Why I invested 3% into a Swedish Serial Acquirer that achieved a 31% CAGR since its SECOND IPO in 2014

A small thread about $LIFCO 🧵

A small thread about $LIFCO 🧵

Wait who?

Lifco started in 1946 as a medical equipment company, but the real story starts in 1998 when Carl Bennet took a majority stake in the business. He then in 2000 took it private to do restructuring and IPOed again in 2014

Lifco started in 1946 as a medical equipment company, but the real story starts in 1998 when Carl Bennet took a majority stake in the business. He then in 2000 took it private to do restructuring and IPOed again in 2014

What do they do?

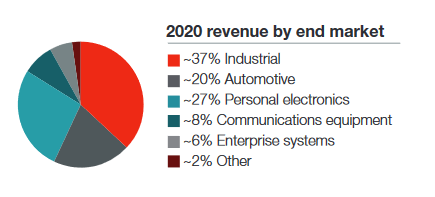

Lifco is a serial acquirer and long-term owner of companies in the Dental, Demotion & Tools and System Solutions industry.

Over the years Lifco purchased hundreds of companies and has a widely diversified portfolio

Lifco is a serial acquirer and long-term owner of companies in the Dental, Demotion & Tools and System Solutions industry.

Over the years Lifco purchased hundreds of companies and has a widely diversified portfolio

There are many similarities to $CSU.TO to be drawn:

- Both companies never sell companies(some exceptions for Lifco)

- Look for stable, long-term growth

- Let purchased companies continue operating, but offer expertise and their network

- Both companies never sell companies(some exceptions for Lifco)

- Look for stable, long-term growth

- Let purchased companies continue operating, but offer expertise and their network

Like Constellation Software, Lifco also has a highly decentralized organization where the focus is on driving value creation and cutting down on bureaucracy.

Both aim to own leaders in niche businesses with small TAM, but low churn and pricing power.

Both aim to own leaders in niche businesses with small TAM, but low churn and pricing power.

CapEx

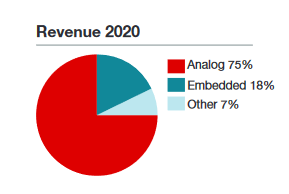

The first thing that came to my mind when I heard that Lifco is an industrial business was high CapEx. It turns out that Lifco is a fan of lean production models and outsources a lot of basic manufacturing and non-value creating activities, resulting in only 2% capex/rev.

The first thing that came to my mind when I heard that Lifco is an industrial business was high CapEx. It turns out that Lifco is a fan of lean production models and outsources a lot of basic manufacturing and non-value creating activities, resulting in only 2% capex/rev.

As a result of this asset-light business model, Lifco has been able to steadily grow its revenues and cash flows at mid-double-digit rates. This leaves more cash to acquire businesses, their bread and butter.

There are many opinions about #ESG and I won't dive into that discussion. But it's worth noting that Lifco has several ESG measures in its due diligence when selecting companies to purchase. All subsidiaries must apply the Code of Conduct and a whistleblower system is in place.

The main objective: Increase profits.

Lifco has had a great track record with 13% Sales CAGR and 17.9% EBITA CAGR over the last 16 years. The results speak for themselves.

Lifco has had a great track record with 13% Sales CAGR and 17.9% EBITA CAGR over the last 16 years. The results speak for themselves.

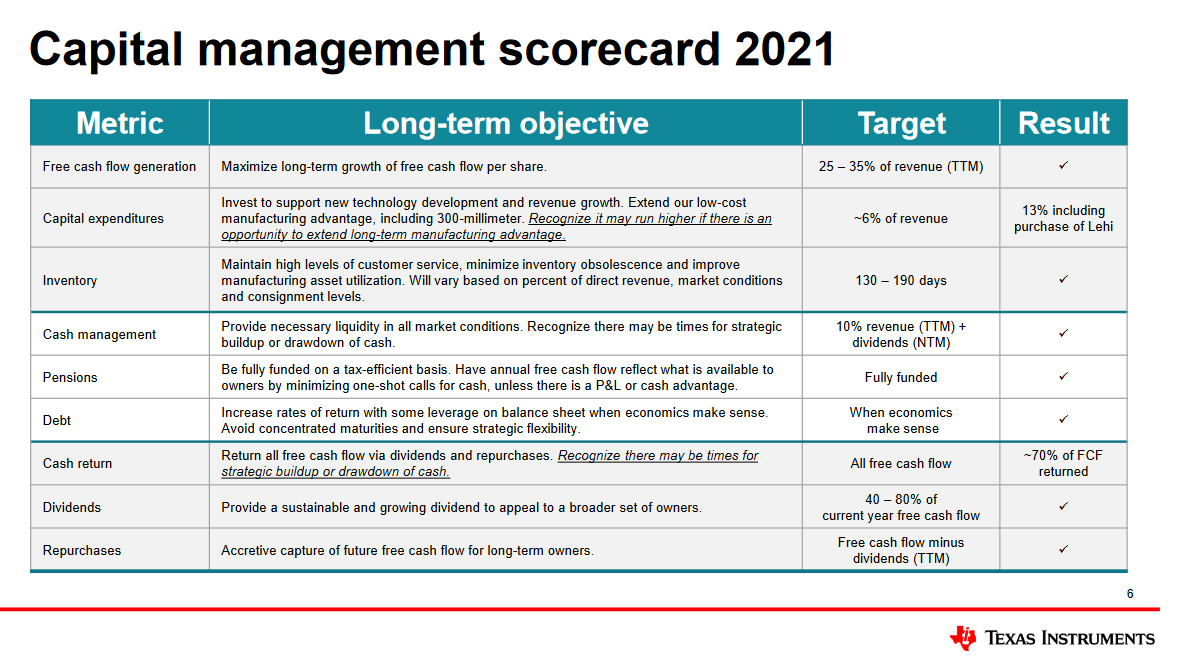

I put a lot of emphasis on Capital allocation and that's where Lifco excels (otherwise why would they have an acquisitive business model). They consistently achieve returns on capital employed around 20%.

Like $CSU, Lifco has never issued a share since going public. The company returns money to shareholders via a small dividend(30-50% of profits according to the strategy). A big difference to Constellation is the higher debt level. They aim for 2-3 times debt/EBITDA, currently 1.8

An acquisitive business rises or falls with the management. Lifco has a great management team with long tenures and skin in the game.

Another interesting aspect is regional diversification: Lifo has around 80% of revenues coming from Europe, where they are the dominant player in a lot of their segments.

At a 24 times forward earnings and 3% FCF yield, Lifco isn't the greatest bargain in the market, but you're getting a high-quality compounding machine at a fair price. I opened a 3% position today and might increase it in the future if opportunities arise.

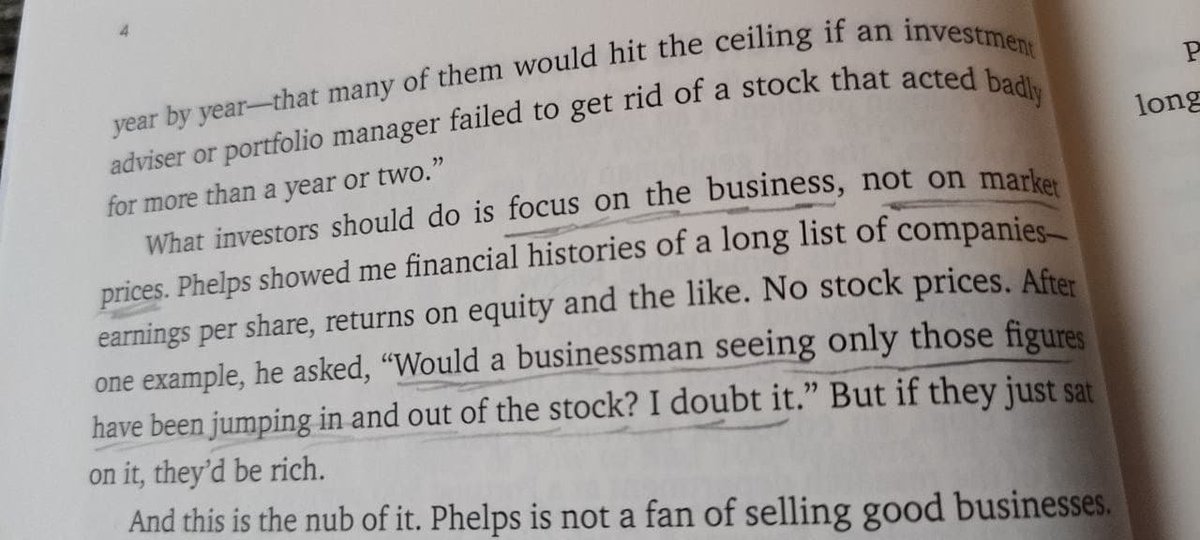

A big shoutout to @chriswmayer, listening to a podcast about his great Book "100 baggers", he mentioned Lifco and I started to dig deeper.

I hope you liked this thread, if you did consider liking, retweeting and following me. Do you own $LIFCO? What do you think about Serial Acquirers in general? Let me know.

Tagging some compounder fans

@CJ0ppel @acquirers_club @SerialAcquirers @Invesquotes @long_equity @Investmentideen @MoS_Investing @SleepwellCap @ArneUlland @BradoCapital @Finding_Moats @PartnershipInv

@CJ0ppel @acquirers_club @SerialAcquirers @Invesquotes @long_equity @Investmentideen @MoS_Investing @SleepwellCap @ArneUlland @BradoCapital @Finding_Moats @PartnershipInv

• • •

Missing some Tweet in this thread? You can try to

force a refresh