WRITE DOWN🆚WRITE OFF

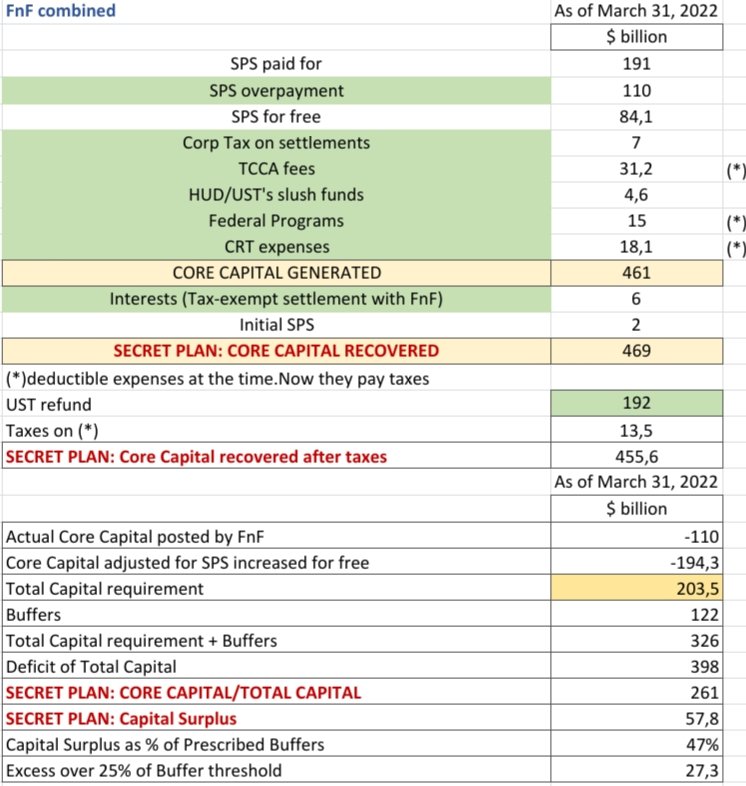

The atty also requested "writing down the LP of the SPS to 0". Not only he didn't add that there must be a tax-exempt profit (Core Capital),but also he uses write down, used for an asset price reduction, but when it's reduced to...#Fanniegate @TheJusticeDept

The atty also requested "writing down the LP of the SPS to 0". Not only he didn't add that there must be a tax-exempt profit (Core Capital),but also he uses write down, used for an asset price reduction, but when it's reduced to...#Fanniegate @TheJusticeDept

https://twitter.com/CarlosVignote/status/1534064255842111488

zero, it's called "write-off",since there are no more incremental write-downs and it involves a credit to a profit acct.

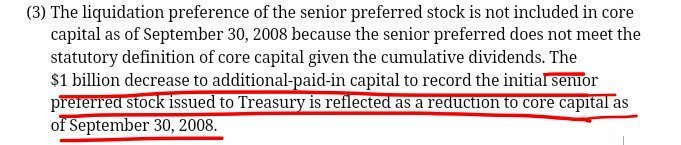

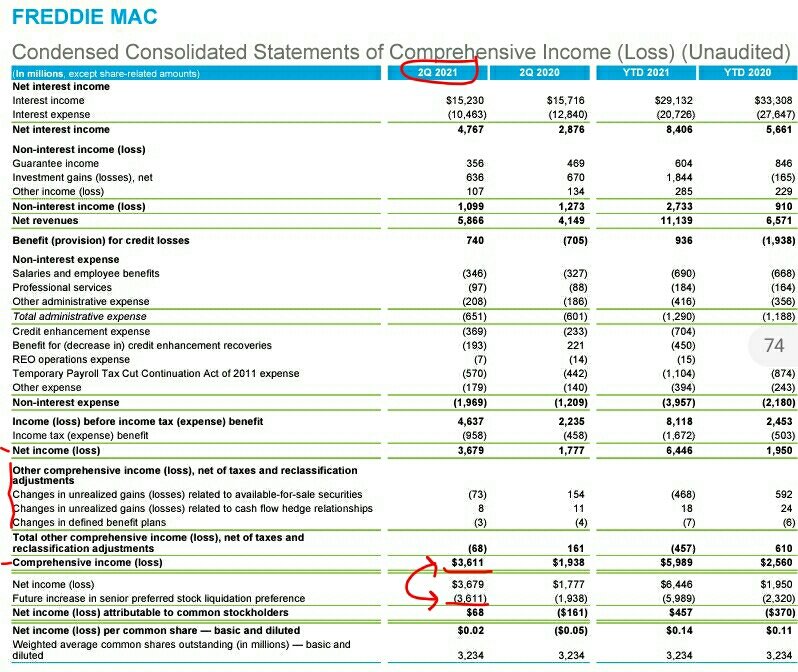

Even a write down involves a profit, because SPS are obligations of FnF(debentures)

In this world,if you are pardoned debt,it's a profit for you.

The same they

Even a write down involves a profit, because SPS are obligations of FnF(debentures)

In this world,if you are pardoned debt,it's a profit for you.

The same they

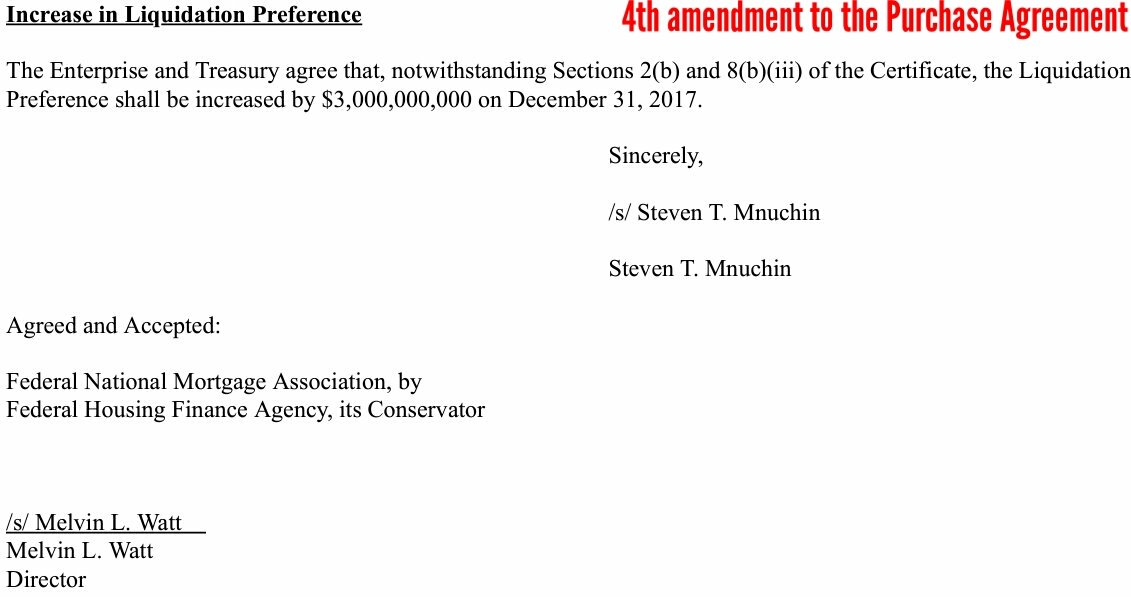

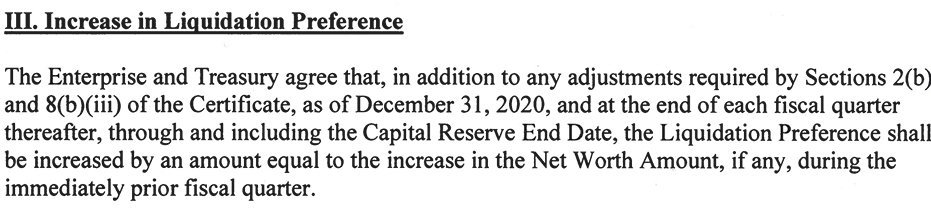

are illegally increased (unique=ISSUED separately each time), he wants to simply reduce the price to zero and evade to record any profit (Core Capital)

The more Capital needs, the more stock offerings for the hedge funds and assault on the ownership.

@WhiteHouse @SEC_Enforcement

The more Capital needs, the more stock offerings for the hedge funds and assault on the ownership.

@WhiteHouse @SEC_Enforcement

Credit to a profit account if the asset class is a Debenture, which is our case.

Debit to an expense account (loss) if it's an Asset of the company.

Debit to an expense account (loss) if it's an Asset of the company.

• • •

Missing some Tweet in this thread? You can try to

force a refresh