It's not over yet...

3AC Liquidation ETH Price:

1042..?

Health factor 1.13... liquidates at 1.00

God speed comrades...

3AC Liquidation ETH Price:

1042..?

Health factor 1.13... liquidates at 1.00

God speed comrades...

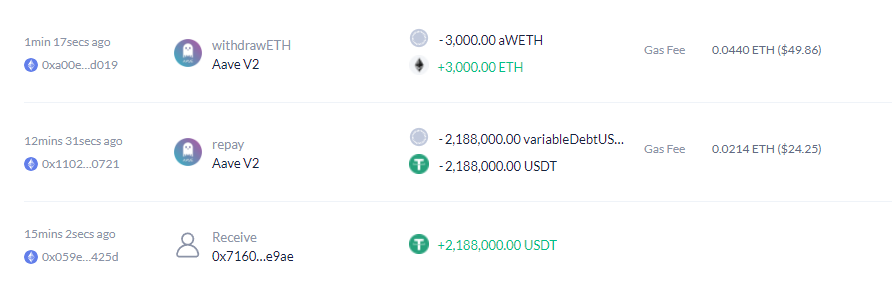

Kinda cute, they are:

sending ETH to a different wallet,

then selling the ETH,

then sending back USDC to original wallet,

then pay back their loan.

Another 3M usdc paid off

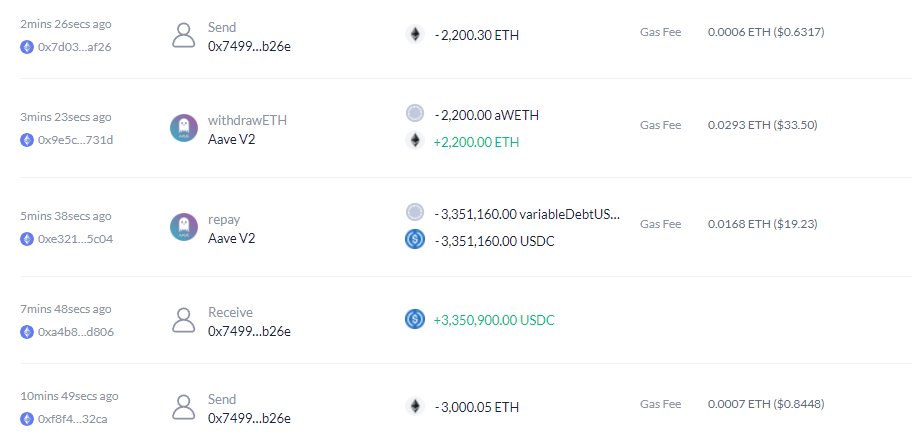

sending ETH to a different wallet,

then selling the ETH,

then sending back USDC to original wallet,

then pay back their loan.

Another 3M usdc paid off

Looks like they still have another $3M in eth on this wallet alone they could still use.

And another $3M of ETH in the wallet they're using to sell.

Still an easy $6M of eth they can sell and pay back.

And another $3M of ETH in the wallet they're using to sell.

Still an easy $6M of eth they can sell and pay back.

There we go. That $6M in ETH also sold off for stables.

3AC Liquidation ETH Price: $1018

• • •

Missing some Tweet in this thread? You can try to

force a refresh