Just published my latest deep dive for @KaikoData looking at the lack of stETH liquidity right now and the trouble that's causing the likes of Celsius.

I also looked at the avenues Celsius and others might be going down as we speak with their stETH

Time for a thread 🧵👇

I also looked at the avenues Celsius and others might be going down as we speak with their stETH

Time for a thread 🧵👇

1) stETH, Lido's liquid token for staked ETH, is at the heart of the liq problems for Celsius, 3AC and others.

Due to a persistent discount relative to #ETH, these entities face large losses if they redeem stETH.

Trouble is, client withdrawals are forcing their hands

Due to a persistent discount relative to #ETH, these entities face large losses if they redeem stETH.

Trouble is, client withdrawals are forcing their hands

2) A rush to swap stETH for ETH has led to a lack of liquidity left in the Curve pool for the pair.

Below is the comparison for the liquidity of the Curve pool a month ago vs now.

Over half the ETH in the pool has been drained and total USD liquidity has fallen by over $1bn.

Below is the comparison for the liquidity of the Curve pool a month ago vs now.

Over half the ETH in the pool has been drained and total USD liquidity has fallen by over $1bn.

3) This lack of liquidity on Curve has left Celsius and others with limited options.

Celsius hold $450m worth of stETH

I checked to if they sold stETH on centralised exchanges

Nothing showed up in the volumes of any decent size (topped at $10m)

Celsius hold $450m worth of stETH

I checked to if they sold stETH on centralised exchanges

Nothing showed up in the volumes of any decent size (topped at $10m)

4) Can they even sell on centralized exchanges?

Nope.

Market depth on the #stETH pair on @FTX_Official was only $300k and has since fallen to >$50k as smaller players have sapped all liquidity

Nope.

Market depth on the #stETH pair on @FTX_Official was only $300k and has since fallen to >$50k as smaller players have sapped all liquidity

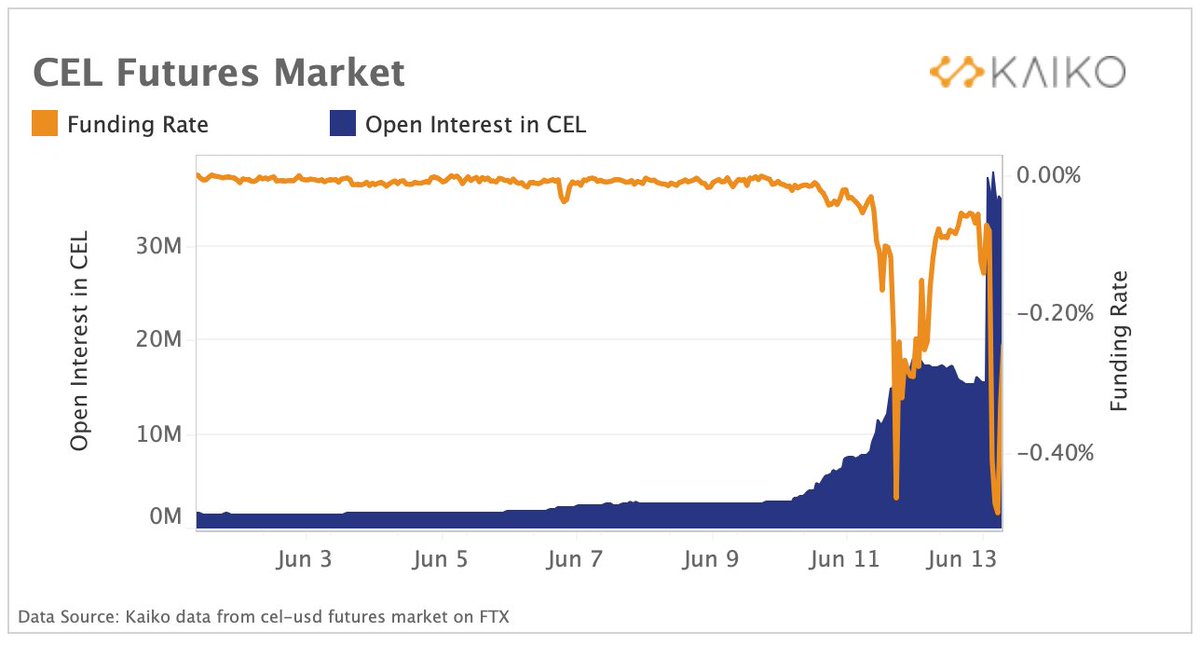

5) The lack of options for Celsius was evident in the futures markets where we saw a huge negative reaction

Open interest spiked while funding rates dipped sharply negative, indicating investors were loading up on short positions

Open interest spiked while funding rates dipped sharply negative, indicating investors were loading up on short positions

6) So how are @CelsiusNetwork not insolvent yet?

They've paused withdrawals to buy them enough time to make some moves

We saw a huge amount of burns in both tokens from the Curve pool as Celsius and others pulled their stETH out and were seen sending it to FTX on-chain

They've paused withdrawals to buy them enough time to make some moves

We saw a huge amount of burns in both tokens from the Curve pool as Celsius and others pulled their stETH out and were seen sending it to FTX on-chain

7) As I pointed out earlier, these volumes never hit the spot markets on FTX

So where did they go? Some form of OTC deal think

A look at ETH futures markets on exchanges shows an anomaly on FTX...coincidence?

So where did they go? Some form of OTC deal think

A look at ETH futures markets on exchanges shows an anomaly on FTX...coincidence?

7) cont. FTX Open interest in USD is rising while the rest are crashing

USD OI falls when prices fall due to liquidations and price effects on the total figure itself

FTX rising means big positions were entered into, and I've a couple of theories that relate to Celsius and co

USD OI falls when prices fall due to liquidations and price effects on the total figure itself

FTX rising means big positions were entered into, and I've a couple of theories that relate to Celsius and co

8) Theory no.1

Celsius OTC deal through FTX to use or swap their stETH to go short ETH futures, allowing them to profit if ETH fell lower by closing out the contract at a lower price.

Pausing withdrawals gives time to profit off this position at a later stage

Celsius OTC deal through FTX to use or swap their stETH to go short ETH futures, allowing them to profit if ETH fell lower by closing out the contract at a lower price.

Pausing withdrawals gives time to profit off this position at a later stage

9) Theory no.2

FTX or some market maker is taking in stETH from Celsius at a significant discount in order to profit once stETH is redeemable 1:1 for ETH.

They used short futures on ETH via FTX to hedge any ETH price exposure

FTX or some market maker is taking in stETH from Celsius at a significant discount in order to profit once stETH is redeemable 1:1 for ETH.

They used short futures on ETH via FTX to hedge any ETH price exposure

10) That's all just speculation and I could easily be wrong, but that's the nature of OTC deals, it's impossible to know.

If you want to read the article in full the link is below, had a lot of fun putting it together

Drop a like for the cheesy title 🧀

blog.kaiko.com/celsius-reache…

If you want to read the article in full the link is below, had a lot of fun putting it together

Drop a like for the cheesy title 🧀

blog.kaiko.com/celsius-reache…

• • •

Missing some Tweet in this thread? You can try to

force a refresh