One of the LARGEST Crypto Venture Capital firms:

Three Arrows Capital.

They're becoming insolvent.

With potentially $18b under management, this could be catastrophic for Crypto.

Here's a timeline of what's going on and the possible consequences:

↓↓↓

Three Arrows Capital.

They're becoming insolvent.

With potentially $18b under management, this could be catastrophic for Crypto.

Here's a timeline of what's going on and the possible consequences:

↓↓↓

Who is Three Arrows Capital?

(I'll refer to them as 3AC)

One of the largest Crypto focused Venture Capital firms in the world.

Started by high school classmates @zhusu and @KylesLdavies in 2012.

Initially based in Singapore 🇸🇬, they've recently moved to Dubai 🇦🇪.

(I'll refer to them as 3AC)

One of the largest Crypto focused Venture Capital firms in the world.

Started by high school classmates @zhusu and @KylesLdavies in 2012.

Initially based in Singapore 🇸🇬, they've recently moved to Dubai 🇦🇪.

@zhusu @KylesLdavies Some of their best investments include:

• Avax 🔺

• Near

• Aave

• Derabit

• Starkware

• Terra Luna

• Axie Infinity

Their assets under management were estimated to be between $10-$18b.

A top 5 VC firm - their power and influence went far in this industry.

• Avax 🔺

• Near

• Aave

• Derabit

• Starkware

• Terra Luna

• Axie Infinity

Their assets under management were estimated to be between $10-$18b.

A top 5 VC firm - their power and influence went far in this industry.

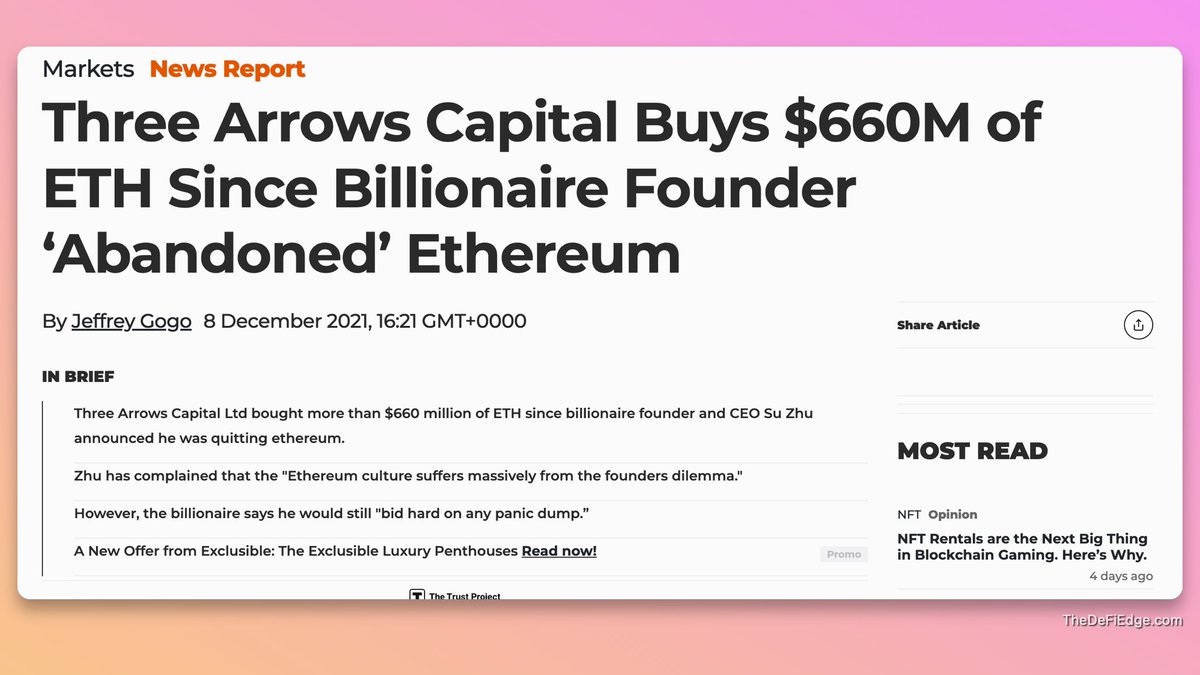

@zhusu @KylesLdavies Psyops and Mind Games

Zhu is influential, with an audience of >560k on Twitter.

He was also known for playing plenty of mind games (Psyops) with his audience.

For example, he created a thread fudding Ethereum, which caused the price to drop.

Zhu is influential, with an audience of >560k on Twitter.

He was also known for playing plenty of mind games (Psyops) with his audience.

For example, he created a thread fudding Ethereum, which caused the price to drop.

https://twitter.com/zhusu/status/1462216210116853762?lang=en

@zhusu @KylesLdavies And then he purchased Ethereum afterward at a lower price point.

So whenever Zhu makes a claim, the industry doesn't know if he's serious or playing mind games on us for his profit.

So whenever Zhu makes a claim, the industry doesn't know if he's serious or playing mind games on us for his profit.

@zhusu @KylesLdavies He was a huge proponent of the Supercycle theory.

In Feb 2021, he projected that the price of BTC would reach $2.5 million on an episode of UpOnly.

A few weeks ago, he announced that his thesis on the Supercycle was wrong.

In Feb 2021, he projected that the price of BTC would reach $2.5 million on an episode of UpOnly.

A few weeks ago, he announced that his thesis on the Supercycle was wrong.

https://twitter.com/zhusu/status/1530160645294931973?ref_src=twsrc%5Etfw

@zhusu @KylesLdavies 3AC Backs Terra Luna

Before the Terra collapse last month, 3AC spent $559.6 million to buy Locked Luna.

It's now worth roughly ~$670.

There is SPECULATION that the massive losses of Luna caused them to use more leverage to earn it back.

Also known as "Revenge trading"

Before the Terra collapse last month, 3AC spent $559.6 million to buy Locked Luna.

It's now worth roughly ~$670.

There is SPECULATION that the massive losses of Luna caused them to use more leverage to earn it back.

Also known as "Revenge trading"

@zhusu @KylesLdavies The Dangers of Leverage

"There are three ways a smart person can go broke: liquor, ladies, and leverage." - Charlie Munger

Token prices have crashed over the past few weeks.

If your collateral value is lowering, you're at risk of liquidation.

"There are three ways a smart person can go broke: liquor, ladies, and leverage." - Charlie Munger

Token prices have crashed over the past few weeks.

If your collateral value is lowering, you're at risk of liquidation.

@zhusu @KylesLdavies How LIQUID is 3AC?

We know 3AC has made some fantastic investments, but many of the tokens are locked and illiquid for years.

So if they're getting margin called, it will to be tough to repay the loans if they don't have the liquidity available.

We know 3AC has made some fantastic investments, but many of the tokens are locked and illiquid for years.

So if they're getting margin called, it will to be tough to repay the loans if they don't have the liquidity available.

@zhusu @KylesLdavies The First Signs of Insolvency

Degen trading claims that 3AC borrows from every major lender.

And they're at risk of being liquidated on many of their positions.

Degen trading claims that 3AC borrows from every major lender.

And they're at risk of being liquidated on many of their positions.

https://twitter.com/hodlKRYPTONITE/status/1536902115540742144

@zhusu @KylesLdavies Rumors of Liquidation

Rumors started swirling that 3AC was about to be liquidated against its $264m ETH position.

• Nansen confirmed that the wallet was NOT tagged as 3AC

• Apparently, there UI was a bug that caused the poster to see it as 3AC

Rumors started swirling that 3AC was about to be liquidated against its $264m ETH position.

• Nansen confirmed that the wallet was NOT tagged as 3AC

• Apparently, there UI was a bug that caused the poster to see it as 3AC

https://twitter.com/OnChainWizard/status/1536918183851982848

@zhusu @KylesLdavies Confirmation of Trouble

At this point, people are confused.

Is there trouble at 3AC or are people spreading FUD about the firm?

Well, Zhu wrote a crypto tweet the other day hinting that there's trouble at 3AC.

At this point, people are confused.

Is there trouble at 3AC or are people spreading FUD about the firm?

Well, Zhu wrote a crypto tweet the other day hinting that there's trouble at 3AC.

https://twitter.com/zhusu/status/1536876343815983104

@zhusu @KylesLdavies "I know it was you, Zhu. you broke my heart."

stETH price has been having some issues.

Everyone assumed it was Celsius that was dumping their stETH.

It looks like it was 3AC doing the dumping.

stETH price has been having some issues.

Everyone assumed it was Celsius that was dumping their stETH.

It looks like it was 3AC doing the dumping.

https://twitter.com/MoonOverlord/status/1536697618797142016

@zhusu @KylesLdavies An Insider's Account

Where there's smoke, there's fire.

Danny's firm works closely with 3AC.

They noticed that $1m was missing from their accounts.

Apparently, the founders are ghosting people, and 3AC is getting liquidated everywhere.

Where there's smoke, there's fire.

Danny's firm works closely with 3AC.

They noticed that $1m was missing from their accounts.

Apparently, the founders are ghosting people, and 3AC is getting liquidated everywhere.

https://twitter.com/Danny8BC/status/1537224378554806272

@zhusu @KylesLdavies Now we're starting to see the initial consequences come in.

Finblox, a CeFi company, is pausing reward distributions because of 3AC's volatility.

3AC is an investor in Finblox.

Credit: @FatManTerra

Finblox, a CeFi company, is pausing reward distributions because of 3AC's volatility.

3AC is an investor in Finblox.

https://twitter.com/finblox/status/1537414199890296838

Credit: @FatManTerra

@zhusu @KylesLdavies @FatManTerra Watch Out for Unlocks

Miles suggests keeping an eye out for unlocks.

If 3AC is having financial issues, then you can assume they'll sell their tokens at the first opportunity.

Miles suggests keeping an eye out for unlocks.

If 3AC is having financial issues, then you can assume they'll sell their tokens at the first opportunity.

https://twitter.com/milesdeutscher/status/1537373757870047233

@zhusu @KylesLdavies @FatManTerra Further Consequences

Unfortunately, we don't have a COMPLETE picture of 3AC's wallets and positions.

We don't know how much damage it'll cause if they're insolvent.

Due to the size of the AUM, the contagion effects will be catastrophic.

Unfortunately, we don't have a COMPLETE picture of 3AC's wallets and positions.

We don't know how much damage it'll cause if they're insolvent.

Due to the size of the AUM, the contagion effects will be catastrophic.

@zhusu @KylesLdavies @FatManTerra VCs Aren't Gods

People have a Halo Effect bias when it comes to Venture Capitalists.

A lot of people felt Terra was too big to fail.

People assumed that firms like Jump and 3AC would bail them out / figure it out.

That didn't happen.

They don't always get it right.

People have a Halo Effect bias when it comes to Venture Capitalists.

A lot of people felt Terra was too big to fail.

People assumed that firms like Jump and 3AC would bail them out / figure it out.

That didn't happen.

They don't always get it right.

@zhusu @KylesLdavies @FatManTerra Managing Risks

3AC got into the seed rounds of some of the most prominent Crypto protocols.

Yet they might go broke.

Risk management is UNDERRATED.

1. Don't fight the Fed

2. Leverage is dangerous

3AC got into the seed rounds of some of the most prominent Crypto protocols.

Yet they might go broke.

Risk management is UNDERRATED.

1. Don't fight the Fed

2. Leverage is dangerous

@zhusu @KylesLdavies @FatManTerra Takeaways:

• 3AC lost a ton of cash in Terra Luna

• 3AC is getting margin called and liquidated

• This could cause a rippling effect on the industry

• Doesn't matter if you're up 100x if you don't practice solid RISK MANAGEMENT

• 3AC lost a ton of cash in Terra Luna

• 3AC is getting margin called and liquidated

• This could cause a rippling effect on the industry

• Doesn't matter if you're up 100x if you don't practice solid RISK MANAGEMENT

@zhusu @KylesLdavies @FatManTerra I hope you've found this thread helpful.

Follow me @thedefiedge for threads like this in the future.

Like/Retweet the first tweet below if you can.

I know a lot of people are confused about the situation.

Follow me @thedefiedge for threads like this in the future.

Like/Retweet the first tweet below if you can.

I know a lot of people are confused about the situation.

https://twitter.com/thedefiedge/status/1537465349976694786

@zhusu @KylesLdavies @FatManTerra Also, I write a free weekly newsletter at TheDeFiEdge.com

I'm sending the next one later today, where I share my thoughts on Celsius, the Fed rate increase, and more.

I'm sending the next one later today, where I share my thoughts on Celsius, the Fed rate increase, and more.

More Info:

After writing the thread, a company that 3AC invested in DM'ed me.

They wish to remain anonymous for now while weighing their legal options.

1. I have verified that 3AC led their seed round

2. I am talking to the founder's account and I'm not getting catfished.

After writing the thread, a company that 3AC invested in DM'ed me.

They wish to remain anonymous for now while weighing their legal options.

1. I have verified that 3AC led their seed round

2. I am talking to the founder's account and I'm not getting catfished.

3AC invests in different seed rounds of companies.

The protocol raises money usually in USDC / USDT.

Well, the treasury is usually sitting around doing nothing.

So a common deal 3AC did with their protocols is "manage" their treasury.

The protocol raises money usually in USDC / USDT.

Well, the treasury is usually sitting around doing nothing.

So a common deal 3AC did with their protocols is "manage" their treasury.

3AC's Treasury Management

3AC gave an 8% APR guarantee on the treasury.

So protocols would park the funds raised by 3AC + additional parts of their treasury.

The protocols felt safe because well...it's 3AC.

3AC gave an 8% APR guarantee on the treasury.

So protocols would park the funds raised by 3AC + additional parts of their treasury.

The protocols felt safe because well...it's 3AC.

Protocol X has mentioned that the ghosting is real.

They've talked to two other protocols who also mentioned that they're being ghosted too by them.

3AC now holds part of their treasury, and they have no idea what's the state of their cash.

They've talked to two other protocols who also mentioned that they're being ghosted too by them.

3AC now holds part of their treasury, and they have no idea what's the state of their cash.

Me: "Can't you trace your funds on the chain?"

Them: "It’s mixed with other stuff… hard to track the movement since they were doing this with a bunch of their investments"

Them: "It’s mixed with other stuff… hard to track the movement since they were doing this with a bunch of their investments"

So now we're in a situation where SOME of the protocols they've invested in...their treasuries might be gone.

Anyways, not trying to add fuel to the fire.

Giving more color to a situation that's mad sus.

Anyways, not trying to add fuel to the fire.

Giving more color to a situation that's mad sus.

• • •

Missing some Tweet in this thread? You can try to

force a refresh