How to get URL link on X (Twitter) App

https://twitter.com/CarlosVignote/status/1590355870009159682

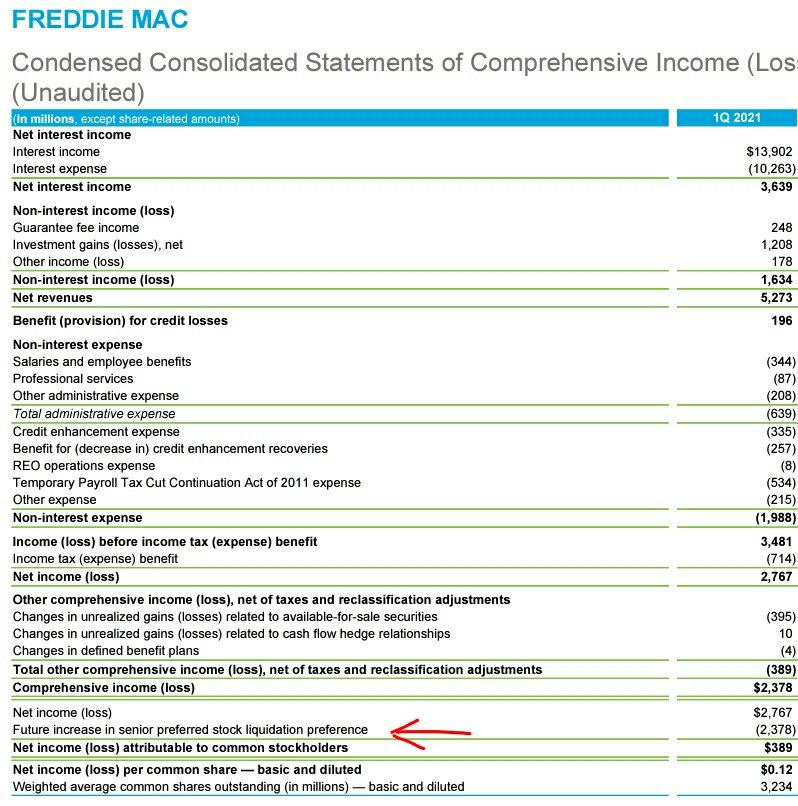

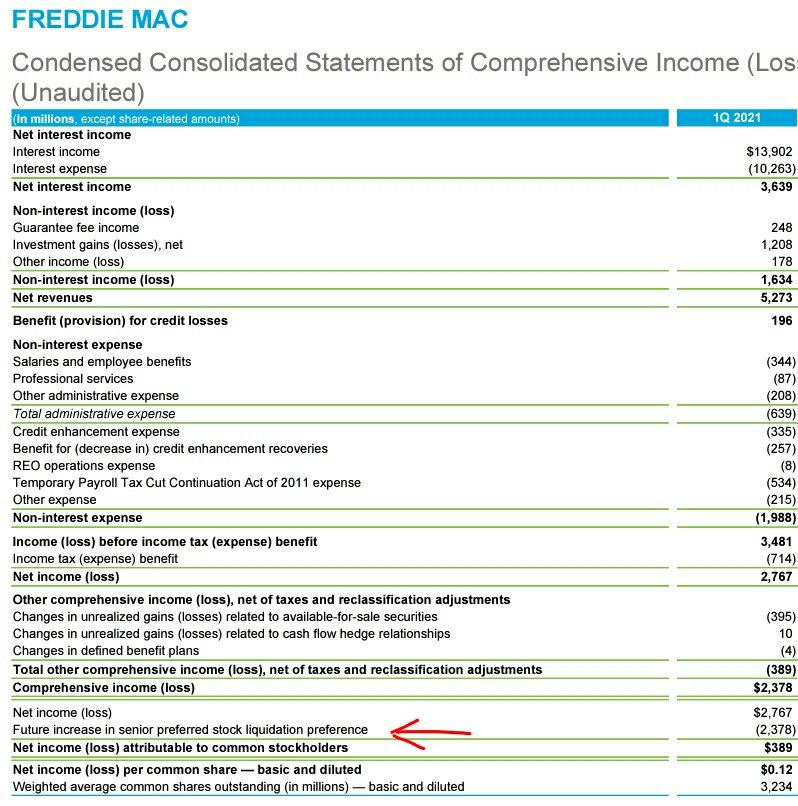

The Income Stmnt would be correct if:

The Income Stmnt would be correct if:

A joke is authorized in the FHFA-C's Incidental Power(FHFA's best interests) if the Common Equity is held in escrow, pursuant to the exceptions 1,2,3,4 in the CFR1237.12. I.e.,at some point, it'd be reversed(SPS cancelled)

A joke is authorized in the FHFA-C's Incidental Power(FHFA's best interests) if the Common Equity is held in escrow, pursuant to the exceptions 1,2,3,4 in the CFR1237.12. I.e.,at some point, it'd be reversed(SPS cancelled)

Once FnF meet the threshold to resume the div payment,the cumulative div on the SPS repaid in 2013/2014, for FMCC/FNMA, resp.,is assessed 0%. Each "purchase" carried its own IRR. 0% due to the illegal collateral W (barred in Fee Limitation),security to (iii) protect the taxpayer.

Once FnF meet the threshold to resume the div payment,the cumulative div on the SPS repaid in 2013/2014, for FMCC/FNMA, resp.,is assessed 0%. Each "purchase" carried its own IRR. 0% due to the illegal collateral W (barred in Fee Limitation),security to (iii) protect the taxpayer.

https://twitter.com/CarlosVignote/status/1534064255842111488

zero, it's called "write-off",since there are no more incremental write-downs and it involves a credit to a profit acct.

zero, it's called "write-off",since there are no more incremental write-downs and it involves a credit to a profit acct.https://twitter.com/Markzandi/status/1517236390861418497because they realized that all the borrowers authorized in the Charter pose similar risk at origination, since the Charter's requirement is just LTV<80%.

https://twitter.com/CarlosVignote/status/1432189385173348353

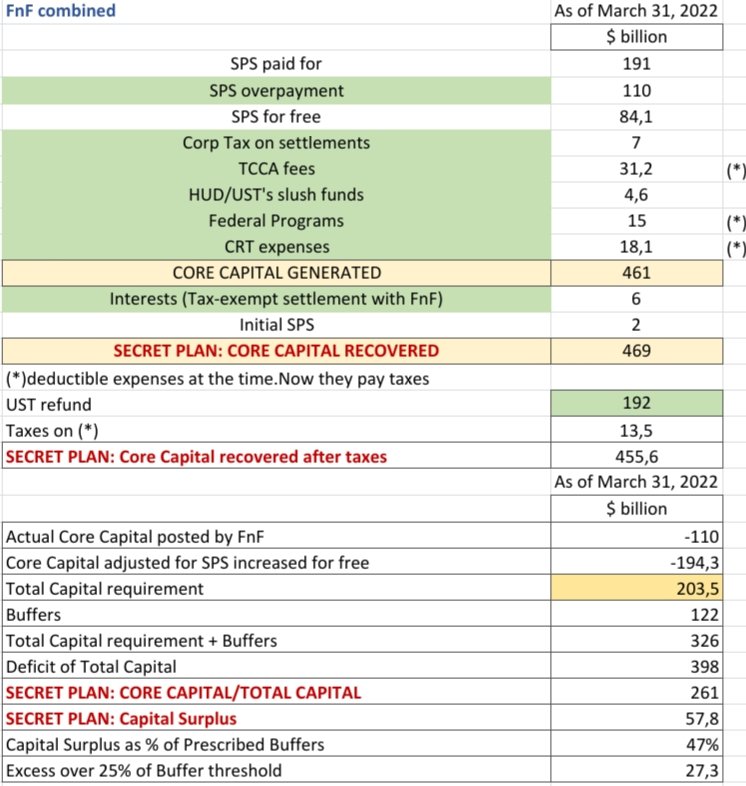

This is why FnF don't include it in Other Comprehensive Income for the Total Comprehensive Income,but outside the Comprehensive Income, as a distribution of income, like occurs with a cash dividend to the JPS/SPS holders.

This is why FnF don't include it in Other Comprehensive Income for the Total Comprehensive Income,but outside the Comprehensive Income, as a distribution of income, like occurs with a cash dividend to the JPS/SPS holders.

https://twitter.com/CarlosVignote/status/1403594963032723458

Later,he just has to tap debt and,illegally, FnF, to pay for this scheme of economic devastation.

Later,he just has to tap debt and,illegally, FnF, to pay for this scheme of economic devastation.

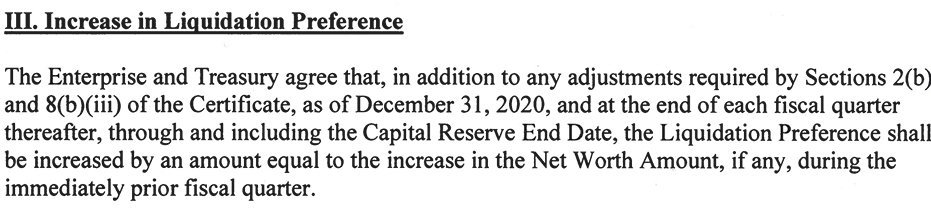

We see in the screenshots that the maximum amount of Net Worth they are allowed to hold, it's called Applicable Capital Reserve, like in the 3rd amndt.

We see in the screenshots that the maximum amount of Net Worth they are allowed to hold, it's called Applicable Capital Reserve, like in the 3rd amndt.

Other examples of this Inc Power:

Other examples of this Inc Power:

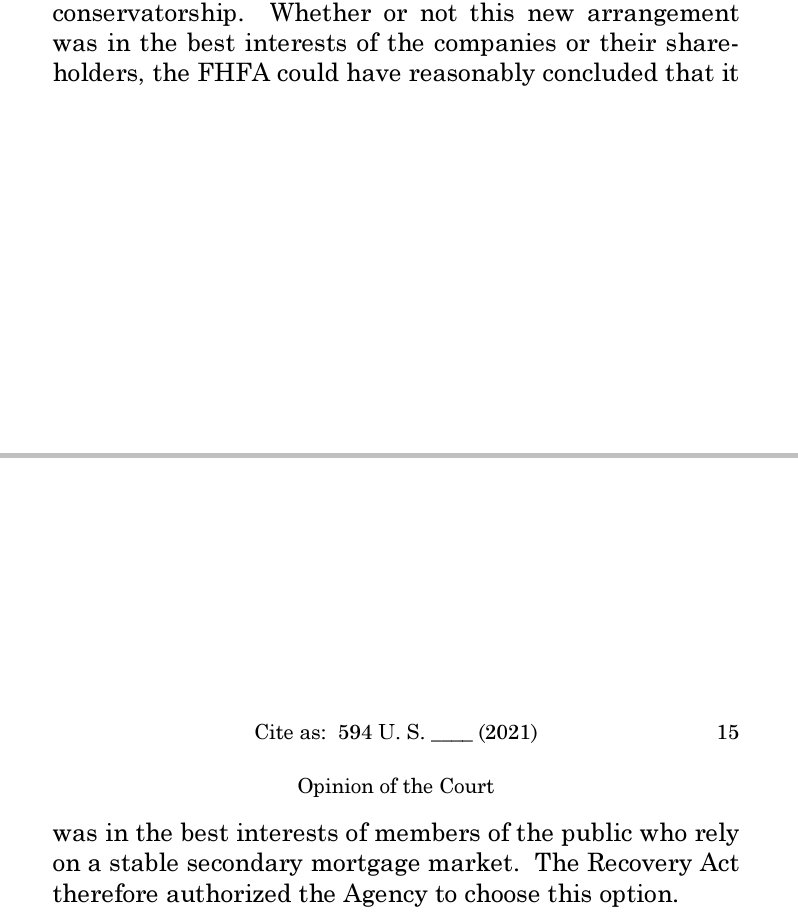

The Justice mixed up the Authority of UST to Purchase Obligations (SPS) that HERA required the emergency determination(ii)to prevent disruptions in the availability of mortgage finance, with the rehabilitation of FnF, which is exclusively the FHFA-C's power: "Put FnF in a sound

The Justice mixed up the Authority of UST to Purchase Obligations (SPS) that HERA required the emergency determination(ii)to prevent disruptions in the availability of mortgage finance, with the rehabilitation of FnF, which is exclusively the FHFA-C's power: "Put FnF in a sound

FDI Act: 12USC1821(d); 12USC1831o(d)

FDI Act: 12USC1821(d); 12USC1831o(d)

https://twitter.com/CarlosVignote/status/1379305622701801473

It seems that he copy/pasted the flawed ruling from J.Sweeney:

It seems that he copy/pasted the flawed ruling from J.Sweeney:

Corroborated also in the preface of the Final Rule,making clear that there is a law that contemplates the Capital distribution while in Conservatorship(besides talking about its Rehab power)

Corroborated also in the preface of the Final Rule,making clear that there is a law that contemplates the Capital distribution while in Conservatorship(besides talking about its Rehab power)

https://twitter.com/CarlosVignote/status/1402836251753938948

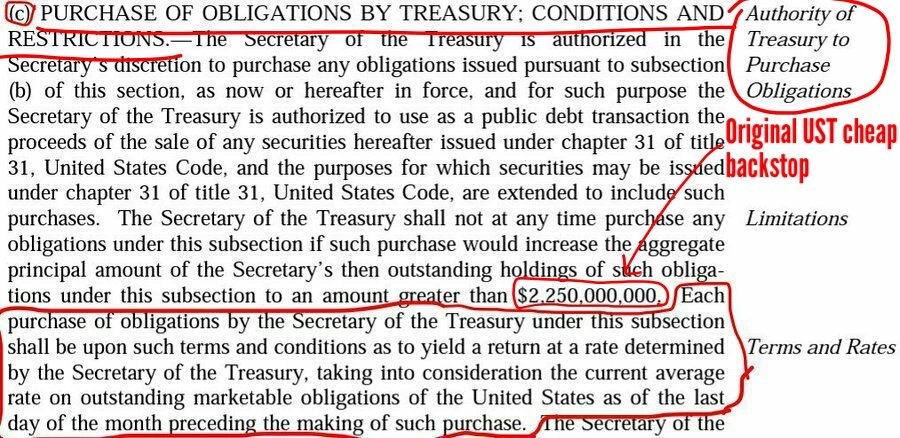

The judge cites an authority of UST(added by HERA)to purchase UNLIMITED YIELD obligations SPS +Warrant(iii)to protect the taxpayer.

The judge cites an authority of UST(added by HERA)to purchase UNLIMITED YIELD obligations SPS +Warrant(iii)to protect the taxpayer.

https://twitter.com/CarlosVignote/status/1402494190655844352

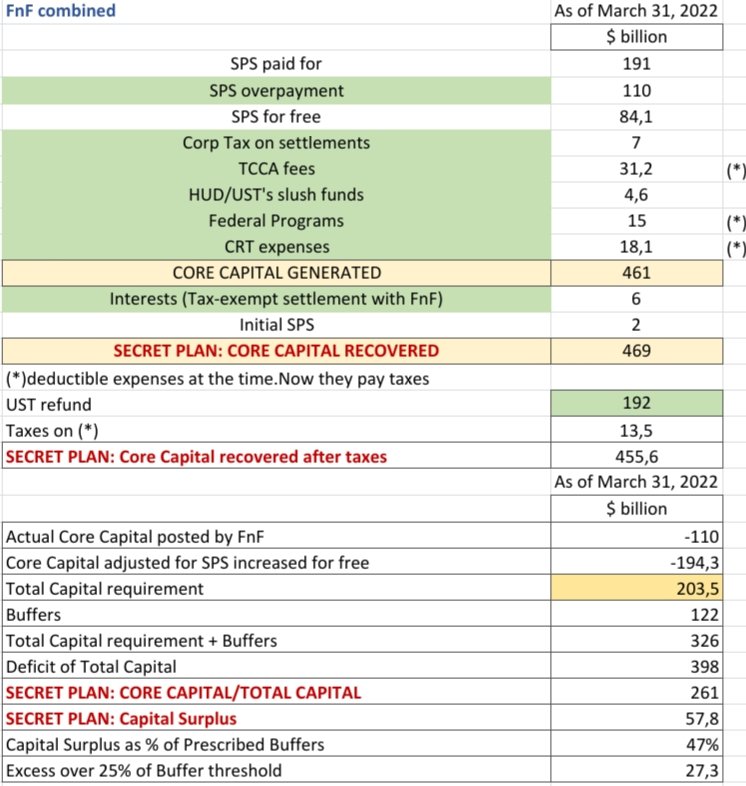

FnF are building up Capital($205b C requirement)w/ the div suspended.Blame FHFA.The crooks Pagliara,Bradford,C.Phillips,Rosner,etc,run the story of Govt theft instead,maintaining the expectation of a Court resolution,when the lawsuits are the problem(Capital deficit not targeted)

FnF are building up Capital($205b C requirement)w/ the div suspended.Blame FHFA.The crooks Pagliara,Bradford,C.Phillips,Rosner,etc,run the story of Govt theft instead,maintaining the expectation of a Court resolution,when the lawsuits are the problem(Capital deficit not targeted)

https://twitter.com/CarlosVignote/status/1402099896753147915

Yellen's proposal could be a 15% rate on foreign Cos subsidiaries of 🇺🇸Cos w/ a 15% min Corp Tax & a credit of 100% of the foreign rate.

Yellen's proposal could be a 15% rate on foreign Cos subsidiaries of 🇺🇸Cos w/ a 15% min Corp Tax & a credit of 100% of the foreign rate.

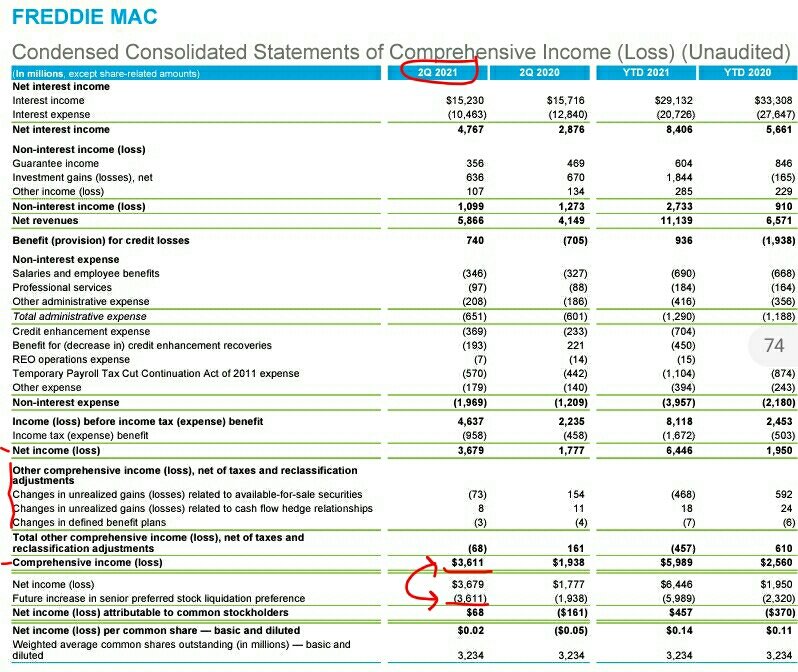

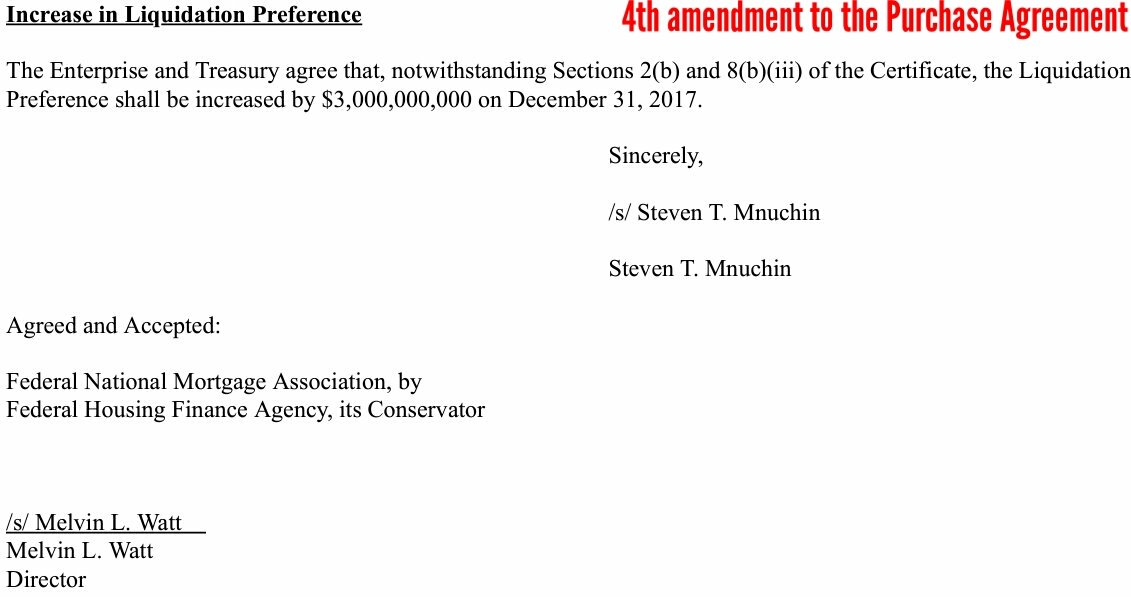

But we see in the balance sheet that it's NEVER recorded. Since the 4th amdnt to PA(Dec 2017),the SPS in the balance sheet don't match the real data(Fin Statement Fraud)in order to don't post the offset(Reduction of Retained Earnings,once Additional Paid-In Capital was exhausted)

But we see in the balance sheet that it's NEVER recorded. Since the 4th amdnt to PA(Dec 2017),the SPS in the balance sheet don't match the real data(Fin Statement Fraud)in order to don't post the offset(Reduction of Retained Earnings,once Additional Paid-In Capital was exhausted)

The key is that it emanates from the provision in the Charter Act called: Authority of UST to Purchase Obligations.Terms and Conditions.

The key is that it emanates from the provision in the Charter Act called: Authority of UST to Purchase Obligations.Terms and Conditions.

https://twitter.com/YPFSatYale/status/1384225714254217222

A report paid by the sponsors of the Moelis plan(J.Paulson/BX)to make the case for the corrupt plaintiffs:the coverup of the statutory provisions in the FHEFSSA and the Charter Act.

A report paid by the sponsors of the Moelis plan(J.Paulson/BX)to make the case for the corrupt plaintiffs:the coverup of the statutory provisions in the FHEFSSA and the Charter Act.

https://twitter.com/CarlosVignote/status/1384352334013247490

It took 2 yrs and 8 mths for the E.U. to take up the Article 33 of Delegated Regulation(EU)2015/2446 and claim that the shift in production of HOG isn't deemed to be "economically justified" on the basis of the facts(HOG's SEC filing was their exit strategy) to avoid the tariffs.

It took 2 yrs and 8 mths for the E.U. to take up the Article 33 of Delegated Regulation(EU)2015/2446 and claim that the shift in production of HOG isn't deemed to be "economically justified" on the basis of the facts(HOG's SEC filing was their exit strategy) to avoid the tariffs.