🧵 The #FMCG industry has become an absolute juggernaut with annual revenue reaching 13-figures! That’s a trillion with a “t”.

A number of rapidly growing health product start-ups are aiming to disrupt this gigantic consumer sector.

And these newcomers are moving quickly.

👇

A number of rapidly growing health product start-ups are aiming to disrupt this gigantic consumer sector.

And these newcomers are moving quickly.

👇

Fast-moving consumer goods, aka FMCGs are products that are sold quickly at a relatively low cost.

The top 40 FMCG companies (incl. @Nestle, @ProcterGamble, @Unilever, @CocaCola and @LOrealGroupe) generated over $1 trillion in revenue in 2020.

The top 40 FMCG companies (incl. @Nestle, @ProcterGamble, @Unilever, @CocaCola and @LOrealGroupe) generated over $1 trillion in revenue in 2020.

https://twitter.com/EconomicTimes/status/1534082738529005571

Over the last two years, the FMCG sector has grown by 10.4% with the wellness market now estimated to be worth more than $1.5 trillion.

https://twitter.com/AudienseCo/status/1399801127479226370

So just how large is the health product sector?

🌍 The global wellness market is estimated to be worth $1.5 trillion.

🛒 Health product sales are predicted to grow 3x faster online than in-store with 54% of global shoppers preferring to shop online.

🌍 The global wellness market is estimated to be worth $1.5 trillion.

🛒 Health product sales are predicted to grow 3x faster online than in-store with 54% of global shoppers preferring to shop online.

https://twitter.com/dinisguarda/status/1533374894662205440

Consumer awareness around wellness is growing – tea brand @Pukkaherbs were able to make the leap from niche organic tea to a £30 million business.

https://twitter.com/Pukkaherbs/status/1250452635230052354

Today’s consumer views wellness across six dimensions:

😴 Better sleep

💪 Better health

🏃♀️ Better fitness

🥕 Better nutrition

🦋 Better appearance

🤗 Better mindfulness

😴 Better sleep

💪 Better health

🏃♀️ Better fitness

🥕 Better nutrition

🦋 Better appearance

🤗 Better mindfulness

https://twitter.com/ingridriley/status/1528768870039035904

We asked three big questions.

🍵 Where do the next consumer opportunities lie in the wellness space?

🍵 How are wellness brands shaking up the FMCG space

🍵 How can wellness brands break into the mass market and go mainstream?

The answers? Keep reading. 👇

🍵 Where do the next consumer opportunities lie in the wellness space?

🍵 How are wellness brands shaking up the FMCG space

🍵 How can wellness brands break into the mass market and go mainstream?

The answers? Keep reading. 👇

Where do the consumer opportunities lie in the wellness space?

To answer this question, we ran interconnectivity reports based on two leading wellness brands and similar audiences that surround them: @medterracbd and @huel.

help.audiense.com/knowledge/audi…

To answer this question, we ran interconnectivity reports based on two leading wellness brands and similar audiences that surround them: @medterracbd and @huel.

help.audiense.com/knowledge/audi…

Both @huel and @medterracbd’s audiences:

🏫 Skew toward the younger demographic of 18-24 years old.

🇺🇸 Are largely based in the US (64% for Medterra and 45% for Huel)

🇬🇧 Have a large London-based segment.

🏫 Skew toward the younger demographic of 18-24 years old.

🇺🇸 Are largely based in the US (64% for Medterra and 45% for Huel)

🇬🇧 Have a large London-based segment.

https://twitter.com/gregfoot/status/1534469445565005824

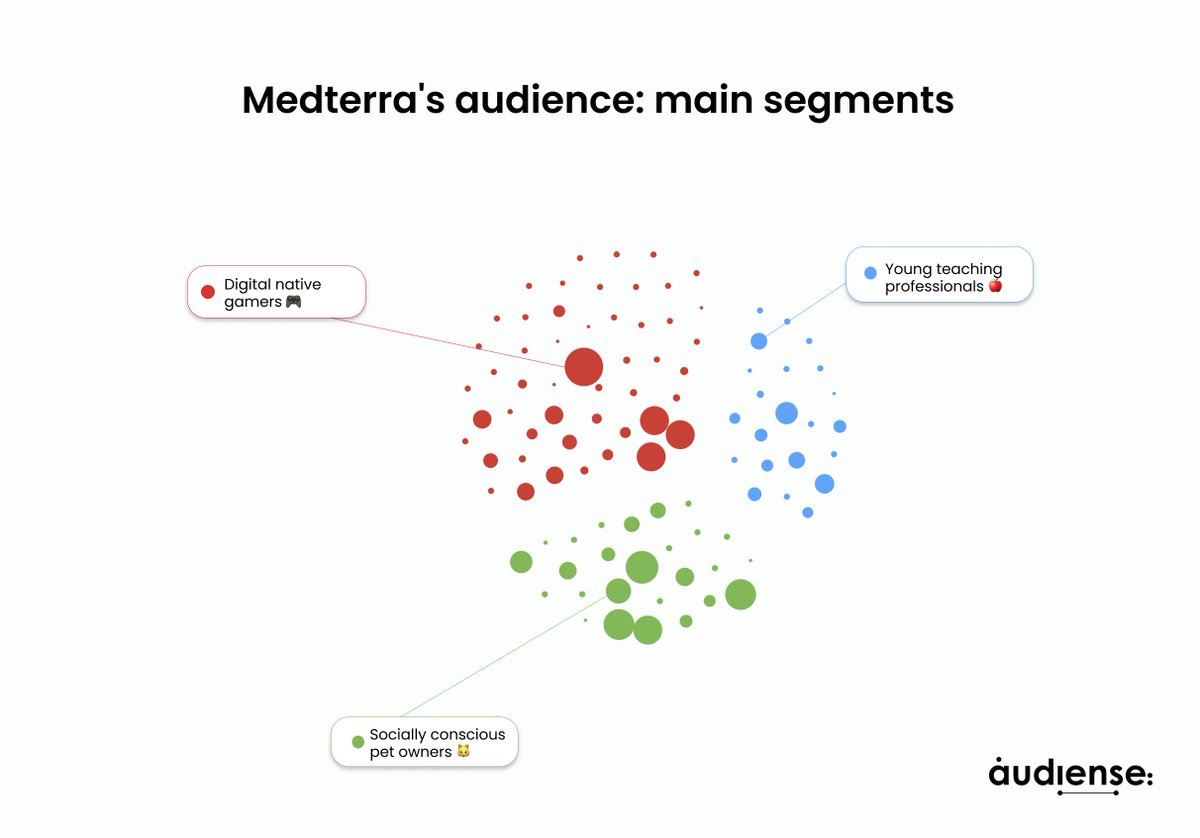

Medterra’s 3 main audience segments:

Digital native gamers 🎮

Socially conscious pet owners 🐱

Young teaching professionals 🍎

Digital native gamers 🎮

Socially conscious pet owners 🐱

Young teaching professionals 🍎

https://twitter.com/brightfieldgrp/status/1524064221570473988

Huel’s 3 main audience segments:

Entertainment aficionados 🎬

Right-leaning Americans 🐘

Up-to-date pet owners 🗞

Entertainment aficionados 🎬

Right-leaning Americans 🐘

Up-to-date pet owners 🗞

How are wellness brands shaking up the FMCG space?

Medterra goes hard on trust as a core element of their brand, which is interesting, given:

👉 Dwindling consumer trust in brands

👉 Gen Z’s resistance to traditional forms of advertising.

Medterra goes hard on trust as a core element of their brand, which is interesting, given:

👉 Dwindling consumer trust in brands

👉 Gen Z’s resistance to traditional forms of advertising.

https://twitter.com/cogsyapp/status/1534948697108123652

In 2021, Medterra launched their first digital campaign called “the CBDo’s and CBDon’ts of CBD” w/ 2 goals in mind.

1️⃣ Busting the myths around CBD.

2️⃣ Establishing Medterra as the go-to brand for high-quality CBD products.

1️⃣ Busting the myths around CBD.

2️⃣ Establishing Medterra as the go-to brand for high-quality CBD products.

https://twitter.com/Adweek/status/1394133108203589634

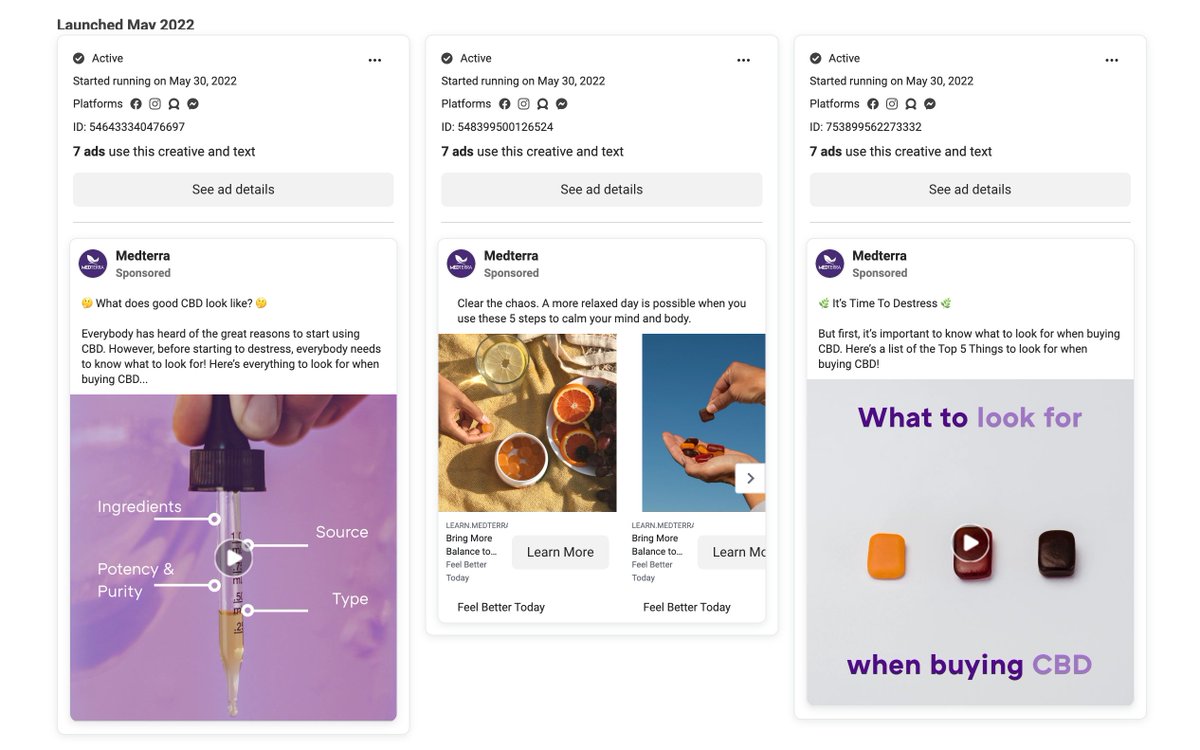

Medterra top invested digital advertising channels are:

Facebook: $396K (56%)

Desktop Display: $212K (30%).

Their successful FB campaigns focus on building trust, offering free samples, and educating audiences on the benefits of CBD for health, wellness, and your pets.

Facebook: $396K (56%)

Desktop Display: $212K (30%).

Their successful FB campaigns focus on building trust, offering free samples, and educating audiences on the benefits of CBD for health, wellness, and your pets.

While still early days for Medterra’s digital strategy, there’s definitely room for growth.

This case study from @convosphere is a great example of how to use audience insights to identify and engage micro-influencers in the space.

resources.audiense.com/blog/how-consu…

This case study from @convosphere is a great example of how to use audience insights to identify and engage micro-influencers in the space.

resources.audiense.com/blog/how-consu…

Huel has become a firm favourite of gym bros, tech bros, and anybody who would like to stop obsessing over what to have for lunch.

Huel has sold over 100 million meals and built a community of around 400K followers across their digital channels.

Huel has sold over 100 million meals and built a community of around 400K followers across their digital channels.

https://twitter.com/huel/status/1509787691440877569

Along the way, Huel has struggled with positioning.

This somewhat niche product has fought hard to make its way in the UK and US markets.

It makes sense that Huel focused on a digital-first marketing strategy.

This somewhat niche product has fought hard to make its way in the UK and US markets.

It makes sense that Huel focused on a digital-first marketing strategy.

https://twitter.com/JohnJackson750/status/1534575552639688706

Audience intelligence and the superior targeting abilities of digital channels, vs more traditional marketing opportunities, has helped Huel create their very own ‘Hueligans’.

They focused on transparency and education, making the science behind the product one of their strongest USPs for doubtful consumers.

https://twitter.com/huel/status/1508806369431986193

How can wellness brands break into the mass market?

We’ve done our homework and come up with four ways 👇

We’ve done our homework and come up with four ways 👇

1⃣ Educate your consumers

If you’re promoting an unknown product:

➡️ Launch an information-focused marketing campaign.

➡️ Provide free samples in places you know your ideal consumer is likely to see them.

If you’re promoting an unknown product:

➡️ Launch an information-focused marketing campaign.

➡️ Provide free samples in places you know your ideal consumer is likely to see them.

https://twitter.com/heavensorganics/status/1422600226293092354

2⃣ Be transparent and trustworthy as a brand

Consumer trust is dwindling, it’s up to you to ensure that your products and your operations, as a business and a marketing team, are as transparent as possible.

Consumer trust is dwindling, it’s up to you to ensure that your products and your operations, as a business and a marketing team, are as transparent as possible.

https://twitter.com/MNathanson/status/1514692549155307520

3⃣ Understand where your audiences are spending time

If you want to reach your audiences, you need to go where they are.

If you want to reach your audiences, you need to go where they are.

https://twitter.com/FleeboyMom/status/1472972551567593487

4⃣ Don’t just sell a product, sell a lifestyle

One of the most striking similarities between brands like Huel and Medterra is the ability to sell more than a product, they’re selling a lifestyle shift.

One of the most striking similarities between brands like Huel and Medterra is the ability to sell more than a product, they’re selling a lifestyle shift.

https://twitter.com/MarkRoss_ecom/status/1534463307188428800

Here’s how several upstart health brands are shaking up the #FMCG sector in their quest to break through to the mainstream.

bit.ly/3xtizT8

bit.ly/3xtizT8

• • •

Missing some Tweet in this thread? You can try to

force a refresh