One thing that I think about a lot, but rarely get right, is understanding the ultimate "unlock" for a stock. $ASTS is obviously a story stock with myriad events coming over the next six months. What will ultimately be the unlock? Let's think about it and look at some examples

One example I had studied previously was Cheniere ($LNG). For those with memory, $LNG was a disaster for investors prior to 2008 as an import story (and before that, a near-shore seismic company). As it pivoted to export, there was a huge overhang to clear

$LNG had commercial risk (would people buy US LNG), regulatory risk (would FERC allow it), construction risk (could they get an EPC contract), financing risk (can they finance it), and management risk (CEO is a nutjob)

When looking at the progression of $LNG, there was the "MOU Phase" where commercial agreements were signed, but they were not finalized, and where perfunctory licenses and permits were secured (everyone got DOE FTA approvals). Did well, but then had some serious retracement

Next came the SPA phase, which are the Sales & Purchase Agreements. This proved to be the real unlock for $LNG. On October 2011, BG signed a 20-year 3.5mpta deal and the stock went up 200%. This proved to the market that something would happen. In short order, an EPC was done

The next phase I call the Expanded Market Phase. It is here that $LNG expanded from 1 trains at Sabine Pass to many trains across various sites. As the SPA's flowed it, the market rewarded the expanded TAM and the stock just worked and worked and worked

Interestingly, the return from "discounting the TAM" was higher than the "binary idea" risk phase. The initial unlock, though...paid well

$ASTS reminds me a bit of $LNG, although obviously the "will it work" factor is a little more acute when blasting something into space. Looking forward over the next six months, we have the following

Regulatory Risk: Let's simplify this and say it seems obvious the FCC approvals will be relevant to investors, but by the time they are due, SpaceMobile will already be operating and monetizing. This is unlikely to be the unlock. $ASTS already has the experimental license.

Management Risk: Unlike Cheniere, $ASTS does not have the same overhang. Abel seems very good and he's proving the ability to attract talent, as highlighted in my #MeetTheTeam thread

https://twitter.com/thekookreport/status/1423388471549317121?s=20&t=bTOcsXSB08qrgFcPTvFWNQ

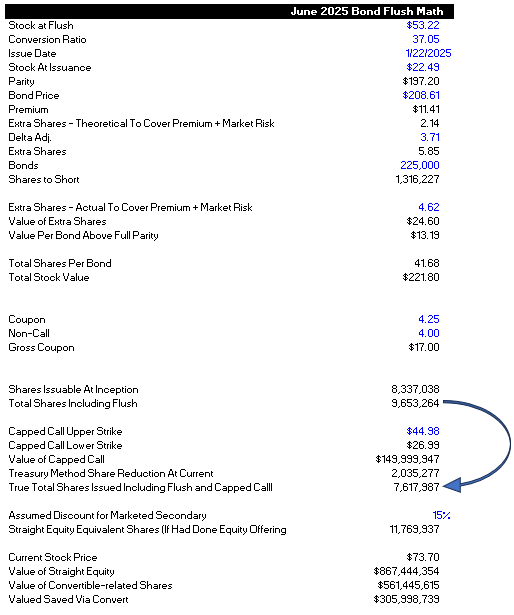

Financing Risk: But the Company continues to be ahead of the curve. For one, they raised $460mm in a SPAC. Now they have the committed equity line. My guess is we have some non-dilutive financing (trade facilities) help too. This is a risk after "it works," not before

Commercial Risk: $LNG announced a ton of MOUs with leading companies, those announcements definitely juiced the stock. The same has not been true for $ASTS, although arguably you could say those MOUs/Deals support the current market cap. Let's call it the latter

Technical Risk: No sh~t this is the big one. How will it be resolved? Clearly when BW-3 does its first phone call, a lot of uncertainty will be resolved, but we have seen the stock react significantly to SpaceX launch news items. Why? How is risk de-risked?

What is obvious to me is that the testing process is a) no joke, b) they literally break it on the ground, and c) once tested, satellites rarely fail. See this analysis for when I dug into this #FudBusters

https://twitter.com/thekookreport/status/1433652706200096769?s=20&t=bTOcsXSB08qrgFcPTvFWNQ

When $ASTS announces that it's wound up the Jack-In-The-Box, we know the testing is done, including a final attempt to destroy it simulated space conditions. The market might (correctly) treat this as a de-risking event more than it seem obvious at the present time

We will then get a lot of other "technical" events, such as the launch date, launch, unfolding, and first operations, etc. Hard to know which will matter

But then we move onto the BlueBird phase and making sure the company can deliver these at scale. I think this will be like the $TSLA Model 3 factory. Arguably another interval over which investors get paid to own the stock

Finally, we will have the execution phase / cash flow phase. I wouldn't discount the return here. For those who sit out the first phases and see some XXX% return and assume they "missed it," I am pretty sure that will not be the case. The $LNG shows this point in case.

We know that $ASTS has more cards up its sleeve. The TAM is probably much larger than we think, and we probably get government applications - which we already know is the case b/c of $T FirstNet literally on the FCC experimental license application

• • •

Missing some Tweet in this thread? You can try to

force a refresh