1/

This Lido fiasco has created a mess of everything and for no reason, ETH is suffering, and most importantly users

There are different versions of this story but more or less it's close to what I could analyze

This Lido fiasco has created a mess of everything and for no reason, ETH is suffering, and most importantly users

There are different versions of this story but more or less it's close to what I could analyze

2/

This liquid staking concept i.e, the derived asset itself works as a full-fledged tradeable asset with other utilities like lending, staking, etc.

It's more like the US housing market collapse in the 2000s

This liquid staking concept i.e, the derived asset itself works as a full-fledged tradeable asset with other utilities like lending, staking, etc.

It's more like the US housing market collapse in the 2000s

3/

Here is one version of the story:

At Lido, stake ETH and get stETH in a 1:1 ratio. Now use that stETH for other purposes

On the other hand, Lido generates money using stETH through lending/borrowing, arbitrage, and other trade opportunities

So far so good

Here is one version of the story:

At Lido, stake ETH and get stETH in a 1:1 ratio. Now use that stETH for other purposes

On the other hand, Lido generates money using stETH through lending/borrowing, arbitrage, and other trade opportunities

So far so good

4/

Now Celsius comes into the picture:

It takes ETH from users, stakes in Lido, and gets stETH. Now uses a chunk of stETH as collateral to borrow stable money to invest in a project that is no longer in existence. So, this money is gone!

Now Celsius comes into the picture:

It takes ETH from users, stakes in Lido, and gets stETH. Now uses a chunk of stETH as collateral to borrow stable money to invest in a project that is no longer in existence. So, this money is gone!

5/

Panic triggering moment: stETH de-pegs/loses its 1:1 value against ETH

As a user, I don't want to be part of another LUNA-UST crash. So, I start off-loading both ETH and stETH to move my assets to a more stable position to minimize my risk

Panic triggering moment: stETH de-pegs/loses its 1:1 value against ETH

As a user, I don't want to be part of another LUNA-UST crash. So, I start off-loading both ETH and stETH to move my assets to a more stable position to minimize my risk

6/

Being Celsius, I don't have money as a major chunk of it was used to get stable coins for investment which is gone

Now if I sell stETH, I am at a further loss as prices are down plus users withdrawing. So, let's freeze the withdrawals because there is no money

More panic!

Being Celsius, I don't have money as a major chunk of it was used to get stable coins for investment which is gone

Now if I sell stETH, I am at a further loss as prices are down plus users withdrawing. So, let's freeze the withdrawals because there is no money

More panic!

7/ Output: More chaos, more panic, and more price downfall

And currently,

stETH is off the track by more than 5%

And currently,

stETH is off the track by more than 5%

8/

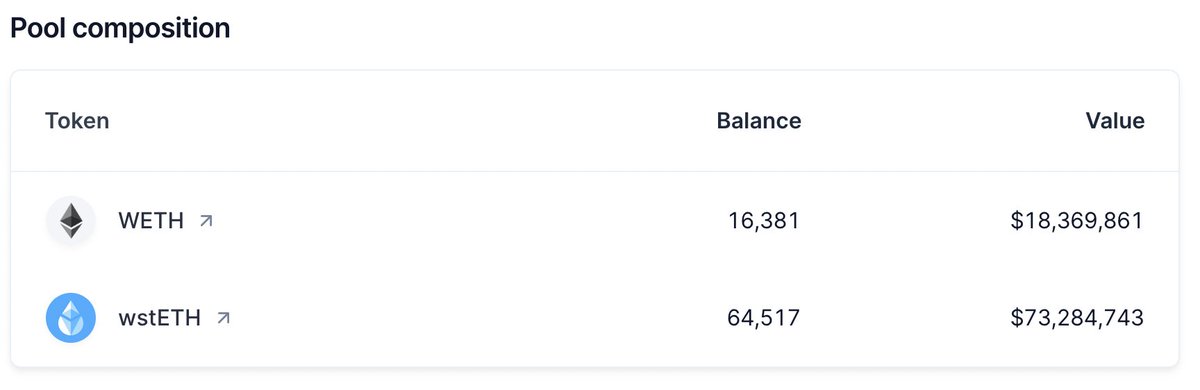

Balancer and curve both have like 80% in stETH and 20% in ETH

Just to get an idea of how big this has got, just have a look at the ecosystem: lido.fi/lido-ecosystem

Balancer and curve both have like 80% in stETH and 20% in ETH

Just to get an idea of how big this has got, just have a look at the ecosystem: lido.fi/lido-ecosystem

9/

A few other things also happened

- stETH was sent to FTX also, most likely to sell

- Alameda Research withdrew 100K ETH from Celsius which created a sense that it might be dumped and before that happens, let's dump our's too

And it went on!

#LIDO #CelsiusNetwork #Crypto

A few other things also happened

- stETH was sent to FTX also, most likely to sell

- Alameda Research withdrew 100K ETH from Celsius which created a sense that it might be dumped and before that happens, let's dump our's too

And it went on!

#LIDO #CelsiusNetwork #Crypto

• • •

Missing some Tweet in this thread? You can try to

force a refresh