Here's a media literacy rule of thumb: any time you hear about how the courts have done something outrageous and absurd to some poor, long-suffering, gigantic, wildly profitable corporation...*dig deeper*. 1/

If you'd like an essay-formatted version of this thread to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

pluralistic.net/2022/06/12/hot… 2/

pluralistic.net/2022/06/12/hot… 2/

The canonical example is the "McDonald's Hot Coffee Story" (aka *Liebeck v. McDonald's*). You know, that time an old lady got burned by her McDonald's coffee and sued for for $2.7 million?! Most people heard about it - and they heard it for a reason.

en.wikipedia.org/wiki/Liebeck_v… 3/

en.wikipedia.org/wiki/Liebeck_v… 3/

The Hot Coffee story was propaganda - specifically, it was propaganda for the idea that corporations should be shielded from legal liability when they maim or even kill the public through gross negligence. 4/

The real Hot Coffee story is a lot more complicated than the "lady gets millions because her coffee was too hot" tale that circulated widely. 5/

One of the best explorations of the Hot Coffee story is @adamconover's "Adam Ruins The Hot Coffee Story" video from 2016, where Conover explains what *really* happened.

6/

6/

The coffee that burned Stella Liebeck in New Mexico in 1994 was served at 190°F. It caused third-degree burns that permanently disfigured Liebeck, required multiple skin grafts, and disabled her for two years. 7/

The surgery was so drastic that Liebeck lost 20% of her body-weight while she was recovering.

McDonald's had a history of serving coffee that was dangerously hot. 8/

McDonald's had a history of serving coffee that was dangerously hot. 8/

It had received *700* complaints about the matter, and had had to settle numerous claims from people who were horribly burned by its coffee. However, it declined to settle with Liebeck, who initially sought $20k to cover her medical expenses. 9/

Denied a settlement, she sued. The jury awarded $2.7m, but the judge lowered it to $640k. Liebeck didn't get that - she and McDonald's reached a confidential settlement under threat of McDonald's appeal.

The story isn't: "Old lady spills coffee and gets millions." 10/

The story isn't: "Old lady spills coffee and gets millions." 10/

It's "McDonald's ignores hundreds of dangerous incidents for years, then maims a customer for life and refuses to pay her medical bills or change its practices to avoid future incidents. 11/

"A judge says she's due a fraction of the jury award, but she doesn't get it because McDonald's uses its massive litigation war-chest to force her into a confidential settlement." 12/

So why did you hear so much about this story? And why was the moral of the story inevitably about how bloodsucking lawyers are victimizing poor l'il multinational corporations like Mickey Dees? 13/

It was propaganda. The "bloodsucking lawyers preying on innocent corporations" story is a creation of the business lobby, which has, for decades, argued that it should be immune to legal consequences when it harms or kills the public. 14/

The cause of "#TortReform" is, in actuality, a corporate charter of impunity.

It worked. Over the past four decades, corporations have steadily whittled away the public's right to civil justice, no matter how egregiously a corporation behaves. 15/

It worked. Over the past four decades, corporations have steadily whittled away the public's right to civil justice, no matter how egregiously a corporation behaves. 15/

The main mechanism for this was the expansion of #BindingArbitration, a 1920s-era law that initially allowed big companies to agree to have their contractual disputes worked out by a mediator, rather than going to court. 16/

Since the 1980s, a series of Supreme Court decisions have steadily expanded binding arbitration, allowing corporations to add "arbitration waivers" to their terms of service, employment contracts and other non-negotiated boilerplates. 17/

Today, the mere act of removing some shrinkwrap or clicking a link can result in the permanent loss of your right to sue, no matter how badly a company treats you. 18/

Instead, your grievances will be heard by a corporate arbitrator, a pretend judge who is *paid by the company that wronged you*. Your case must be heard in isolation, and not part of a class action. 19/

The proceedings are secret, and even if you win, you don't set a precedent for others who are similarly wronged. It's "a justice system just for corporations."

onthecommons.org/magazine/we-no… 20/

onthecommons.org/magazine/we-no… 20/

American corporations pushed the expansion of binding arbitration waivers as a get-out-of-court-free card, and for many years, it worked. Remember when Wells Fargo forged millions of its customers' signatures to fraudulently open high-fee accounts in their names? 21/

The company argued that because the forged agreements included arbitration waivers, those customers couldn't sue over the fraud:

thenation.com/article/the-ce…

Everybody got in on the act. If you're a Pokemon Go player, you're stuck in binding arbitration:

consumerist.com/2016/07/14/pok… 22/

thenation.com/article/the-ce…

Everybody got in on the act. If you're a Pokemon Go player, you're stuck in binding arbitration:

consumerist.com/2016/07/14/pok… 22/

Unsurprisingly, Trump *loved* binding arbitration. One of his first acts as president was to strip nursing home residents of the right to sue, which was great news for the nursing homes that murdered patients by abandoning them to covid:

consumerreports.org/consumerist/tr… 24/

consumerreports.org/consumerist/tr… 24/

(Older voters love the GOP, but it sure as hell doesn't love them back.)

Forced arbitration wasn't just a matter of civil justice - it was also a matter of economics. 25/

Forced arbitration wasn't just a matter of civil justice - it was also a matter of economics. 25/

As @linakhanFTC and @deepakguptalaw showed in their 2016 @acslaw paper "Arbitration As Wealth Transfer," "Forced arbitration clauses are a form of wealth transfer to the rich":

acslaw.org/issue_brief/br… 26/

acslaw.org/issue_brief/br… 26/

But the business leaders who bankrolled the forced arbitration epidemic were - characteristically - overconfident. It turns out that arbitration has weaknesses. 27/

It's possible to do *mass arbitration* - to automate filing arbitration claims by thousands of corporate victims, which triggers hundreds of millions of dollars in arbitration fees, which the company is on the hook for, win or lose. 28/

Uber was one of the first companies to discover this, when thousands of drivers brought arbitration claims at once. 29/

Not only would Uber have to pay for arbitrators in each case, but because arbitration decisions do not constitute precedents, it would have to argue each case, over and over again, even if it won. The company surrendered and paid drivers $146m:

reuters.com/legal/governme… 30/

reuters.com/legal/governme… 30/

This spooked Amazon, which amended its terms of service for Alexa to *remove* binding arbitration:

pluralistic.net/2021/06/02/arb…

Law-tech firms like Fairshake created automation systems to enable mass arbitration filings at scale and on a budget:

pluralistic.net/2020/04/11/soc… 31/

pluralistic.net/2021/06/02/arb…

Law-tech firms like Fairshake created automation systems to enable mass arbitration filings at scale and on a budget:

pluralistic.net/2020/04/11/soc… 31/

Something *wonderful* and wild started to happen. Companies that had argued for *decades* that binding arbitration was, well, *binding*, began to argue that arbitration waivers were *unconstitutional*, despite the precedents that they had bankrolled, at *enormous* expense. 32/

The poster child of arbitration buyer's remorse is Intuit, a company that has stolen hundreds of millions of dollars in tax-prep fees from the poorest Americans by tricking them into fake "Free File" products using dark patterns on its website. 33/

Intuit is now facing arbitration at scale - more than 100,000 claims - and a court has ordered them to hire arbitrators to hear each and every one of them. 34/

After all it was Intuit - not its customers - who put the arbitration clauses in its terms of service, claiming that court cases were a bad way to resolve their disputes:

pluralistic.net/2020/04/11/soc… 35/

pluralistic.net/2020/04/11/soc… 35/

Which brings me back to McDonald's, hot coffee, and juicy stories about giant corporations being abused by the courts.

Have you heard about the Geico STD judgment? A woman caught an STD from her then-boyfriend when they had sex in his car. 36/

Have you heard about the Geico STD judgment? A woman caught an STD from her then-boyfriend when they had sex in his car. 36/

She won a judgment against him for $5.2m. Geico insures his car. A court has ordered Geico to pay that judgment.

yahoo.com/news/jackson-c…

But it's more complicated than that!

It's not a *court* that ordered Geico to pay the judgment - it's an *arbitrator*. 37/

yahoo.com/news/jackson-c…

But it's more complicated than that!

It's not a *court* that ordered Geico to pay the judgment - it's an *arbitrator*. 37/

Geico is one of the companies that forces its customers into arbitration. Why would an insurance company want arbitrators to hear cases about its refusal to pay claims, rather than judges? 38/

I mean, duh. Insurance companies have a long, dishonorable tradition of taking your premiums every month, then stranding you when you actually experience an "insured event," arguing that the obscure, obfuscating language in their contract doesn't cover your losses. 39/

The *real* Geico STD story is this: Geico *demanded* that the case be heard by its arbitrator, who ruled against Geico, because Geico's insurance terms *did* cover this event. 40/

Now, Geico is claiming that the arbitration *it insisted upon* "violates the company's due process rights" and that *its own arbitration agreement is unenforceable.*

The case that's being reported on isn't about the $5.2m award for the STD. That happened way back in 2021. 41/

The case that's being reported on isn't about the $5.2m award for the STD. That happened way back in 2021. 41/

The case that's in the news this week is a court telling Geico that when it forces its customers into arbitration, it has to abide by the arbitrator's decision, even in those rare instances in which the arbitrator finds against the company who pays their fees. 42/

But you wouldn't know it from the coverage. All this stuff about arbitration is buried way down in the story. The headline is: $5.2m judgment for a venereal disease! 43/

This is McDonald's Hot Coffee 2.0. Someone *pitched* this story, and the pitch emphasized the poor, downtrodden corporation (Geico is owned by Warren Buffet and has $32b in assets) - not the fact that Geico is reaping what it sowed. 44/

The real story here is: "Corporation seeks to replace civil justice system with a kangaroo court, and gets kicked by its own kangaroo." 45/

Incidentally, if you miss Adam Conover's "Adam Ruins Everything" and you have a Netflix password, check out "The G-Word," his incredible new show about regulatory competence and the deadly threats it holds at bay:

netflix.com/title/81037116 46/

netflix.com/title/81037116 46/

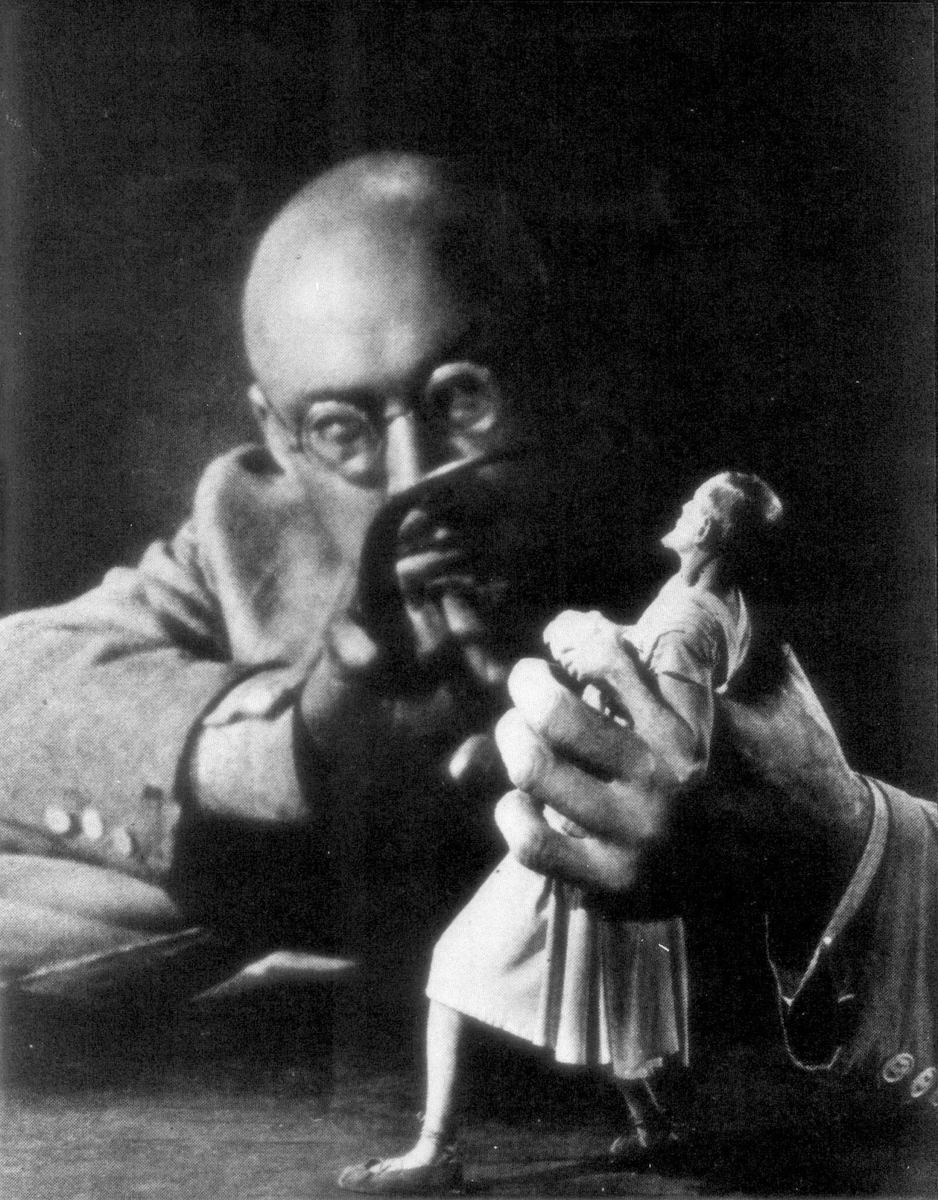

Image:

Adam Ruins Everything/College Humor (modified)

Fair use

eff.org/issues/intelle…

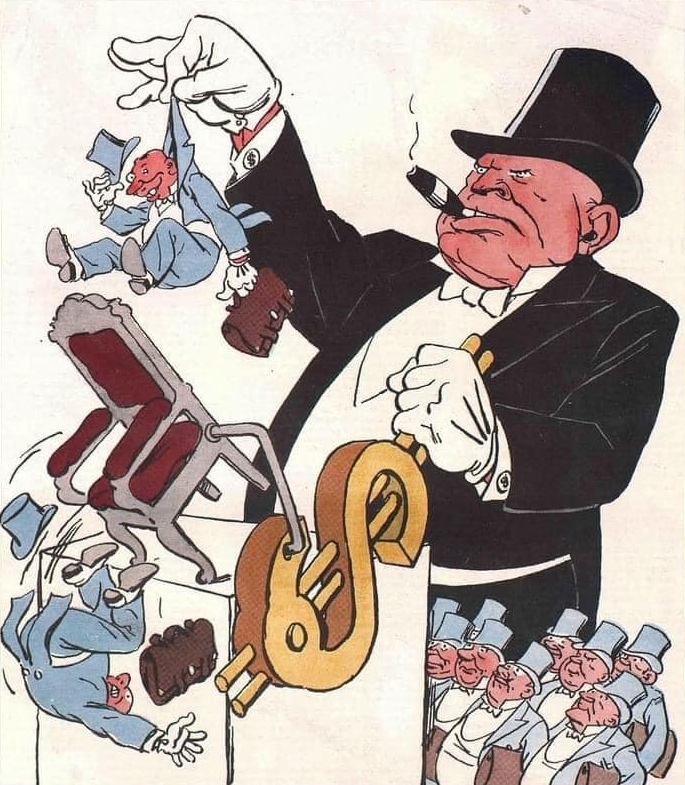

Geico (modified)

geico.com

Fair use

eff.org/issues/intelle… 47/

Adam Ruins Everything/College Humor (modified)

Fair use

eff.org/issues/intelle…

Geico (modified)

geico.com

Fair use

eff.org/issues/intelle… 47/

• • •

Missing some Tweet in this thread? You can try to

force a refresh