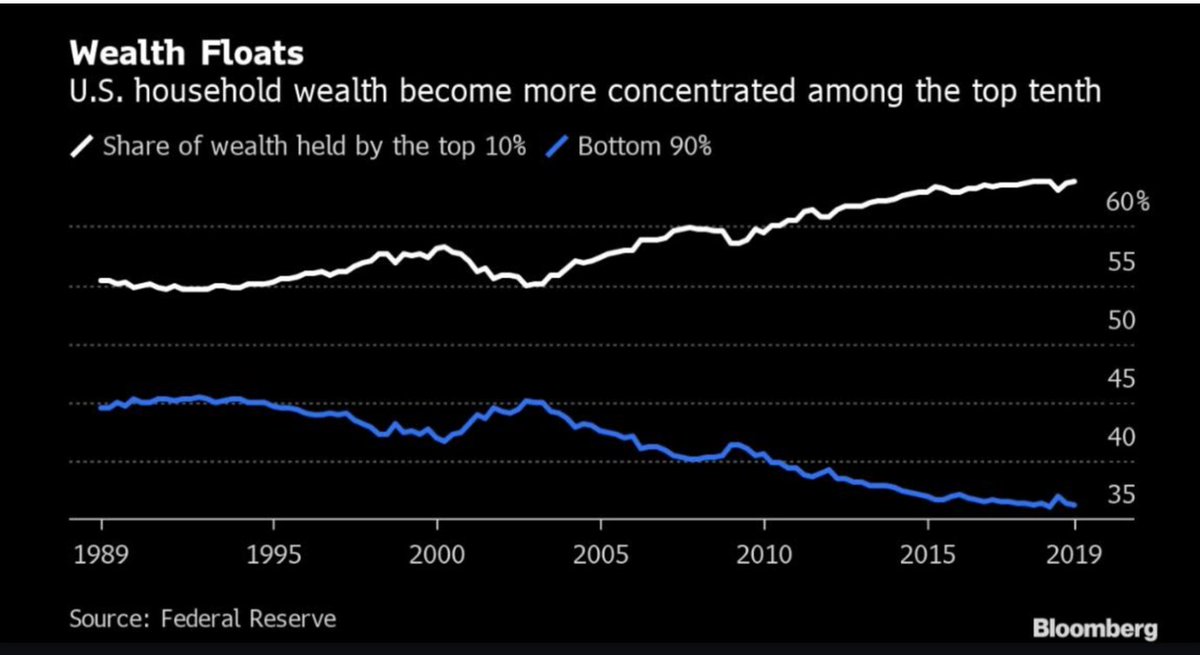

This has severely centralized ownership of America’s corporations in the sense that these three firms (Vanguard, BlackRock and State Street) hold more than half of the combined value of all shares for companies in the S&P 500.

This means a handful of people at Vanguard, BlackRock and State Street cast a profoundly outsized number of shareholder votes. This concentration of ownership is deeply anticompetitive. Jack Bogle himself acknowledged this toward the end of his life.

(4) this enviro has contributed to the proliferation of financial products and the financialization of everything that has so profoundly reshaped our domestic economy. The finance, insurance, and real estate industries now account for a higher percentage of GDP than all others.

One of #Bitcoin’s most seemingly banal, yet utterly transformative use-cases is as a way to restore the power of saving money and, in doing so, fundamentally change our collective economic reality.

If money is unmanipulable, it incentivizes saving and obviates the need for every single person to be a full-time investor.

This has a multitude of positive downstream effects. It leads to less malinvestment, less concentration of corporate ownership, more competition, more efficient markets, a radical diminution of the Cantillon Effect, and a disempowering of rent-seeking industries like finance.

It means working people are not compelled by dire necessity to put their hard-earned money at risk because their purchasing power won’t be continuously diluted through inflationary monetary policies.

So yes, putting your money in a savings account will not make you wealthy in our current economic system. But instead of accepting this dystopian fate, we should question the value and the utility of a system in which saving $ reduces wealth. And then we should change it.

I write about all this and more in the most recent issue of my free biweekly newsletter about Bitcoin. Check it out 👇

thinkbitcoin.substack.com/p/think-bitcoi…

thinkbitcoin.substack.com/p/think-bitcoi…

I also share great work by @rettlerb, @resistancemoney, @craigwarmke, @Ayelen_Osorio, @level39, and @sebbunney.

• • •

Missing some Tweet in this thread? You can try to

force a refresh